by Calculated Risk on 3/17/2015 09:38:00 AM

Tuesday, March 17, 2015

CoreLogic: "1.2 Million US Borrowers Regained Equity in 2014, 5.4 Million Properties Remain in Negative Equity"

From CoreLogic: CoreLogic Reports 1.2 Million US Borrowers Regained Equity in 2014

CoreLogic ... today released new analysis showing 1.2 million borrowers regained equity in 2014, bringing the total number of mortgaged residential properties with equity at the end of Q4 2014 to approximately 44.5 million or 89 percent of all mortgaged properties. Nationwide, borrower equity increased year over year by $656 billion in Q4 2014. The CoreLogic analysis also indicates approximately 172,000 U.S. homes slipped into negative equity in the fourth quarter of 2014 from the third quarter 2014, increasing the total number of mortgaged residential properties with negative equity to 5.4 million, or 10.8 percent of all mortgaged properties. This compares to 5.2 million homes, or 10.4 percent, that were reported with negative equity in Q3 2014, a quarter-over-quarter increase of 3.3 percent. Compared to 6.6 million homes, or 13.4 percent, reported for Q4 2013, the number of underwater homes has decreased year over year by 1.2 million or 18.9 percent.

... Of the 49.9 million residential properties with a mortgage, approximately 10 million, or 20 percent, have less than 20-percent equity (referred to as “under-equitied”) and 1.4 million of those have less than 5-percent equity (referred to as near-negative equity). Borrowers who are “under-equitied” “under-equitied” may have a more difficult time refinancing their existing homes or obtaining new financing to sell and buy another home due to underwriting constraints. Borrowers with near negative equity are considered at risk of moving into negative equity if home prices fall. In contrast, if home prices rose by as little as 5 percent, an additional 1 million homeowners now in negative equity would regain equity. ...

“The share of homeowners that had negative equity increased slightly in the fourth quarter of 2014, reflecting the typical weakness in home values during the final quarter of the year,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Our CoreLogic HPI dipped 0.7 percent from September to December, and the percent of owners 'underwater' increased to 10.8 percent. However, from December-to-December, the CoreLogic index was up 4.8 percent, and the negative equity share fell by 2.6 percentage points.”

emphasis added

Click on graph for larger image.

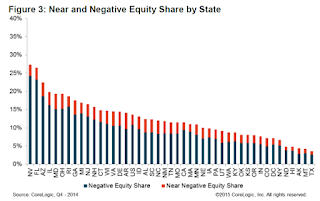

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 24.2 percent; followed by Florida (23.2 percent); Arizona (18.7 percent); Illinois (16.2 percent) and Rhode Island (15.8 percent). These top five states combined account for 31.7 percent of negative equity in the United States."

Note: The share of negative equity is still very high in Nevada and Florida, but down from a year ago (Q4 2013) when the negative equity share in Nevada was at 30.4 percent, and at 28.1 percent in Florida.

The second graph shows the distribution of home equity in Q4 compared to Q3 2014. Close to 4% of residential properties have 25% or more negative equity.

The second graph shows the distribution of home equity in Q4 compared to Q3 2014. Close to 4% of residential properties have 25% or more negative equity.In Q4 2013, there were 6.6 million properties with negative equity - now there are 5.4 million. A significant change.

Housing Starts decreased sharply to 897 thousand Annual Rate in February

by Calculated Risk on 3/17/2015 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 897,000. This is 17.0 percent below the revised January estimate of 1,081,000 and is 3.3 percent (±12.5%)* below the February 2014 rate of 928,000.

Single-family housing starts in February were at a rate of 593,000; this is 14.9 percent (±10.0%) below the revised January figure of 697,000. The February rate for units in buildings with five units or more was 297,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,092,000. This is 3.0 percent above the revised January rate of 1,060,000 and is 7.7 percent above the February 2014 estimate of 1,014,000.

Single-family authorizations in February were at a rate of 620,000; this is 6.2 percent (±0.9%) below the revised January figure of 661,000. Authorizations of units in buildings with five units or more were at a rate of 445,000 in February.

Click on graph for larger image.

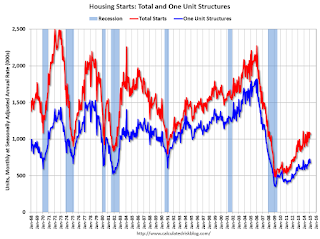

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased sharply in February. Multi-family starts are down 10% year-over-year.

Single-family starts (blue) decreased in February and are up slightly year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),This was well below expectations of 1.040 million starts in February, although starts in January were revised up. Overall this was a weak report, although permits were decent (an indicator for March), and a large portion of the weakness was in the volatile multi-family sector. I'll have more later ...

Monday, March 16, 2015

Sacramento Housing in February: Total Sales up 12% Year-over-year

by Calculated Risk on 3/16/2015 09:01:00 PM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For some time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In February, 14.8% of all resales were distressed sales. This was down from 16.6% last month, and down from 19.1% in February 2014. Since distressed sales happen year round, but conventional sales decline in December and January, the percent of distressed sales bumps up in the winter (seasonal).

The percentage of REOs was at 8.3%, and the percentage of short sales was 6.5%.

Here are the statistics for February.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes increased 13.9% year-over-year (YoY) in February. In general the YoY increases have been trending down after peaking at close to 100%. This is the smallest YoY increase in inventory since May 2013.

Cash buyers accounted for 16.8% of all sales (frequently investors).

Total sales were up 11.6% from February 2014, and conventional equity sales were up 17.6% compared to the same month last year.

Summary: This data suggests a healing market with fewer distressed sales, more equity sales, and less investor buying.

Tuesday: Housing Starts

by Calculated Risk on 3/16/2015 05:47:00 PM

From Reuters: U.S. fuel consumption is soaring amid cheaper prices (ht Shane)

Fuel demand in Texas is growing strongly as lower oil prices encourage motorists to use their vehicles more and buy larger replacements.Tuesday:

Receipts of motor fuel taxes in February 2015 were 6 percent higher than in the same month in 2014, according to the Texas Comptroller of Public Accounts.

• 8:30 AM ET, Housing Starts for February. Total housing starts were at 1.065 million (SAAR) in January. Single family starts were at 678 thousand SAAR in January. The consensus is for total housing starts to decrease to 1.040 million (SAAR) in February.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for January

WTI Crude Oil Falls Close to $43 per Barrel

by Calculated Risk on 3/16/2015 01:54:00 PM

From the WSJ: Oil Prices Fall to Six-Year Intraday Low

Crude prices extended losses in early New York trading on a report, issued by a private data provider, that showed rising oil stockpiles at a key U.S. storage hub. Earlier, oil dropped as traders weighed the prospect of more Iranian crude hitting the global market, as negotiators came closer to a tentative political agreement on Tehran’s nuclear program.

...

Recently, light, sweet crude for April delivery recently fell $1.65, or 3.7%, at $43.19 a barrel on the Nymex. It dipped as low as $42.85 a barrel, the lowest intraday price since March 12, 2009. Oil is now on pace for a five-session losing streak and is down nearly 14% in that span.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI has fallen 2.8% today to $43.52 per barrel, and Brent to $53.23.

WTI oil prices are off almost 60% from the peak last year, and there should be further declines in gasoline prices over the next couple of weeks. Nationally gasoline prices are around $2,42 per gallon, and gasoline futures are down about 4 cents per gallon today.

NAHB: Builder Confidence decreased to 53 in March

by Calculated Risk on 3/16/2015 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 53 in March, down from 55 in February. Any number above 50 indicates that more builders view sales conditions as good than poor.

From Reuters: Builder Confidence Drops Two Points in March

Builder confidence in the market for newly built, single-family homes in March fell two points to a level of 53 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today.

“Even with this slight slip, the HMI remains in positive territory and we expect the market to improve as we enter the spring buying season,” said NAHB Chairman Tom Woods, a home builder from Blue Springs, Mo.

“The drop in builder confidence is largely attributable to supply chain issues, such as lot and labor shortages as well as tight underwriting standards,” said NAHB Chief Economist David Crowe. “These obstacles notwithstanding, we are expecting solid gains in the housing market this year, buoyed by sustained job growth, low mortgage interest rates and pent-up demand.”

Two of the three HMI components posted losses in March. The component gauging current sales conditions fell three points to 58 while the component measuring buyer traffic dropped two points to 37. The gauge charting sales expectations in the next six months held steady at 59.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 56.

Fed: Industrial Production increased 0.1% in February

by Calculated Risk on 3/16/2015 09:26:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.1 percent in February after decreasing 0.3 percent in January. In February, manufacturing output moved down 0.2 percent, its third consecutive monthly decline. The rates of change for the total index in January and for manufacturing in both December and January are lower than previously reported. The index for mining fell 2.5 percent in February; drops in the indexes for coal mining and for oil and gas well drilling and servicing primarily accounted for the decrease. The output of utilities jumped 7.3 percent, as especially cold temperatures drove up demand for heating. At 105.8 percent of its 2007 average, total industrial production in February was 3.5 percent above its level of a year earlier. Capacity utilization for the industrial sector decreased to 78.9 percent in February, a rate that is 1.2 percentage points below its long-run (1972–2014) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.0 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.9% is 1.2% below the average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

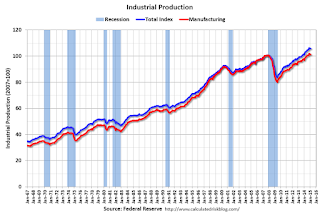

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.1% in January to 102.8. This is 26.4% above the recession low, and 2.6% above the pre-recession peak.

This was below expectations, and there were downward revisions to prior months.

Sunday, March 15, 2015

Monday: Industrial Production, Empire State Mfg, Homebuilder Confidence

by Calculated Risk on 3/15/2015 09:08:00 PM

From Jim Hamilton: U.S. oil supply update (excerpt):

U.S. crude oil inventories continued to increase last week, signaling that so far supply continues to outstrip demand. And the Wall Street Journal reports a strategy followed by some companies that could enable them to bring production back up quickly if prices recover:Monday:

Now many are adopting a new strategy that will allow them to pump even more crude as soon as oil prices begin to rise. They are drilling wells but holding off on hydraulic fracturing, or forcing in water and chemicals to free oil from shale formations. The delay in the start of fracking lets companies store oil in the ground in a way that enables them to tap it unusually quickly if they wish– and flood the market again.The backlog of wells waiting to be fracked– some are calling it fracklog– adds to the record above-ground inventories to restrain any significant price resurgence. Eventually, however, the economic fundamentals have to prevail, and we will settle down to a price around the true long-run marginal cost. The 2020 WTI futures contract closed at $67/barrel last week. But today North Dakota’s Williston Basin Sweet is fetching less than $29/barrel.

• 8:30 AM ET, the NY Fed Empire State Manufacturing Survey for March. The consensus is for a reading of 7.0, down from 7.8 last month (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for February. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.5%.

• At 10:00 AM, the March NAHB homebuilder survey. The consensus is for a reading of 56, up from 55 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

Weekend:

• Schedule for Week of March 15, 2015

• FOMC Preview: Remove "Patient"

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 5 and DOW futures are down 30 (fair value).

Oil prices were down sharply over the last week with WTI futures at $44.11 per barrel and Brent at $53.56 per barrel. A year ago, WTI was at $99, and Brent was at $107 - so prices are down 50%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.43 per gallon (down about $1.00 per gallon from a year ago). Prices in California are now declining following a refinery fire in February and a strike that is now over.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

FOMC Preview: Remove "Patient"

by Calculated Risk on 3/15/2015 11:08:00 AM

The FOMC will meet on Tuesday and Wednesday. The FOMC statement will be released Wednesday at 2:00 PM ET. Fed Chair Janet Yellen will hold a press conference at 2:30 PM. Here is what I expect on Wednesday:

• The initial focus will be on the word "patient" in the FOMC statement. From the January statement:

"Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy."It seems very likely "patient" will be removed on Wednesday.

• How the FOMC discusses inflation will also be important since inflation has declined sharply and is well below the FOMC 2% target. My guess is these sentences will remain about the same, but the FOMC could express more concern about low inflation:

"Inflation has declined further below the Committee’s longer-run objective, largely reflecting declines in energy prices. Market-based measures of inflation compensation have declined substantially in recent months; survey-based measures of longer-term inflation expectations have remained stable.• The key focus will be on Fed Chair Janet Yellen's press conference and the FOMC projections.

...

Inflation is anticipated to decline further in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate. The Committee continues to monitor inflation developments closely."

• The following paragraph from Fed Chair Janet Yellen's testimony on February 24th seemed to suggest "patient" would be dropped from the FOMC statement at the meeting this week. Sentence by sentence from her testimony:

The FOMC's assessment that it can be patient in beginning to normalize policy means that the Committee considers it unlikely that economic conditions will warrant an increase in the target range for the federal funds rate for at least the next couple of FOMC meetings.That just repeated the previous understanding. If the FOMC wants to have the option to raise rates in June, they would most likely drop "patient" from the statement in March (June is the second meeting after March).

If economic conditions continue to improve, as the Committee anticipates, the Committee will at some point begin considering an increase in the target range for the federal funds rate on a meeting-by-meeting basis. Before then, the Committee will change its forward guidance.Yes, the FOMC needs to drop "patient" before they move to a meeting-by-meeting basis.

However, it is important to emphasize that a modification of the forward guidance should not be read as indicating that the Committee will necessarily increase the target range in a couple of meetings.This was an important clarification.

My guess is Yellen will reiterate that dropping "patient" does not mean a rate hike is guaranteed two meetings later - just that a hike may be considered based on incoming data (employment and inflation). She will also state that the first rate hike will be data dependent.

• It will also be interesting to see the changes to the FOMC projections. For review, here are the previous projections. GDP is looking weak in Q1, and it is possible GDP projections for 2015 will be decreased slightly.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2015 | 2016 | 2017 | |

| Dec 2014 Meeting Projections | 2.6 to 3.0 | 2.5 to 3.0 | 2.3 to 2.5 | |

| Sept 2014 Meeting Projections | 2.6 to 3.0 | 2.6 to 2.9 | 2.3 to 2.5 | |

The unemployment rate was at 5.5% in February, so the unemployment rate projection for Q4 2015 might be lowered slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2015 | 2016 | 2017 | |

| Dec 2014 Meeting Projections | 5.2 to 5.3 | 5.0 to 5.2 | 4.9 to 5.3 | |

| Sept 2014 Meeting Projections | 5.4 to 5.6 | 5.1 to 5.4 | 4.9 to 5.3 | |

As of January, PCE inflation was up only 0.2% from January 2014, and core inflation was up 1.3%. PCE inflation will probably be revised down for 2014, and will be well below the FOMC's 2% target. A key will be projections for 2016 and 2017.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2015 | 2016 | 2017 | |

| Dec 2014 Meeting Projections | 1.0 to 1.6 | 1.7 to 2.0 | 1.9 to 2.0 | |

| Sept 2014 Meeting Projections | 1.6 to 1.9 | 1.7 to 2.0 | 1.9 to 2.0 | |

PCE core inflation was up only 1.3% in January. A key will be if PCE core inflation is revised down for 2014 in the projections.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2015 | 2016 | 2017 | |

| Dec 2014 Meeting Projections | 1.5 to 1.8 | 1.7 to 2.0 | 1.8 to 2.0 | |

| Sept 2014 Meeting Projections | 1.6 to 1.9 | 1.8 to 2.0 | 1.9 to 2.0 | |

Saturday, March 14, 2015

Schedule for Week of March 15, 2015

by Calculated Risk on 3/14/2015 10:00:00 AM

The key economic report this week is February housing starts on Tuesday.

For manufacturing, the February Industrial Production and Capacity Utilization report, and the March NY Fed (Empire State), and Philly Fed surveys, will be released this week.

The FOMC meets on Tuesday and Wednesday.

8:30 AM: NY Fed Empire State Manufacturing Survey for March. The consensus is for a reading of 7.0, down from 7.8 last month (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.5%.

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 56, up from 55 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for February.

8:30 AM: Housing Starts for February. Total housing starts were at 1.065 million (SAAR) in January. Single family starts were at 678 thousand SAAR in January.

The consensus is for total housing starts to decrease to 1.040 million (SAAR) in February.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for January

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to make no change to policy, however the word "patient" will probably be removed from the statement opening the possibility of a rate hike as early as June.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 293 thousand from 289 thousand.

10:00 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 7.0, up from 5.2 last month (above zero indicates expansion).

No economic releases scheduled.