by Calculated Risk on 3/12/2015 04:35:00 PM

Thursday, March 12, 2015

Hotels: Solid Start for 2015

From HotelNewsNow.com: STR: US hotel results for week ending 7 March

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 1-7 March 2015, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 0.5 percent to 64.5 percent. Average daily rate increased 2.0 percent to finish the week at US$116.74. Revenue per available room for the week was up 2.5 percent to finish at US$75.27.

emphasis added

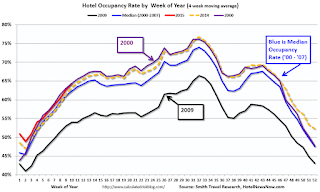

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now in the Spring travel period and business travel will increase over the next couple of months.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above 2014.

So far 2015 is at about the same level as 2000 (best year for hotels) - and 2015 will probably be the best year ever for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Fed's Q4 Flow of Funds: Household Net Worth at Record High

by Calculated Risk on 3/12/2015 12:00:00 PM

The Federal Reserve released the Q4 2014 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q4 compared to Q3:

The net worth of households and nonprofits rose to $82.9 trillion during the fourth quarter of 2014. The value of directly and indirectly held corporate equities increased $742 billion and the value of real estate rose $356 billion.Prior to the recession, net worth peaked at $67.9 trillion in Q2 2007, and then net worth fell to $54.9 trillion in Q1 2009 (a loss of $13.0 trillion). Household net worth was at $82.9 trillion in Q4 2014 (up $28.0 trillion from the trough in Q1 2009).

The Fed estimated that the value of household real estate increased to $20.6 trillion in Q4 2014. The value of household real estate is still $1.9 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is close to the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles. The ratio has been trending up but has moved sideways over the last year.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2014, household percent equity (of household real estate) was at 54.5% - up from Q3, and the highest since Q1 2007. This was because of an increase in house prices in Q4 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 54.5% equity - and millions still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $5 billion in Q4.

Mortgage debt has declined by $1.26 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up slightly in Q4, and somewhat above the average of the last 30 years (excluding bubble).

Weekly Initial Unemployment Claims decreased to 289,000

by Calculated Risk on 3/12/2015 09:25:00 AM

Catching up: The DOL reported:

In the week ending March 7, the advance figure for seasonally adjusted initial claims was 289,000, a decrease of 36,000 from the previous week's revised level. The previous week's level was revised up by 5,000 from 320,000 to 325,000. The 4-week moving average was 302,250, a decrease of 3,750 from the previous week's revised average. The previous week's average was revised up by 1,250 from 304,750 to 306,000.The previous week was revised up to 325,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 302,250.

This was below the consensus forecast of 300,000, and the low level of the 4-week average suggests few layoffs.

Retail Sales decreased 0.6% in February

by Calculated Risk on 3/12/2015 08:42:00 AM

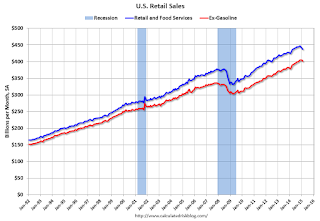

On a monthly basis, retail sales decreased 0.6% from January to February (seasonally adjusted), and sales were up 1.7% from February 2014. Sales in December were unrevised at a 0.8% decrease.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $437.0 billion, a decrease of 0.6 percent from the previous month, but up 1.7 percent above February 2014. ... The December 2014 to January 2015 percent change was unrevised from -0.8 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline decreased 0.8%.

Retail sales ex-autos decreased 0.1%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 5.1% on a YoY basis (1.7% for all retail sales).

Retail and Food service sales ex-gasoline increased by 5.1% on a YoY basis (1.7% for all retail sales).The decrease in February was below consensus expectations of a 0.3% increase. This was a weak report.

Wednesday, March 11, 2015

Thursday: Retail Sales, Flow of Funds, Unemployment Claims

by Calculated Risk on 3/11/2015 08:11:00 PM

Thursday:

• 8:30 AM ET, Retail sales for February will be released. On a monthly basis, retail sales decreased 0.8% from December to January (seasonally adjusted), and sales were up 3.3% from January 2014. The consensus is for retail sales to increase 0.3% in February, and to increase 0.5% ex-autos.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 309 thousand from 320 thousand.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for a 0.1% increase in inventories.

• At 12:00 PM, the Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

• At 2:00 PM ET, the Monthly Treasury Budget Statement for February.

Fed Fails Deutsche Bank and Santander Capital Plans, BofA required to Submit New Plan by Q3

by Calculated Risk on 3/11/2015 04:41:00 PM

From the Federal Reserve: Comprehensive Capital Analysis and Review (CCAR)

The Federal Reserve on Wednesday announced it has not objected to the capital plans of 28 bank holding companies participating in the Comprehensive Capital Analysis and Review (CCAR). One institution received a conditional non-objection based on qualitative grounds, and the Federal Reserve objected to two firms' plans on qualitative grounds.From the WSJ: Federal Reserve Rejects 2 Banks’ Capital Plans in Annual ‘Stress Tests’

...

The Federal Reserve did not object to the capital plan of Bank of America Corporation, but is requiring the institution to submit a new capital plan by the end of the third quarter to address certain weaknesses in its capital planning processes. The Federal Reserve objected to the capital plans of Deutsche Bank Trust Corporation and Santander Holdings USA on qualitative concerns.

Twenty-eight of 31 large banks received Federal Reserve approval to return capital to investors on Wednesday but only after some of the biggest Wall Street firms came perilously close to failing the regulator’s annual “stress test.”

A 29th firm, Bank of America Corp. , received conditional approval of its capital plan and can move forward with boosting dividends or stock buybacks, but must resubmit its proposal to address “certain weaknesses” including its ability to measure losses and revenue, the Fed said. ... The Fed rejected the capital plans of two large banks, the U.S. units of Deutsche Bank AG and Banco Santander SA, for “qualitative” deficiencies including ability to model losses and identify risks. ...

Deutsche Bank, which took the stress test for the first time this year, was rejected for “numerous and significant deficiencies” across several areas of the capital planning process including the bank’s ability to identify risks, the Fed said.

Quarterly Services Survey suggests upward revision to Q4 GDP to 2.5%

by Calculated Risk on 3/11/2015 12:14:00 PM

From Reuters: U.S. services data suggest upward revision to Q4 growth

The Commerce Department's quarterly services survey ... showed consumption ... increased at a faster clip than the government had assumed in its second estimate of [GDP].Here is the Q4 Quarterly Services Press Release

Economists said the data suggested fourth-quarter consumer spending could be raised by at least six-tenths of a percentage point to a 4.9 percent annual rate ... the QSS suggested fourth-quarter GDP growth could be raised to a 2.5 percent pace from the 2.2 percent rate reported last month ...

Real Estate Data Resource for Local Area Sales and Inventory

by Calculated Risk on 3/11/2015 10:43:00 AM

Each month I track sales and inventory data for several previous bubble areas (like Las Vegas, Phoenix, Sacramento). These areas are interesting because they had huge prices bubbles, and large price declines - followed by significant investor buying (that is now declining). I also track these areas because the data is available on line.

Housing economist Tom Lawler is tracking a number of other areas, and has been kind enough to share that data with us (focused on distressed sales and cash buying).

If you are looking for data on your own area, you could try the local MLS, or look at the Zillow Research data. In addition to prices, Zillow tracks inventory and sales by metro area and zip code. Scroll down to "Other Metrics" and look at "Home Sales" and "For-sale Inventory" for the last five years.

Caution: Zillow has been expanding their coverage, so use caution when creating a data series based on aggregate data.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/11/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 6, 2015. ...

The Refinance Index decreased 3 percent from the previous week to the lowest level since January 2015. The seasonally adjusted Purchase Index increased 2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.01 percent, the highest level since the week ending January 2, 2015, from 3.96 percent, with points increasing to 0.39 from 0.30 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see a little more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 2% higher than a year ago.

Tuesday, March 10, 2015

Wednesday: Q4 Quarterly Services Report, Banks Comprehensive Capital Analysis

by Calculated Risk on 3/10/2015 07:39:00 PM

From Jon Hilsenrath at the WSJ: Fed Leans Toward Removing ‘Patient’ Promise on Rates

The Federal Reserve is strongly considering removing a barrier to raising short-term interest rates, by dropping its promise to be “patient” before acting.It seems very likely that "patient" will be removed from the statement. This will mean a June rate hike is possible, but not guaranteed.

...

Dropping the patience promise next week doesn’t mean officials are yet set on a rate increase in June. Ms. Yellen has signaled that the inflation backdrop is the key wildcard in the months ahead. Though the job market is improving as the Fed hoped, inflation isn’t moving back toward its 2% objective.

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, the Q4 Quarterly Services Report from the Census Bureau.

• At 4:30 PM, the Federal Reserve will release the Comprehensive Capital Analysis and Review Results (Stress Test)