by Calculated Risk on 1/30/2015 08:30:00 AM

Friday, January 30, 2015

BEA: Real GDP increased at 2.6% Annualized Rate in Q4

From the BEA: Gross Domestic Product: Fourth Quarter and Annual 2014 (Advance Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 2.6 percent in the fourth quarter of 2014, according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 5.0 percent.The advance Q4 GDP report, with 2.6% annualized growth, was below expectations of a 3.2% increase.

...

The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, exports, nonresidential fixed investment, state and local government spending, and residential fixed investment that were partly offset by a negative contribution from federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP growth in the fourth quarter primarily reflected an upturn in imports, a downturn in federal government spending, and decelerations in nonresidential fixed investment and in exports that were partly offset by an upturn in private inventory investment and an acceleration in PCE.

The price index for gross domestic purchases, which measures prices paid by U.S. residents, decreased 0.3 percent in the fourth quarter, in contrast to an increase of 1.4 percent in the third. Excluding food and energy prices, the price index for gross domestic purchases increased 0.7 percent, compared with an increase of 1.6 percent.

Personal consumption expenditures (PCE) increased at a 4.3% annualized rate - a strong pace!

The key negatives were trade (subtracted 1.02 percentage point) and Federal government spending (subtracted 0.54 percentage points).

Click on graph for larger image.

Click on graph for larger image.The first graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has been increasing, but it still below the levels of previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

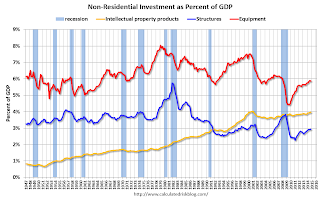

The second graph shows non-residential investment in structures, equipment and "intellectual property products". Investment is trending up as a percent of GDP..

The second graph shows non-residential investment in structures, equipment and "intellectual property products". Investment is trending up as a percent of GDP..I'll add details for investment in offices, malls and hotels next week.

Overall this was a solid report with strong PCE and private domestic investment.

Thursday, January 29, 2015

Friday: GDP, Chicago PMI, Consumer Sentiment

by Calculated Risk on 1/29/2015 07:31:00 PM

From the Atlanta Fed:

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2014 was 3.5 percent on January 27, unchanged from January 21.From Nomura:

Incoming data suggest that the economy grew at a slower pace in Q4 than the strong 5.0% growth in Q3. As such, we forecast that GDP increased at a still robust annualized rate of 3.4% in Q4. In particular, we expect final sales to grow by 3.4%, exceeding 3% for the fifth time in six quarters. Personal spending should make a significant positive contribution to growth in Q4. We expect inventory investment to make a negligible negative contribution.The two month method for forecasting PCE (using October and November), suggests real PCE growth of 4.3% in Q4 (of course December could be disappointing). That would be the best quarter for real PCE growth since 2006.

Friday:

• At 8:30 AM ET, Gross Domestic Product, 4th quarter 2014 (advance estimate). The consensus is that real GDP increased 3.2% annualized in Q4.

• At 9:45 AM, Chicago Purchasing Managers Index for January. The consensus is for a reading of 57.7, down from 58.8 in December.

• At 10:00 AM, the University of Michigan's Consumer sentiment index (final for January). The consensus is for a reading of 98.2, unchanged from the preliminary reading of 98.2, and up from the December reading of 93.6.

Zillow: Case-Shiller House Price Index year-over-year change expected to slow further in December

by Calculated Risk on 1/29/2015 03:15:00 PM

The Case-Shiller house price indexes for November were released Tuesday. Zillow has started forecasting Case-Shiller a month early - now including the National Index - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Expect Recent Trend of Sub-5% Annual Growth in Case-Shiller to Continue into 2015

The November S&P/Case-Shiller (SPCS) data released [Tuesday] showed a slight uptick in the pace of national home value appreciation in the housing market, with annual growth in the U.S. National Index rising to 4.7 percent, from 4.6 percent in October.So the year-over-year change in the Case-Shiller index will probably slow in December.

Despite the modestly faster pace of growth, annual appreciation in home values as measured by SPCS has been less than 5 percent for the past three months. We anticipate this trend to continue as annual growth in home prices slows to more normal levels between 3 percent and 5 percent. Zillow predicts the U.S. National Index to rise 4.5 percent on an annual basis in December.

The 10- and 20-City Indices saw annual growth rates decline in November; the 10-City index rose 4.2 percent and the 20-City Index rose 4.4 percent – down from rates of 4.4 percent and 4.5 percent, respectively, in October.

The non-seasonally adjusted (NSA) 20-City index fell 0.2 percent from October to November, and we expect it to decrease 0.4 percent in December from November. We expect the same monthly decline in the 10-City Composite Index next month, falling 0.4 percent from November to December (NSA).

All forecasts are shown in the table below. These forecasts are based on the November SPCS data release and the December 2014 Zillow Home Value Index (ZHVI), released Jan. 22. Officially, the SPCS Composite Home Price Indices for December will not be released until Tuesday, Feb. 24.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| November Actual YoY | 4.2% | 4.2% | 4.3% | 4.3% | 4.7% | 4.7% |

| December Forecast YoY | 3.8% | 3.8% | 4.0% | 4.0% | 4.5% | 4.5% |

| December Forecast MoM | -0.4% | 0.2% | -0.4% | 0.3% | 0.0% | 0.5% |

Philly Fed: State Coincident Indexes increased in 46 states in December

by Calculated Risk on 1/29/2015 11:58:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for December 2014. In the past month, the indexes increased in 46 states and remained stable in four, for a one-month diffusion index of 94. Over the past three months, the indexes increased in 50 states, for a three-month diffusion index of 100.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In December, 49 states had increasing activity (including minor increases). This measure has been moving up and down, and is in the normal range for a recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is all green again.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is all green again. It seems likely that several oil producing states will turn red sometime in 2015 - possibly Texas, North Dakota, Alaska or Oklahoma.

HVS: Q4 2014 Homeownership and Vacancy Rates

by Calculated Risk on 1/29/2015 10:15:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q4 2014.

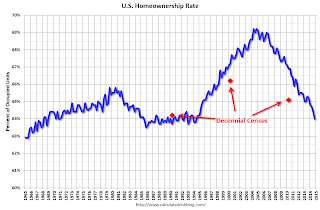

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 64.0% in Q4, from 64.4% in Q3.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

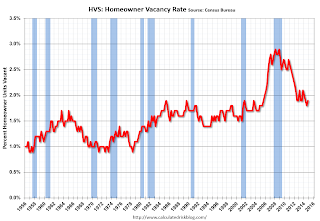

Are these homes becoming rentals?

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate - and Reis reported that the rental vacancy rate increased slightly over the last few quarters - and might have bottomed.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

NAR: Pending Home Sales Index decreased 3.7% in December, up 6.1% year-over-year

by Calculated Risk on 1/29/2015 10:03:00 AM

From the NAR: Pending Home Sales Stall in December

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 3.7 percent to 100.7 in December from a slightly downwardly revised 104.6 in November but is 6.1 percent above December 2013 (94.9). Despite last month’s decline (the largest since December 2013 at 5.8 percent), the index experienced its highest year-over-year gain since June 2013 (11.7 percent).Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

...

The PHSI in the Northeast experienced the largest decline, dropping 7.5 percent to 82.1 in December, but is still 6.3 percent above a year ago. In the Midwest the index decreased 2.8 percent to 97.1in December, but is 1.9 percent above December 2013.

Pending home sales in the South declined 2.6 percent to an index of 116.6 in December, but are 8.6 percent above last December. The index in the West fell 4.6 percent in December to 94.0, but is 6.3 percent above a year ago.

Weekly Initial Unemployment Claims decreased to 265,000

by Calculated Risk on 1/29/2015 08:34:00 AM

The DOL reported:

In the week ending January 24, the advance figure for seasonally adjusted initial claims was 265,000, a decrease of 43,000 from the previous week's revised level. This is the lowest level for initial claims since April 15, 2000 when it was 259,000. The previous week's level was revised up by 1,000 from 307,000 to 308,000. The 4-week moving average was 298,500, a decrease of 8,250 from the previous week's revised average. The previous week's average was revised up by 250 from 306,500 to 306,750.The previous week was revised up to 308,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 298,500.

This was much lower than the consensus forecast of 300,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, January 28, 2015

Thursday: Unemployment Claims, Pending Home Sales

by Calculated Risk on 1/28/2015 08:01:00 PM

On mortgage rates from Matthew Graham at Mortgage News Daily: Mortgage Rates Back to Long Term Lows After Fed

Mortgage rates fell again today, and while the move wasn't big, it was enough to bring most lenders back in line with the best rates from two weeks ago. Those have the added distinction of being the best rates since May 2013. At these levels, 3.625% is widely available as a top tier conforming 30yr fixed quote and a few lenders are quoting 3.5%.CR Note: The Ten Year yield declined to 1.72% from 1.83% yesterday. The low for the Ten Year yield was 1.4% back in July 2012.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 307 thousand.

• At 10:00 AM, Pending Home Sales Index for December. The consensus is for a 0.5% increase in the index.

• Also at 10:00 AM, the Q4 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

EIA: Record Oil Inventories, Imports at 7.4 million barrels per day

by Calculated Risk on 1/28/2015 04:27:00 PM

Every week the EIA releases a petroleum status report. I wanted to post an excerpt this week for two reasons: 1) Oil inventories are at a record level for this time of year (see blue line on graph), and 2) the US is a very large oil importer at 7.4 million barrels per day (contrary to some myths).

From the EIA: Weekly Petroleum Status Report

U.S. crude oil refinery inputs averaged about 15.3 million barrels per day during the week ending January 23, 2015, 347,000 barrels per day more than the previous week’s average. Refineries operated at 88.0% of their operable capacity last week. ...

U.S. crude oil imports averaged over 7.4 million barrels per day last week, up by 204,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged over 7.2 million barrels per day, 4.8% below the same four-week period last year. ...

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 8.9 million barrels from the previous week. At 406.7 million barrels, U.S. crude oil inventories are at the highest level for this time of year in at least the last 80 years.

emphasis added

FOMC Statement: "Economic activity has been expanding at a solid pace", "Patient" on Policy

by Calculated Risk on 1/28/2015 02:00:00 PM

As expected ... solid growth, patient on policy.

FOMC Statement:

Information received since the Federal Open Market Committee met in December suggests that economic activity has been expanding at a solid pace. Labor market conditions have improved further, with strong job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately; recent declines in energy prices have boosted household purchasing power. Business fixed investment is advancing, while the recovery in the housing sector remains slow. Inflation has declined further below the Committee’s longer-run objective, largely reflecting declines in energy prices. Market-based measures of inflation compensation have declined substantially in recent months; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to decline further in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy. However, if incoming information indicates faster progress toward the Committee’s employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated. Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Jeffrey M. Lacker; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams.

emphasis added