by Calculated Risk on 1/29/2015 10:03:00 AM

Thursday, January 29, 2015

NAR: Pending Home Sales Index decreased 3.7% in December, up 6.1% year-over-year

From the NAR: Pending Home Sales Stall in December

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 3.7 percent to 100.7 in December from a slightly downwardly revised 104.6 in November but is 6.1 percent above December 2013 (94.9). Despite last month’s decline (the largest since December 2013 at 5.8 percent), the index experienced its highest year-over-year gain since June 2013 (11.7 percent).Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

...

The PHSI in the Northeast experienced the largest decline, dropping 7.5 percent to 82.1 in December, but is still 6.3 percent above a year ago. In the Midwest the index decreased 2.8 percent to 97.1in December, but is 1.9 percent above December 2013.

Pending home sales in the South declined 2.6 percent to an index of 116.6 in December, but are 8.6 percent above last December. The index in the West fell 4.6 percent in December to 94.0, but is 6.3 percent above a year ago.

Weekly Initial Unemployment Claims decreased to 265,000

by Calculated Risk on 1/29/2015 08:34:00 AM

The DOL reported:

In the week ending January 24, the advance figure for seasonally adjusted initial claims was 265,000, a decrease of 43,000 from the previous week's revised level. This is the lowest level for initial claims since April 15, 2000 when it was 259,000. The previous week's level was revised up by 1,000 from 307,000 to 308,000. The 4-week moving average was 298,500, a decrease of 8,250 from the previous week's revised average. The previous week's average was revised up by 250 from 306,500 to 306,750.The previous week was revised up to 308,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 298,500.

This was much lower than the consensus forecast of 300,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, January 28, 2015

Thursday: Unemployment Claims, Pending Home Sales

by Calculated Risk on 1/28/2015 08:01:00 PM

On mortgage rates from Matthew Graham at Mortgage News Daily: Mortgage Rates Back to Long Term Lows After Fed

Mortgage rates fell again today, and while the move wasn't big, it was enough to bring most lenders back in line with the best rates from two weeks ago. Those have the added distinction of being the best rates since May 2013. At these levels, 3.625% is widely available as a top tier conforming 30yr fixed quote and a few lenders are quoting 3.5%.CR Note: The Ten Year yield declined to 1.72% from 1.83% yesterday. The low for the Ten Year yield was 1.4% back in July 2012.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 307 thousand.

• At 10:00 AM, Pending Home Sales Index for December. The consensus is for a 0.5% increase in the index.

• Also at 10:00 AM, the Q4 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

EIA: Record Oil Inventories, Imports at 7.4 million barrels per day

by Calculated Risk on 1/28/2015 04:27:00 PM

Every week the EIA releases a petroleum status report. I wanted to post an excerpt this week for two reasons: 1) Oil inventories are at a record level for this time of year (see blue line on graph), and 2) the US is a very large oil importer at 7.4 million barrels per day (contrary to some myths).

From the EIA: Weekly Petroleum Status Report

U.S. crude oil refinery inputs averaged about 15.3 million barrels per day during the week ending January 23, 2015, 347,000 barrels per day more than the previous week’s average. Refineries operated at 88.0% of their operable capacity last week. ...

U.S. crude oil imports averaged over 7.4 million barrels per day last week, up by 204,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged over 7.2 million barrels per day, 4.8% below the same four-week period last year. ...

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 8.9 million barrels from the previous week. At 406.7 million barrels, U.S. crude oil inventories are at the highest level for this time of year in at least the last 80 years.

emphasis added

FOMC Statement: "Economic activity has been expanding at a solid pace", "Patient" on Policy

by Calculated Risk on 1/28/2015 02:00:00 PM

As expected ... solid growth, patient on policy.

FOMC Statement:

Information received since the Federal Open Market Committee met in December suggests that economic activity has been expanding at a solid pace. Labor market conditions have improved further, with strong job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately; recent declines in energy prices have boosted household purchasing power. Business fixed investment is advancing, while the recovery in the housing sector remains slow. Inflation has declined further below the Committee’s longer-run objective, largely reflecting declines in energy prices. Market-based measures of inflation compensation have declined substantially in recent months; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to decline further in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy. However, if incoming information indicates faster progress toward the Committee’s employment and inflation objectives than the Committee now expects, then increases in the target range for the federal funds rate are likely to occur sooner than currently anticipated. Conversely, if progress proves slower than expected, then increases in the target range are likely to occur later than currently anticipated.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee’s holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Jeffrey M. Lacker; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams.

emphasis added

Duy: "While We Wait For Yet Another FOMC Statement..."

by Calculated Risk on 1/28/2015 11:13:00 AM

From Tim Duy: While We Wait For Yet Another FOMC Statement... Excerpt:

The Fed recognizes that hiking rates prematurely to "give them room" in the next recession is of course self-defeating. They are not going to invite a recession simply to prove they have the tools to deal with another recession.

The reasons the Fed wants to normalize policy are, I fear, a bit more mundane:

1. They believe the economy is approaching a more normal environment with solid GDP growth and near-NAIRU unemployment. They do not believe such an environment is consistent with zero rates.I am currently of the opinion that there is a reasonable chance the Fed is wrong on the third point, and that they have less room to maneuver than they believe. If so, they will find themselves back at the zero bound in the next recession, very quickly I might add. ...

2. They believe that monetary policy operates with long and variable lags. Consequently, they need to act before inflation hits 2% if they do not want to overshoot their target. And they in fact have no intention of overshooting their target.

3. They do not believe in the secular stagnation story. They do not believe that the estimate of the neutral Fed Funds rate should be revised sharply downward. Hence 25bp, or 50bp, or even 100bp still represents loose monetary policy by their definition.

Whether or not they can maintain their mid-year target is of course the topic du jour. But the logic of those who believe the Fed will not have what it needs in June and thus expect the first hike much later is more convincing than those who argue that they will raise rates due to some pressing need to prepare for the next recession.

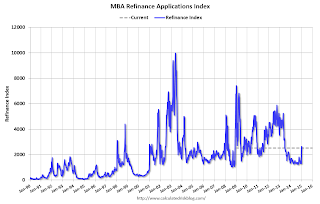

MBA: "Mortgage Applications decrease in Latest MBA Weekly Survey"

by Calculated Risk on 1/28/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 23, 2015. This week’s results include an adjustment to account for the Martin Luther King holiday. ...

The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.1 percent from one week earlier.

...

The FHA share of total applications increased to 9.1 percent this week from 8.0 percent last week. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.83 percent from 3.80 percent, with points decreasing to 0.26 from 0.29 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It looks like 2015 will see more refinance activity than in 2014, especially from FHA loans!

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the purchase index is up 1% from a year ago.

Tuesday, January 27, 2015

Wednesday: FOMC Statement

by Calculated Risk on 1/27/2015 09:01:00 PM

I don't expect much to change in the FOMC statement. I expect "patient" to remain:

"Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy."And this sentence will probably be dropped (it seemed like a one time transition sentence):

"The Committee sees this guidance as consistent with its previous statement that it likely will be appropriate to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time following the end of its asset purchase program in October, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored."The major data flow has been consistent with the FOMC's view; the consensus estimate of Q4 GDP is at 3.2%, and the December employment report was solid (252 thousand jobs added, unemployment rate declined to 5.6%). Inflation too low is an ongoing concern, but overall I think the FOMC will be, uh, patient.

Wednesday:

• At 7:00 AM, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, FOMC Meeting Statement. The FOMC is expected to retain the word "patient" in the FOMC statement

BLS: Forty-two States had Unemployment Rate Decreases in December

by Calculated Risk on 1/27/2015 06:44:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in December. Forty-two states and the District of Columbia had unemployment rate decreases from November, four states had increases, and four states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Mississippi had the highest unemployment rate among the states in December, 7.2 percent. The District of Columbia had a rate of 7.3 percent. North Dakota again had the lowest jobless rate, 2.8 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Mississippi, at 7.2%, had the highest state unemployment rate although D.C was higher.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Two states and D.C. are still at or above 7% (dark blue).

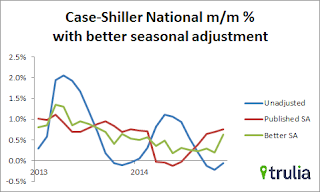

House Prices: Better Seasonal Adjustment; Real Prices and Price-to-Rent Ratio in November

by Calculated Risk on 1/27/2015 03:57:00 PM

This morning, S&P reported that the National index increased 0.8% in October seasonally adjusted. However, it appears the seasonal adjustment has been distorted by the high level of distressed sales in recent years. Trulia's Jed Kolko wrote in August: "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

The housing crisis substantially changed the seasonal pattern of housing activity: relative to conventional home sales, which peak in summer, distressed home sales are more evenly spread throughout the year and sell at a discount. As a result, in years when distressed sales constitute a larger share of overall sales, the seasonal swings in home prices get bigger while the seasonal swings in sales volumes get smaller.

Sharply changing seasonal patterns create problems for seasonal adjustment methods, which typically estimate seasonal adjustment factors by averaging several years’ worth of observed seasonal patterns. A sharp but ultimately temporary change in the seasonal pattern for housing activity affects seasonal adjustment factors more gradually and for more years than it should. Despite the recent normalizing of the housing market, seasonal adjustment factors are still based, in part, on patterns observed at the height of the foreclosure crisis, causing home price indices to be over-adjusted in some months and under-adjusted in others.

Kolko proposed a better seasonal adjustment:

Kolko proposed a better seasonal adjustment:This graph from Kolko shows the weighted seasonal adjustment (see Kolko's article for a description of his method). Kolko calculates that prices increased 0.6% on a weighted seasonal adjustment basis in November - as opposed to the 0.8% SA increase and 0.1% NSA decrease reported by Case-Shiller.

The "better" SA (green) shows prices are still increasing, but more slowly than the Case-Shiller SA.

The expected slowdown in year-over-year price increases is ongoing. In November 2013, the Comp 20 index was up 13.8% year-over-year (YoY). Now the index is only up 4.3% YoY. This is the smallest YoY increase since October 2012 (the National index was up 10.9% YoY in October 2013, is now up 4.7% - a little more than the YoY change last month).

Looking forward, I expect the YoY increases for the indexes to move more sideways (as opposed to down). Two points: 1) I don't expect the indexes to turn negative YoY (in 2015) , and 2) I think most of the slowdown on a YoY basis is now behind us. This slowdown in price increases was expected by several key analysts, and I think it is good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $277,000 today adjusted for inflation (39%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Another point on real prices: In the Case-Shiller release this morning, the National Index was reported as being 9.1% below the bubble peak. However, in real terms, the National index is still about 23% below the bubble peak.

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through November) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through November) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to April 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to November 2004 levels, and the CoreLogic index (NSA) is back to February 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to March 2003 levels, the Composite 20 index is back to September 2002, and the CoreLogic index back to March 2003.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to April 2003 levels, the Composite 20 index is back to October 2002 levels, and the CoreLogic index is back to April 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels - and maybe moving a little sideways now.