by Calculated Risk on 1/06/2015 09:03:00 AM

Tuesday, January 06, 2015

CoreLogic: House Prices up 5.5% Year-over-year in November

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose by 5.5 Percent Year Over Year in November 2014

Home prices nationwide, including distressed sales, increased 5.5 percent in November 2014 compared to November 2013. This change represents 33 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, rose by 0.1 percent in November 2014 compared to October 2014.

...

Excluding distressed sales, home prices nationally increased 5.3 percent in November 2014 compared to November 2013 and 0.3 percent month over month compared to October 2014. Also excluding distressed sales, all states and the District of Columbia showed year-over-year home price appreciation in November. Distressed sales include short sales and real estate owned (REO) transactions. ...

“After decelerating for most of the year, home price growth has been holding firm between a 5-percent and 6-percent growth rate for the last four months,” said Sam Khater, deputy chief economist at CoreLogic. “However, pockets of weakness are clear in Baltimore and Washington D.C., and three of the top four states with the highest price appreciation are energy intensive and had been benefitting from the energy boom which is currently receding as oil prices trend downward. These states—Texas, Colorado and North Dakota, may see some downward pressure on prices in 2015.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.1% in November, and is up 5.5% over the last year.

This index is not seasonally adjusted, and this small - but positive - month-to-month increase was during the seasonally weak period.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty three consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty three consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increases had been slowing, but has moved sideways over the last few months.

Reis: Apartment Vacancy Rate unchanged in Q4 at 4.2%

by Calculated Risk on 1/06/2015 08:28:00 AM

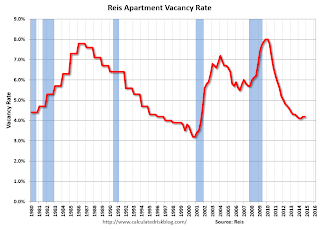

Reis reported that the apartment vacancy rate was unchanged in Q4 at 4.2%, the same as in Q3. In Q4 2013 (a year ago), the vacancy rate was also at 4.2%, and the rate peaked at 8.0% at the end of 2009.

Some comments from Reis Senior Economist Ryan Severino:

The national vacancy rate was unchanged at 4.2% during the fourth quarter. This follows last quarter's slight 10 basispoint increase in vacancy which was the first increase since the fourth quarter of 2009. Although vacancy did not continue to increase this quarter, the unchanged vacancy rate shows that the days of excess demand are likely over. Additionally, the surge in construction that we have observed in recent periods eased a bit this quarter after increasing during each of the last two quarters. Some of this is due to seasonality ‐ the market tends to slow during the fourth and first quarters of calendar years. Meanwhile, demand had a surprising rebound during the fourth quarter to 45,027 units, the highest quarterly figure since the fourth quarter of 2013. This is an important point ‐ even as construction increases in 2015 and beyond, demand will remain robust due to the large number of young renters in the US. However, as we mentioned last quarter, this is the beginning of an up cycle in vacancy and demand will struggle to keep pace with the significant amounts of new construction that should come online over the next few years.

...

While the market is still very tight at 4.2%, that level of vacancy is not going to be sustainable over the next few years. Supply will outpace demand and vacancy will slowly drift upward. While we still anticipate that the market will remain relatively tight, rising vacancy is likely to put downward pressure on NOI growth over the next few years, even as rents continue to grow.

Asking and effective rents both grew by 0.6% during the fourth quarter. This is a bit of a slowdown from the pace observed during the second and third quarters, but seasonality surely contributed to this. This was the weakest quarterly rate of rent growth since the first quarter of 2013. None the less, the trend in rents over time is up. 2014 annual rent growth for asking and effective rents was 3.5% and 3.6%, respectively. Not only is this the best performance in the apartment market since 2007, but apartment easily remains the best performing property type in this respect. Yet again, rents reached record‐high nominal levels during the fourth quarter. Although an improving labor market with more jobs and faster wage growth should provide landlords with more leverage to increase rents, over time this will be stymied by the sheer number of new units that are going to come online, increasing competition in the market. Although rent growth should remain positive for the next five years, the rate of growth is anticipated to slow, even as new units come online with rents that are higher than the market average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

Apartment vacancy data courtesy of Reis.

Monday, January 05, 2015

Tuesday: ISM Non-Manufacturing Index

by Calculated Risk on 1/05/2015 07:32:00 PM

For fun, here is a graph (click on graph for larger image) from Doug Short and shows the S&P 500 since the 2007 high ...

Tuesday:

• Early: Reis Q4 2014 Apartment Survey of rents and vacancy rates.

• At 10:00 AM ET, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is for a 0.2 decrease in November orders.

• Also at 10:00 AM ET, ISM non-Manufacturing Index for December. The consensus is for a reading of 58.2, down from 59.3 in November. Note: Above 50 indicates expansion.

U.S. Light Vehicle Sales decrease to 16.8 million annual rate in December

by Calculated Risk on 1/05/2015 02:05:00 PM

Based on a WardsAuto estimate, light vehicle sales were at a 16.75 million SAAR in December. That is up 8.8% from December 2013, and down 1.7% from the 17.09 million annual sales rate last month.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 16.75 million SAAR from WardsAuto).

This was below the consensus forecast of 16.9 million SAAR (seasonally adjusted annual rate).

Note: dashed line is current estimated sales rate.

This was another strong month for vehicle sales - the eighth consecutive month with a sales rate over 16 million - and the best year since 2006.

WTI Crude Oil Falls Close to $50 per Barrel

by Calculated Risk on 1/05/2015 11:41:00 AM

From Business Insider: Oil Keeps Falling

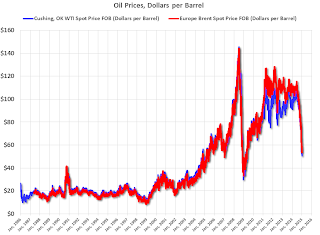

US crude and Brent futures dropped to fresh 5-1/2-year lows Monday as worries about a surplus of global supplies amid weak demand continued to drag on oil markets.Note: For why prices are falling, see A Comment on Oil Prices and Question #7 for 2015: What about oil prices in 2015?

At 4.20pm GMT (11.20 am ET), West Texas Intermediate crude was trading at $50.30 a barrel, a decline of more than 4.5% from Friday's close to the lowest level since April 2009.

Brent crude, the international benchmark, was also down more than 5% to below $54 a barrel, the lowest price since May 2009.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI has fallen 4.5% today to $50.31 per barrel, and Brent to $53.33.

Oil prices are off about 53% from the peak last year, and if this price decline holds, there should be further declines in gasoline prices over the next couple of weeks. Nationally gasoline prices are around $2,18 per gallon, and gasoline futures are down about 6 cents per gallon today.

Reis: Office Vacancy Rate declined in Q4 to 16.7%

by Calculated Risk on 1/05/2015 08:59:00 AM

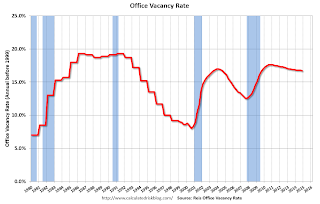

Reis released their Q4 2014 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined in Q4 to 16.7% from 16.8% in Q3 2014. This is down from 16.9% in Q4 2013, and down from the cycle peak of 17.6%.

From Bloomberg: U.S. Office-Occupancy Gains Jump to a Seven-Year High

Occupied office space increased by a net 10.97 million square feet (1 million square meters) during the last three months of the year, the most since the third quarter of 2007, according to property-research firm Reis Inc. The measure, known as net absorption, jumped 28 percent in 2014 to 32.5 million square feet, also a seven-year high.

...

The nationwide vacancy rate at the end of the year was 16.7 percent, the lowest since the third quarter of 2009 and down from 16.9 percent in 2013.

...

“As long as we don’t get a random shock to the economy, and labor growth continues, vacancies should fall and rents should rise faster in 2015,” [Ryan Severino, Reis senior economist] said.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.7% in Q4, down from 16.9% in Q4 2014. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010, and Q1 2011.

Net absorption is picking up, but there will not be a significant pickup in new construction until the vacancy rate falls much further.

Office vacancy data courtesy of Reis.

Sunday, January 04, 2015

Monday: Vehicle Sales

by Calculated Risk on 1/04/2015 07:47:00 PM

Starting in 2009, there were always a large number of analysts predicting the Fed would raise rates very soon (not me) - until Bernanke and the FOMC stopped that speculation when they included the following phrase in the August 2011 statement: "The Committee currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013."

That was eventually changed to "late 2014", and then to "mid-2015" ... now it seems likely the FOMC will raise rates this year. It has been a long long time!

From the WSJ: As Fed Prepares to Raise Rates, Economists Caution of Potential Bumps

“If we do it right, we don’t put the economy off-kilter,” said Federal Reserve Bank of Boston President Eric Rosengren . But “there are unusual conditions that I think complicate the normalization of rates this time.”Monday:

For instance, the current low level of long-term interest rates “indicates that there may be a bumpier ride, just because there needs to be an adjustment at some point along the cycle,” he said.

Still, Mr. Rosengren and others who spoke over the weekend at the American Economic Association’s annual meeting in Boston expressed relief that the U.S. economy has healed to the point where officials can seriously consider their first rate increase since 2006.

It is remarkable, said New York University economist Mark Gertler, that “after six or seven years, we’re finally talking about policy normalization, and it’s not a hypothetical conversation.”

• Early: Reis Q4 2014 Office Survey of rents and vacancy rates.

• All day: Light vehicle sales for December. The consensus is for light vehicle sales to decrease to 16.9 million SAAR in December from 17.1 million in November (Seasonally Adjusted Annual Rate).

Weekend:

• Schedule for Week of January 4, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 14 and DOW futures are down 100 (fair value).

Oil prices were down over the last week with WTI futures at $52.69 per barrel and Brent at $56.42 per barrel. A year ago, WTI was at $94, and Brent was at $107 - so prices are down 44% and 47% year-over-year respectively.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.20 per gallon (down about $1.10 per gallon from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Update: Framing Lumber Prices down Year-over-year

by Calculated Risk on 1/04/2015 09:53:00 AM

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand), however prices didn't fall as sharply either.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Dec 19th (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down about 2% from a year ago, and CME futures are down 9% year-over-year. Mostly prices have moved sideways for the last 18 months.

Saturday, January 03, 2015

Schedule for Week of January 4, 2015

by Calculated Risk on 1/03/2015 11:29:00 AM

The key report this week is the December employment report on Friday.

Other key reports include December vehicle sales on Monday, the December ISM non-manufacturing index on Tuesday, and the November Trade Deficit on Wednesday.

Also, Reis will release their quarterly surveys of rents and vacancy rates for offices, apartments and malls.

Early: Reis Q4 2014 Office Survey of rents and vacancy rates.

All day: Light vehicle sales for December. The consensus is for light vehicle sales to decrease to 16.9 million SAAR in December from 17.1 million in November (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for December. The consensus is for light vehicle sales to decrease to 16.9 million SAAR in December from 17.1 million in November (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the November sales rate.

Early: Reis Q4 2014 Apartment Survey of rents and vacancy rates.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is for a 0.2 decrease in November orders.

10:00 AM: ISM non-Manufacturing Index for December. The consensus is for a reading of 58.2, down from 59.3 in November. Note: Above 50 indicates expansion.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 223,000 payroll jobs added in December, up from 207,000 in November.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through October. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $42.0 billion in November from $43.4 billion in October.

Early: Reis Q4 2014 Mall Survey of rents and vacancy rates.

2:00 PM: FOMC Minutes for Meeting of December 16-17, 2014

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 300 thousand from 298 thousand.

Early: Trulia Price Rent Monitors for December. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

3:00 PM: Consumer Credit for November from the Federal Reserve. The consensus is for credit to increase $15.0 billion.

8:30 AM: Employment Report for December. The consensus is for an increase of 240,000 non-farm payroll jobs added in December, down from the 321,000 non-farm payroll jobs added in November.

The consensus is for the unemployment rate to decline to 5.7% in December from 5.8% the previous month.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In November, the year-over-year change was 2.73 million jobs, and that should increase further in December. Barring a huge downside surprise in the December report, 2014 will be the best year since the '90s for both total nonfarm and private sector employment growth.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a 0.3% increase in inventories.

Friday, January 02, 2015

Unofficial Problem Bank list declines to 400 Institutions

by Calculated Risk on 1/02/2015 09:28:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 2, 2015.

Changes and comments from surferdude808:

This past Monday, the FDIC released an update on its enforcement action activities through November 2014. The release contributed to several changes to the Unofficial Problem Bank List this week. After three removals and two additions, the list holds 400 institutions with assets of $124.8 billion. A year ago, the list held 618 institutions with assets of $205.6 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 400.

The FDIC terminated actions against Legacy Bank of Florida, Boca Raton, FL ($275 million); First Home Bank, Seminole, FL ($76 million); and Bank of Wrightsville, Wrightsville, GA ($52 million).

The FDIC issued actions against The Elkhart State Bank, Elkhart, TX ($53 million) and State Bank of Burnettsville, Burnettsville, IN ($49 million).

Next week likely will be slow in terms of changes to the list.