by Calculated Risk on 12/26/2014 09:24:00 PM

Friday, December 26, 2014

Unofficial Problem Bank list unchanged at 401 Institutions, Q4 2014 Transition Matrix

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 26, 2014.

Changes and comments from surferdude808:

The FDIC did not release an update on its enforcement action activities through November this week. We had anticipated the release as the FDIC's issuance pattern is on the last Friday of the month. However, President Obama provided federal workers an additional day off given that Christmas fell on a Thursday. So it looks like the FDUC will issue the release one day next week. Otherwise, there are no changes to report to the Unofficial Problem Bank List. Thus, the list ends the month and year holding 401 institutions with assets of $125.1 billion. A year ago, the list held 619 institutions with assets of $205.8 billion. During December 2014, the list declined by a net seven institutions after nine action terminations, one failure, one merger, and four additions. However, assets during the month rose by $405 million, which is the first monthly increase since September 2012. The asset increase ends a streak of 26 consecutive months of lower assets.

Given no changes this week, we decided to bring the transition matrix a week earlier than planned. For full details, see the accompanying table and a graphic depicting trends in how institutions have arrived and departed the list. Since publication of the Unofficial Problem Bank List started in August 2009, a total of 1,684 institutions have appeared on the list. Since year-end 2012, new entrants have slowed as 83 institutions have been added since then while 520 institutions have been removed. The pace of action terminations moved slightly higher in the latest quarter from the pace latest quarter. There has been a notable slowdown over the past six months (9.5 terminations per month average) compared with pace in the preceding 12 months (20 terminations per month average). Granted the list count is lower, but the per capita action termination rate of has slowed from 9.7 percent per quarter to 6.4 percent per quarter. At the start of the fourth quarter, there were 432 institution on the list with 30 institutions being removed because of action termination.

At the end of the fourth quarter, only 401 or 23.8 percent of the banks that have been on the list at some point remain. Action terminations of 676 account for about 53 percent of the 1,283 institutions removed. Although failures have slowed over the past two years, they do account for a significant number of institutions that have been removed from the list. Since publication, 387 of the institutions that have appeared on the list have failed accounting for more than 30 percent of all removals. Should another institution on the current list not fail, then nearly 23 percent of the 1,684 institutions that made an appearance on the list would have failed. A 23 percent default rate is more than double the rate often cited by media reports on the failure rate of banks on the FDIC's official list. Of the $673 billion in assets removed from the list, the largest amount of $297.4 billion is from failure while terminations still trail at $279.7 billion.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 142 | (56,729,564) | |

| Unassisted Merger | 35 | (8,440,695) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 154 | (184,269,578) | |

| Asset Change | (4,697,497) | ||

| Still on List at 12/31/2014 | 54 | 11,591,999 | |

| Additions after 8/7/2009 | 347 | 113,481,158 | |

| End (12/31/2014) | 401 | 125,073,157 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 534 | 222,995,923 | |

| Unassisted Merger | 171 | 74,507,776 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 233 | 113,167,202 | |

| Total | 948 | 412,995,043 | |

| 1Institution not on 8/7/2009 or 12/31/2014 list but appeared on a weekly list. | |||

Question #9 for 2015: What will happen with house prices in 2015?

by Calculated Risk on 12/26/2014 12:12:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2015. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2014.

7) House Prices: House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 5% or so in 2014 (after increasing about 12% nationally in 2013). What will happen with house prices in 2015?

The following graph shows the year-over-year change in the seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 SA was up 4.9% compared to September 2013, the Composite 20 SA was up 4.9% and the National index SA was up 4.8% year-over-year. Other house price indexes have indicated similar gains (see table below).

Although I use Case-Shiller, I also use several other price indexes. The following table shows the year-over-year change for several house prices indexes. The year-over-year price increases slowed in 2014, but the slowdown is probably mostly over (I don't expect prices to go negative year-over-year).

| Year-over-year Change for Various House Price Indexes | ||

|---|---|---|

| Index | Through | Increase |

| Case-Shiller Comp 20 | Sept-14 | 4.9% |

| Case-Shiller National | Sept-14 | 4.8% |

| CoreLogic | Oct-14 | 6.1% |

| Zillow | Oct-14 | 6.4% |

| Black Knight | Sept-14 | 4.6% |

| FNC | Oct-14 | 5.7% |

| FHFA Purchase Only | Sept-14 | 4.5% |

Some of the key factors in 2012 and 2013 were limited inventory, fewer foreclosures, investor buying in certain areas, and a change in psychology as buyers and sellers started believing house prices had bottomed. In some areas, like Phoenix, there appeared to be a bounce off the bottom - but that bounce appears to have ended in 2014. The investor buying has slowed - as have distressed sales.

The consensus of housing analysts appears to be for price increases of around 3.5% in 2015.

In 2015, inventories will probably remain low, but I expect inventories to continue to increase on a year-over-year basis. Low inventories, and a better economy (with more consumer confidence) suggests further price increases in 2015. I expect we will see prices up mid single digits (percentage) in 2015 as measured by these house price indexes.

Here are the ten questions for 2015 and a few predictions:

• Question #2 for 2015: How many payroll jobs will be added in 2015?

• Question #3 for 2015: What will the unemployment rate be in December 2015?

• Question #4 for 2015: Will too much inflation be a concern in 2015?

• Question #5 for 2015: Will the Fed raise rates in 2015? If so, when?

• Question #6 for 2015: Will real wages increase in 2015?

• Question #7 for 2015: What about oil prices in 2015?

• Question #8 for 2015: How much will Residential Investment increase?

• Question #9 for 2015: What will happen with house prices in 2015?

• Question #10 for 2015: How much will housing inventory increase in 2015?

Question #10 for 2015: How much will housing inventory increase in 2015?

by Calculated Risk on 12/26/2014 09:36:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2015. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2014.

10) Housing Inventory: It appears housing inventory bottomed in early 2013. Will inventory increase further in 2015, and, if so, by how much?

Tracking housing inventory is very helpful. The plunge in inventory in 2011 helped me call the bottom for house prices in early 2012 (The Housing Bottom is Here). And the increase in inventory in late 2005 (see first graph below) helped me call the top for house prices in 2006.

This graph shows nationwide inventory for existing homes through November 2014.

According to the NAR, inventory at 2.09 million is up slightly year-over-year from 2.05 million in November 2013, and up from 1.99 million in November 2012. A small increase over the last two years.

Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January as sellers take their homes off the market for the holidays. Trulia chief economist Jed Kolko sent me the seasonally adjusted inventory and this shows that inventory bottomed in January 2013, and is now up about 9.1% from the bottom on a seasonally adjusted basis.

Inventory increased 2.0% year-over-year in November from November 2013 (blue line).

Months of supply was at 5.1 months in November, unchanged from 5.1 months in November 2013. Even with the increase in inventory over the last two years, the current supply is still very low.

The NAR numbers are the usual measure of inventory. However Zillow also has some inventory data (by state, city, zip code and more here). We have to be careful using the Zillow data because the coverage is probably increasing, but looking at the zip code data, it appears inventory is up about 9% year-over-year. This ranges from a sharp year-over-year decrease in some cities (like Denver) to a sharp increase in other areas (like Bakersfield, CA). The housing market is slowly moving back to normal, and real estate is local!

Whenever I talk with real estate agents, I ask why they think inventory is so low. A common reason for low inventory is that potential sellers can't find homes to buy (because inventory is so low). Another reason for low inventory is that many homeowners are still "underwater" on their mortgages and can't sell. This is becoming less of a problem.

As the market moves back to normal, it seems homeowners will sell for the usual reasons (changing jobs, kids, etc).

Right now my guess is active inventory will increase further in 2015 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in 2015). I expect active inventory to move closer to 6 months supply this summer. If correct, this will keep house price increases down in 2015.

Here are the ten questions for 2015 and a few predictions:

• Question #2 for 2015: How many payroll jobs will be added in 2015?

• Question #3 for 2015: What will the unemployment rate be in December 2015?

• Question #4 for 2015: Will too much inflation be a concern in 2015?

• Question #5 for 2015: Will the Fed raise rates in 2015? If so, when?

• Question #6 for 2015: Will real wages increase in 2015?

• Question #7 for 2015: What about oil prices in 2015?

• Question #8 for 2015: How much will Residential Investment increase?

• Question #9 for 2015: What will happen with house prices in 2015?

• Question #10 for 2015: How much will housing inventory increase in 2015?

Thursday, December 25, 2014

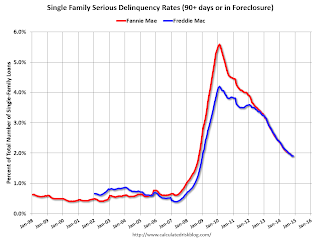

Freddie Mac: Mortgage Serious Delinquency rate unchanged in November

by Calculated Risk on 12/25/2014 06:39:00 PM

Freddie Mac reported yesterday that the Single-Family serious delinquency rate was unchanged in November at 1.91%. Freddie's rate is down from 2.43% in November 2013, and the rate in October and November was the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

The serious delinquency had declined every month since December 2012 (when it was also unchanged).

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for November next week.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.52 percentage points over the last year - and at that rate of improvement, the serious delinquency rate will not be below 1% until late 2016.

Note: Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales for perhaps 2 more years (mostly in judicial foreclosure states).

Happy Holidays!

by Calculated Risk on 12/25/2014 08:41:00 AM

Happy Holidays and Merry Christmas to All!

Out through the fields and the woodsLove greatly. Enjoy the season!

And over the walls I have wended;

I have climbed the hills of view

And looked at the world, and descended;

I have come by the highway home,

And lo, it is ended.

The leaves are all dead on the ground,

Save those that the oak is keeping

To ravel them one by one

And let them go scraping and creeping

Out over the crusted snow,

When others are sleeping.

And the dead leaves lie huddled and still,

No longer blown hither and thither;

The last lone aster is gone;

The flowers of the witch-hazel wither;

The heart is still aching to seek,

But the feet question ‘Whither?’

Ah, when to the heart of man

Was it ever less than a treason

To go with the drift of things,

To yield with a grace to reason,

And bow and accept the end

Of a love or a season?

Reluctance by Robert Frost From A Boy's Will, 1913.

Wednesday, December 24, 2014

"Mortgage Rates Match December Highs"

by Calculated Risk on 12/24/2014 07:37:00 PM

30 year mortgage rates moved up a little today, but are way down from 4.60% a year ago.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Match December Highs

Mortgage rates continued higher today as lenders opted for typically conservative holiday pricing strategies. The bond markets that most directly influence mortgage rates improved slightly from yesterday's precipitous weakness. Normally, those underlying market movements do more to move rates than anything else, but in cases where lenders are getting caught up to abrupt market changes or when they're protecting against uncertainty associated with long holiday weekends, their individual strategies can result in higher rates in spite of market movements suggesting lower rates. That's the case today, and it puts the average conforming 30yr fixed rate quote at 4.0%, matching the previous high from December 5th.Here is a table from Mortgage News Daily:

There's no way to know if rates will move higher or lower next week (don't expect much change this Friday). What we do know is that rates would improve if trading levels merely held flat between now and then. In other words, there's a bit of extra negativity baked into current rate sheets, and if markets manage to hold their ground or improve heading into the new year, we would get some of the recent losses back. To be clear, that's something that makes sense to HOPE for, but isn't justification to forgo locking your rate unless you're prepared to lock at even higher rates if the market happens to move against you.

Ten Economic Questions for 2015

by Calculated Risk on 12/24/2014 03:01:00 PM

Here is a review of the Ten Economic Questions for 2014.

There are always many questions for the new year. There are international economic issues with Russia in recession, Europe struggling and China slowing. There are always problems in the middle east, North Korea, and in other regions.

In the U.S., this is an odd year (no election), and Congress might threaten the economy again. And something might surprise us again (did anyone see yields dropping this far in 2014?).

Here are my ten questions for 2015. I'll follow up with some thoughts on each of these questions.

1) Economic growth: Heading into 2015, most analysts are pretty sanguine. Even with contraction in Q1, 2014 was a decent year (GDP will grow around 2.4% in 2014). Will 2015 be the best year of the recovery so far? Could 2015 be the best year since the '90s? Or will 2015 disappoint again?

2) Employment: With one month to go, 2014 is already the best year for employment growth since the '90s. Will 2015 be as strong? Or will job creation slow in 2015?

3) Unemployment Rate: The unemployment rate was at 5.8% in November, down 0.9 percentage points year-over-year. Currently the FOMC is forecasting the unemployment rate will be in the 5.2% to 5.3% range next December. What will the unemployment rate be in December 2015?

4) Inflation: The inflation rate is still running well below the Fed's 2% target. Will the core inflation rate rise in 2015? Will too much inflation be a concern in 2015?

5) Monetary Policy: The Fed completed QE3 in 2014, and now the question is will the Fed raise rates in 2015? If so, when? And by how much? The Fed Funds rate has been at 0 to 0.25% since December 2008.

6) Real Wage Growth: Last month I listed a few economic "words of the year" for the last decade. I finished with: "2015: Wages (Just being hopeful - maybe 2015 will be the year that real wages start to increase)". Will real wages increase in 2015?

7) Oil Prices: Declining oil prices and falling bond yields were two of the biggest stories of 2014. Will oil prices continue to decline in 2015?

8) Residential Investment: Residential investment (RI) picked was up solidly in 2012 and 2013 - up 13.5% and 11.9% respectively - but RI was only up 1.6% through Q3 2014. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. How much will RI increase in 2015? How about housing starts and new home sales in 2015?

9) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 5% or so in 2014 (after increasing about 12% nationally in 2013). What will happen with house prices in 2015?

10) Housing Inventory: It appears housing inventory bottomed in early 2013. Will inventory increase further in 2015, and, if so, by how much?

There are other key questions, but these are the ones I'm thinking about now.

Vehicle Sales Forecasts: "Strongest December in 10 Years", 17 Million in 2015

by Calculated Risk on 12/24/2014 10:52:00 AM

The automakers will report December vehicle sales on Monday, Jan 5th. Sales in November were at 17.1 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in December might be close to 17 million SAAR again.

Note: There were 26 selling days in December this year compared to 25 last year.

Here are a few forecasts:

From WardsAuto: Forecast: December Sales Set to Reach 10-Year High

A WardsAuto forecast calls for U.S. automakers to sell 1.51 million light vehicles in December, which would be the second-highest December sales tally since at least 1980, just behind December 2004’s 1.53 million. ... The forecast puts the seasonally adjusted annual rate of sales at 16.95 million-units, within a hair of breaking the 17 million mark for two consecutive months for the first time since June and July 2005.From J.D. Power: Vehicle Sales Forecast Increases for 2014 and 2015; December Retail SAAR Highest Since 2006

Total light-vehicle sales in December 2014 are expected to reach 1.5 million units, a 6 percent increase, compared with December 2013. [Total forecast 16.7 million SAAR]From Kelley Blue Book: New-Vehicle Sales To Jump Nearly 10 Percent In Best December Since 2004; Kelley Blue Book Forecasts 16.9 Million SAAR In 2015

...

For 2015, LMC Automotive has raised its forecast to 17.4 million units from 17.2 million, which is a 3 percent growth from 2014.

In December, new light-vehicle sales, including fleet, are expected to hit 1,490,000 units, up 9.8 percent from December 2013 and up 14.7 percent from November 2014. The seasonally adjusted annual rate (SAAR) for December 2014 is estimated to be 16.7 million, up from 15.4 million in December 2013 and down from 17.1 million in November 2014.And on 2015 from TrueCar: TrueCar projects 2015 U.S. new auto sales to reach decade-high 17 million, set all-time record revenue of $553 billion

TrueCar, Inc. ... expects a healthy U.S. auto industry in 2015 with sales of new cars and trucks rising at least 2.6 percent to 17 million units, the highest level since 2005.Another strong month for auto sales.

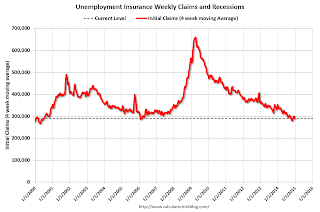

Weekly Initial Unemployment Claims decreased to 280,000

by Calculated Risk on 12/24/2014 08:50:00 AM

From the DOL reported:

In the week ending December 20, the advance figure for seasonally adjusted initial claims was 280,000, a decrease of 9,000 from the previous week's unrevised level of 289,000. The 4-week moving average was 290,250, a decrease of 8,500 from the previous week's unrevised average of 298,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 290,250.

This was lower than the consensus forecast of 290,000, and the level suggests few layoffs.

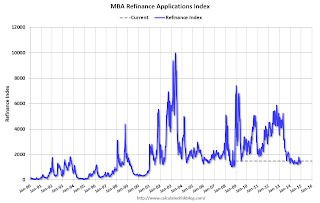

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 12/24/2014 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 19, 2014. ...

The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.02 percent, the lowest level since May 2013, from 4.06 percent, with points increasing to 0.26 from 0.21 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 72% from the levels in May 2013.

Even with the general decline in mortgage rates, refinance activity is very low this year and 2014 will be the lowest since year 2000. Rates would have to decline significantly for there to be a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down 1% from a year ago.