by Calculated Risk on 12/13/2014 08:09:00 AM

Saturday, December 13, 2014

Unofficial Problem Bank list declines to 406 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 12, 2014.

Changes and comments from surferdude808:

As anticipated, there were few changes to the Unofficial Problem Bank List this week. After the removal of one bank, the list count is 406 institutions with assets of $123.9 billion. A year ago, the list held 641 institutions with assets of $219.4 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 406.

The Ohio State Bank, Marion, OH ($85 million) was removed after if found a merger partner. Next week, we anticipate the OCC will provide an update on its enforcement action activities.

Friday, December 12, 2014

Goldman: FOMC Preview

by Calculated Risk on 12/12/2014 07:51:00 PM

Some excerpts from a research note by economists Sven Jari Stehn and David Mericle at Goldman Sachs:

The economic dataflow has been solid since the October FOMC meeting. ... News on inflation, however, has been mixed. On the one hand, actual inflation measures have firmed a bit since October. But, on the other hand, oil prices have continued to decline and market-implied measures of inflation expectations have dropped further.The meeting is next Tuesday and Wednesday.

We expect modest upgrades to Fed officials’ projections and to the description of growth and the labor market in the FOMC statement, while the inflation forecasts are likely to come down a bit. These expectations for the economic projections would suggest that the “dots” remain broadly unchanged.

We expect the FOMC to modify its “considerable time” forward guidance. One possibility would be to state that the committee will be “patient” in raising the funds rate until it is clear that the economy is on the path to achieving the FOMC’s goals. ... Our forecast for updated guidance is a close call, however, as the committee would want to avoid a tightening of financial conditions in light of the mixed inflation news. We would therefore expect the committee to indicate that the change in guidance is not meant to convey an expectation of an earlier liftoff than previously communicated, either in the statement itself or in Chair Yellen’s press conference.

An area of particular interest for the press conference will be any discussion of the post-liftoff guidance, as recent Fed communication has raised the prospect that views might be starting to shift away from the “shallow glide path.” Our forecast remains for the first hike in September 2015, followed by a steeper path of the funds rate than current market pricing.

Hotels: Occupancy Rate Finishing 2014 Strong

by Calculated Risk on 12/12/2014 05:18:00 PM

From HotelNewsNow.com: STR: US results for week ending 6 December

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 30 November through 6 December 2014, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 3.1 percent to 57.1 percent. Average daily rate increased 4.5 percent to finish the week at US$114.73. Revenue per available room for the week was up 7.7 percent to finish at US$65.48.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now in the slow period of the year.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and since mid-June, the occupancy rate has been a little higher than for the same period in 2000.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Merrill and Nomura: FOMC Preview

by Calculated Risk on 12/12/2014 02:10:00 PM

From Lewis Alexander et al at Nomura:

We expect the December FOMC meeting to give us additional insight into the future path of monetary policy. We will receive another round of FOMC forecasts for the first time since September, which will incorporate significant new data. The drop in energy prices will likely lead the FOMC to lower its inflation forecasts, and the Committee will likely have to lower its unemployment rate forecasts, due to the faster-than-expected declines in the unemployment rate.From Michael Hanson at Merrill Lynch:

Moreover, we expect the FOMC to make changes to its forward guidance. Given recent Fed speak and improvement in US economic momentum, we now think it is more likely than not that the FOMC will drop the “considerable time” language in its December policy statement. However, we expect them to replace this with some statement that suggests that rate hikes are not imminent.

Next week’s FOMC meeting will feature updated forecasts (including the dot plot) and a press conference from Fed Chair Janet Yellen. But most market discussion of late has focused on the “considerable time” phrase: will it stay or will it go? Our base case is that the Fed will replace it with language emphasizing patience, but it is a close call versus keeping the current text. Whether or not that language is changed, we expect Chair Janet Yellen to signal a patient and gradual evolution of policy in a data-dependent context in her post-meeting press conference. The Fed likely wants to gradually guide the markets toward liftoff, not shock them.Here are the most recent FOMC projections. It looks like GDP will be revised up for 2014 (and possibly for 2015).

...

What is almost certain is that the Fed will not simply drop “considerable time” without any substitute. ... as New York Fed President Bill Dudley reiterated this past week, to be a bit too late than to be too early. Additional reasons for patience include the limited set of policy options should the Fed have to ease further, as well as the hit to credibility of having to soon reverse a hiking cycle. We expect patience will be a main message in the December FOMC meeting and in Yellen’s post-meeting remarks.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2014 | 2015 | 2016 | 2017 |

| Sept 2014 Meeting Projections | 2.0 to 2.2 | 2.6 to 3.0 | 2.6 to 2.9 | 2.3 to 2.5 |

| June 2014 Meeting Projections | 2.1 to 2.3 | 3.0 to 3.2 | 2.5 to 3.0 | n.a. |

The unemployment rate was at 5.8% in both October and November, so the unemployment rate projection for Q4 2014 will be lowered again.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2014 | 2015 | 2016 | 2017 |

| Sept 2014 Meeting Projections | 5.9 to 6.0 | 5.4 to 5.6 | 5.1 to 5.4 | 4.9 to 5.3 |

| June 2014 Meeting Projections | 6.0 to 6.1 | 5.4 to 5.7 | 5.1 to 5.5 | n.a. |

As of October, PCE inflation was up 1.4% from October 2013, and core inflation was up 1.6%. Headline inflation will be even lower in November and December with the decline in oil prices. It seems likely the FOMC will lower their inflation projections (or move to the lower end of the September range). The key will be the inflation projections for next year.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2014 | 2015 | 2016 | 2017 |

| Sept 2014 Meeting Projections | 1.5 to 1.7 | 1.6 to 1.9 | 1.7 to 2.0 | 1.9 to 2.0 |

| June 2014 Meeting Projections | 1.5 to 1.7 | 1.5 to 2.0 | 1.6 to 2.0 | n.a. |

Here are the FOMC's recent core inflation projections:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2014 | 2015 | 2016 | 2017 |

| Sept 2014 Meeting Projections | 1.5 to 1.6 | 1.6 to 1.9 | 1.8 to 2.0 | 1.9 to 2.0 |

| June 2014 Meeting Projections | 1.5 to 1.6 | 1.6 to 2.0 | 1.7 to 2.0 | n.a. |

Preliminary December Consumer Sentiment increases to 93.8

by Calculated Risk on 12/12/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for December was at 93.8, up from 88.8 in November.

This was above the consensus forecast of 89.5 and is at the highest level since before the recession. Lower gasoline prices and a stronger economy are probably the reasons for the sharp increase.

Sacramento Housing in November: Total Sales down 6% Year-over-year, Active Inventory increased 37%

by Calculated Risk on 12/12/2014 08:06:00 AM

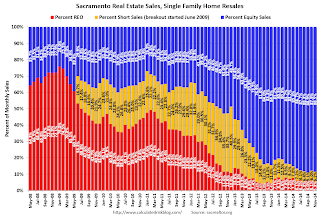

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For some time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In November 2014, 11.5% of all resales were distressed sales. This was down from 12.1% last month, and down from 15.5% in November 2013.

The percentage of REOs was at 5.3%, and the percentage of short sales was 6.2%.

Here are the statistics for November.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes increased 36.6% year-over-year (YoY) in November. In general the YoY increases have been trending down after peaking at close to 100%, however this was a larger YoY increase than in October.

Cash buyers accounted for 16.9% of all sales, down from 25.0% in November 2013 (frequently investors). This has been trending down, and it appears investors are becoming much less of a factor in Sacramento.

Total sales were down 6.1% from November 2013, and conventional equity sales were down 1.6% compared to the same month last year.

Summary: Distressed sales down sharply, cash buyers are down significantly, and inventory up significantly (but increases slowing). This is what we'd expect to see in a healing market. As I've noted before, we are seeing a similar pattern in other distressed areas.

Thursday, December 11, 2014

Would you loan money to this guy?

by Calculated Risk on 12/11/2014 07:11:00 PM

Would you make an unsecured personal loan to an individual so they can pay off $14,000 in credit card debt? If so, at what interest rate (the credit card debt is at 17%). The person has a 15 year credit history, a FICO score of 699, an annual income of $73,000 and a DTI of 17% (excluding mortgage debt).

Maybe for a close friend or family member, I'd consider helping - if I knew all the circumstances. However, for everyone else, my answer isn't no, it is Hell No!

The first guideline of personal finance is to pay off your credit card balance every month (with exceptions for extraordinary events). This person has a 15 year credit history - is probably in their 30s - and still can't pay off their credit card balance every month?

Maybe there was an extraordinary event - medical bills for a family member or maybe the borrower lost their job for some time. That would make a difference. But for most borrowers, I suspect they have just lived a little beyond their means.

If so, imagine what will happen after they pay off their credit card. In a year or two, it seems likely they will have run up their credit card debt again.

As long as the economy is expanding, and the person keeps their job - they will probably pay this personal loan. So, with no recession on the horizon, a 3 year loan right now will probably perform well. But what happens during the next recession?

This is the average Lending Club borrower (that they call "quality"). Yes - an individual lender can diversify among a number of borrowers of the same credit quality (that is less risky than lending to one person), but this isn't for me.

Friday:

• At 8:30 AM ET, the Producer Price Index for November from the BLS. The consensus is for a 0.1% decrease in prices, and a 0.1% increase in core PPI.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (preliminary for December). The consensus is for a reading of 89.5, up from 88.8 in November.

Mortgage Equity Withdrawal Still Negative in Q3 2014

by Calculated Risk on 12/11/2014 04:37:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released this morning) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is still little (but increasing) MEW right now - and normal principal payments and debt cancellation.

For Q3 2014, the Net Equity Extraction was minus $26 billion, or a negative 0.8% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $12 billion in Q3. This was only the second quarterly increase in mortgage debt since Q1 2008.

The Flow of Funds report also showed that Mortgage debt has declined by almost $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. With residential investment increasing, and a slower rate of debt cancellation, it is possible that MEW will turn positive again soon.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Fed's Flow of Funds: Household Net Worth "dipped slightly" in Q3

by Calculated Risk on 12/11/2014 12:23:00 PM

The Federal Reserve released the Q3 2014 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth decreased slightly in Q3 compared to Q2:

The net worth of households and nonprofits dipped slightly to $81.3 trillion during the third quarter of 2014. The value of directly and indirectly held corporate equities decreased $0.7 trillion and the value of real estate rose $245 billion.Prior to the recession, net worth peaked at $67.9 trillion in Q2 2007, and then net worth fell to $54.9 trillion in Q1 2009 (a loss of $13.0 trillion). Household net worth was at $81.3 trillion in Q3 2014 (up $26.4 trillion from the trough in Q1 2009).

The Fed estimated that the value of household real estate increased to $20.4 trillion in Q3 2014. The value of household real estate is still $2.2 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is above peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles. The ratio has been trending up but decreased slightly in Q3.

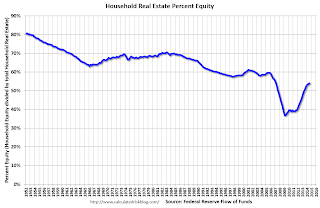

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2014, household percent equity (of household real estate) was at 53.9% - up from Q2, and the highest since Q1 2007. This was because of an increase in house prices in Q3 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 53.9% equity - and millions still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $12 billion in Q3.

Mortgage debt has declined by $1.26 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was down in Q3 (as GDP increased faster than house prices), and somewhat above the average of the last 30 years (excluding bubble).

Weekly Initial Unemployment Claims decreased to 294,000

by Calculated Risk on 12/11/2014 09:15:00 AM

Earlier from the DOL reported:

In the week ending December 6, the advance figure for seasonally adjusted initial claims was 294,000, a decrease of 3,000 from the previous week's unrevised level of 297,000. The 4-week moving average was 299,250, an increase of 250 from the previous week's unrevised average of 299,000.The previous week was unrevised at 297,000.

There were no special factors impacting this week's initial claims

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 299,250.

This was close to the consensus forecast of 296,000, and the level suggests few layoffs.