by Calculated Risk on 12/09/2014 08:15:00 AM

Tuesday, December 09, 2014

NFIB: Small Business Optimism Index Increases in November

From the National Federation of Independent Business (NFIB): Small Business Optimism Perks Up in December

The NFIB Small Business Optimism Index jumped up 2.0 points to 98.1, just a tick lower than its historical average before the Great Recession. ...And in another positive sign, the percent of firms reporting "poor sales" as the single most important problem has fallen to 12, down from 15 last year - and "taxes" at 23 and "regulations" at 22 are the top problems (taxes are usually reported as the top problem during good times - there always has to be a "top problem"!).

Fifty-seven percent reported outlays, 1 point better than October. The percent of owners planning capital outlays in the next 3 to 6 months fell 1 point to 25, a strong reading ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 98.1 in November from 96.1 in October.

Monday, December 08, 2014

Tuesday: Job Openings, Small Business Optimism

by Calculated Risk on 12/08/2014 06:37:00 PM

From Jon Hilsenrath at the WSJ: Fed Aims to Signal Shift on Low Rates

Federal Reserve officials are seriously considering an important shift in tone at their policy meeting next week: dropping an assurance that short-term interest rates will stay near zero for a “considerable time” as they look more confidently toward rate increases around the middle of next year.The FOMC statement (and press conference) will be released next week, Wednesday, December 17th.

Senior officials have hinted lately that they’re looking at dropping this closely watched interest-rate signal, which many market participants take as a sign rates won’t go up for at least six months.

Tuesday:

• At 7:30 AM ET, NFIB Small Business Optimism Index for November.

• At 10:00 AM, Job Openings and Labor Turnover Survey for October from the BLS. Jobs openings decreased in September to 4.735 million from 4.853 million in August. The number of job openings (yellow) were up 20% year-over-year compared to September 2013, and Quits were up 16% year-over-year.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.2% increase in inventories.

•During the day: Trulia Price Rent Monitors for November. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

FNC: More Long Term Home Owners selling in 2014

by Calculated Risk on 12/08/2014 04:06:00 PM

FNC released an interesting report today: Larger Homes Show Faster Appreciation than Smaller Homes Over the Past Decade

According to FNC, in 2004, about half of existing home sales were homes held 5 years of less. In 2014, only about one-fourth of home sales were held 5 years or less.

And in 2004, just 10% of home sales were held for more than 15 years. In 2014, that has doubled (more long term owners are selling now).

From FNC on the composition of existing home sales:

• A 10-year comparison of ownership duration on existing-home sales reveals a significant decline in the turnovers of homes held for short periods.

• 2004: 11.9% held for 18 months or less & 18.1% between 18-36 months• Rising share of homes held for longer periods:

• 2014: 5.8% held for 18 months or less & 7.6% between 18-36 months

• 2004: 5.7% for 12-15 years & 10.0% above 15 years• Median ownership duration currently stands at eight years, double the number from the pre-2009 periods.

• 2014: 9.6% for 12-15 years & 19.3% above 15 years

Click on graph for larger image.

Click on graph for larger image.This graph from FNC shows existing home sales by duration of ownership for 2004 and 2014.

Fewer flippers - and more long term owners selling.

Phoenix Real Estate in November: Sales down 4%, Cash Sales down Sharply, Inventory up only 3%

by Calculated Risk on 12/08/2014 12:40:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in November were down 3.8% year-over-year.

2) Cash Sales (frequently investors) were down about 20% to 28.0% of total sales. Non-cash sales were up 5.0% year-over-year.

3) Active inventory is now up 2.5% year-over-year - and at about the same level as in November 2011 (in 2011 house prices bottomed in Phoenix). Note: This is the smallest year-over-year inventory increase this year, so the inventory build may be slowing.

More inventory (a theme this year) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow ...

According to Case-Shiller, Phoenix house prices bottomed in August 2011 (mostly flat for all of 2011), and then increased 23% in 2012, and another 15% in 2013. Those large increases were probably due to investor buying, low inventory and some bounce back from the steep price declines in 2007 through 2010. Now, with more inventory, price increases have flattened out in 2014.

As an example, the Phoenix Case-Shiller index through September shows prices up less than 1% in 2014, and the Zillow index shows Phoenix prices up 3% over the last year.

| November Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Nov-08 | 4,417 | --- | 1,217 | 27.6% | 56,2271 | --- |

| Nov-09 | 7,494 | 69.7% | 2,572 | 34.3% | 40,372 | -28.2% |

| Nov-10 | 6,789 | -9.4% | 2,966 | 43.7% | 45,353 | 12.3% |

| Nov-11 | 7,147 | 5.3% | 3,245 | 45.4% | 26,798 | -40.9% |

| Nov-12 | 6,810 | -4.7% | 2,945 | 43.2% | 23,232 | -13.3% |

| Nov-13 | 5,181 | -23.9% | 1,761 | 34.0% | 26,762 | 15.2% |

| Nov-14 | 4,986 | -3.8% | 1,396 | 28.0% | 27,426 | 2.5% |

| 1 November 2008 probably includes pending listings | ||||||

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 12/08/2014 10:38:00 AM

By request, a few more employment graphs ...

Here are the previous posts on the employment report:

• November Employment Report: 321,000 Jobs, 5.8% Unemployment Rate

• Employment Report Comments: Best Year for Employment since the '90s

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is just below 1.8% of the labor force - the lowest since January 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 677 thousand.

The BLS diffusion index for total private employment was at 69.7 in November, up from 63.8 in October.

The BLS diffusion index for total private employment was at 69.7 in November, up from 63.8 in October.For manufacturing, the diffusion index was at 63.0, down from 64.2 in October.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good, close to 70 is great. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was widespread in November - another good sign.

Sunday, December 07, 2014

Sunday Night Futures

by Calculated Risk on 12/07/2014 08:22:00 PM

Monday:

• At 10:00 AM ET, the Fed will release the monthly Labor Market Conditions Index (LMCI).

Weekend:

• Schedule for Week of December 7th

• Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends

• The Future's so Bright ...

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are up slightly and DOW futures are also up slightly (fair value).

Oil prices were down over the last week with WTI futures at $65.84 per barrel and Brent at $69.07 per barrel. A year ago, WTI was at $97, and Brent was at $112 - so prices are down 32% and 38% year-over-year respectively.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.68 per gallon (down about 60 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends

by Calculated Risk on 12/07/2014 12:48:00 PM

For several years, I've been arguing that "most of the recent decline in the participation rate" was due to demographics and other long term structural trends (like more education). Clearly this was an important issue because if most of the decline had been due to cyclical weakness, then we'd expect a significant increase in participation as the economy improved. If the decline was due to demographics and other long term trends, then the participation rate might keep falling (or flatten out for a period before declining again) as the economy improves.

Definitions from the BLS:

Labor force participation rate: The labor force as a percent of the civilian noninstitutional population.Basically the labor force participation rate is the percent of people, 16 years and older, in the labor force (employed or unemployed).

Labor Force: The labor force includes all persons classified as employed or unemployed in accordance with the definitions contained in this glossary.

Civilian noninstitutional population: Included are persons 16 years of age and older residing in the 50 States and the District of Columbia who are not inmates of institutions (for example, penal and mental facilities, homes for the aged), and who are not on active duty in the Armed Forces.

Most of the recent research supports my view. As an example, from Federal Reserve researchers Stephanie Aaronson, Tomaz Cajner, Bruce Fallick, Felix Galbis-Reig, Christopher L. Smith, and William Wascher: Labor Force Participation: Recent Developments and Future Prospects

The evidence we present in this paper suggests that much of the steep decline in the labor force participation rate since 2007 owes to ongoing structural influences that are pushing down the participation rate rather than a pronounced cyclical weakness related to potential jobseekers’ discouragement about the weak state of the labor market ...In June, Dean Baker wrote: The Question on People Leaving the Labor Force is 41-Year-Olds, Not 61-Year-Olds

[T]he story of people leaving the labor force is not primarily one of older workers who are near retirement age, it is primarily a story of prime age workers. ...This brings up a few key points:

It is difficult to envision any obvious reason why people in their prime working years would suddenly decide that they did not want to work other than the weakness of the labor market. Most of these workers will presumably come back into the labor market if they see opportunities for employment.

1) Analyzing and forecasting the labor force participation requires looking at a number of factors. Everyone is aware that there is a large cohort has moved into the 50 to 70 age group, and that that has pushing down the overall participation rate. Another large cohort has been moving into the 16 to 24 year old age group - and many in this cohort are staying in school (a long term trend that has accelerated recently) - and that is another key factor in the decline in the overall participation rate.

2) But there are other long term trends. One of these trends is for a decline in the participation rate for prime working age men (25 to 54 years old).

3) Although Dr. Baker argues that the decline in prime working age workers is due to "weakness of the labor market", this decline was happening long before the Great Recession. For some reasons, see: Possible Reasons for the Decline in Prime-Working Age Men Labor Force Participation and on demographics from researchers at the Atlanta Fed: "Reasons for the Decline in Prime-Age Labor Force Participation"

Lets take a look at Dean Bakers "41-Year-Olds". I used the BLS data on 40 to 44 year old men (only available Not Seasonally Adjusted since 1976). I choose men only to simplify.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 40 to 44 year old men participation rate since 1976 (note the scale doesn't start at zero to better show the change).

There is a clear downward trend, and a researcher looking at this trend in the year 2000 might have predicted the 40 to 44 year old men participation rate would about the level as today (see trend line).

Clearly there are other factors than "economic weakness" causing this downward trend. I listed some reasons a few months ago, and research from Pew Research suggests stay-at-home dads is one of the reasons: Growing Number of Dads Home with the Kids

Just looking at this graph, I don't think there are many "missing 41-Year-Old" men that will be returning to the labor force.

The second graph shows the trends for each prime working age men 5-year age group.

The second graph shows the trends for each prime working age men 5-year age group.Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

Clearly there is a downward trend for all 5 year age groups. When arguing about how many workers are "missing", we need to take these long term trends into account.

The third graph shows the same data but with the full scale (0% to 100%). The trend is still apparent, but the decline has been gradual.

The third graph shows the same data but with the full scale (0% to 100%). The trend is still apparent, but the decline has been gradual.The bottom line is that the participation rate was declining for prime working age workers before the recession, there are several reasons for this decline (not just recent "economic weakness") and many estimates of "missing workers" are probably way too high.

And here is a look at the participation rate of women in the prime working age groups over time.

Click on graph for larger image.

Click on graph for larger image.This graph shows the trends for each prime working age women 5-year age group.

Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

For women, the participation rate increased significantly until the late 90s, and then started declining slowly. This is a more complicated story than for men, and that is why I used prime working age men only in the previous graphs to show the gradual downward decline in participation that has been happening for decades (and is not just recent economic weakness).

This graph shows the same data for women but with the full scale (0% to 100%). The upward participation until the late 80s is very clear, and the decline since then has been gradual.

This graph shows the same data for women but with the full scale (0% to 100%). The upward participation until the late 80s is very clear, and the decline since then has been gradual.To repeat: The bottom line is that the participation rate was declining for prime working age workers before the recession, there are several reasons for this decline (not just recent "economic weakness") and many estimates of "missing workers" are probably way too high.

Saturday, December 06, 2014

Schedule for Week of December 7th

by Calculated Risk on 12/06/2014 01:11:00 PM

The key economic report this week is November retail sales on Thursday.

Also the Census Bureau will release the Q3 Quarterly Services Report on Wednesday, and the Fed will release the Q2 Flow of Funds report on Thursday.

At 10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

7:30 AM ET: NFIB Small Business Optimism Index for November.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in September to 4.735 million from 4.853 million in August.

The number of job openings (yellow) were up 20% year-over-year compared to September 2013, and Quits were up 16% year-over-year.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.2% increase in inventories.

Early: Trulia Price Rent Monitors for November. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: The Q3 Quarterly Services Report from the Census Bureau.

2:00 PM ET: The Monthly Treasury Budget Statement for November.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 296 thousand from 297 thousand.

8:30 AM ET: Retail sales for November will be released.

8:30 AM ET: Retail sales for November will be released.This graph shows retail sales since 1992 through October 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales decreased 0.3% from September to October (seasonally adjusted), and sales were up 4.1% from October 2013.

The consensus is for retail sales to increase 0.4% in November, and to increase 0.1% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for September. The consensus is for a 0.3% increase in inventories.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: The Producer Price Index for November from the BLS. The consensus is for a 0.1% decrease in prices, and a 0.1% increase in core PPI.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for December). The consensus is for a reading of 89.5, up from 88.8 in November.

Unofficial Problem Bank list declines to 407 Institutions

by Calculated Risk on 12/06/2014 08:01:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 5, 2014.

Changes and comments from surferdude808:

Very quiet week for changes to the Unofficial Problem Bank List as there was only one removal that pushed the list total down to 407 institutions with assets of $124.0 billion. A year ago, the list held 643 institutions with assets of $219.8 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 407.

The Federal Reserve terminated the Written Agreement issued against United Security Bank, Fresno, CA ($693 million Ticker: UBFO). We expect for minimal changes to the list next week.

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Friday, December 05, 2014

The Future's so Bright ...

by Calculated Risk on 12/05/2014 04:47:00 PM

Almost two years ago I wrote The Future's so Bright .... In that post I outlined why I was becoming more optimistic. Now that 2014 is the best year for employment since the '90s, it is time for an update!

For new readers: I was very bearish on the economy when I started this blog in 2005 - back then I wrote mostly about housing (see: LA Times article and more here for comments about the blog). I started looking for the sun in early 2009, and now I'm more optimistic.

Here are some updates to the graphs I posted two years ago. Several of these graphs have changed direction since I wrote that post. As example, state and local government employment is now increasing, and household deleveraging is over (as predicted).

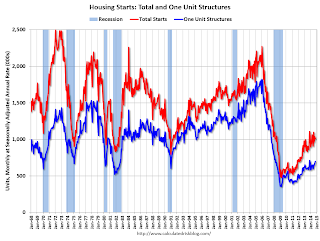

This graph shows total and single family housing starts. Even though starts have almost doubled from the bottom, starts are still way below the average level of 1.5 million per year from 1959 through 2000. As of October, starts are still close to the bottom for previous recessions.

Growth for starts in 2014 was slow, but that just means there is more growth ahead. Demographics and household formation suggests starts will increase to around 1.5 million over the next few years. That means starts will probably increase another 50% or so from the October 2014 level of 1 million starts (SAAR).

Residential investment and housing starts are usually the best leading indicator for the economy, so this suggests the economy will continue to grow over the next couple of years.

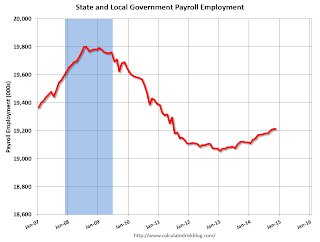

In 2013, state and local government employment increased by 44,000 jobs.

This year, through November 2014, state and local employment is up 96,000. So, in the aggregate, state and local government layoffs are over - and the economic drag on the economy is over.

As we've been discussing, the US deficit as a percent of GDP has been declining, and will probably remain under 3% for several years.

Here are a couple of graph on household debt (and debt service):

From the NY Fed: Household Debt Balances Increase as Deleveraging Period Concludes

Total cash flow from mortgage debt and nonmortgage debt combined (black dotted line) has turned slightly positive during the past four quarters, ending a five-year period of negative values, suggesting that, by this measure, the deleveraging process has ended; households have begun to use credit to supplement their cash flow again.There will be some more deleveraging ahead for certain households (mostly from foreclosures and distressed sales), but in the aggregate, household deleveraging is over.

emphasis added

This graph is from the Fed's Q2 Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

This graph is from the Fed's Q2 Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.The overall Debt Service Ratio decreased in Q2, and is near the record low set in Q4 2012. Note: The financial obligation ratio (FOR) is also near a record low (not shown)

Also the DSR for mortgages (blue) are near the low for the last 30 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

This data suggests household cash flow is in much better shape than several years ago.

And for commercial real estate, here is the AIA Architecture Billings Index. This is usually a leading indicator for commercial real estate, and the readings over the last year suggest more increases in CRE investment in 2014 (except oil and power with the recent decline in oil prices).

And for commercial real estate, here is the AIA Architecture Billings Index. This is usually a leading indicator for commercial real estate, and the readings over the last year suggest more increases in CRE investment in 2014 (except oil and power with the recent decline in oil prices).Overall it appears the economy is poised for more growth.

And in the longer term I remain very optimistic.

Earlier this year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

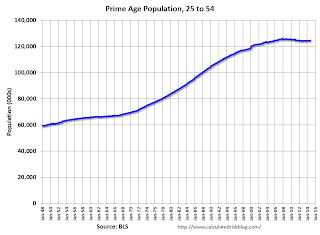

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through October 2014.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

These young workers are well educated and tech savvy. And they will have babies and buy homes soon. For more, see from Joe Weisenthal: The Analyst Who Nailed The Housing Crash Is Quietly Revealing The Next Big Thing

Over two years ago I said that looking forward I was the most optimistic since the '90s. And things are only getting better. The future's so bright, I gotta wear shades.

Yes, the song was about nuclear holocaust ... but it was originally intended the way I'm using it.