by Calculated Risk on 11/18/2014 12:34:00 PM

Tuesday, November 18, 2014

LA area Port Traffic in October: Strong Imports, Soft Exports

Note: There is a trucker strike in LA that might impact port traffic in November. From the LA Times: L.A.-area port truckers expand strike to three new companies

A port truck driver strike at the twin ports of Los Angeles and Long Beach grew Monday, as protest organizers targeted three more companies that they accuse of wage theft. ... The expanded strike comes as tension at the nation’s busiest port complex is high. A powerful dockworkers union and multinational shipping lines are negotiating a new contract for about 20,000 workers on the West Coast.Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for October since LA area ports handle about 40% of the nation's container port traffic.

Dockworkers have been without a contract since July ...

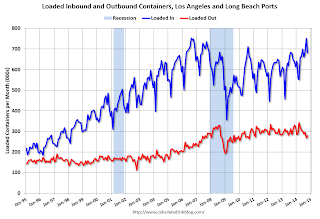

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was up 0.5% compared to the rolling 12 months ending in September. Outbound traffic was down 0.9% compared to 12 months ending in September.

Inbound traffic has been increasing, and outbound traffic has been mostly moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). This was the 3rd highest level for imports in October, only behind October 2006 and 2007.

Imports were up 5.7% year-over-year in October, exports were down 10.4% year-over-year.

This might suggest U.S. retailers are expecting a happy holiday season - but exports suggest a slowdown in Asia.

NAHB: Builder Confidence increased to 58 in November

by Calculated Risk on 11/18/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 58 in November, up from 54 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Rises Four Points in November

Builder confidence in the market for newly built single-family homes rose four points to a level of 58 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

“Growing confidence among consumers is what’s fueling this optimism among builders,” said NAHB Chairman Kevin Kelly, a home builder and developer from Wilmington, Del. “Members in many areas of the country continue to see increasing buyer traffic and signed contracts.”

“Low interest rates, affordable home prices and solid job creation are contributing to a steady housing recovery,” said NAHB Chief Economist David Crowe. “After a slow start to the year, the HMI has remained above the 50-point benchmark for five consecutive months, and we expect the momentum to continue into 2015.”

...

All three HMI components increased in November. The index gauging current sales conditions rose five points to 62, while the index measuring expectations for future sales moved up two points to 66 and the index gauging traffic of prospective buyers increased four points to 45.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose three points to 44, the South posted a four-point gain to 62, and the West edged up one point to 58. The Midwest registered a two-point loss to 57.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast of 55.

Monday, November 17, 2014

Tuesday: Homebuilder survey, PPI

by Calculated Risk on 11/17/2014 07:10:00 PM

Some excellent research from the NY Fed Liberty Street Economics: Measuring Labor Market Slack: Are the Long-Term Unemployed Different?. The conclusion:

[W]e find that long-term unemployed workers are not less attached to the labor market than short-term unemployed workers. If anything, the long-term unemployed group has the largest share of prime-age workers, the age group likely to have the strongest labor force attachment. We also see that long-term unemployment is an economy-wide phenomenon, spread across industries and occupations. While there may be unobservable characteristics of long-term unemployed workers that make them less attached to the labor force, when looking at their observable characteristics, it’s hard to argue that they should not be considered as part of labor market slack.The "underutilization of labor resources" may be "gradually diminishing" (from the recent FOMC statement), but based on this research, the unemployment rate, and the number of people working part time for economic reasons, it appears there is still a fair amount of slack in the labor market.

Tuesday:

• At 8:30 AM ET, the Producer Price Index for October from the BLS. The consensus is for a 0.1% decrease in prices, and a 0.1% increase in core PPI.

• At 10:00 AM, the November NAHB homebuilder survey. The consensus is for a reading of 55, up from 54 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

CoStar: Commercial Real Estate prices increased in September

by Calculated Risk on 11/17/2014 04:14:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Real Estate Price Surge Continues In Third Quarter

NATIONAL COMPOSITE INDICES CONTINUE TO CLIMB. Both the value-weighted and the equal-weighted U.S. Composite Indices of the CCRSI made strong gains in September 2014 to close the quarter. The value-weighted index, which is heavily influenced by core transactions, advanced by 1.9% in the month of September and 3.3% in the third quarter of 2014. The value-weighted index is now 2.8% above its prerecession high and continues to make solid gains. The equal-weighted U.S. Composite Index, which is heavily influenced by smaller non-core deals, increased by 1.3% in September and 4.2% in the third quarter of 2014.

...

ANNUAL PRICE GAINS REALIZED ACROSS ALL MAJOR PROPERTY SECTORS. The retail, industrial, and office segments all moved up toward 2007 pricing levels in September 2014 and are now within 11.4%, 14.4%, and 21.2% of their previous peaks, respectively. The multifamily sector, which recovered earlier than the other property types, is now 1% above its previous peak.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is above the pre-recession peak, but the equal weighted is still well below the pre-recession peak.

There are indexes by sector and region too.

The second graph shows indexes by sector.

The second graph shows indexes by sector.The multifamily sector is now above the previous peak. The office sector is lagging.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

WSJ: Audit shows FHA Back in Black

by Calculated Risk on 11/17/2014 12:59:00 PM

Update: Here is the summary Summary of FY2014 FHA Annual Report to Congress on the Financial Health of the Mutual Mortgage Insurance Fund

Joe Light at the WSJ writes: Federal Housing Authority in the Black for First Time Since 2011

The audit found that the FHA’s insurance fund had an economic value of $4.8 billion at the end of September, up from negative $1.1 billion last fiscal year. Its capital-reserve ratio, which the FHA is supposed to keep above 2%, grew to 0.41%. While an improvement, it was still short of last year’s projection.Recent FHA loans have performed very well, and the better performance combined with higher fees has led to the improvement.

...

More important, the report estimated that the FHA won’t return to the congressionally mandated 2% threshold until 2016, a year later than formerly estimated.

Fed: Industrial Production decreased 0.1% in October

by Calculated Risk on 11/17/2014 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production edged down 0.1 percent in October after having advanced 0.8 percent in September. In October, manufacturing output increased 0.2 percent for the second consecutive month. The index for mining declined 0.9 percent and the output of utilities moved down 0.7 percent. At 104.9 percent of its 2007 average, total industrial production in October was 4.0 percent above its level of a year earlier. Capacity utilization for the industrial sector decreased 0.3 percentage point in October to 78.9 percent, a rate that is 1.2 percentage points below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.9% is 1.2 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.1% in October to 105.1. This is 25.3% above the recession low, and 4.1% above the pre-recession peak.

The monthly change for Industrial Production was below expectations.

NY Fed: Empire State Manufacturing Survey indicates "pace of growth somewhat faster than last month’s" in November

by Calculated Risk on 11/17/2014 08:34:00 AM

From the NY Fed: Empire State Manufacturing Survey

The November 2014 Empire State Manufacturing Survey indicates that business activity continued to expand for New York manufacturers. The headline general business conditions index climbed four points to 10.2, indicating a pace of growth somewhat faster than last month’s. The new orders index rose eleven points to 9.1, and the shipments index advanced eleven points to 11.8. The index for number of employees edged down to 8.5 but remained positive, indicating that employment levels grew; the average workweek index, by contrast, was negative, pointing to a decline in hours worked. ...This is the first of the regional surveys for November. The general business conditions index was at the consensus forecast of a reading of 10.5, and indicates slightly faster expansion in November than in October (above zero suggests expansion).

emphasis added

Sunday, November 16, 2014

Monday: Industrial Production, Empire State Mfg Survey

by Calculated Risk on 11/16/2014 07:23:00 PM

Saturday, November 15th, was Doris "Tanta" Dungey's birthday. Happy Birthday T!

For new readers, Tanta was my co-blogger back in 2007 and 2008. She was a brilliant, writer - very funny - and a mortgage expert. Sadly, she passed away in 2008, and I like to celebrate her life on her birthday.

I strongly recommend Tanta's "The Compleat UberNerd" posts for an understanding of the mortgage industry. And here are many of her other posts.

On her passing, from the NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47, from the WaPo: Doris J. Dungey; Blogger Chronicled Mortgage Crisis, from me: Sad News: Tanta Passes Away

Monday:

• At 8:30 AM ET, the NY Fed Empire Manufacturing Survey for November. The consensus is for a reading of 10.5, up from 6.2 in October (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 79.3%.

• Note: New York Fed to Publish Blog Series on Long-term Unemployment and Labor Market Slack

Weekend:

• Schedule for Week of November 16th

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are down 4 and DOW futures are down 31 (fair value).

Oil prices were down over the last week with WTI futures at $75.84 per barrel and Brent at $79.51 per barrel. A year ago, WTI was at $94, and Brent was at $107 - so prices are down more than 20% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.89 per gallon (down about 30 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Unofficial Problem Bank list declines to 415 Institutions

by Calculated Risk on 11/16/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 14, 2014.

Changes and comments from surferdude808:

Four removals this week from the Unofficial Problem Bank List that push the list count down to 415 institutions with assets of $128 billion. From last week, assets have declined by $3.9 billion, with $2.9 billion coming from the roll to Q3 from Q2 assets. A year ago, the list held 655 institutions with assets of $223.2 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now back down to 415.

Actions have been terminated against Community First Bank & Trust, Columbia, TN ($436 million) and Devon Bank, Chicago, IL ($239 million). Through a merger partner, Highlands Independent Bank, Sebring, FL ($251 million) and Grant County Deposit Bank, Williamstown, KY ($76 million) have found a way off the list.

Next week, we anticipate the OCC will provide an update on its latest enforcement action activity.

Saturday, November 15, 2014

Schedule for Week of November 16th

by Calculated Risk on 11/15/2014 12:12:00 PM

The key economic reports this week are October housing starts on Wednesday, and October existing home sales on Thursday.

For manufacturing, the October Industrial Production and Capacity Utilization report, and the November NY Fed (Empire State), Philly Fed and Kansas City Fed manufacturing surveys, will be released this week.

For prices, PPI will be released on Tuesday and CPI on Thursday.

8:30 AM: NY Fed Empire Manufacturing Survey for November. The consensus is for a reading of 10.5, up from 6.2 in October (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 79.3%.

Note: New York Fed to Publish Blog Series on Long-term Unemployment and Labor Market Slack

8:30 AM: The Producer Price Index for October from the BLS. The consensus is for a 0.1% decrease in prices, and a 0.1% increase in core PPI.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 55, up from 54 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. Total housing starts were at 1.017 million (SAAR) in September. Single family starts were at 646 thousand SAAR in September.

The consensus is for total housing starts to increase to 1.025 million (SAAR) in October.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

2:00 PM: the FOMC Minutes for the Meeting of October 28-29, 2014

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 281 thousand from 290 thousand.

8:30 AM: Consumer Price Index for October. The consensus is for a 0.1% decrease in CPI in October, and for core CPI to increase 0.1%.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for sales of 5.15 million on seasonally adjusted annual rate (SAAR) basis. Sales in September were at a 5.17 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.28 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

10:00 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 18.5, down from 20.7 last month (above zero indicates expansion).

10:00 AM: Regional and State Employment and Unemployment (Monthly) for October 2014

11:00 AM: the Kansas City Fed manufacturing survey for November.