by Calculated Risk on 11/18/2014 12:34:00 PM

Tuesday, November 18, 2014

LA area Port Traffic in October: Strong Imports, Soft Exports

Note: There is a trucker strike in LA that might impact port traffic in November. From the LA Times: L.A.-area port truckers expand strike to three new companies

A port truck driver strike at the twin ports of Los Angeles and Long Beach grew Monday, as protest organizers targeted three more companies that they accuse of wage theft. ... The expanded strike comes as tension at the nation’s busiest port complex is high. A powerful dockworkers union and multinational shipping lines are negotiating a new contract for about 20,000 workers on the West Coast.Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for October since LA area ports handle about 40% of the nation's container port traffic.

Dockworkers have been without a contract since July ...

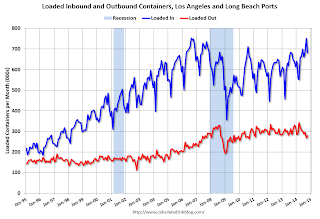

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was up 0.5% compared to the rolling 12 months ending in September. Outbound traffic was down 0.9% compared to 12 months ending in September.

Inbound traffic has been increasing, and outbound traffic has been mostly moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year). This was the 3rd highest level for imports in October, only behind October 2006 and 2007.

Imports were up 5.7% year-over-year in October, exports were down 10.4% year-over-year.

This might suggest U.S. retailers are expecting a happy holiday season - but exports suggest a slowdown in Asia.