by Calculated Risk on 10/17/2014 11:45:00 AM

Friday, October 17, 2014

A few comments on September Housing Starts

There were 761 thousand total housing starts during the first nine months of 2014 (not seasonally adjusted, NSA), up 9.5% from the 695 thousand during the same period of 2013. Single family starts are up 4%, and multifamily starts up 23%. The key weakness has been in single family starts.

The following table shows the annual housing starts since 2005, and the percent change from the previous year (estimates for 2014). The housing recovery has slowed in 2014, especially for single family starts. I expect to further growth in starts over the next several years.

| Housing Starts (000s) and Annual Change | ||||

|---|---|---|---|---|

| Total | Total % Change | Single | Single % Change | |

| 2005 | 2,068.3 | 5.8% | 1,715.8 | 6.5% |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 2012 | 780.6 | 28.2% | 535.3 | 24.3% |

| 2013 | 924.9 | 18.5% | 617.6 | 15.4% |

| 20141 | 990.0 | 7.0% | 630.0 | 2.0% |

| 1Estimate for 2014 | ||||

This graph shows the month to month comparison between 2013 (blue) and 2014 (red). Starts in 2014 have been above the same month in 2013 for six consecutive months.

Click on graph for larger image.

Click on graph for larger image.Starts in Q1 2014 averaged 925 thousand SAAR, and starts in Q2 averaged 985 thousand SAAR, up 7% from Q1.

Starts in Q3 averaged 1.024 million SAAR, up 4% from Q2 (and up 16% from Q3 2013).

This year, I expect starts to mostly increase throughout the year (Q1 will probably be the weakest quarter, and Q2 the second weakest).

However the year-over-year growth will slow in Q4 because the comparisons will be more difficult.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

For the second consecutive month, there were more multifamily completions than multifamily starts.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Single family starts had been moving up, but recently starts have only increased slowly on a rolling 12 months basis.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Preliminary October Consumer Sentiment increases to 86.4

by Calculated Risk on 10/17/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for October was at 86.4, up from 84.6 in September.

This was above the consensus forecast of 84.2. Sentiment has been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

Housing Starts increase to 1.017 Million Annual Rate in September

by Calculated Risk on 10/17/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 1,017,000. This is 6.3 percent above the revised August estimate of 957,000 and is 17.8 percent above the September 2013 rate of 863,000.

Single-family housing starts in September were at a rate of 646,000; this is 1.1 percent above the revised August figure of 639,000. The September rate for units in buildings with five units or more was 353,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,018,000. This is 1.5 percent above the revised August rate of 1,003,000 and is 2.5 percent above the September 2013 estimate of 993,000.

Single-family authorizations in September were at a rate of 624,000; this is 0.5 percent below the revised August figure of 627,000. Authorizations of units in buildings with five units or more were at a rate of 369,000 in September.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in September (Multi-family is volatile month-to-month).

Single-family starts (blue) also increased slightly in September.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was at expectations of 1.010 million starts in September.

This was an OK report; close to expectations. I'll have more later ...

Thursday, October 16, 2014

Friday: Housing Starts, Yellen

by Calculated Risk on 10/16/2014 07:35:00 PM

From Jann Swanson at Mortgage News Daily: Relaxed QRM Rules Expected Next Week(ht Soylent Green is People)

Federal regulators may finally produce the long anticipated market standards for Qualified Residential Mortgages (QRM), perhaps even as early as next week. The new rules are designed to ensure the quality of mortgages that are pooled and packaged into securities for sale to investors on the secondary market. Insiders expect that the final regulations will be more relaxed than those originally proposed, largely in response to demands by real estate and mortgage industry groups.Friday:

• At 8:30 AM, Housing Starts for September. Total housing starts were at 956 thousand (SAAR) in August. Single family starts were at 643 thousand SAAR in August. The consensus is for total housing starts to increase to 1.010 million (SAAR) in September.

• Also at 8:30 AM, Speech by Fed Chair Janet Yellen, Economic Opportunity, At the Federal Reserve Bank of Boston Economic Conference: Inequality of Economic Opportunity, Boston, Massachusetts

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for a reading of 84.2, down from 84.6 in September.

CoStar: Commercial Real Estate prices increased in August

by Calculated Risk on 10/16/2014 05:21:00 PM

Here is a price index for commercial real estate that I follow.

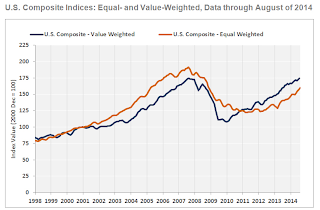

From CoStar: Commercial Property Prices Sustain Upward Climb in August

Fueled by better than expected job growth, demand continues to outstrip supply across major property types, resulting in tighter vacancy rates and continued investor interest in commercial real estate. The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—increased by 1% and 1.5%, respectively, in August 2014.

...

The value-weighted U.S. Composite Index, which is heavily influenced by larger, core transactions, has now reached prerecession peak levels, and price gains have naturally slowed as a result. The Index increased 8.7% for the 12 months ending in August 2014, following 12% growth in the prior 12 months. Meanwhile, price growth in the equal-weighted U.S. Composite Index, which is influenced more by smaller non-core deals, accelerated to an annual rate of 13.6% in August 2014, up from an average of 8.7% in the prior 12 months.

...

Just 10.5% of all repeat sale transactions involved distressed assets in the first eight months of 2014, down from one-third of all repeat sale transactions in 2010.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is back to the pre-recession peak, but the equal weighted is still well below the pre-recession peak.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 35% at the peak.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Earlier: Philly Fed Manufacturing Survey declines to 20.7 in October

by Calculated Risk on 10/16/2014 12:56:00 PM

Earlier from the Philly Fed: October Manufacturing Survey

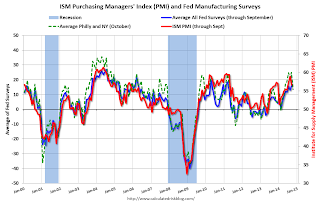

The diffusion index for current activity edged down from a reading of 22.5 to 20.7 this month ... The current shipments and employment indexes also declined but remained positive, while the current new orders index increased 2 points [to 17.3].This at the consensus forecast of a reading of 20.0 for October.

...

Although positive for the 16th consecutive month, the employment index decreased 9 points. [to 12.1] ...

The survey’s indicators for future manufacturing conditions fell from higher readings but continued to reflect general optimism about growth in activity and employment over the next six months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through October. The ISM and total Fed surveys are through September.

The average of the Empire State and Philly Fed surveys declined in October, but still suggests another decent ISM report for October.

NAHB: Builder Confidence decreased to 54 in October

by Calculated Risk on 10/16/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 54 in October, down from 59 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Four-Month Upturn Ends as Builder Confidence Falls in October

After four consecutive monthly gains, builder confidence in the market for newly built single-family homes fell five points to a level of 54 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

“We are seeing a return to the mid-50s index level trend established earlier in the summer, which is in line with the gradual pace of the housing recovery,” said NAHB Chairman Kevin Kelly, a home builder and developer from Wilmington, Del.

“While there was a dip this month, builders are still positive about the housing market.” “After the HMI posted a nine-year high in September, it’s not surprising to see the number drop in October,” said NAHB Chief Economist David Crowe. “However, historically low mortgage interest rates, steady job gains, and significant pent up demand all point to continued growth of the housing market.”

...

All three HMI components declined in October. The index gauging current sales conditions decreased six points to 57, while the index measuring expectations for future sales slipped three points to 64 and the index gauging traffic of prospective buyers dropped six points to 41.

Looking at the three-month moving averages for regional HMI scores, the Northeast and Midwest remained flat at 41 and 59, respectively. The South rose two points to 58 and the West registered a one-point loss to 57.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 59.

Fed: Industrial Production increased 1.0% in September

by Calculated Risk on 10/16/2014 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

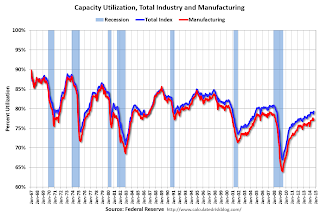

Industrial production increased 1.0 percent in September and advanced at an annual rate of 3.2 percent in the third quarter of 2014, roughly its average quarterly increase since the end of 2010. In September, manufacturing output moved up 0.5 percent, while the indexes for mining and for utilities climbed 1.8 percent and 3.9 percent, respectively. For the third quarter as a whole, manufacturing production rose at an annual rate of 3.5 percent and mining output increased at an annual rate of 8.7 percent. The output of utilities fell at an annual rate of 8.5 percent for a second consecutive quarterly decline. At 105.1 percent of its 2007 average, total industrial production in September was 4.3 percent above its level of a year earlier. The capacity utilization rate for total industry moved up 0.6 percentage point in September to 79.3 percent, a rate that is 1.0 percentage point above its level of 12 months earlier but 0.8 percentage point below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.3% is 0.8 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 1.0% in September to 105.1. This is 25.5% above the recession low, and 4.3% above the pre-recession peak.

The monthly change for Industrial Production was above expectations.

Weekly Initial Unemployment Claims decrease to 264,000, 4-Week Average lowest since 2000

by Calculated Risk on 10/16/2014 08:30:00 AM

The DOL reports:

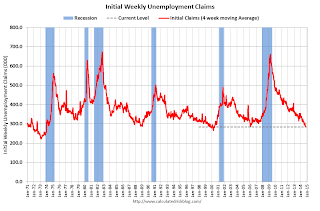

In the week ending October 11, the advance figure for seasonally adjusted initial claims was 264,000, a decrease of 23,000 from the previous week's unrevised level of 287,000. This is the lowest level for initial claims since April 15, 2000 when it was 259,000. The 4-week moving average was 283,500, a decrease of 4,250 from the previous week's unrevised average of 287,750. This is the lowest level for this average since June 10, 2000 when it was 283,500.The previous week was unrevised at 287,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 283,500.

This was below the consensus forecast of 290,000 and suggests few layoffs.

Wednesday, October 15, 2014

Thursday: Industrial Production, Unemployment Claims, Homebuilder Survey, Philly Fed Mfg Survey

by Calculated Risk on 10/15/2014 07:27:00 PM

Just a highlight of a few prices ...

Brent oil futures are down to $83.78 per barrel, down from $110 a year ago.

National gasoline prices are down to $3.18 per gallon and under $3.00 in many states. This is down from $3.35 per gallon a year ago. If oil prices stay at this level, national gasoline prices will probably fall under $3.00.

30 year fixed mortgage rates are down to 3.90% down from 4.38% a year ago. Loan officer Logan Mohtashami notes:

Right now, people who bought their homes in late 2013 and early 2014 may be good candidates to refinance their mortgages. Having said that, refinance activity is down 72% from the peak in May of 2013 because many already have lower rates and this recent move down won’t mean much to them. Therefore, people who can take advantage of these lower rates will only be a small pool of home owners. For those with the sufficient equity to eliminate their private mortgage insurance due to recent home prices gains, could benefit by refinancing. Others may benefit by combining their first and second loans into one at a new loan as well.As I noted earlier, we will not see a significant increase in refinance activity at these rates, because so many people refinanced in 2012 and early 2013 at even lower rates. Still - for some people as Logan notes - refinancing now makes sense.

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 287 thousand.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.0%.

• At 10:00 AM, the October NAHB homebuilder survey. The consensus is for a reading of 59, unchanged from 59 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, the the Philly Fed manufacturing survey for October. The consensus is for a reading of 20.0, down from 22.5 last month (above zero indicates expansion).