by Calculated Risk on 9/21/2014 08:38:00 PM

Sunday, September 21, 2014

Monday: Existing Home Sales

Another excellent article from Nick Timiraos at the WSJ: Should Mortgage Lending Standards Ease?

Easy credit fueled the home-price bubble of the past decade, which spurred overbuilding of homes and boosted consumer spending on everything from cars to college educations. Mortgage investors suffered huge losses after prices collapsed, and private lending markets have struggled to revive. Banks now are sharply limiting their mortgage offerings.Monday:

Subprime auto lending, by comparison, contracted sharply during the recession but has roared back—at a pace nearly four times that of prime lending over the past four years.

Auto lending has rebounded in part because investors didn't take the drubbing that mortgage investors did. Loans are smaller, cars can be repossessed faster than homes when borrowers default, and the collateral is easier to value. Car sales have also been fueled by an aging fleet that has resulted in pent-up demand.

• At 8:30 AM ET, the Chicago Fed National Activity Index for August. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for sales of 5.18 million on seasonally adjusted annual rate (SAAR) basis. Sales in July were at a 5.15 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.12 million SAAR.

Weekend:

• Schedule for Week of September 21st

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $92.41 per barrel and Brent at $98.08 per barrel. A year ago, WTI was at $104, and Brent was at $110 - so prices are down 10%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.35 per gallon (down almost 15 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Hotels: Occupancy up 4.5%, RevPAR up 11.8% Year-over-Year

by Calculated Risk on 9/21/2014 12:13:00 PM

From HotelNewsNow.com: STR: US results for week ending 13 September

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 7-13 September 2014, according to data from STR.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rate rose 4.5 percent to 68.0 percent. Average daily rate increased 6.9 percent to finish the week at US$117.73. Revenue per available room for the week was up 11.8 percent to finish at US$80.04.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

There is always a dip in occupancy after the summer (less leisure travel), and business travel should pick up soon.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at about the level as for the same week in 2000 (the previous high).

Right now it looks like 2014 will be the best year since 2000 for hotels. Since it takes some time to plan and build hotels, I expect 2015 will be a record year for hotel occupancy. Note: Smith Travel analysts say that supply growth will pickup next year, but remain relatively slow, "hotel supply growth in the United States is forecast to be 1% this year and 1.3% in 2015".

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Saturday, September 20, 2014

Schedule for Week of September 21st

by Calculated Risk on 9/20/2014 01:11:00 PM

The key reports this week are August New home sales on Wednesday, Existing home sales on Monday, and the third estimate of Q2 GDP on Friday.

For manufacturing, the September Richmond and Kansas City Fed surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for sales of 5.18 million on seasonally adjusted annual rate (SAAR) basis. Sales in July were at a 5.15 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.12 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

9:00 AM: FHFA House Price Index for July. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for September.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for August from the Census Bureau.

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for an increase in sales to 430 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 412 thousand in July.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 300 thousand from 280 thousand.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 17.1% decrease in durable goods orders (last month durable goods orders were up 22.6% due to aircraft orders).

11:00 AM: the Kansas City Fed manufacturing survey for September.

8:30 AM: Gross Domestic Product, 2nd quarter 2014 (third estimate). The consensus is that real GDP increased 4.6% annualized in Q2, up from 4.2% in the second estimate.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 84.6, unchanged from the preliminary reading of 84.6, and up from the August reading of 82.5.

Unofficial Problem Bank list unchanged at 435 Institutions

by Calculated Risk on 9/20/2014 08:05:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 19, 2014.

Changes and comments from surferdude808:

Only one addition and deletion to report this week to the Unofficial Problem Bank List. So the list count stays steady at 435 institutions but assets move down slightly to $137.4 billion. A year ago, the list held 692 institutions with assets of $242.9 billion. This is the fourth time since November 2012 the weekly list count has gone unchanged otherwise the week-to-week list count has been declining since August 10, 2012.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 435.

This week the OCC terminated its actions against The First National Bank and Trust, Atmore, AL ($130 million). Added this week was Fayette County Bank, St. Elmo, IL ($53 million). Notice of this action came from the Illinois Department of Financial & Professional Regulation, which is one of the few state banking departments in the nation to provide transparency around its enforcement actions against commercial banks. So we give them major props and wish that all of their state brethren be as transparent.

Next week, we anticipate the FDIC will provide an update on its enforcement action activities.

Friday, September 19, 2014

CoStar: Commercial Real Estate prices increased 11.9% year-over-year in July

by Calculated Risk on 9/19/2014 04:56:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Real Estate Prices Advance in July amid Rising Transaction Volume and Improving Liquidity Measures

CoStar’s equal-weighted U.S. Composite Index increased by a strong 1.5% in July 2014 and 11.9% for the 12 months ending in July 2014. It has now advanced to within 20% of its prerecession peak reached in 2007, supported by increased investor interest beyond core properties in primary markets. The value-weighted U.S. Composite Index, which is more heavily influenced by higher-value trades, began to recover earlier and is nearly back to its peak levels reached in 2007. As a result, annual pricing gains have moderated slightly over the last several months. The value-weighted Composite Index advanced 0.8% in July 2014, and 8.0% for the 12 months ending in July 2014.

...

Trailing 12-month repeat sale deal volume increased 24% as of July 2014 over the prior 12-month period ending in July 2013, as healthy market fundamentals, low interest rates and increasing allocations to commercial real estate by major investors provide a healthy environment for real estate transactions.

...

Distress sales as a percentage of total sales continued to decline from a peak of over 35% in 2011 to 11% through the first seven months of 2014.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is almost back to the pre-recession peak, but the equal weighted is still well below the pre-recession peak.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 35% at the peak.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Mortgage Equity Withdrawal Still Negative in Q2 2014

by Calculated Risk on 9/19/2014 12:45:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released this morning) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is little MEW right now - and normal principal payments and debt cancellation.

For Q2 2014, the Net Equity Extraction was minus $45 billion, or a negative 1.4% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding decreased by $7 billion in Q2. Compared to recent years, this was a small decrease in mortgage debt.

The Flow of Funds report also showed that Mortgage debt has declined by over $1.3 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance. With residential investment increasing, and a slower rate of debt cancellation, it is possible that MEW will turn positive again soon.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

BLS: State unemployment rates little changed in August

by Calculated Risk on 9/19/2014 10:43:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in August. Twenty-four states and the District of Columbia had unemployment rate increases from July, 15 states had decreases, and 11 states had no change, the U.S. Bureau of Labor Statistics reported today. Forty-five states and the District of Columbia had unemployment rate decreases from a year earlier, three states had increases, and two states had no change.

...

Georgia had the highest unemployment rate among the states in August, 8.1 percent. North Dakota again had the lowest jobless rate, 2.8 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Georgia had the highest unemployment rate in August at 8.1%.

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).One state has an unemployment rate at or above 8% (light blue), and 11 states are still at or above 7% (dark blue).

Fed's Q2 Flow of Funds: Household Net Worth at Record High

by Calculated Risk on 9/19/2014 08:03:00 AM

The Federal Reserve released the Q2 2014 Flow of Funds report yesterday: Flow of Funds.

According to the Fed, household net worth increased in Q2 compared to Q1, and is at a new record high:

The net worth of households and nonprofits rose $1.4 trillion to $81.5 trillion during the second quarter of 2014. The value of directly and indirectly held corporate equities increased $1.0 trillion and the value of real estate expanded $230 billion.Net worth previously peaked at $67.9 trillion in Q2 2007, and then net worth fell to $55.0 trillion in Q1 2009 (a loss of $12.9 trillion). Household net worth was at $81.5 trillion in Q2 2014 (up $26.5 trillion from the trough in Q1 2009).

The Fed estimated that the value of household real estate increased to $20.2 trillion in Q2 2014. The value of household real estate is still $2.3 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is above peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles. The ratio has been trending up and increased again in Q2 with both stock and real estate prices increasing.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2014, household percent equity (of household real estate) was at 53.6% - up from Q1, and the highest since Q1 2007. This was because of both an increase in house prices in Q2 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 53.6% equity - and millions have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt decreased by $7 billion in Q2.

Mortgage debt has now declined by $1.32 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q2 (as house prices increased), and somewhat above the average of the last 30 years (excluding bubble). However household mortgage debt, as a percent of GDP, is still historically high, suggesting still a little more deleveraging ahead for certain households.

Thursday, September 18, 2014

Lawler on 2013 ACS: Headship Rates, Homeownership Rates Fell Last Year

by Calculated Risk on 9/18/2014 06:18:00 PM

From housing economist Tom Lawler:

The Census Bureau released the one-year estimates for the 2013 American Community Survey this morning. For various housing and demographic information, the results are estimates of year averages.

The ACS estimate of the number of households in 2013 was 116,291,033, up just 321,493 from 2012.

If accurate of trends, the report suggests that:

1. household growth last year was very slow

2. homeownership rates continued to decline, with significant declines in the 35-64 year age groups.

To remind folks, here is a comparison of the ACS and the HVS with the Decennial Census for 2010.

| Homeownership Rate by Age of Householder, 2010 | |||

|---|---|---|---|

| Age | Decennial Census (4/1) | ACS (avg.) | HVS (avg.) |

| 15-24 | 16.1% | 14.7% | 22.8% |

| 25-34 | 42.0% | 41.3% | 44.4% |

| 35-44 | 62.3% | 61.9% | 65.0% |

| 45-54 | 71.5% | 71.7% | 73.5% |

| 55-64 | 77.3% | 77.9% | 79.0% |

| 65-74 | 80.2% | 81.1% | 82.0% |

| 75+ | 74.5% | 75.7% | 78.9% |

| All ages | 65.1% | 65.4% | 66.9% |

And the ACS and HVS for the last four years:

| Homeownership Rate by Age of Householder | ||||||||

|---|---|---|---|---|---|---|---|---|

| American Community Survey | Housing Vacancy Survey | |||||||

| Age | 2010 | 2011 | 2012 | 2013 | 2010 | 2011 | 2012 | 2013 |

| 15-24 | 14.7% | 13.5% | 12.5% | 12.6% | 22.8% | 22.6% | 21.7% | 22.2% |

| 25-34 | 41.3% | 39.7% | 37.9% | 37.4% | 44.4% | 42.6% | 41.5% | 41.6% |

| 35-44 | 61.9% | 60.0% | 58.6% | 57.8% | 65.0% | 63.5% | 61.4% | 60.6% |

| 45-54 | 71.7% | 70.7% | 69.9% | 69.3% | 73.5% | 72.7% | 71.7% | 71.2% |

| 55-64 | 77.9% | 77.1% | 76.5% | 75.7% | 79.0% | 78.5% | 77.4% | 76.6% |

| 65-74 | 81.1% | 80.9% | 80.7% | 80.3% | 82.0% | 82.4% | 82.2% | 81.5% |

| 75+ | 75.7% | 75.8% | 76.3% | 76.1% | 78.9% | 79.3% | 80.0% | 80.0% |

| All ages | 65.4% | 64.6% | 63.9% | 63.5% | 66.9% | 66.1% | 65.4% | 65.1% |

Here are implied “headship” rates by age group from the ACS for 2012 and 2013, with headship rate defined at householders divided by resident population.

| Headship Rate by Age Group, ACS | ||

|---|---|---|

| Age | 2012 | 2013 |

| 15-24 | 10.5% | 10.4% |

| 25-34 | 42.2% | 41.6% |

| 35-44 | 51.3% | 51.1% |

| 45-54 | 54.5% | 54.2% |

| 55-64 | 57.1% | 56.8% |

| 65-74 | 60.4% | 60.0% |

| 75+ | 62.8% | 62.1% |

| All ages | 45.9% | 45.6% |

A few comments on August Housing Starts

by Calculated Risk on 9/18/2014 03:11:00 PM

This was a disappointing report for housing starts in August.

Starts were only up 8.0% year-over-year in August.

There were 670 thousand total housing starts during the first eight months of 2014 (not seasonally adjusted, NSA), up 8.6% from the 617 thousand during the same period of 2013. Single family starts are up 3%, and multi-family starts up 23%. The key weakness has been in single family starts.

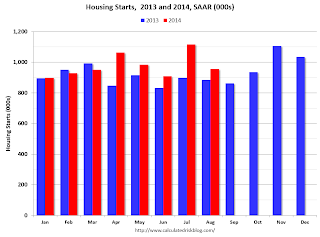

This graph shows the month to month comparison between 2013 (blue) and 2014 (red). Starts in 2014 have been above the same month in 2013 for five consecutive months.

Starts in Q1 averaged 925 thousand SAAR, and starts in Q2 averaged 985 thousand SAAR, up 7% from Q1.

Even with the weakness in August, Q3 is averaging 1.037 million SAAR, up 5% from Q2.

This year, I expect starts to mostly increase throughout the year (Q1 will probably be the weakest quarter, and Q2 the second weakest). The comparisons will be easy for the next couple of months, and starts should finish the year up from 2013.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions later this year and in 2015.

Single family starts had been moving up, but recently starts have been moving more sideways on a rolling 12 months basis.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.