by Calculated Risk on 9/11/2014 01:55:00 PM

Thursday, September 11, 2014

Hotels: Occupancy up 4.5%, RevPAR up 10.6% Year-over-Year

From HotelNewsNow.com: STR: US results for week ending 6 September

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 31 August through 6 September 2014, according to data from STR.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rate rose 4.5 percent to 59.0 percent. Average daily rate increased 5.9 percent to finish the week at US$108.87. Revenue per available room for the week was up 10.6 percent to finish at US$64.20.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

There is always a dip in occupancy after the summer (less leisure travel), and business travel should pick up soon.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is at about the level as for the same week in 2000 (the previous high).

Right now it looks like 2014 will be the best year since 2000 for hotels. Since it takes some time to plan and build hotels, I expect 2015 will be a record year for hotel occupancy. Note: Smith Travel analysts say that supply growth will pickup next year, but remain relatively slow, "hotel supply growth in the United States is forecast to be 1% this year and 1.3% in 2015".

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Goldman Sachs Revises Q2 GDP estimate to 4.7%

by Calculated Risk on 9/11/2014 12:05:00 PM

From Brett LoGiurato at Business Insider: Goldman Is Now Saying That Q2 GDP Growth Was Absolutely Massive

Goldman Sachs revised its estimate of second-quarter GDP growth to 4.7% on Thursday, based on new data from the Census Bureau's Quarterly Services Survey (QSS).Here is the Q2 Quarterly Services Press Release

Stronger-than-expected healthcare spending growth led to the revised Goldman estimate of 4.7%, which was up 0.5% from the Bureau of Economic Analysis' second advance-estimate of 4.2%.

Health care and social assistance The estimate of U.S. health care and social assistance revenue for the second quarter of 2014, not adjusted for seasonal variation, or price changes, was $565.6 billion, an increase of 3.0 percent (± 0.9%) from the first quarter of 2014 and up 3.7 percent (± 0.9%) from the second quarter of 2013. The fourth quarter of 2013 to first quarter of 2014 percent change was not revised from -2.0 percent (± 0.8%).The third estimate of Q2 GDP will be released on Friday, September 26th. Some of the Q2 GDP increase was a bounce back from the weather impacted Q1.

Weekly Initial Unemployment Claims increase to 315,000

by Calculated Risk on 9/11/2014 08:35:00 AM

The DOL reports:

In the week ending September 6, the advance figure for seasonally adjusted initial claims was 315,000, an increase of 11,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 302,000 to 304,000. The 4-week moving average was 304,000, an increase of 750 from the previous week's revised average. The previous week's average was revised up by 500 from 302,750 to 303,250.The previous week was revised up to 304,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 304,000.

This was above the consensus forecast of 300,000 and in the normal range for an economic expansion.

Wednesday, September 10, 2014

Thursday: Unemployment Claims, Quarterly Services Report

by Calculated Risk on 9/10/2014 07:01:00 PM

This is an important change ... from the WSJ: Cost of Employer Health Coverage Shows Muted Growth

The cost of employer health coverage continued its muted growth this year with a 3% increase that pushed the average annual premium for a family plan to $16,834, according to a major survey.Thursday:

The increase was slightly less than the 4% seen last year, according to the annual poll of employers performed by the nonprofit Kaiser Family Foundation along with the Health Research & Educational Trust, a nonprofit affiliated with the American Hospital Association. The share of the family-plan premium borne by employees was $4,823, or 29% of the total, the same percentage as last year.

The total annual cost of employer coverage for an individual was $6,025 in the 2014 survey, up 2%, a difference that wasn't statistically significant.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 302 thousand.

• At 10:00 AM, the Q2 Quarterly Services Report from the Census Bureau.

• At 2:00 PM, the Monthly Treasury Budget Statement for August.

Vehicle Sales: Fleet Turnover Ratio

by Calculated Risk on 9/10/2014 02:29:00 PM

Back in early 2009, I wrote a couple of posts arguing there would be an increase in auto sales - Vehicle Sales (Jan 2009) and Looking for the Sun (Feb 2009). This was an out-of-the-consensus call and helped me call the bottom for the US economy in mid-2009.

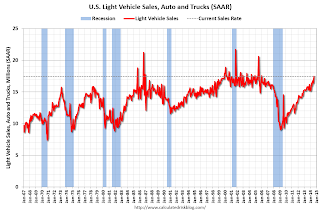

Here is an update to the U.S. fleet turnover graph.

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate through August 2014 - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age or the composition of the fleet). Note: the number of registered vehicles is estimated for 2012 through 2014.

The wild swings in 2009 were due to the "cash for clunkers" program.

The estimated ratio for August was just over 14 years - back to a more normal level.

Note: I argued the turnover ratio would "probably decline to 15 or so eventually" and that has happened.

The current sales rate is now near the top (excluding one month spikes) of the '98/'06 auto boom.

Light vehicle sales were at a 17.45 million seasonally adjusted annual rate (SAAR) in August.

I now expect vehicle sales to mostly move sideways over the next few years.

FNC: Residential Property Values increased 7.4% year-over-year in July

by Calculated Risk on 9/10/2014 10:58:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their July index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.6% from June to July (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.4% and 0.6% in July. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

The year-over-year (YoY) change slowed in July, with the 100-MSA composite up 7.4% compared to July 2013. For FNC, the YoY increase has been slowing since peaking in February at 9.4%.

The index is still down 19.5% from the peak in 2006.

This graph shows the year-over-year change based on the FNC index (four composites) through July 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

All of the price indexes are now showing a slowdown in price increases.

The July Case-Shiller index will be released on Tuesday, September 30th, and I expect Case-Shiller to show a further slowdown in YoY price increases.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey, Refinance Activity Lowest since 2008

by Calculated Risk on 9/10/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 5, 2014. This week’s results included an adjustment for the Labor Day holiday. ...

The Refinance Index decreased 11 percent from the previous week, to the lowest level since November 2008. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier, to the lowest level since February 2014. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.27 percent, the first increase in four weeks, from 4.25 percent, with points increasing to 0.25 from 0.24 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 76% from the levels in May 2013 and at the lowest level since 2008.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 12% from a year ago.

Tuesday, September 09, 2014

Update: Framing Lumber Prices

by Calculated Risk on 9/09/2014 08:59:00 PM

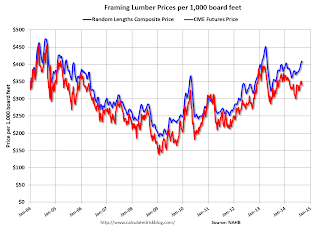

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs. Then prices declined over 25% from the highs by mid-year 2013.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand), however prices haven't fallen as sharply either.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up about 12% from a year ago, and CME futures are up about 4% year-over-year.

Las Vegas Real Estate in August: YoY Non-contingent Inventory up 39%, Distressed Sales and Cash Buying down YoY

by Calculated Risk on 9/09/2014 02:39:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local home prices holding steady, fewer cash buyers

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in August was 3,120, down from 3,314 in July and down from 3,539 one year ago.There are several key trends that we've been following:

GLVAR said 32.1 percent of all existing local homes sold in August were purchased with cash. That’s down from 35.6 percent in July, near a five-year low and well short of the February 2013 peak of 59.5 percent, suggesting that fewer investors are buying homes in Southern Nevada.

...

Since 2013, GLVAR has reported fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in August, when GLVAR reported that 11.5 percent of all sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That matched the percentage of short sales in July. Another 8.9 percent of all August sales were bank-owned properties, down from 9.1 percent in July.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in August was 13,752, up 0.3 percent from 13,717 in July, but down 5.0 percent from one year ago. ...

By the end of August, GLVAR reported 7,788 single-family homes listed without any sort of offer. That’s up 7.2 percent from 7,266 such homes listed in July, and a 38.8 percent jump from one year ago.

emphasis added

1) Overall sales were down about 12% year-over-year.

2) Conventional (equity, not distressed) sales were up 5% year-over-year. In August 2013, only 67.0% of all sales were conventional equity. This year, in August 2014, 79.6% were equity sales.

3) The percent of cash sales has declined year-over-year from 52.5% in August 2013 to 32.1% in August 2014. (investor buying appears to be declining).

4) Non-contingent inventory is up 38.8% year-over-year.

More inventory (a major theme for 2014) suggests price increases will slow.

Trulia: Asking House Prices up 7.8% year-over-year in August

by Calculated Risk on 9/09/2014 12:09:00 PM

From Trulia chief economist Jed Kolko: Slow and Steady Now Winning the Home-Price Race

Nationally, the month-over-month increase in asking home prices rose to 1.0% in August, up a bit from 0.7% in July. Asking prices rose 7.8% year-over-year, slower than one year ago, in August 2013, when asking prices were up 9.9% year-over-year. At the local level, asking prices rose year-over-year in 96 of the 100 largest U.S. metros.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

...

Foreclosures have shaped where and when home prices have recovered. Foreclosed homes tend to depress neighboring home values and sell at a discount. But once most of the foreclosures in a market are sold, then overall inventory tightens – especially at the low end – giving home prices a boost. In states with a “non-judicial” foreclosure process (such as California, Michigan, and Texas), foreclosures don’t have to go through the courts. That means homes in non-judicial states are foreclosed and sold more quickly than in states with a “judicial” process (such as Florida, Illinois, and New York). As a result, the foreclosure wave cleared sooner and faster in non-judicial states, and housing markets in those states got an earlier and sharper price boost.

But now, even judicial states are seeing the light at the end of the foreclosure tunnel and are getting their own price boost. In August 2014, asking prices on for-sale homes excluding foreclosures were up 6.9% year-over-year in metros in judicial states, only slightly behind the 7.8% increase in metros in non-judicial states. In contrast, in August 2013, the year-over-year price gain was 14.1% in non-judicial states and just 5.1% in judicial states.

...

Rents Accelerate, Rising 6.3% Year-over-Year

In five of the 25 largest rental markets, rents rose more than 10% year-over-year. Three of these five are in northern California: Sacramento, San Francisco, and Oakland have the highest rent increases in the country, followed by Denver and Miami. Rents rose faster year-over-year in August than three months ago, in May, in 20 of the 25 largest rental markets. In August compared to May, rents accelerated most in Sacramento while cooling in San Diego.

emphasis added