by Calculated Risk on 9/09/2014 10:00:00 AM

Tuesday, September 09, 2014

BLS: Jobs Openings at 4.7 million in July, Up 22% Year-over-year

From the BLS: Job Openings and Labor Turnover Summary

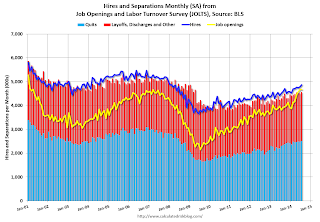

here were 4.7 million job openings on the last business day of July, little changed from June, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits was little changed in July at 2.5 million.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for July, the most recent employment report was for August.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased slightly in July to 4.673 million from 4.675 million in June.

The number of job openings (yellow) are up 22% year-over-year compared to July 2013.

Quits are up 9% year-over-year and are at the highest level since 2008. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

It is a good sign that job openings are over 4 million for the sixth consecutive month, and that quits are increasing.

NFIB: Small Business Optimism Index increases in August

by Calculated Risk on 9/09/2014 08:12:00 AM

From the National Federation of Independent Business (NFIB): NFIB SBET Sees Slight Bump in August

August’s Optimism Index rose 0.4 points to 96.1 making it the second highest reading since October, 2007. ...Hiring plans decreased to 10.

NFIB owners increased employment by an average of 0.02 workers per firm in August (seasonally adjusted), the eleventh positive month in a row but basically a “zero” net gain. emphasis added

And in a positive sign, the percent of firms reporting "poor sales" as the single most important problem has fallen to 13, down from 17 last year - and "taxes" and "regulations" are the top problems at 22 (taxes are usually reported as the top problem during good times).

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 96.1 in August from 95.7 in July.

Note: There is high percentage of real estate related businesses in the "small business" survey - and this has held down over all optimism.

Monday, September 08, 2014

Tuesday: Job Openings, Small Business Survey

by Calculated Risk on 9/08/2014 06:20:00 PM

From Nick Timiraos at the WSJ: Why More Renters Aren’t Buying (Hint: Weak Incomes, Savings)

A new survey says that younger workers and other renters aren’t turning away from homeownership because they lack the desire to own homes. Instead, they’re staying on the sidelines because they lack the capacity to purchase.My view is people will want to own ... and as their incomes eventually increase, they will become homeowners. No worries.

The analysis from the New York Federal Reserve Bank comes via their survey of consumer expectations in February. It polled 867 homeowners and 344 renters on their attitudes toward homeownership and their plans to move.

One popular trend cited frequently in the press is that millennials and other renters have permanently turned away from owning homes after watching their parents’ generation take it on the chin during the housing bust. ...

But the New York Fed researchers say their survey points to a different conclusion: borrowers want to buy, but they can’t cut it financially. Conservative mortgage lending standards are only likely to exacerbate this problem.

Tuesday:

• At 7:30 AM ET, the NFIB Small Business Optimism Index for August.

• Early, the Trulia Price Rent Monitors for August. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 10:00 AM, Job Openings and Labor Turnover Survey for July from the BLS. Jobs openings increased in June to 4.671 million from 4.577 million in May. That was the highest level since February 2001. The number of job openings were up 18% year-over-year compared to June 2013. Quits were up 15% year-over-year in June.

Duy on Fed's "considerable time" phrase

by Calculated Risk on 9/08/2014 01:47:00 PM

From Tim Duy at Economist's View: Forward Guidance Heading for a Change

The lackluster August employment report clearly defied expectations (including my own) for a strong number to round out the generally positive pattern of recent data. That said, one number does not make a trend, and the monthly change in nonfarm payrolls is notoriously volatile. The underlying pattern of improvement remains in tact, and thus the employment report did not alleviate the need to adjust the Fed's forward guidance, allow there is a less pressing need to do so at the next meeting. In any event, the days of the "considerable time" language are numbered.CR Note: The next FOMC meeting is on Sept 16th and 17th. Duy is referring to these sentences in the FOMC statement:

...

Arguably the only trend that is markedly different is the more rapid decline in long-term unemployment, a positive cyclical indicator. Labor force participation remains subdued, although the Fed increasing views that as a structural issue. Average wage growth remained flat while wages for production workers accelerated slightly to 2.53% over the past year. A postive development to be sure, but too early to declare a sustained trend.

The notable absence of any bad news in the labor report leaves the door open to changing the forward guidance at the next FOMC meeting. ...

...

The trick is to change the language without suggesting the timing of the first rate hike is necessarily moving forward. The benefit of the next meeting is that it includes updated projections and a press conference. Stable policy expectations in those projections would create a nice opportunity to change the language. Moreover, Yellen would be able to to further explain any changes at that time. This also helps set the stage for the end of asset purchases in October. A shift in the guidance next week has a lot to offer.

Bottom Line: The US economy is moving to a point in the cycle in which monetary policymakers have less certainty about the path of rates. Perhaps they need to be pulled forward, perhaps pushed back. Policymakers will need to be increasingly pragmatic, to use Yellen's term, when assessing the data. The "considerable time" language is inconsistent with such a pragmatic approach. It is hard to see that such language survives more than another FOMC statement. Seems to be data and policy objections are not the impediments preventing a change in the guidance, but instead the roadblock is the ability to reach agreement on new language in the next ten days.

emphasis added

"In determining how long to maintain the current 0 to 1/4 percent target range for the federal funds rate, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored."

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 9/08/2014 11:02:00 AM

By request, here is an update on an earlier post through the August employment report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,885 |

| Clinton 2 | 10,070 |

| GW Bush 1 | -841 |

| GW Bush 2 | 379 |

| Obama 1 | 1,998 |

| Obama 21 | 3,826 |

| 119 months into 2nd term | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the second year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 841,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 462,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,998,000 more private sector jobs at the end of Mr. Obama's first term. Eighteen months into Mr. Obama's second term, there are now 5,824,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 682,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -713 |

| Obama 21 | 56 |

| 119 months into 2nd term | |

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. The cutbacks are clearly over at the state and local levels in the aggregate, and it appears cutbacks at the Federal level have slowed. Right now I'm expecting some increase in public employment in 2014, but nothing like what happened during Reagan's second term.

Phoenix Real Estate in August: Sales down 9%, Cash Sales down Sharply, Inventory up 22%

by Calculated Risk on 9/08/2014 08:11:00 AM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in August were down 8.8% year-over-year and at the lowest for August since 2008. Note: This is the smallest year-over-year sales decline this year.

2) Cash Sales (frequently investors) were down about 33% to 25% of total sales. Non-cash sales were up 3.5% year-over-year. So the decline in sales is probably mostly due to less investor buying.

3) Active inventory is now up 22% year-over-year - and at the highest level for August since 2011 (when prices bottomed in Phoenix). Note: This is the smallest year-over-year inventory increase this year, so the inventory build may be slowing.

Inventory has clearly bottomed in Phoenix (A major theme for housing in 2013). And more inventory (a theme this year) - and less investor buying - suggests price increases should slow sharply in 2014.

According to Case-Shiller, Phoenix house prices bottomed in August 2011 (mostly flat for all of 2011), and then increased 23% in 2012, and another 15% in 2013. Those large increases were probably due to investor buying, low inventory and some bounce back from the steep price declines in 2007 through 2010. Now, with more inventory, price increases should flatten out in 2014.

As an example, the Phoenix Case-Shiller index through June shows prices up less than 1% in 2014, and the Zillow index shows Phoenix prices up only 0.1% over the last year!

| August Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Aug-08 | 5,660 | --- | 1,004 | 17.7% | 53,5691 | --- |

| Aug-09 | 8,008 | 41.5% | 2,849 | 35.6% | 38,085 | -28.9% |

| Aug-10 | 7,358 | -8.1% | 3,129 | 42.5% | 44,307 | 16.3% |

| Aug-11 | 8,712 | 18.4% | 3,953 | 45.4% | 26,983 | -39.1% |

| Aug-12 | 7,574 | -13.1% | 3,382 | 44.7% | 20,934 | -22.4% |

| Aug-13 | 7,055 | -6.9% | 2,409 | 34.1% | 21,444 | 2.4% |

| Aug-14 | 6,431 | -8.8% | 1,621 | 25.2% | 26,138 | 21.9% |

| 1 August 2008 probably includes pending listings | ||||||

Sunday, September 07, 2014

Sunday Night Futures

by Calculated Risk on 9/07/2014 07:51:00 PM

From Ben Leubsdorf at the WSJ: Services-Spending Report Gains Wider Attention

A quarterly reading from the Commerce Department has quietly emerged as one of the most consequential government reports, with the power to roil estimates for U.S. economic growth and the impact of the Affordable Care Act.The Q2 Quarterly Services Report will be released on Thursday, September 11, 2014 at 10AM ET.

The Quarterly Services Survey, or QSS, measures revenue at service-providing companies including hospitals, day-care centers and law offices. ... Federal Reserve policy makers and private economists are taking a much closer look at the gauge. ...

Consumer spending accounts for more than two-thirds of U.S. economic output, but measuring spending on services is tricky. The government often relies on indirect clues, like payroll growth in certain industries. The QSS offers the best—that is, only—source of timely hard data. It is the basis for roughly one-fifth of the Commerce Department's quarterly calculation of gross domestic product.

June's report led to a steep downgrade for first-quarter GDP.

Weekend:

• Schedule for Week of September 7th

• Update: Prime Working-Age Population Growing Again

• Research: Much of Recent Decline in Labor Force Participation Rate due to "ongoing structural influences"

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 14 (fair value).

Oil prices were down slightly over the last week with WTI futures at $93.48 per barrel and Brent at $100.80 per barrel. A year ago, WTI was at $109, and Brent was at $116 - so prices are down solidly year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.44 per gallon (down almost 15 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Research: Much of Recent Decline in Labor Force Participation Rate due to "ongoing structural influences"

by Calculated Risk on 9/07/2014 12:23:00 PM

For several years, I've been arguing that "most of the recent decline in the participation rate" was due to demographics and other long term structural trends (like more education). This is an important issue because if most of the decline had been due to cyclical weakness, then we'd expect a significant increase in participation as the economy improved. If the decline was due to demographics and other long term trends, then the participation rate might keep falling (or flatten out) as the economy improves.

Note: So far this year, the participation rate has moved sideways at 62.8% - probably because demographics and other long term factors are being offset by people returning to the labor force this year. However, looking forward, the participation rate should continue to decline for the next couple of decades.

From Federal Reserve researchers Stephanie Aaronson, Tomaz Cajner, Bruce Fallick, Felix Galbis-Reig, Christopher L. Smith, and William Wascher: Labor Force Participation: Recent Developments and Future Prospects

The evidence we present in this paper suggests that much of the steep decline in the labor force participation rate since 2007 owes to ongoing structural influences that are pushing down the participation rate rather than a pronounced cyclical weakness related to potential jobseekers’ discouragement about the weak state of the labor market – in many ways a similar message as was conveyed in the 2006 Brookings Paper. Most prominently, the ongoing aging of the babyboom generation into ages with traditionally lower attachment to the labor force can, by itself, account for nearly half of the decline. In addition, estimates from our model, as well as the supplementary evidence on which we report, show persistent declines in participation rates for some specific age/sex categories that appear to have their roots in longer-run changes in the labor market that pre-date the financial crisis by a decade or more.

In particular, participation rates among youths have been declining since the mid-1990s, in part reflecting the higher returns to education documented extensively by other researchers, but also, we believe, some crowding out of job opportunities for young workers associated with the decline in middle-skill jobs and thus greater competition for the low-skilled jobs traditionally held by teenagers and young adults. Such “polarization” effects also appear to have weighed on the participation of less-educated prime-age men and, more recently, prime-age women. In contrast, increasing longevity and better health status, coupled with changes in social security rules and increased educational attainment, have contributed to an ongoing rise in the participation rates of older individuals, but these increases have not been large enough to provide much offset to the various downward influences on the aggregate participation rate.

That is not to say that all of the decline in labor force participation reflects structural influences. Our cohort-based model suggests that cyclical weakness was depressing the participation rate by about ¼ percentage point in 2014:Q2, while evidence from cross-state regressions suggests that the contribution of cyclical weakness could be as much as 1 percentage point. The greater cyclicality evidenced in the cross-state regressions could be capturing some of the features of the current labor market we discussed outside the context of the model, such as the unusually high level of those out of the labor force who want a job, or any unusual cyclicality in youth participation or retirement.

Looking ahead, demographics will likely continue to play a prominent role in determining the future path of the aggregate labor force participation rate. The youngest members of the baby-boom generation are still in their early fifties, and thus the effects of population aging will continue to put downward pressure on the participation rate for some time. Indeed, on our estimates, the continued aging of the population alone will subtract 2½ percentage points from the aggregate participation rate over the next ten years. And the overall downtrend could be even larger if some of the negative trends evident for particular age-sex groups persist.

Saturday, September 06, 2014

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 9/06/2014 06:06:00 PM

This is an update to a previous post through August.

Earlier this year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through August 2014.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

Schedule for Week of September 7th

by Calculated Risk on 9/06/2014 01:12:00 PM

The key report this week is August retail sales on Friday.

3:00 PM: Consumer Credit for July from the Federal Reserve. The consensus is for credit to increase $17.4 billion.

7:30 AM ET: NFIB Small Business Optimism Index for August.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in June to 4.671 million from 4.577 million in May. This was the highest level since February 2001.

The number of job openings (yellow) were up 18% year-over-year compared to June 2013. Quits were up 15% year-over-year.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for July. The consensus is for a 0.5% increase in inventories.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 302 thousand.

10:00 AM: The Q2 Quarterly Services Report from the Census Bureau.

2:00 PM ET: The Monthly Treasury Budget Statement for August.

8:30 AM ET: Retail sales for August will be released.

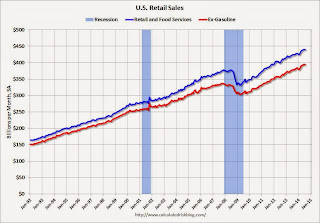

8:30 AM ET: Retail sales for August will be released.This graph shows retail sales since 1992 through July 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were unchanged from June to July (seasonally adjusted), and sales were up 3.7% from July 2013.

The consensus is for retail sales to increase 0.4% in August, and to increase 0.3% ex-autos.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 83.1, up from 82.5 in August.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.5% increase in inventories.