by Calculated Risk on 7/19/2014 01:11:00 PM

Saturday, July 19, 2014

Schedule for Week of July 20th

The key reports this week are New and Existing home sales for June.

For manufacturing, the July Richmond and Kansas City Fed surveys will be released.

For prices, CPI will be released on Tuesday.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

8:30 AM: Consumer Price Index for June. The consensus is for a 0.3% increase in CPI in June and for core CPI to increase 0.2%.

9:00 AM: FHFA House Price Index for May. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% increase.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 4.99 million on seasonally adjusted annual rate (SAAR) basis. Sales in May were at a 4.89 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.96 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 5.5, up from 3 in June.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 302 thousand.

10:00 AM: New Home Sales for June from the Census Bureau.

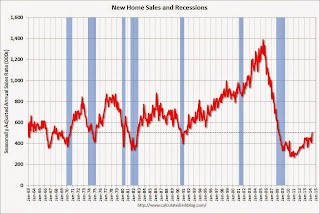

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the May sales rate.

The consensus is for a decrease in sales to 475 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 504 thousand in May.

11:00 AM: the Kansas City Fed manufacturing survey for July.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 0.2% increase in durable goods orders.

Unofficial Problem Bank list declines to 463 Institutions

by Calculated Risk on 7/19/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 18, 2014.

Changes and comments from surferdude808:

Surprisingly there were few changes to the Unofficial Problem Bank List this week given that the OCC released an update of its enforcement action activity this Friday. There were two removals this week that push the list count down to 463 institutions with assets of $147.4 billion. A year ago, the list held 734 institutions with assets of $267.2 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 463.

Removals this week include the OCC terminating an action against Commerce National Bank & Trust, Winter Park, FL ($77 billion). The other removal was the failed Eastside Commercial Bank, Conyers, GA ($169 million), which was the 13th failure this year. This is the first failure in Georgia since Sunrise Bank failed more than a year ago on May 10, 2013. Still, there have now been an astonishing 88 failures of Georgia-based institutions with aggregate assets of $33.4 billion since the on-set of the Great Recession. So 17.5 percent of the 503 institutions that have failed in this crisis were headquartered in Georgia.

Next week we anticipate the FDIC will provide an update on its enforcement action activity.

Friday, July 18, 2014

Bank Failure #13 in 2014: Eastside Commercial Bank, Conyers, Georgia

by Calculated Risk on 7/18/2014 05:17:00 PM

From the FDIC: Community & Southern Bank, Atlanta, Georgia, Assumes All of the Deposits of Eastside Commercial Bank, Conyers, Georgia

As of March 31, 2014, Eastside Commercial Bank had approximately $169.0 million in total assets and $161.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $33.9 million. ... Eastside Commercial Bank is the 13th FDIC-insured institution to fail in the nation this year, and the first in Georgia.There hasn't been a failure in Georgia since May 2013, but this is the 88th failure in Georgia since the crisis started - the most of any state.

The Recovery for U.S. Heavy Truck Sales

by Calculated Risk on 7/18/2014 01:52:00 PM

Just a quick graph ... heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009 on a seasonally adjusted annual rate (SAAR) from a peak of 555 thousand in February 2006.

Sales were above 382 thousand (SAAR) in June (after increasing to over 400 thousand SAAR in April for the first time since 2007).

Click on graph for larger image.

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is current estimated sales rate.

The recovery for heavy truck has slowed, but as construction for both residential and commercial picks up, heavy truck sales will probably increase further.

BLS: No State with Unemployment Rate at or above 8% in June, First Time since mid-2008

by Calculated Risk on 7/18/2014 10:45:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in June. Twenty-two states and the District of Columbia had unemployment rate decreases from May, 14 states had increases, and 14 states had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia had unemployment rate decreases from a year earlier and one state had an increase.

...

Mississippi and Rhode Island had the highest unemployment rates among the states in June, 7.9 percent each. North Dakota again had the lowest jobless rate, 2.7 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Rhode Island and Mississippi had the highest unemployment rates in June at 7.9%.

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).For the first time since mid-2008, no state has an unemployment rate at or above 8% (light blue), although 9 states are still at or above 7% (dark blue).

Preliminary July Consumer Sentiment decreases to 81.3

by Calculated Risk on 7/18/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for July was at 81.3, down from 82.5 in June.

This was below the consensus forecast of 83.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

Thursday, July 17, 2014

DataQuick: "California Foreclosure Starts Lowest Since 2005"

by Calculated Risk on 7/17/2014 08:12:00 PM

From DataQuick: California Foreclosure Starts Lowest Since 2005

A total of 17,524 Notices of Default (NoDs) were recorded at county recorders offices during the April-through-June period. That was down 8.8 percent from 19,215 in the prior quarter, and down 31.9 percent from 25,747 in second-quarter 2013, according to DataQuick, which is owned by Irvine-based CoreLogic, a leading global property information, analytics and data-enabled services provider.

Last quarter's NoD tally was the lowest since fourth-quarter 2005, when 15,337 NoDs were recorded. NoD filings peaked in first-quarter 2009 at 135,431. DataQuick's NoD statistics go back to 1992.

"It looks like the mortgage servicers doing the foreclosure paperwork are systematically working through a backlog. While their pile is getting smaller, they're working at a steady pace. With one exception, the number of NoDs we've seen filed each quarter over the last year-and-a-half hasn't changed much, and probably just reflects staffing and workload logistics," said John Karevoll, DataQuick analyst.

In first quarter 2013 California saw 18,568 NoDs filed. In last year's second quarter the number was 25,747. In third quarter 2013 it was 20,314. Fourth quarter was 18,120. In first quarter 2014 the tally was 19,215, and last quarter it was 17,524.

"The relatively high NoD tally in second quarter last year reflected a one-time bump because of deferred activity and policy change. Otherwise the quarterly flow of NoDs since early last year has been remarkably flat, and probably doesn't reflect any meaningful changes in trends. The overall trend is that homeowner distress continues to decline because of a stronger economy and rising home prices," Karevoll said.

Most of the loans going into default are still from the 2005-2007 period.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of Notices of Default (NoD) filed in California each year. 2014 is in red (Q1 plus Q2 times 2).

Last year was the lowest year for foreclosure starts since 2005, and 2013 was also below the levels in 1997 through 2000 when prices were rising following the much smaller late '80s housing bubble / early '90s bust in California.

Overall foreclosure starts are close to a normal level in California (foreclosure starts were over 50,000 in 2004 and 2005 when prices were rising quickly).

Note: Foreclosures are still higher than normal in states with a judicial foreclosure process.

LA area Port Traffic: Imports increasing

by Calculated Risk on 7/17/2014 06:06:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for June since LA area ports handle about 40% of the nation's container port traffic. Note: This is for the month before the recent trucker strike.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 1.0% compared to the rolling 12 months ending in May. Outbound traffic was up 0.5% compared to 12 months ending in May.

Inbound traffic has been increasing, and outbound traffic has been moving up a little recently after moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Imports were up 13% year-over-year in June, exports were up 7% year-over-year.

Imports were 4% below the all time high for June (set in June 2007), and it is possible that imports will be at a record high later this year.

A few comments on June Housing Starts

by Calculated Risk on 7/17/2014 01:32:00 PM

This was a weak report for housing starts in June.

There were 479 thousand total housing starts during the first half of 2014 (not seasonally adjusted, NSA), up 6.0% from the 452 thousand during the same period of 2013. Single family starts are up 1%, and multi-family starts up 18%. The key weakness is in single family starts.

The weak growth so far in 2014 is due to several factors: severe weather early in the year, higher mortgage rates (although rates are now down year-over-year), higher prices and probably supply constraints in some areas. And some judicial foreclosure states are still working through a backlog of distressed homes that depress new construction.

Starts were up 7.5% year-over-year in June, but the year-over-year comparison for housing starts is easier now than in Q1 (see first graph). There was a huge surge in housing starts early in 2013, and then a lull - and finally more starts at the end of the year.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month to month comparison between 2013 (blue) and 2014 (red).

Starts in Q1 averaged 925 thousand SAAR, and starts in Q2 averaged 980 thousand SAAR (up 6% from Q1).

This year, I expect starts to increase (Q1 will probably be the weakest quarter, and Q2 the second weakest).

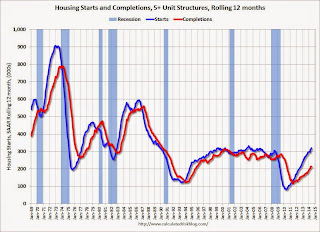

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) are lagging behind - but completions will continue to follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family completions in 2014 and 2015. Multi-family starts will probably move more sideways soon.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Single family starts had been moving up, but recently starts have been moving sideways on a rolling 12 months basis.

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Philly Fed Manufacturing Survey highest since March 2011

by Calculated Risk on 7/17/2014 10:11:00 AM

From the Philly Fed: July Manufacturing Survey

The diffusion index of current general activity increased from a reading of 17.8 in June to 23.9 this month. The index has remained positive for five consecutive months and is at its highest reading since March 2011. The current new orders [at 34.2] and shipments indexes increased notably this month, increasing 17 points and 19 points, respectively.This was above the consensus forecast of a reading of 15.5 for July.

...

The current indicators for labor market conditions also suggest improved conditions this month. The employment index remained positive, and, although it increased less than 1 point [to 12.2], it has improved for four consecutive months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The average of the Empire State and Philly Fed surveys is at the highest level since 2004, and this suggests stronger expansion in the ISM report for July.