by Calculated Risk on 5/13/2014 01:25:00 PM

Tuesday, May 13, 2014

NFIB: Small Business Optimism Index increases in April, Highest since 2007

From the National Federation of Independent Business (NFIB) earlier this morning: NFIB: Optimism Improves, But Don't Get Too Excited

April’s Small Business Optimism Index rose 1.8 points to a post-recession high of 95.2. The economy continues to perform modestly and April’s index followed suit as it crossed the 95 marker for the first time since 2007. ...

Labor Markets. NFIB owners increased employment by an average of 0.07 workers per firm in April (seasonally adjusted), weaker than March but the seventh positive month in a row and the best string of gains since 2006.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 95.2 in April from 93.4 in March.

NY Fed: Household Debt increased in Q1 2014, Delinquency Rates Lowest Since Q3 2007

by Calculated Risk on 5/13/2014 11:00:00 AM

Here is the Q1 report: Household Debt and Credit Report. From the NY Fed:

In its Q1 2014 Household Debt and Credit Report, the Federal Reserve Bank of New York announced that outstanding household debt increased $129 billion from the previous quarter. The increase was led by rises in mortgage debt ($116 billion), student loan debt ($31 billion) and auto loan balances ($12 billion), slightly offset by a $27 billion declines in credit card and HELOC balances. Total household indebtedness stood at $11.65 trillion, 1.1 percent higher than the previous quarter. Overall household debt remains 8.1 percent below the peak of $12.68 trillion reached in Q3 2008. The report is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample drawn from anonymized Equifax credit data.

Additionally, an update to a recent blog discussing the impact of student loan debt on housing and auto markets is available on our Liberty Street Economics Blog.

“We’ve observed household debt increase three quarters in a row and delinquency rates at their lowest levels since 2008,” said Andy Haughwout, vice president and economist at the New York Fed. “However, the direction of future mortgage originations will have an important implication on the household financial outlook and we will continue to monitor it.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q1.

This suggests households (in the aggregate) may be near the end of deleveraging. If so, this is a significant change that started mid-2013.

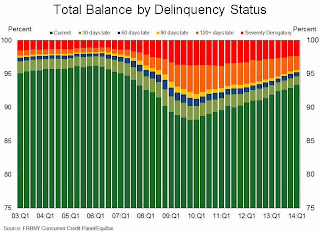

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate has declined to 6.61% in Q1, from 7.12% in Q4. This is the lowest rate since Q3 2007.

The Severely Derogatory (red) rate has fallen to 2.34%, the lowest since Q1 2008.

The 120+ days late (orange) rate has declined to 2.09%, the lowest since Q3 2008.

Short term delinquencies are back to normal levels (lowest since 2006).

Here is the press release from the NY Fed: Household Debt Grows for the Fourth Consecutive Quarter

There are a number of credit graphs at the NY Fed site.

Retail Sales increased 0.1% in April

by Calculated Risk on 5/13/2014 08:30:00 AM

On a monthly basis, retail sales increased 0.1% from March to April (seasonally adjusted), and sales were up 3.8% from April 2013. Sales in March were revised up from a 1.1% increase to a 1.5% increase. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for April, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $434.6 billion, an increase of 0.1 percent from the previous month, and 4.0 percent above April 2013.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were unchanged.

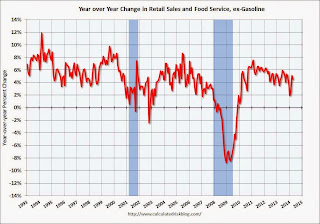

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.6% on a YoY basis (4.0% for all retail sales).

Retail sales ex-gasoline increased by 4.6% on a YoY basis (4.0% for all retail sales).The increase in April was well below consensus expectations - however sales in March were revised up.

Monday, May 12, 2014

Tuesday: Retail Sales, Q1 Household Debt and Credit

by Calculated Risk on 5/12/2014 07:45:00 PM

This could be significant from Nick Timiraos at the WSJ: Regulator Extends Greater Shield to Lenders on Mortgage 'Put-Backs'

Fannie Mae and Freddie Mac will extend new waivers to lenders ...Tuesday:

The changes are significant because some industry analysts and economists have said they could lay the groundwork for lenders to relax credit standards. Lenders and policy makers have faulted ambiguous rules around mortgage put-backs for lending standards that they say are unnecessarily rigid.

...

The FHFA's new director, Mel Watt, is set to make his first public speech on Tuesday in Washington.

emphasis added

• At 7:30 AM ET, the NFIB Small Business Optimism Index for April.

• At 8:30 AM, Retail sales for April will be released. The consensus is for retail sales to increase 0.4% in April, and to increase 0.6% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.4% increase in inventories.

• At 11:00 AM, the Q1 2014 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York. Note: "In conjunction with the release of the report, the New York Fed will also post an update to a recent blog discussing the impact of student loan debt on housing and auto markets."

Weekly Update: Housing Tracker Existing Home Inventory up 9.4% year-over-year on May 12th

by Calculated Risk on 5/12/2014 05:11:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for March). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 9.4% above the same week in 2013.

Inventory is still very low - still below the level in 2012 (yellow) when prices started increasing - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in April

by Calculated Risk on 5/12/2014 04:11:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in April.

Note: From Lawler:

While I don’t yet have enough report/data to produce a “decent” projection for April existing home sales as measured by the National Association of Realtors, the data I’ve seen so far seems to be consistent with a annualized seasonally adjusted sales pace of about 4.67 million.From CR: The NAR reported sales of 4.59 million SAAR in March, and 4.99 million SAAR in April 2013.

On distressed: Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Foreclosures are down in most of these areas too, although foreclosures are up in the mid-Atlantic area and Las Vegas (there was a state law change that slowed foreclosures dramatically in Nevada at the end of 2011 - so it isn't a surprise that foreclosures are up a little year-over-year).

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably decline. Omaha's cash share is up.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Apr-14 | Apr-13 | Apr-14 | Apr-13 | Apr-14 | Apr-13 | Apr-14 | Apr-13 | |

| Las Vegas | 12.4% | 32.5% | 11.4% | 10.0% | 23.8% | 42.5% | 41.4% | 59.3% |

| Reno** | 15.0% | 33.0% | 6.0% | 8.0% | 21.0% | 41.0% | ||

| Phoenix | 4.0% | 12.7% | 6.5% | 11.3% | 10.5% | 24.1% | 32.2% | 42.0% |

| Minneapolis | 5.0% | 7.4% | 15.9% | 24.0% | 20.9% | 31.4% | ||

| Mid-Atlantic | 5.9% | 9.9% | 10.0% | 8.6% | 15.9% | 18.5% | 19.5% | 19.4% |

| Memphis* | 16.6% | 24.7% | ||||||

| Toledo | 33.4% | 40.8% | ||||||

| Des Moines | 17.1% | 19.6% | ||||||

| Omaha | 22.3% | 17.4% | ||||||

| Tucson | 30.5% | 33.5% | ||||||

| Georgia*** | 34.3% | N/A | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Update: Framing Lumber Prices

by Calculated Risk on 5/12/2014 12:13:00 PM

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs. Then prices started to decline sharply, and prices declined over 25% from the highs by June.

The price increases early last year were due to stronger demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand), however prices haven't fallen as sharply either.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down about 2% from a year ago, and CME futures are up about 4% year-over-year.

MBA: Applications for New Home Purchases Increased in April 2014

by Calculated Risk on 5/12/2014 09:39:00 AM

From the MBA: Applications for New Home Purchases Increased in April 2014

The Mortgage Bankers Association’s (MBA) Builder Application Survey (BAS) data for March 2014 shows mortgage applications for new home purchases increased by 5 percent relative to the previous month. This change does not include any adjustment for typical seasonal patterns.A couple of comments:

...

The MBA estimate of new single-family home sales were running at a seasonally adjusted annual rate of 419,000 units in April 2014, based on data from the BAS. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors. The BAS market coverage was rebenchmarked this month to an estimate of over 30 percent of annual sales volume based on data from the Census Bureau.

The seasonally adjusted estimate for April is an increase of five percent from the revised March pace of 400,000 units.

1) So far the MBA Builder survey hasn't been helpful in predicting Census Bureau reports. As an example, last month the MBA estimated March new home sales at 479,000 on a seasonally adjusted annual rate basis (SAAR), and the Census Bureau reported sales of 384,000 SAAR. Not close.

2) Now the MBA has increased market coverage, so maybe the survey will be more useful. A 419,000 SAAR would be up from March, but down from 446,000 in April 2013.

Sunday, May 11, 2014

Sunday Night Futures

by Calculated Risk on 5/11/2014 08:12:00 PM

A somewhat strange story on inflation in the WSJ: Markets Watch, Warily, for a Small Bump in Inflation

Normally, a move of a couple of tenths of a percentage point in the inflation measures wouldn't matter much to anyone. But the stakes are high now as Federal Reserve officials justify their plan to keep short-term interest rates near zero in part because inflation is running so far below their 2% objective.Uh, the Fed expects inflation to move up towards 2%, and if it doesn't, the Fed might slow or stop the tapering of QE3 asset purchases. In her testimony last week, Fed Chair Yellen said: "Looking ahead, I expect that economic activity will expand at a somewhat faster pace this year than it did last year, that the unemployment rate will continue to decline gradually, and that inflation will begin to move up toward 2 percent."

Fed officials expect inflation to move from near 1% to 1.5% by year-end. If it moves up sooner or more than they expect, officials could consider raising rates sooner than planned.

emphasis added

The most recent FOMC projections show PCE inflation moving up to 1.5% to 1.6% by Q4, but the Fed wouldn't raise rates sooner just because inflation rate moved closer to 2% this year - unless employment indicators improved significantly too.

And another sentence from the WSJ article:

The persistent low inflation has befuddled economists who thought Fed easy-money policies would spark rampant price gains.Well, yes, some economists had the wrong model, but most economists realized that easy-money policies wouldn't lead to inflation in a depressed economy (I've been making fun of incorrect inflation forecasts for years). Eventually we will see a little more inflation - and an increase in inflation towards 2% would be good news - not something to watch "warily" for.

Monday:

• At 2:00 PM ET, the Monthly Treasury Budget Statement for April. Note: The CBO's estimate is the deficit through April in fiscal 2014 was $301 billion, compared to $488 billion for the same period in fiscal 2013.

Weekend:

• Schedule for Week of May 11th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 5 and DOW futures are up 47 (fair value).

Oil prices were mixed over the last week with WTI futures at $100.07 per barrel and Brent at $107.89 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.62 per gallon (might have peaked, and only slightly above the level of a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

FNC: Residential Property Values increased 9.1% year-over-year in March

by Calculated Risk on 5/11/2014 10:26:00 AM

In addition to Case-Shiller, CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their March index data. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.6% from February to March (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.2% and 0.4% in March. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

The year-over-year change slowed slightly in March, with the 100-MSA composite up 9.1% compared to March 2013. In February, the year-over-year increase was 9.2%. The index is still down 22.2% from the peak in 2006.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the year-over-year change based on the FNC index (four composites) through March 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

There is still no clear evidence in the FNC index of a slowdown in price increases yet.

The March Case-Shiller index will be released on Tuesday, May 27th, and I expect Case-Shiller to show a slowdown in price increases.