by Calculated Risk on 5/13/2014 11:00:00 AM

Tuesday, May 13, 2014

NY Fed: Household Debt increased in Q1 2014, Delinquency Rates Lowest Since Q3 2007

Here is the Q1 report: Household Debt and Credit Report. From the NY Fed:

In its Q1 2014 Household Debt and Credit Report, the Federal Reserve Bank of New York announced that outstanding household debt increased $129 billion from the previous quarter. The increase was led by rises in mortgage debt ($116 billion), student loan debt ($31 billion) and auto loan balances ($12 billion), slightly offset by a $27 billion declines in credit card and HELOC balances. Total household indebtedness stood at $11.65 trillion, 1.1 percent higher than the previous quarter. Overall household debt remains 8.1 percent below the peak of $12.68 trillion reached in Q3 2008. The report is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample drawn from anonymized Equifax credit data.

Additionally, an update to a recent blog discussing the impact of student loan debt on housing and auto markets is available on our Liberty Street Economics Blog.

“We’ve observed household debt increase three quarters in a row and delinquency rates at their lowest levels since 2008,” said Andy Haughwout, vice president and economist at the New York Fed. “However, the direction of future mortgage originations will have an important implication on the household financial outlook and we will continue to monitor it.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q1.

This suggests households (in the aggregate) may be near the end of deleveraging. If so, this is a significant change that started mid-2013.

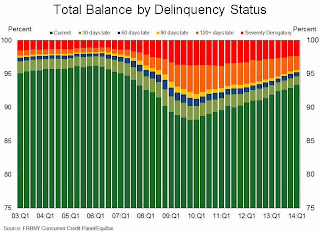

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate has declined to 6.61% in Q1, from 7.12% in Q4. This is the lowest rate since Q3 2007.

The Severely Derogatory (red) rate has fallen to 2.34%, the lowest since Q1 2008.

The 120+ days late (orange) rate has declined to 2.09%, the lowest since Q3 2008.

Short term delinquencies are back to normal levels (lowest since 2006).

Here is the press release from the NY Fed: Household Debt Grows for the Fourth Consecutive Quarter

There are a number of credit graphs at the NY Fed site.