by Calculated Risk on 5/08/2014 09:15:00 AM

Thursday, May 08, 2014

Fannie and Freddie Results in Q1: REO inventory declines, "Lower demand for foreclosed properties"

• Fannie Mae reported net income of $5.3 billion, the company’s ninth consecutive quarterly profit, and comprehensive income of $5.7 billion for the first quarter of 2014.

• Fannie Mae’s financial results for the first quarter of 2014 included $4.1 billion in revenue from legal settlements relating to private-label securities lawsuits.

• Fannie Mae expects to pay Treasury $5.7 billion in dividends in June 2014. With the expected June dividend payment, Fannie Mae will have paid a total of $126.8 billion in dividends to Treasury in comparison to $116.1 billion in draw requests since 2008. Dividend payments do not offset prior Treasury draws.

...

The continued decrease in the number of our seriously delinquent single-family loans, as well as the slower pace of completed foreclosures we are experiencing due to lengthy foreclosure timelines in a number of states, have resulted in a reduction in the number of REO acquisitions, while the lower demand for foreclosed properties has resulted in fewer REO dispositions in the first quarter of 2014 as compared with the first quarter of 2013.

emphasis added

From Freddie Mac:

• First quarter 2014 net income was $4.0 billion – the company’s tenth consecutive quarter of positive earnings, compared to $8.6 billion in the fourth quarter of 2013

• First quarter 2014 comprehensive income was $4.5 billion, compared to $9.8 billion in the fourth quarter of 2013

...

• Recent level of earnings is not sustainable over the long term, and earnings may be volatile from period to period

Treasury Draws and Dividend Payments at March 31, 2014

• Based on March 31, 2014 net worth of $6.9 billion, the company’s June 2014 dividend obligation will be $4.5 billion, bringing total cash dividends paid to Treasury to $86.3 billion

• Senior preferred stock held by Treasury remains $72.3 billion, as dividend payments do not reduce prior Treasury draws

...

In 1Q14, REO inventory declined primarily due to lower single-family foreclosure activity as a result of Freddie Mac’s loss mitigation efforts and a declining amount of delinquent loans.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie REO.

REO inventory decreased in Q1 for both Fannie and Freddie.

Delinquencies are falling, but there are still a large number of properties in the foreclosure process with long time lines in judicial foreclosure states.

Fannie noted there was less demand for foreclosed properties.

Weekly Initial Unemployment Claims decrease to 319,000

by Calculated Risk on 5/08/2014 08:30:00 AM

The DOL reports:

In the week ending May 3, the advance figure for seasonally adjusted initial claims was 319,000, a decrease of 26,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 344,000 to 345,000. The 4-week moving average was 324,750, an increase of 4,500 from the previous week's revised average. The previous week's average was revised up by 250 from 320,000 to 320,250.The previous week was revised up from 344,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 324,750.

This was below the consensus forecast of 330,000. The 4-week average is close to normal levels for an expansion.

Wednesday, May 07, 2014

Thursday: More Yellen, Unemployment Claims

by Calculated Risk on 5/07/2014 07:02:00 PM

First, an update to an earlier comment: The Mortgage Bankers Association (MBA) told me they have expanded coverage of the mortgage purchase index to include many smaller "purchase focused" lenders. The MBA doesn't believe their purchase index is "skewed" by large lenders who were focused on refinance applications.

Second, from Jon Hilsenrath at the WSJ: Yellen Offers Upbeat Outlook, but Points to Housing Risk

The fitful housing recovery poses one risk that could throw the Fed off track.Thursday:

"The recent flattening out in housing activity could prove more protracted than currently expected rather than resuming its earlier pace of recovery," Ms. Yellen warned, dwelling on the housing slowdown more prominently than she or other Fed officials have in the recent past.

Her emphasis on this weak point in the recovery is notable because housing is highly sensitive to interest rates. If officials become more seriously worried about the pace of the housing recovery, they could decide to hold interest rates lower for longer.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 344 thousand.

• Early, the Trulia Price Rent Monitors for April. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 9:30 AM, Testimony by Fed Chair Janet Yellen, The Economic Outlook, Before the Committee on the Budget, U.S. Senate

DataQuick: California Foreclosure Starts Hover Near 8-Year Low

by Calculated Risk on 5/07/2014 02:49:00 PM

This was released in late April by DataQuick: California Foreclosure Starts Hover Near 8-Year Low

Lenders and their servicers recorded 19,215 Notices of Default (NoDs) on California house and condo owners during this year's first quarter, which runs January through March. That was up 6.0 percent from 18,120 NoDs in the prior quarter, which had the lowest NoD tally since fourth-quarter 2005, and was up 3.5 percent from 18,568 NoDs in first-quarter last year, according to San Diego-based DataQuick.

The trough for DataQuick's NoD statistics, which begin in 1992, was 12,417 in third-quarter 2004, while the peak was 135,431 in first-quarter 2009. Each NoD represents a "foreclosure start" because the filing of the Notice of Default begins the formal foreclosure process.

"It may well be that the foreclosure starts in recent quarters don't reflect the ebb and flow of financial distress as much as they reflect a steady state of workload capacity on the part of the servicers. They may well be just working their way through a backlog, stacks of paper piled high on desks," said John Karevoll, DataQuick analyst.

The past three quarters, along with the first quarter of 2013, have seen the lowest NoD totals since late 2005 and early 2006.

Although this year's first quarter was the first to log a year-over-year increase in default filings since fourth quarter 2009, that gain can be attributed to an anomaly early in first-quarter 2013: There was a short-lived plunge in NoD filings in January and February last year as new state laws - known as the "Homeowner Bill of Rights" - took effect, causing lenders and services to pause and adjust. On a year-over-year basis, NoD filings have only increased in January this year, rising 63.9 percent, while February and March NoD levels fell 2.8 percent and 22.5 percent, respectively, from a year earlier.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of Notices of Default (NoD) filed in California each year. 2014 is in red (Q1 times 4).

Last year was the lowest year for foreclosure starts since 2005, and 2013 was also below the levels in 1997 through 2000 when prices were rising following the much smaller late '80s housing bubble / early '90s bust in California.

Overall foreclosure starts are close to a normal level in California (foreclosure starts were over 50,000 in 2004 and 2005 when prices were rising quickly).

Note: Foreclosures are still higher than normal in states with a judicial foreclosure process.

Phoenix Real Estate in April: Sales down 12%, Cash Sales down 33%, Inventory up 49%

by Calculated Risk on 5/07/2014 11:17:00 AM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in April were down 12% year-over-year and at the lowest level since April 2008.

2) Cash Sales (frequently investors) were down 33%, so investor buying appears to be declining. Non-cash sales were up year-over-year.

3) Active inventory is now increasing rapidly and is up 49% year-over-year - and at the highest level since 2011.

Inventory has clearly bottomed in Phoenix (A major theme for housing last year). And more inventory (a theme this year) - and less investor buying - suggests price increases should slow sharply in 2014.

According to Case-Shiller, Phoenix house prices bottomed in August 2011 (mostly flat for all of 2011), and then increased 23% in 2012, and another 15% in 2013. Those large increases were probably due to investor buying, low inventory and some bounce back from the steep price declines in 2007 through 2010. Now, with more inventory, price increases should flatten out in 2014.

We only have Case-Shiller through February, but the Zillow index shows Phoenix prices down slightly in March (most recent data), and down 1.2% in Q1.

| April Residential Sales and Inventory, Greater Phoenix Area, ARMLS | |||||

|---|---|---|---|---|---|

| Sales | Cash | Percent Cash | Inventory | YoY Change | |

| Apr-08 | 4,8751 | 986 | 20.2% | 55,7261 | --- |

| Apr-09 | 8,564 | 3,464 | 40.4% | 44,165 | -20.7% |

| Apr-10 | 9,261 | 3,641 | 39.3% | 41,756 | -5.5% |

| Apr-11 | 9,328 | 4,489 | 48.1% | 34,515 | -17.3% |

| Apr-12 | 8,438 | 4,013 | 47.6% | 21,125 | -38.8% |

| Apr-13 | 8,744 | 3,670 | 42.0% | 20,083 | -4.9% |

| Apr-14 | 7,656 | 2,469 | 32.2% | 29,889 | 48.8% |

| 1 April 2008 does not include manufactured homes, ~100 more | |||||

Fed Chair Janet Yellen: Expects Growth Rate to Increase, "A high degree of monetary accommodation remains warranted"

by Calculated Risk on 5/07/2014 10:05:00 AM

Testimony by Chair Yellen on the economic outlook. A couple of excerpts:

Looking ahead, I expect that economic activity will expand at a somewhat faster pace this year than it did last year, that the unemployment rate will continue to decline gradually, and that inflation will begin to move up toward 2 percent. A faster rate of economic growth this year should be supported by reduced restraint from changes in fiscal policy, gains in household net worth from increases in home prices and equity values, a firming in foreign economic growth, and further improvements in household and business confidence as the economy continues to strengthen. Moreover, U.S. financial conditions remain supportive of growth in economic activity and employment.And on monetary policy:

emphasis added

As always, our policy will continue to be guided by the evolving economic and financial situation, and we will adjust the stance of policy appropriately to take account of changes in the economic outlook. In light of the considerable degree of slack that remains in labor markets and the continuation of inflation below the Committee's 2 percent objective, a high degree of monetary accommodation remains warranted.

MBA: Refinance Share of Mortgage Applications under 50% for first time since 2009

by Calculated Risk on 5/07/2014 07:00:00 AM

For the first time since 2009 there were more purchase mortgage applications than refinance applications last week!

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 2, 2014. ...

The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 9 percent from one week earlier to the highest level since January 2014. ...

...

The refinance share of mortgage activity decreased to 49 percent of total applications from 50 percent the previous week.

"It is official: we are in a majority purchase market for the first time since 2009,” said Mike Fratantoni, MBA’s Chief Economist. “A sizeable increase in purchase applications last week likely reflected the impact of somewhat lower mortgage rates as well as continued growth in the job market, as confirmed by Friday’s employment report from the BLS. Despite the strong increase in the purchase market last week, volume continues to run 16 percent behind last year's pace."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.43 percent, the lowest rates since November 2013, from 4.49 percent, with points decreasing to 0.21 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

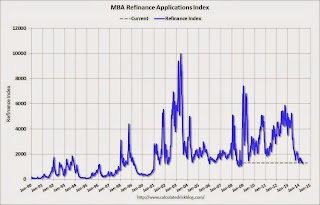

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013 (one year ago).

As expected, with the mortgage rate increases, refinance activity is very low this year.

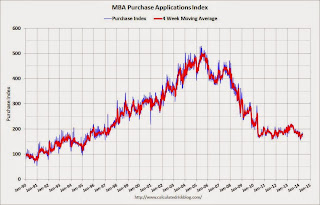

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 18% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index.

Tuesday, May 06, 2014

Wednesday: Yellen on the Economic Outlook

by Calculated Risk on 5/06/2014 08:44:00 PM

From Business Insider, here are some housing graphs: Here's Jeff Gundlach's Big Presentation On Why Homeownership Is Overrated And Why He's Short The Homebuilders. Gundlach is arguing the homebuilders are overvalued (I have no comment), and I'm not sure if he made any macro predictions.

This is a weird time because housing is improving, but most housing statistics are ugly. As an example, if I hadn't been paying attention - and someone told me the level of mortgage delinquencies and foreclosures - I'd guess the US was in a deep recession. But the trend for delinquencies tells a very different story.

If Gundlach made some macro predictions, please send them along and maybe I'll comment ...

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Testimony by Fed Chair Janet Yellen, The Economic Outlook, Before the Joint Economic Committee, U.S. Congress

• At 3:00 PM, Consumer Credit for March from the Federal Reserve. The consensus is for credit to increase $15.1 billion.

What's Right with Housing?

by Calculated Risk on 5/06/2014 03:37:00 PM

There have been quite a few hand-wringing articles lately discussing the problems with housing. Most articles point to some of these suspects:

1) Existing home sales were down 7.5% year-over-year in March.

2) New home sales were down 13% year-over-year in March and down slightly Q1 over Q1.

3) Housing starts were down 5.9% year-over-year in March, and down 2% Q1 compared to Q1 2013.

4) The 4-week average of the Mortgage Bankers Association (MBA) mortgage purchase index is down 19% compared to the same week last year.

5) Mortgage credit is still tight.

6) Mortgage rates are up significantly from last year.

7) The homeownership rate is still falling.

8) Younger people prefer renting and more ...

Oh my, the sky is falling!

Well, maybe not.

The first mistake these writers make is they are asking the wrong question. Of course housing is lagging the recovery because of the residual effects of the housing bust and financial crisis (this lag was predicted on this blog and elsewhere for years - it should not be a surprise).

The correct question is: What's right with housing? And there is plenty.

1) Existing home sales were down 7.5% year-over-year in March. Wait, isn't that bad news? Nope - not if the decline is related to fewer distressed sales - and it is. (fewer foreclosures and short sales).

2) Mortgage delinquencies are down sharply. See: Fannie Mae and Freddie Mac: Mortgage Serious Delinquency rate declined in March and Mortgage Monitor: Mortgage delinquency rate in March lowest since October 2007, "Only One in 10 American Borrowers Underwater"

3) Mortgage credit is tight. Hey, isn't that bad news? Nope. There is only one way to go ...

Click on graph for larger image.

Click on graph for larger image.

4) New home sales are up significantly from the bottom, but are still historically very low.

There really is no where to go but up. A growing population will require more new homes. (I'll post again on household formation in the future). The graph for housing starts looks similar.

5) The percent of borrowers with negative equity is declining sharply. See: CoreLogic: 4 Million Residential Properties Returned to Positive Equity in 2013 and Zillow: Negative Equity declines further in Q4 2013

6) The impact from rising mortgage rates is mostly behind us. Economists at Goldman Sachs have found "the effect of monetary policy shocks on [building] permits persists for 3-4 quarters". Rates increased from around 3.5% in May 2013 to 4.4% in July 2013. Since then rates have moved sideways or down a little - and the "3-4 quarters" is almost over.

7) Existing home inventory is increasing, and house price increases are slowing. Sometimes rising inventory is a sign of trouble (I was pointing to this in 2005), but now inventory is so low that it is a positive that inventory is increasing. This will also slow house price increases (I think that will be a positive for housing too - a more normal market).

8) The MBA purchase index is skewed by large lenders. Over the last few years, small lenders (many not included in the MBA survey) have focused on purchase applications (they market through real estate channels and charge lower fees than the large lenders). Other data suggests mortgage applications are mostly flat year-over-year. UPDATE: The MBA told me they have expanded coverage of the index to include many smaller purchase focused lenders. The MBA doesn't believe their data is "skewed" by the large lenders.

9) Investor buying is declining.

Housing is a slow moving market - and the recovery will not be smooth or fast with all the residual problems. But overall housing is clearly improving and the outlook remains positive for the next few years.

Zillow: Case-Shiller House Price Index expected to slow to 11.9% year-over-year increase in March

by Calculated Risk on 5/06/2014 11:23:00 AM

The Case-Shiller house price indexes for February were released last week (CoreLogic this morning). Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

It looks like the year-over-year change for Case-Shiller will continue to slow. From Zillow: Finally…We’re Seeing More of the Slowdown

The Case-Shiller data for February 2014 came out [last week], and based on this information and the March 2014 Zillow Home Value Index (ZHVI, released April 21), we predict that next month’s Case-Shiller data (March 2014) will show that the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased 11.9 and 12.1 percent on a year-over-year basis, respectively. The seasonally adjusted (SA) month-over-month change from February to March will be 0.8 percent for the 20-City Composite Index and 0.7 percent for the 10-City Composite Home Price Index (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for March will not be released until Tuesday, May 27.The Case-Shiller Comp 20 was up 13.7% year-over-year (YoY) in November, up 13.4% YoY in December, 13.2% in January, and up 12.9% YoY in February - and will probably be around 11.9% YoY in March - so the index appears to be slowing down.

| Zillow March 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Mar 2013 | 161.13 | 165.55 | 148.44 | 152.58 |

| Case-Shiller (last month) | Feb 2014 | 179.96 | 184.04 | 165.35 | 169.21 |

| Zillow Forecast | YoY | 12.1% | 12.1% | 11.9% | 11.9% |

| MoM | 0.4% | 0.7% | 0.5% | 0.8% | |

| Zillow Forecasts1 | 180.7 | 185.5 | 166.1 | 170.7 | |

| Current Post Bubble Low | 146.45 | 149.81 | 134.07 | 137.10 | |

| Date of Post Bubble Low | Mar-12 | Feb-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 23.4% | 23.8% | 23.9% | 24.5% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||