by Calculated Risk on 3/25/2014 01:51:00 PM

Tuesday, March 25, 2014

Comment on House Prices: Graphs, Real Prices, Price-to-Rent Ratio, Cities

S&P/Case-Shiller's website crashed this morning. For some reason people seem to care about house prices!

Here is the website and the monthly Home Price Indices for January ("January" is a 3 month average of November, December and January prices). This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

Here is the press release from S&P: Pace of Home Price Gains Slow According to the S&P/Case-Shiller Home Price Indices

Click on graph for larger image.

Click on graph for larger image.

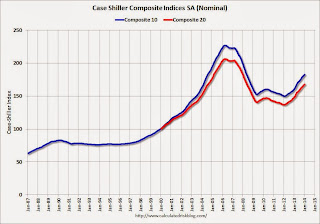

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 19.5% from the peak, and up 0.8% in January (SA). The Composite 10 is up 21.9% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 18.7% from the peak, and up 0.8% (SA) in January. The Composite 20 is up 22.6% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 SA is up 13.5% compared to January 2013.

The Composite 20 SA is up 13.2% compared to January 2013.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in January seasonally adjusted. (Prices increased in 7 of the 20 cities NSA) Prices in Las Vegas are off 44.8% from the peak, and prices in Dallas and Denver are at new highs (SA).

This was at the consensus forecast for a 13.3% YoY increase.

I've been hearing reports of a slowdown in house price increases (more than the usual seasonal slowdown), and perhaps this slowdown in price increases is finally showing up in the Case-Shiller index. This makes sense since inventory is starting to increase.

According to Trulia chief economist Jed Kolko, asking price increases have slowed down recently, and Kolko expects that price slowdown will "hit Feb sales prices and get reported in April index releases".

It might take a few months, but I also expect to see smaller year-over-year price increases going forward.

I also think it is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (about 38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through January) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through January) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2004 levels (and also back up to Q3 2008), and the Case-Shiller Composite 20 Index (SA) is back to Oct 2004 levels, and the CoreLogic index (NSA) is back to August 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q2 2001 levels, the Composite 20 index is back to June 2002, and the CoreLogic index back to May 2002.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q2 2001 levels, the Composite 20 index is back to Sept 2002 levels, and the CoreLogic index is back to Dec 2002.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

A comment on the New Home Sales report

by Calculated Risk on 3/25/2014 11:56:00 AM

Earlier: New Home Sales at 440,000 Annual Rate in February

The Census Bureau reported that new home sales in January and February combined were 68,000 not seasonally adjusted (NSA). This is the same as last year NSA - so there was no growth over the first two months of the year.

Weather probably played a small role in the lack of growth, but higher mortgage rates and higher prices probably were probably bigger factors.

Also this was a difficult comparison period. Sales in 2013 were up 16.8% from 2012, but sales in January and February 2013 were up over 28% from the same months of the previous year! The comparisons to last year will be easier in a few months - and I expect to see solid growth again this year.

On revisions: Although sales in January were revised down by 13 thousand, sales in November and December were revised up a combined 18 thousand - so overall revisions were positive.

Note: Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the 440 thousand sales rate in February. So I expect the housing recovery to continue.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through February 2014. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I expect existing home sales to decline some more or move sideways (distressed sales will slowly decline and be partially offset by more conventional / equity sales). And I expect this gap to close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 440,000 Annual Rate in February

by Calculated Risk on 3/25/2014 10:00:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 440 thousand.

January sales were revised down from 468 thousand to 455 thousand, and December sales were revised up from 427 thousand to 441 thousand (November was revised up slightly too).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in February 2014 were at a seasonally adjusted annual rate of 440,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.3 percent below the revised January rate of 455,000 and is 1.1 percent below the February 2013 estimate of 445,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Even with the increase in sales over the last two years, new home sales are still near the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply increased in February to 5.2 months from 5.0 months in January.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of February was 189,000. This represents a supply of 5.2 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is still low, but moving up. The combined total of completed and under construction is also very low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In February 2014 (red column), 35 thousand new homes were sold (NSA). Last year 36 thousand homes were also sold in February. The high for February was 109 thousand in 2005, and the low for February was 22 thousand in 2011.

This was at expectations of 440,000 sales in February.

I'll have more later today .

Case-Shiller: Comp 20 House Prices increased 13.2% year-over-year in January

by Calculated Risk on 3/25/2014 09:17:00 AM

Note: The S&P website crashed (again), and I'll post graphs and more later today.

From the WSJ: U.S. Home Prices Rise 13.2% in January

According to the S&P/Case-Shiller home price report, the home price index covering 10 major U.S. cities increased 13.5% in the year ended in January. The 20-city price index advanced 13.2% ...

... "From the bottom in 2012, prices are up 23% and the housing market is showing signs of moving forward with more normal price increases." [said David Blitzer, chairman of the index committee at S&P Dow Jones Indices.]

...

"Expectations and recent data point to continued home price gains for 2014. Although most analysts do not expect the same rapid increases we saw last year, the consensus is for moderating gains," the report said.

Monday, March 24, 2014

Tuesday: New Home Sales, Case-Shiller House Prices

by Calculated Risk on 3/24/2014 08:59:00 PM

A reminder of a friendly bet I made with NDD on housing starts and new home sales in 2014:

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.NDD has Starts and Permits. I have Starts and New Home sales.

Of course, with the terms of the bet, we could both "win" at some point during the year. (I expect to "win" in a few months, but not now due to the severe weather and limited starts and sales in many parts of the country).

In February 2013, new home sales were at a 445 thousand seasonally adjusted annual rate (SAAR). For me to win, new home sales would have to be up 20% or at 534 thousand SAAR in February (not likely).

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for January. Although this is the January report, it is really a 3 month average of November, December and January. The consensus is for a 13.3% year-over-year increase in the Composite 20 index (NSA) for January. The Zillow forecast is for the Composite 20 to increase 13.0% year-over-year, and for prices to increase 0.5% month-to-month seasonally adjusted.

• Also at 9:00 AM, FHFA House Price Index for January 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

• At 10:00 AM, New Home Sales for February from the Census Bureau. The consensus is for a decrease in sales to 440 thousand Seasonally Adjusted Annual Rate (SAAR) in February from 468 thousand in January.

• Also at 10:00 AM, the Conference Board's consumer confidence index for March. The consensus is for the index to increase to 78.6 from 78.1.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for March.

Weekly Update: Housing Tracker Existing Home Inventory up 6.2% year-over-year on March 24th

by Calculated Risk on 3/24/2014 04:27:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for February). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year, and finished up about 2.7% YoY.

Inventory in 2014 (Red) is now 6.2% above the same week in 2013.

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

Black Knight (formerly LPS): House Price Index unchanged in January, Up 8.0% year-over-year

by Calculated Risk on 3/24/2014 01:43:00 PM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight (formerly LPS), Zillow, FHFA, FNC and more). The timing of different house prices indexes can be a little confusing. Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Flat for the Month; Up 8.0 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services (formerly the LPS Data & Analytics division) released its latest Home Price Index (HPI) report, based on January 2014 residential real estate transactions. ... The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The year-over-year increase was less in January (8.0%) than in December (8.4%), November (8.5%) and October (8.8%), so this suggests price increases might be slowing.

The LPS HPI is off 14.0% from the peak in June 2006.

Note: The press release has data for the 20 largest states, and 40 MSAs. Prices increased in 10 of the 20 largest states in January and were unchanged in two. LPS shows prices off 44.3% from the peak in Las Vegas, off 36.8% in Orlando, and 34.9% off from the peak in Riverside-San Bernardino, CA (Inland Empire). "After many months of hitting new peaks, Texas and its major metros backed off trend of consecutive new highs."

Note: Case-Shiller for January will be released tomorrow.

Black Knight on Mortgages: "Nearly 1 million fewer loans in U.S. non-current population since last February"

by Calculated Risk on 3/24/2014 09:45:00 AM

According to Black Knight (formerly LPS) First Look report for February, the percent of loans delinquent decreased in February compared to January, and declined by more than 12% year-over-year.

Also the percent of loans in the foreclosure process declined further in January and were down 34% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 5.97% from 6.27% in January. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 2.22% in February from 2.48% in January.

The number of delinquent properties, but not in foreclosure, is down 419,000 properties year-over-year, and the number of properties in the foreclosure process is down 579,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for February in early April.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| February 2014 | January 2014 | February 2013 | |

| Delinquent | 5.97% | 6.27% | 6.80% |

| In Foreclosure | 2.22% | 2.35% | 3.38% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,749,000 | 1,851,000 | 1,927,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,242,000 | 1,289,000 | 1,483,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,115,000 | 1,175,000 | 1,694,000 |

| Total Properties | 4,106,000 | 4,315,000 | 5,104,000 |

Chicago Fed: "Economic activity increased in February"

by Calculated Risk on 3/24/2014 08:42:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth increased in February

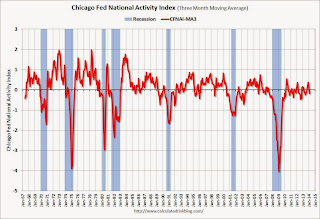

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.14 in February from –0.45 in January. ...This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.18 in February from +0.02 in January, marking its first reading below zero in six months. February’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in February (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, March 23, 2014

Sunday Night Futures

by Calculated Risk on 3/23/2014 08:33:00 PM

Jon Hilesenrath at the WSJ points out that even if the Fed starts raising rates a little earlier than expected, rates are expected to be below normal for a long time: Inside Fed Statement Lurks Hint on Rates

The Fed, in its official policy statement, said it planned to keep short-term rates below what it sees as appropriate for a normal economy even after the unemployment rate and inflation revert to typical levels.Monday:

In 2016, for example, the Fed projects the jobless rate will reach 5.4%, economic output will be growing at a rate near 3% and inflation will be just below 2%. That level of unemployment would be lower than the average over the past 50 years.

Yet officials see the Fed's target short-term interest rate at just over 2% at the end of 2016, well below the 4% they consider appropriate for an economy running on all cylinders.

• At 8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

• Early, Black Knight (formerly LPS) will release their monthly "First Look" at February mortgage performance data.

Weekend:

• Schedule for Week of March 23rd

• The Favorable Demographics for Apartments

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are mostly unchanged (fair value).

Oil prices are mixed with WTI futures at $99.21 per barrel and Brent at $106.92 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.51 per gallon (up sharply over the last month, but still down from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |