by Calculated Risk on 3/07/2014 08:30:00 AM

Friday, March 07, 2014

February Employment Report: 175,000 Jobs, 6.7% Unemployment Rate

From the BLS:

Total nonfarm payroll employment increased by 175,000 in February, and the unemployment rate was little changed at 6.7 percent, the U.S. Bureau of Labor Statistics reported today. ...

The change in total nonfarm payroll employment for December was revised from +75,000 to +84,000, and the change for January was revised from +113,000 to +129,000. With these revisions, employment gains in December and January were 25,000 higher than previously reported.

...

Click on graph for larger image.

Click on graph for larger image.The headline number was above expectations of 150,000 payroll jobs added.

The first graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

Employment is 0.5% below the pre-recession peak (666 thousand fewer total jobs).

NOTE: The second graph is the change in payroll jobs ex-Census - meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

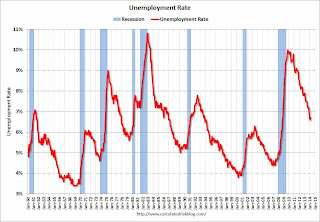

The third graph shows the unemployment rate.

The unemployment rate increased in February to 6.7% from 6.6% in January.

The fourth graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged in February at 63.0%. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio was unchanged in February at 58.8% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

This was a decent employment report considering the recent harsh weather. I'll have much more later ...

Thursday, March 06, 2014

Friday: Employment Report, Trade Deficit

by Calculated Risk on 3/06/2014 08:09:00 PM

From Nelson Schwartz at the NY Times Economix: On February Jobs Data, It’s Anybody’s Guess. Here is my guess: Employment Preview for February: Another Weak Report

Another great piece from Tim Duy at Economist's View: Fed Watch: Tapering is Sooo 2013

Bottom Line: Barring the outlier outcomes of either recession or explosive growth, tapering is on autopilot. Rate guidance is now qualitative and actual policy is discretionary. Incoming data is interesting for what it says about the timing of the first rate hike. So far, though, it is not telling us much given the Fed's belief that weak data is largely weather related. The degree to which asset bubbles are a concern varies greatly accross Fed officials but the general consensus is that such concerns are of second or third order magnitude compared to missing on both sides of the dual mandate.Friday:

• At 8:30 AM ET, the Employment Report for February. The consensus is for an increase of 150,000 non-farm payroll jobs in February, up from the 113,000 non-farm payroll jobs added in January. The consensus is for the unemployment rate to be unchanged at 6.6% in February.

• At 8:30 AM, the Trade Balance report for January from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $39.0 billion in January from $38.7 billion in December.

• At 3:00 PM, Consumer Credit for January from the Federal Reserve. The consensus is for credit to increase $14.5 billion in January.

Trulia: Asking House Prices up 10.4% year-over-year in February, Price increases "Slowdown"

by Calculated Risk on 3/06/2014 02:53:00 PM

From Trulia chief economist Jed Kolko: What The Home-Price Slowdown Really Looks Like

Nationally, asking home prices rose 10.4% year-over-year in February 2014, down slightly after peaking in November 2013. But the year-over-year change is an average of the past twelve months and therefore obscures the most recent trends in prices. Looking at quarter-over-quarter changes instead, it’s clear that price gains have been slowing for most of the last year: asking home prices rose just 1.9% in February – a rate similar to those recorded in January and December – compared with increases near 2.5% from July 2013 to November 2013 and over 3% from April 2013 to June 2013. The quarter-over-quarter change in asking prices topped out at 3.5% in April 2013 and now, at 1.9%, the increase is just over half of that peak.It appears the year-over-year asking price gains are slowing, but asking prices are still increasing.

...

The 10 U.S. metros with the biggest year-over-year price increases in February 2014 all experienced a severe housing bust after the bubble popped (by “severe,” we mean a price drop from peak to trough of at least 30%, according to the Federal Housing Finance Agency index). Why? After prices fell in these markets, homes looked like bargains to investors and other buyers. At the same time, price drops also spurred foreclosures, which forced many families to become renters. Price drops and stronger rental demand together create the ideal conditions for investors to buy and rent out single-family homes, which helped boost home prices.

In February, rents rose 3.4% year-over-year nationally. In 20 the 25 largest rental markets, February’s increase was larger than the year-over-year rent increase from three months earlier, in November. emphasis added

In November 2013, year-over-year asking prices were up 12.2%. In December, the year-over-year increase in asking home prices slowed slightly to 11.9%. In January, the year-over-year increase was 11.4%, and now, in February, the increase was 10.4%.

As Kolko notes, the slowdown has started - but prices are still increasing.

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases, but at a slower rate, over the next few months on a seasonally adjusted basis.

Fed's Q4 Flow of Funds: Household Net Worth at Record High

by Calculated Risk on 3/06/2014 12:00:00 PM

The Federal Reserve released the Q4 2013 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q4 compared to Q3, and is at a new record high. Net worth peaked at $68.8 trillion in Q2 2007, and then net worth fell to $55.6 trillion in Q1 2009 (a loss of $13.2 trillion). Household net worth was at $80.7 trillion in Q4 2013 (up $25.1 trillion from the trough in Q1 2009).

The Fed estimated that the value of household real estate increased to $19.4 trillion in Q4 2013. The value of household real estate is still $3.2 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.

This is the Households and Nonprofit net worth as a percent of GDP. Although household net worth is at a record high, as a percent of GDP it is still below the peak in 2006 (housing bubble), but above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles. The ratio has been trending up and increased again in Q4 with both stock and real estate prices increasing.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2013, household percent equity (of household real estate) was at 51.7% - up from Q3, and the highest since Q2 2007. This was because of both an increase in house prices in Q4 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 50.7% equity - and millions have negative equity.

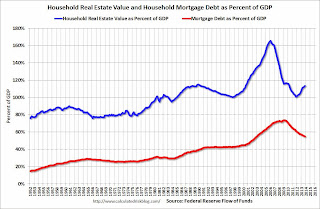

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt decreased by $11 billion in Q4, after increasing slightly in Q3.

Mortgage debt has now declined by $1.32 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q4 (as house prices increased), but still close to the average of the last 30 years (excluding bubble). However household mortgage debt, as a percent of GDP, is still historically high, suggesting a little more deleveraging ahead for certain households.

CoreLogic: 4 Million Residential Properties Returned to Positive Equity in 2013

by Calculated Risk on 3/06/2014 09:51:00 AM

From CoreLogic: CoreLogic reports 4 Million Residential Properties Returned to Positive Equity in 2013

CoreLogic ... today released new analysis showing 4 million homes returned to positive equity in 2013, bringing the total number of mortgaged residential properties with equity to 42.7 million. The CoreLogic analysis indicates that nearly 6.5 million homes, or 13.3 percent of all residential properties with a mortgage, were still in negative equity at the end of 2013. Due to a small slowdown in the quarterly growth rate of the Home Price Index, the negative equity share was virtually unchanged from the end of the third quarter of 2013.

... Of the 42.7 million residential properties with positive equity, 10 million have less than 20-percent equity. Borrowers with less than 20-percent equity, referred to as “under-equitied,” may have a more difficult time obtaining new financing for their homes due to underwriting constraints. Under-equitied mortgages accounted for 21.1 percent of all residential properties with a mortgage nationwide in 2013, with more than 1.6 million residential properties at less than 5-percent equity, referred to as near-negative equity. Properties that are near-negative equity are considered at risk if home prices fall. ...

“The plight of the underwater borrower has improved dramatically since negative equity peaked in December 2009 when more than 12 million mortgaged homeowners were underwater,” said Mark Fleming, chief economist for CoreLogic. “Over the past four years, more than 5.5 million homeowners have regained equity, reducing their risk of foreclosure and unlocking pent-up supply in the housing market.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 30.4 percent, followed by Florida (28.1 percent), Arizona (21.5 percent), Ohio (19.0 percent) and Illinois (18.7 percent). These top five states combined account for 36.9 percent of negative equity in the United States."

Note: The share of negative equity is still very high in Nevada and Florida, but down significantly from a year ago (Q4 2012) when the negative equity share in Nevada was at 52.4 percent, and at 40.2 percent in Florida.

The second graph shows the distribution of home equity in Q4 compared to Q3. Close to 5% of residential properties have 25% or more negative equity, down slightly from Q3, and down from around 6% in Q2 and 8% in Q1.

The second graph shows the distribution of home equity in Q4 compared to Q3. Close to 5% of residential properties have 25% or more negative equity, down slightly from Q3, and down from around 6% in Q2 and 8% in Q1.In Q4 2012, there were 10.4 million properties with negative equity - now there are 6.5 million. A significant change.

Weekly Initial Unemployment Claims decline to 323,000

by Calculated Risk on 3/06/2014 08:35:00 AM

The DOL reports:

In the week ending March 1, the advance figure for seasonally adjusted initial claims was 323,000, a decrease of 26,000 from the previous week's revised figure of 349,000. The 4-week moving average was 336,500, a decrease of 2,000 from the previous week's revised average of 338,500.The previous week was revised up from 348,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 336,500.

This was below the consensus forecast of 338,000. The 4-week average is mostly moving sideways ...

Wednesday, March 05, 2014

Thursday: Unemployment Claims, Q4 Flow of Funds

by Calculated Risk on 3/05/2014 08:04:00 PM

From Tim Duy Fed Watch: A Lackluster Start to the New Year

Incoming data has tended to disappoint. While weather impacts are taking part of the blame, I tend to think that part of the blame should fall on overly optimistic interpretations of data patterns at the end of 2013. ...CR Note: I think Duy is correct that tapering will continue "unless activity lurches sharply downward", but I remain fairly optimistic about 2014. We will see ...

Bottom Line: Data disappointment in part is driven by excessive optimism. In any event, data are not sufficiently disappointing to derail the Fed's tapering plans. Unless activity lurches sharply downward, I think the tapering process is pretty much on autopilot. It is now all about interest rates.

Thursday:

• Early, Trulia Price Rent Monitors for February. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 338 thousand from 348 thousand.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for January. The consensus is for a 0.5% decrease in January orders.

• At 12:00 PM, the Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

Employment Preview for February: Another Weak Report

by Calculated Risk on 3/05/2014 03:41:00 PM

Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus is for an increase of 150,000 non-farm payroll jobs in February, and for the unemployment rate to be unchanged at 6.6%.

Note: This was an unusually harsh winter, and the weather apparently impacted hiring in December, January and in February too. The Fed's beige book today mentioned weather 119 times (including all the District reports). In the January beige book, weather was only mentioned 21 times. In the March 2013 beige book, weather was mentioned 18 times. So weather could be a significant factor in the February report.

Here is a summary of recent data:

• The ADP employment report showed an increase of 139,000 private sector payroll jobs in February. This was below expectations of 158,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. But in general, this suggests employment growth below expectations.

• The ISM manufacturing employment index was unchanged in February at 52.3%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 7,000 in February. The ADP report indicated a 1,000 increase for manufacturing jobs in February.

The ISM non-manufacturing employment index decreased in February to 47.5% from 56.4% in January. A historical correlation between the ISM non-manufacturing index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing were unchanged in February.

Taken together, these surveys suggest around 6,000 fewer jobs in February - far below the consensus forecast.

• Initial weekly unemployment claims averaged close to 338,000 in February. This was up from an average of 333,000 in January. For the BLS reference week (includes the 12th of the month), initial claims were at 334,000; this was up slightly from 329,000 during the reference week in January.

This suggests mostly layoffs in line with the consensus forecast.

• The final February Reuters / University of Michigan consumer sentiment index increased to 81.6 from the January reading of 81.2. This is frequently coincident with changes in the labor market, but there are other factors too.

• The small business index from Intuit showed no change in small business employment in February.

• Conclusion: Usually the data is mixed, but the data this month was fairly weak across the board. The ADP report was lower in February compared to the initial January report (January was revised down in the report today), the Intuit small business index showed no hiring, and the ISM surveys suggest essentially no change in payrolls in February

There is always some randomness to the employment report - and the timing and survey methods are different than for some other reports - but my guess is the BLS report will be under the consensus forecast of 150,000 nonfarm payrolls jobs added in February.

Fed's Beige Book: Economic activity increased at "modest to moderate" pace in Most Districts

by Calculated Risk on 3/05/2014 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Atlanta and based on information collected before February 24, 2014."

Reports from most of the twelve Federal Reserve Districts indicated that economic conditions continued to expand from January to early February. Eight Districts reported improved levels of activity, but in most cases the increases were characterized as modest to moderate. New York and Philadelphia experienced a slight decline in activity, which was mostly attributed to the unusually severe weather experienced in those regions. Growth slowed in Chicago, and Kansas City reported that conditions remained stable during the reporting period. The outlook among most Districts remained optimistic.And on real estate:

Reports on residential housing markets were somewhat mixed. Many Districts continued to report improving conditions but noted that growth had slowed. Most of the Districts indicating otherwise attributed the slowing pace of improvement to unusually severe winter weather conditions. Home sales increased in Richmond, Atlanta, Chicago, St. Louis, and Dallas, while sales were down in Philadelphia, Cleveland, Minneapolis, and Kansas City. Boston and New York reported that the trend in sales for their Districts was mixed. New home construction increased in Richmond, Atlanta, Chicago, St. Louis, and Minneapolis, and remained flat in Kansas City, and was down slightly from the previous period in Philadelphia. Most Districts reported low levels of home inventories and indicated that home prices continued to appreciate. The outlook for sales and residential construction was positive in Boston, Philadelphia, Cleveland, Atlanta, and San Francisco.Some pretty positive comments on commercial real estate. This is a downgrade to the previous beige book, but might be weather related.

Strong multifamily construction was cited in New York, Cleveland, Richmond, Atlanta, and Dallas, while Boston indicated that its pipeline of multifamily construction was declining. Dallas experienced rent growth above its historical average, while New York reported mixed trends in rent growth. Cleveland noted that it expects healthy growth in rents this year.

Many Districts, including New York, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, and San Francisco, indicated that commercial real estate activity had increased and that conditions continued to improve since the previous report. Philadelphia noted that there was very little activity to report in construction or leasing due to severe winter weather. The outlook for nonresidential construction was fairly optimistic in Boston, Philadelphia, Cleveland, Atlanta, Minneapolis, Kansas City, Dallas, and San Francisco.

emphasis added

Lawler on Hovnanian: Net Home Orders Far Short of Expectations; Sales Incentives Coming

by Calculated Risk on 3/05/2014 11:02:00 AM

From housing economist Tom Lawler:

Hovnanian Enterprises, the nation’s sixth largest home builder in 2012, reported that net home orders (including unconsolidated joint ventures) in the quarter ended January 31, 2014 totaled 1,202, down 10.6% from the comparable quarter of 2013. The company’s sales cancellation rate, expressed as a % of gross orders, was 18% last quarter, up from 17% a year ago. Home deliveries last quarter totaled 1,138, down 4.2% from the comparable quarter of 2013, at an average sales price of $351,279, up 6.1% from a year ago. The company’s order backlog at the end of January was 2,438, up 6.0% from last January, at an average order price of $368,243, up 4.3% from a year ago.

Hovnanian’s net orders in California plunged by 43.4% compared to a year ago. Hovnanian’s average net order price in California last quarter was $653,366, up 46.8% from a year ago and up 83.2% from two years ago. Net orders in the Southwest were down 10.0% YOY.

Here is an excerpt from the company’s press release.

"While our first quarter is always the slowest seasonal period for net contracts, the strong recovery trajectory from the spring selling season of 2013 has softened on a year-over-year basis. Net contracts in the months of December, January and February have not met our expectations. In addition to the lull in sales momentum, both sales and deliveries were impacted by poor weather conditions and deliveries were further impacted by shortages in labor and certain materials in some markets that have extended cycle times," stated Ara K. Hovnanian, Chairman of the Board, President and Chief Executive Officer.The company reported that it owned or controlled 34,763 lots at the end of January, up 17.0% from last January.

"We are encouraged by the fact that we have a higher contract backlog, gross margin and community count than we did at the same point in time last year. Furthermore, we have taken steps to spur additional sales in the spring selling season, including the launch of Big Deal Days, a national sales campaign during the month of March. Our first quarter has always been the slowest seasonal period and we expect to report stronger results as the year progresses. We believe this is a temporary pause in the industry's recovery, and based on the level of housing starts across the country, we continue to believe the homebuilding industry is still in the early stages of recovery," concluded Mr. Hovnanian.

emphasis added