by Calculated Risk on 2/21/2014 10:00:00 AM

Friday, February 21, 2014

Existing Home Sales in January: 4.62 million SAAR, Inventory up 7.3% Year-over-year

The NAR reports: Existing-Home Sales Drop in January While Prices Continue to Grow

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 5.1 percent to a seasonally adjusted annual rate of 4.62 million in January from 4.87 million in December, and are also 5.1 percent below the 4.87 million-unit pace in January 2013. Last month’s level of activity was the slowest since July 2012, when it stood at 4.59 million.

...

Total housing inventory at the end of January rose 2.2 percent to 1.90 million existing homes available for sale, which represents a 4.9-month supply at the current sales pace, up from 4.6 months in December. Unsold inventory is 7.3 percent above a year ago, when there was a 4.4-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January (4.62 million SAAR) were 5.1% lower than last month, and were 5.1% below the January 2013 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.90 million in January from 1.86 million in December. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

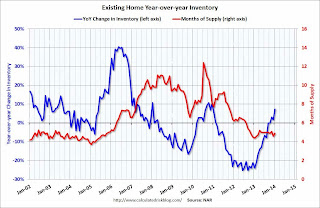

According to the NAR, inventory increased to 1.90 million in January from 1.86 million in December. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 7.3% year-over-year in January compared to January 2013. This year-over-year increase in inventory suggests inventory bottomed earlier last year.

Inventory increased 7.3% year-over-year in January compared to January 2013. This year-over-year increase in inventory suggests inventory bottomed earlier last year.Months of supply was at 4.9 months in January.

This was slightly below expectations of sales of 4.70 million. For existing home sales, the key number is inventory - and the key story is inventory is still low, but up year-over-year. I'll have more later ...

Thursday, February 20, 2014

Friday: Existing Home Sales

by Calculated Risk on 2/20/2014 07:53:00 PM

First, here is a minor indicator that I follow, from ATA: Winter Weather Pushed ATA Truck Tonnage Index Down 4.3% in January

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index decreased 4.3% in January, after edging 0.8% lower in December. In January, the index equaled 124.4 (2000=100) versus 130.0 in December. The all-time high was in November 2013 (131.0). Compared with January 2013, the SA index increased 1.2%.

...

“Like most economic indicators, truck tonnage was negatively impacted by bad winter weather in January,” said ATA Chief Economist Bob Costello. “The thing about truck freight is that it’s difficult to catch up. Drivers are governed by hours-of-service regulations and trucks are limited to trailer lengths and total weights, thus it is nearly impossible to recoup the days lost due to bad storms.”

As a result, Costello said January will be a tough month to gauge.

“January wasn’t just one storm, it was several across a large part of the country. Therefore, I wouldn’t panic from the largest monthly drop in two years," Costello said. "I’ve heard from many fleets that freight was good, in-between storms. The fundamentals for truck freight still look good.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is up 1.2% year-over-year.

Friday:

• At 10:00 AM ET, Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for sales of 4.70 million on seasonally adjusted annual rate (SAAR) basis. Sales in December were at a 4.87 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.67 million SAAR.

MBA National Delinquency Survey: Judicial vs. Non-Judicial Foreclosure States in Q4 2013

by Calculated Risk on 2/20/2014 02:59:00 PM

Earlier I posted the MBA National Delinquency Survey press release and a graph that showed mortgage delinquencies and foreclosures by period past due. There is a clear downward trend for mortgage delinquencies, however some states are further along than others. From the press release:

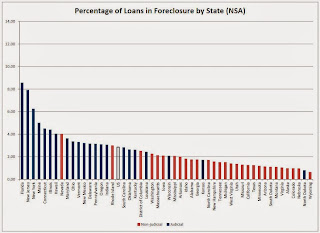

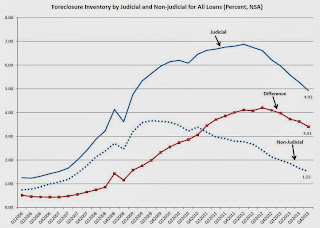

States with judicial foreclosure systems still account for most of the loans in foreclosure. Of the 17 states that had a higher foreclosure inventory rate than the national average, 15 were judicial states. While the percentage of loans in foreclosure dropped in both judicial and nonjudicial states, the average rate for judicial states was 4.92 percent compared to the average rate of 1.52 percent for nonjudicial states. That being said, for judicial states this was still a significant improvement from the rate of 6.88 percent recorded in 2012.

Click on graph for larger image.

Click on graph for larger image.This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission. Blue is for judicial foreclosure states, and red for non-judicial foreclosure states.

The top states are Florida (8.56% in foreclosure down from 9.48% in Q3), New Jersey (7.90% down from 8.28%), New York (6.24% down from 6.34%), and Maine (5.00% down from 5.44%). Nevada is the only non-judicial state in the top 10, and this is partially due to state laws that slow foreclosures.

California (1.25% down from 1.42%) and Arizona (1.12% down from 1.26%) are now far below the national average by every measure.

For judicial foreclosure states, foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for six consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.

For judicial foreclosure states, foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for six consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.It looks like the judicial states will have a significant number of distressed sales for a few more years - however the non-judicial states are closer to normal levels.

Key Measures Shows Low Inflation in January

by Calculated Risk on 2/20/2014 12:30:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.2% annualized rate) in January. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.5% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for January here. The price for fuel oil and other fuels increased sharply in January, but prices for motor fuels declined.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.7% annualized rate) in January. The CPI less food and energy increased 0.1% (1.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.0%, the trimmed-mean CPI rose 1.6%, and the CPI less food and energy rose 1.6%. Core PCE is for December and increased just 1.2% year-over-year.

On a monthly basis, median CPI was at 2.2% annualized, trimmed-mean CPI was at 1.5% annualized, and core CPI increased 1.5% annualized.

These measures suggest inflation remains below the Fed's target.

MBA: Mortgage "Delinquency and Foreclosure Rates Decline to Lowest Level in Six Years" in Q4

by Calculated Risk on 2/20/2014 10:38:00 AM

From the MBA: Delinquency and Foreclosure Rates Decline to Lowest Level in Six Years

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 6.39 percent of all loans outstanding at the end of the fourth quarter of 2013, the lowest level since the first quarter of 2008. The delinquency rate decreased two basis points from the previous quarter, and 70 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 2.86 percent, down 22 basis points from the third quarter and 88 basis points lower than one year ago. This was the lowest foreclosure inventory rate seen since 2008.

...

“We continue to see substantial improvement in both delinquency and foreclosure rates, with most measures now back to pre-crisis levels,” said Michael Fratantoni, MBA’s Chief Economist and Senior Vice President of Research and Industry Technology. “The delinquency rate, at 6.39 percent, is more than 3 percentage points lower than its peak of over 10 percent in 2010 and is edging closer to the historical average of around 5 percent. The percentage of loans in foreclosure has fallen for the seventh consecutive quarter, decreasing to 2.86 percent, the lowest level in six years. The percentage of new foreclosures started, at 0.54 percent, is the lowest in eight years and is back within its typical historical range.

“There was broad improvement in foreclosure rates in the fourth quarter, with 49 states and the District of Columbia recording a decrease. Florida still leads the nation in the percentage of loans in foreclosure, but that percentage has fallen to 8.56 percent from a peak of 14.5 percent. New Jersey and New York had the next two highest rates but both states did see a drop from the previous quarter. States with judicial foreclosure systems still account for most of the loans in foreclosure. Of the 17 states that had a higher foreclosure inventory rate than the national average, 15 were judicial states. While the percentage of loans in foreclosure dropped in both judicial and nonjudicial states, the average rate for judicial states was 4.92 percent compared to the average rate of 1.52 percent for nonjudicial states. That being said, for judicial states this was still a significant improvement from the rate of 6.88 percent recorded in 2012."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 2.89% from 2.79% in Q3. This is close to the long term average.

Delinquent loans in the 60 day bucket decreased to 1.06% in Q4, from 1.07% in Q3. This is still slightly elevated.

The 90 day bucket decreased to 2.45% from 2.56%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 2.86% from 3.08% and is now at the lowest level since 2008.

Most of the poor performing loans were originated in 2007 or earlier, from the MBA's Fratantoni:

“Loan cohorts from 2009 and earlier continue to make up more than 90 percent of seriously delinquent loans. Loans originated in 2007 and earlier accounted for 75 percent of the seriously delinquent loans, while loans originated in 2008 and 2009 accounted for another 16 percent."This survey has shown steady improvement in delinquency and foreclosure rates, but it will take a few more years to work through the backlog - especially in judicial foreclosure states.

Philly Fed Manufacturing Survey indicates Contraction in February

by Calculated Risk on 2/20/2014 10:00:00 AM

From the Philly Fed: February Manufacturing Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from a reading of 9.4 in January to ‐6.3 this month. This was the first negative reading of the index in nine months.This was well below the consensus forecast of a reading of 10.0 for February.

...

The current employment index remained positive for the eighth consecutive month but declined 5 points from January.

emphasis added

Also Market released their Flash PMI for February this morning that suggests faster manufacturing expansion:

February data suggested a solid rebound in U.S. manufacturing business conditions following the slowdown recorded during the previous month. This was highlighted by a rise in the Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™), which is based on approximately 85% of usual monthly replies, from 53.7 in January to 56.7 in February. The latest reading pointed to the fastest overall improvement in U.S. manufacturing business conditions since May 2010.

Commenting on the flash PMI data, Chris Williamson, Chief Economist at Markit said:

“The flash manufacturing PMI provides the first indications that production has rebounded from the weather - related slowdown seen in January . Having slumped to a three - month low in January the PMI surged to its highest for almost four years in February, as companies reported business returning to normal after freezing temperatures and snow disrupted operations and supply chains.

“Hiring also picked up to the fastest since last March, with the survey signalling approximately 15,000 jobs being created in February.

“While the strong PMI reading in part represents a rebound from the temporary weakness seen at the start of the year, further growth looks likely in coming months, suggesting the underlying health of the economy remain s robust. In particular, February saw the largest rise in backlogs of work seen since prior to the financial crisis, as well as a further steep fall in inventories of finished goods. Both point to ongoing growth of production and hiring in March.”

emphasis added

Weekly Initial Unemployment Claims decrease to 336,000

by Calculated Risk on 2/20/2014 08:33:00 AM

The DOL reports:

In the week ending February 15, the advance figure for seasonally adjusted initial claims was 336,000, a decrease of 3,000 from the previous week's unrevised figure of 339,000. The 4-week moving average was 338,500, an increase of 1,750 from the previous week's unrevised average of 336,750.The previous week was unrevised.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 338,500.

This was close to the consensus forecast of 335,000. Mostly moving sideways ...

Wednesday, February 19, 2014

Thursday: Unemployment Claims, CPI, Philly Fed Mfg Survey

by Calculated Risk on 2/19/2014 08:24:00 PM

First an update on Sacramento: Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). For a long time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In January 2014, 19.5% of all resales (single family homes) were distressed sales. This was up from 18.8% last month, and down from 44.5% in January 2013.

The percentage of REOs was at 8.1%, and the percentage of short sales decreased to 11.5%. The increase in December and January was seasonal (happens at the end of every year).

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently (blue).

Active Listing Inventory for single family homes increased 96.3% year-over-year in January.

Cash buyers accounted for 26.6% of all sales, down from 37.4% a year ago (frequently investors). This has been trending down, and it appears investors are becoming less of a factor in Sacramento.

Total sales were down 24% from January 2013, but equity sales (non-distressed) were up compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

As I've noted before, we are seeing a similar pattern in other distressed areas. This suggests what will happen in other areas: 1) Flat or declining overall existing home sales, 2) but increasing conventional (equity) sales, 3) Less investor buying, 4) more inventory, and 5) slower price increases.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 339 thousand.

• Also at 8:30 AM, the Consumer Price Index for January. The consensus is for a 0.1% increase in CPI in January and for core CPI to increase 0.1%.

• At 10:00 AM, the Philly Fed manufacturing survey for February. The consensus is for a reading of 10.0, up from 9.4 last month (above zero indicates expansion).

LA area Port Traffic: Imports up year-over-year in January

by Calculated Risk on 2/19/2014 04:41:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for January since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 0.4% compared to the rolling 12 months ending in December. Outbound traffic was unchanged compared to 12 months ending in December.

Inbound traffic is increasing, and it appears outbound traffic is starting to pick up a little.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

![]() Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March (depending on the timing of the Chinese New Year).

Inbound traffic was up 5% compared to January 2012 and outbound traffic was down slightly.

This suggests an increase in trade the trade deficit with Asia in January.

FOMC Minutes: "A clear presumption in favor" of Additional Tapering

by Calculated Risk on 2/19/2014 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, January 28-29, 2014 . Excerpt:

In their discussion of the path for monetary policy, most participants judged that the incoming information about the economy was broadly in line with their expectations and that a further modest step down in the pace of purchases was appropriate. A couple of participants observed that continued low readings on inflation and considerable slack in the labor market raised questions about the desirability of reducing the pace of purchases; these participants judged, however, that a pause in the reduction of purchases was not justified at this stage, especially in light of the strength of the economy in the second half of 2013. Several participants argued that, in the absence of an appreciable change in the economic outlook, there should be a clear presumption in favor of continuing to reduce the pace of purchases by a total of $10 billion at each FOMC meeting. That said, a number of participants noted that if the economy deviated substantially from its expected path, the Committee should be prepared to respond with an appropriate adjustment to the trajectory of its purchases.A few notes: 1) Tapering will continue unless the economy deviates "substantially from its expected path". 2) There is "a clear presumption in favor" of additional tapering. 3) the forward guidance will be changed soon, probably at the next meeting.

Participants agreed that, with the unemployment rate approaching 6-1/2 percent, it would soon be appropriate for the Committee to change its forward guidance in order to provide information about its decisions regarding the federal funds rate after that threshold was crossed. A range of views was expressed about the form that such forward guidance might take. Some participants favored quantitative guidance along the lines of the existing thresholds, while others preferred a qualitative approach that would provide additional information regarding the factors that would guide the Committee's policy decisions. Several participants suggested that risks to financial stability should appear more explicitly in the list of factors that would guide decisions about the federal funds rate once the unemployment rate threshold is crossed, and several participants argued that the forward guidance should give greater emphasis to the Committee's willingness to keep rates low if inflation were to remain persistently below the Committee's 2 percent longer-run objective. Additional proposals included relying to a greater extent on the Summary of Economic Projections as a communications device and including in the guidance an indication of the Committee's willingness to adjust policy to lean against undesired changes in financial conditions.

A few participants raised the possibility that it might be appropriate to increase the federal funds rate relatively soon. One participant cited evidence that the equilibrium real interest rate had moved higher, and a couple of them noted that some standard policy rules tended to suggest that the federal funds rate should be raised above its effective lower bound before the middle of this year. Other participants, however, suggested that prescriptions from standard policy rules were not appropriate in current circumstances, either because the target federal funds rate had been constrained by the lower bound for some time or because the equilibrium real rate of interest was likely still being held down by various factors, including the lingering effects of the financial crisis, and was significantly below the value of the longer-run rate built into standard policy rules.

emphasis added