by Calculated Risk on 2/20/2014 02:59:00 PM

Thursday, February 20, 2014

MBA National Delinquency Survey: Judicial vs. Non-Judicial Foreclosure States in Q4 2013

Earlier I posted the MBA National Delinquency Survey press release and a graph that showed mortgage delinquencies and foreclosures by period past due. There is a clear downward trend for mortgage delinquencies, however some states are further along than others. From the press release:

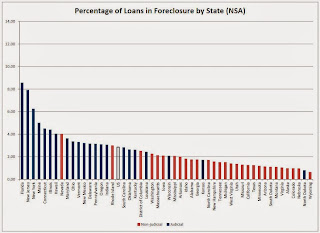

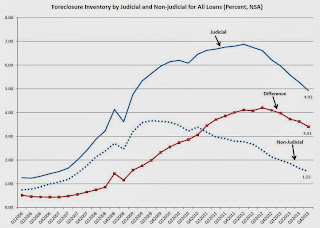

States with judicial foreclosure systems still account for most of the loans in foreclosure. Of the 17 states that had a higher foreclosure inventory rate than the national average, 15 were judicial states. While the percentage of loans in foreclosure dropped in both judicial and nonjudicial states, the average rate for judicial states was 4.92 percent compared to the average rate of 1.52 percent for nonjudicial states. That being said, for judicial states this was still a significant improvement from the rate of 6.88 percent recorded in 2012.

Click on graph for larger image.

Click on graph for larger image.This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission. Blue is for judicial foreclosure states, and red for non-judicial foreclosure states.

The top states are Florida (8.56% in foreclosure down from 9.48% in Q3), New Jersey (7.90% down from 8.28%), New York (6.24% down from 6.34%), and Maine (5.00% down from 5.44%). Nevada is the only non-judicial state in the top 10, and this is partially due to state laws that slow foreclosures.

California (1.25% down from 1.42%) and Arizona (1.12% down from 1.26%) are now far below the national average by every measure.

For judicial foreclosure states, foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for six consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.

For judicial foreclosure states, foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for six consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.It looks like the judicial states will have a significant number of distressed sales for a few more years - however the non-judicial states are closer to normal levels.