by Calculated Risk on 1/30/2014 04:09:00 PM

Thursday, January 30, 2014

Vehicle Sales Forecasts: Decent Sales Expected for January

Note: The automakers will report January vehicle sales on Monday, February 3rd.

Here are a few forecasts:

From Edmunds.com: Winter Weather Freezes January Auto Sales ... Says Edmunds.com

Edmunds.com forecasts that 1,036,533 new cars and trucks will be sold in the U.S. in January for an estimated Seasonally Adjusted Annual Rate (SAAR) of 15.6 million. ...From Kelley Blue Book: New-Car Sales To Improve Nearly 2 Percent From Last Year; Kelley Blue Book Projects Best January Since 2007

January's weather complications mean that sales will likely be made up in February.

New-vehicle sales are expected to improve 1.6 percent year-over-year in January to a total of 1.06 million units, and an estimated 15.9 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book. ... At 15.9 million, this would be the highest recorded January SAAR since 2007, when it was 16.4 million. ...From J.D. Power: Strong January New-Vehicle Sales Produce Sunny Forecast for Auto Industry

"January is typically the weakest sales month of the year as many consumers take advantage of holiday deals in December. However, winter storms also could impact new-vehicle sales this month, as much of the country deals with historically cold weather and snowstorms," said Alec Gutierrez, senior analyst for Kelley Blue Book. "Early estimates indicate fleet sales will be down as well."

New-vehicle sales for January 2014 are expected to rise 3%, according to a sales forecast jointly issued by the Power Information Network (PIN) from J.D. Power and LMC Automotive. According to the forecast, consumers are expected to purchase 847,000 new vehicles in January 2014, meaning that dealerships would move more metal than in any January since 2004.It appears sales in January were OK even with the cold weather (January is usually the weakest month of the year, so there is a large seasonal adjustment).

A Comment on the Pending Home Sales Index

by Calculated Risk on 1/30/2014 12:09:00 PM

From the NAR: December Pending Home Sales Fall

The Pending Home Sales Index, a forward-looking indicator based on contract signings, fell 8.7 percent to 92.4 in December from a downwardly revised 101.2 in November, and is 8.8 percent below December 2012 when it was 101.3. The data reflect contracts but not closings, and are at the lowest level since October 2011, when the index was 92.2.A few comments:

Lawrence Yun, NAR chief economist, said several factors are working against buyers. “Unusually disruptive weather across large stretches of the country in December forced people indoors and prevented some buyers from looking at homes or making offers,” he said. “Home prices rising faster than income is also giving pause to some potential buyers, while at the same time a lack of inventory means insufficient choice. Although it could take several months for us to get a clearer read on market momentum, job growth and pent-up demand are positive factors.”

...

The PHSI in the Northeast dropped 10.3 percent to 74.1 in December, and is 5.5 percent below a year ago. In the Midwest the index declined 6.8 percent to 93.6 in December, and is 6.9 percent lower than December 2012. Pending home sales in the South fell 8.8 percent to an index of 104.9 in December, and are 6.9 percent below a year ago. The index in the West, which is most impacted by constrained inventory, dropped 9.8 percent in December to 85.7, and is 16.0 percent below December 2012.

Total existing-home sales this year should hold close to 5.1 million, essentially the same as 2013, but inventory remains limited in much of the country.

emphasis added

• Mr. Yun blamed some of the decline on the weather (the weather was unusually bad in December), but the index was down sharply in the South too (probably not weather), and in the West (partially related to low inventories).

• My view is there were several reasons for the decline in this index: weather in some areas, fewer distressed sales, less investor buying, fewer "pending" short sales, and low inventories. I think fewer distressed sales, fewer "pending" short sales, and less investor buying are all signs of a healthier market - even if overall sales decline.

• Mr Yun is forecasting 5.1 million existing home sales in 2014, about the same as in 2013. I'll take the under on that forecast, and I think it would be a positive sign if sales were under 5 million in 2014 as long as distressed sales continue to decline and conventional sales increase.

• Of course, for housing, what really matters for the economy and employment is new home sales (not existing), and housing starts.

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

Q4 GDP: Solid Report, Positives Looking Forward

by Calculated Risk on 1/30/2014 09:34:00 AM

The advance Q4 GDP report, with 3.2% annualized growth, was slightly above expectations. Personal consumption expenditures (PCE) increased at a 3.3% annualized rate - a solid pace.

However the Federal Government subtracted 0.98 percentage points from growth in Q4, and residential investment subtracted 0.32 percentage points. Imagine no Federal austerity - Q4 GDP would have been above 4%. Luckily it appears austerity at the Federal level will diminish in 2014, and of course I expect that residential investment will make a solid contribution this year.

Change in private inventories made another positive contributions in Q4 (added 0.42 percentage points). I expect inventories will probably be a drag in 2014.

On a Q4-over-Q4 basis, real GDP increased 2.7% (above the Fed's December projections of 2.2% to 2.3%). On an annual basis, real GDP increased 1.9%. Note: See GDP: Annual and Q4-over-Q4 for the difference in calculations.

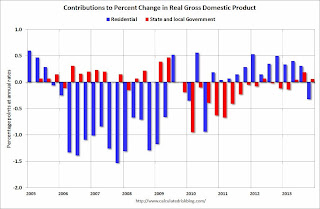

The first graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The drag from state and local governments appears to have ended after an

unprecedented period of state and local austerity (not seen since the

Depression). State and local governments have added to GDP for three consecutive

quarters now.

I expect state and local governments to continue to make small positive contributions to GDP going forward.

The blue bars are for residential investment (RI). RI added to GDP growth for 12 consecutive quarters, before subtracting in Q4. However since RI is still very low, I expect RI to make a solid positive contribution to GDP in 2014.

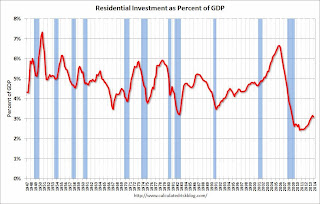

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.

Residential Investment as a percent of GDP has bottomed, but it still below the levels of previous recessions.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

The third graph shows non-residential investment in structures, equipment and "intellectual property products".

I'll add details for investment in offices, malls and hotels next week.

Overall this was a solid report, and there are several positives going forward: RI should make a positive contribution in 2014, the drag from the Federal Government should diminish, state and local governments should make a small positive contribution again this year, and investment in equipment and software and non-residential structures should also be positive in 2014.

Q4 GDP 3.2%, Weekly Initial Unemployment Claims increase to 348,000

by Calculated Risk on 1/30/2014 08:36:00 AM

I'll have more on GDP soon. From the BEA: Gross Domestic Product, 4th quarter and annual 2013 (advance estimate)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 3.2 percent in the fourth quarter of 2013 (that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.The DOL reports:

...

The increase in real GDP in the fourth quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, nonresidential fixed investment, private inventory investment, and state and local government spending that were partly offset by negative contributions from federal government spending and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased.

In the week ending January 25, the advance figure for seasonally adjusted initial claims was 348,000, an increase of 19,000 from the previous week's revised figure of 329,000. The 4-week moving average was 333,000, an increase of 750 from the previous week's revised average of 332,250.The previous week was revised up from 326,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 333,000.

This was the above the consensus forecast of 327,000.

Wednesday, January 29, 2014

Thursday: Q4 GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 1/29/2014 08:36:00 PM

It is likely that the Fed will change their forward guidance soon since the unemployment rate is approaching 6.5%. The Fed has been clear that 6.5% is not a trigger, but the wording will have to change soon.

It is very possible that there will be more emphasis on inflation as Cardiff Garcia at the FT Alphaville discusses The Fed’s converging misses on inflation and unemployment

[L]ooking ahead, there are at least two reasons why the Yellen Fed might soon consider, or at least should consider, downplaying the unemployment rate threshold in its forward guidance in favour of a greater emphasis on inflation.Thursday:

The first, and more widely discussed, is that there remains uncertainty about what is causing the demographic-adjusted decline in the labour force participation rate, and therefore it’s also uncertain how reliably the unemployment rate is reflecting labour market health. ...

The second reason is partly a matter of simple mathematics. The unemployment rate, now at 6.7 per cent, has been falling quickly towards the Fed’s central tendency forecast of 5.2-5.8 per cent for the long-term rate, while the latest year-on-year readings for both core and headline inflation (1.1 and 0.9 per cent respectively) have remained well below the Fed’s explicit 2 per cent target — as they have for nearly two years.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 327 thousand from 326 thousand.

• Also at 8:30 AM, the Q4 GDP report. This is the advance estimate of Q4 GDP from the BEA. The consensus is that real GDP increased 3.0% annualized in Q4.

• At 10:00 AM ET, Pending Home Sales Index for December. The consensus is for a 0.5% decrease in the index.

Freddie Mac: Mortgage Serious Delinquency rate declined in December, Lowest since February 2009

by Calculated Risk on 1/29/2014 04:38:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in December to 2.39% from 2.43% in November. Freddie's rate is down from 3.25% in December 2012, and this is the lowest level since February 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for December on Friday.

Click on graph for larger image

Click on graph for larger image

Although this indicates progress, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen from 0.86 percentage points over the last year - and at that rate of improvement, the serious delinquency rate will not be below 1% until mid-to-late 2015.

Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of distressed sales for another 2+ years (mostly in judicial foreclosure states).

FOMC Statement: More Taper

by Calculated Risk on 1/29/2014 02:00:00 PM

Information received since the Federal Open Market Committee met in December indicates that growth in economic activity picked up in recent quarters. Labor market indicators were mixed but on balance showed further improvement. The unemployment rate declined but remains elevated. Household spending and business fixed investment advanced more quickly in recent months, while the recovery in the housing sector slowed somewhat. Fiscal policy is restraining economic growth, although the extent of restraint is diminishing. Inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate. The Committee sees the risks to the outlook for the economy and the labor market as having become more nearly balanced. The Committee recognizes that inflation persistently below its 2 percent objective could pose risks to economic performance, and it is monitoring inflation developments carefully for evidence that inflation will move back toward its objective over the medium term.

Taking into account the extent of federal fiscal retrenchment since the inception of its current asset purchase program, the Committee continues to see the improvement in economic activity and labor market conditions over that period as consistent with growing underlying strength in the broader economy. In light of the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions, the Committee decided to make a further measured reduction in the pace of its asset purchases. Beginning in February, the Committee will add to its holdings of agency mortgage-backed securities at a pace of $30 billion per month rather than $35 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $35 billion per month rather than $40 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee's sizable and still-increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.

The Committee will closely monitor incoming information on economic and financial developments in coming months and will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. If incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings. However, asset purchases are not on a preset course, and the Committee's decisions about their pace will remain contingent on the Committee's outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. The Committee also reaffirmed its expectation that the current exceptionally low target range for the federal funds rate of 0 to 1/4 percent will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Richard W. Fisher; Narayana Kocherlakota; Sandra Pianalto; Charles I. Plosser; Jerome H. Powell; Jeremy C. Stein; Daniel K. Tarullo; and Janet L. Yellen.

emphasis added

CoreLogic: Completed Foreclosures Down 24% in 2013

by Calculated Risk on 1/29/2014 09:52:00 AM

From CoreLogic: The foreclosure inventory fell 31 percent nationally in 2013

CoreLogic® ... today released its December National Foreclosure Report, which provides data on completed U.S. foreclosures and the national foreclosure inventory. According to CoreLogic, there were 620,111 completed foreclosures across the country in 2013 compared to 820,498 in 2012, a decrease of 24 percent. For the month of December, there were 45,000 completed foreclosures, down from 52,000 in December 2012, a year-over-year decrease of 14 percent. On a month-over-month basis, completed foreclosures decreased 4.1 percent, from 47,000 reported in November 2013.

Completed foreclosures are an indication of the total number of homes actually lost to foreclosure. Since the financial crisis began in September 2008, there have been approximately 4.8 million completed foreclosures across the country. As a basis of comparison, prior to the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month nationwide between 2000 and 2006.

As of December 2013, approximately 837,000 homes in the United States were in some stage of foreclosure, known as the foreclosure inventory, compared to 1.2 million in December 2012, a year-over-year decrease of 31 percent. The foreclosure inventory as of December 2013 represented 2.1 percent of all homes with a mortgage compared to 3.0 percent in December 2012. The foreclosure inventory was down 2.7 percent from November 2013 to December 2013.

“The foreclosure inventory fell by more than 30 percent in December on a year-over-year basis, twice the decline from a year ago,” said Mark Fleming, chief economist for CoreLogic. “The decline indicates that the distressed foreclosure inventory is healing at an accelerating rate heading into 2014.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic shows the foreclosure inventory by state (Foreclosure inventory are properties in the foreclosure process). The foreclosure inventory is still high in some judicial foreclosure states. From CoreLogic:

The five states with the highest foreclosure inventory as a percentage of all mortgaged homes were Florida (6.7 percent), New Jersey (6.5 percent), New York (4.9 percent), Connecticut (3.6 percent) and Maine (3.6 percent).

MBA: Mortgage Purchase Applications Increase Slightly

by Calculated Risk on 1/29/2014 07:01:00 AM

From the MBA: Mortgage Applications Essentially Flat in Latest MBA Weekly Survey

Mortgage applications decreased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 24, 2014. The results include an adjustment to account for the Martin Luther King, Jr. holiday. ...

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.52 percent, the lowest rate since the week ending November 29, 2013, from 4.57 percent, with points increasing to 0.40 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 68% from the levels in early May.

With the mortgage rate increases, refinance activity will be significantly lower in 2014 than in 2013.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index is now down about 12% from a year ago.

The purchase index is probably understating purchase activity because small lenders tend to focus on purchases, and those small lenders are underrepresented in the purchase index.

Tuesday, January 28, 2014

Wednesday: Fed Day

by Calculated Risk on 1/28/2014 08:42:00 PM

I expect the FOMC to announce additional tapering on Wednesday. Merrill Lynch economists think the Fed will change their forward guidance soon, but probably not at this meeting:

The market widely expects the Fed to continue to taper by US$10bn at its January meeting, and we do not expect it to disappoint. This action would bring its purchase pace to US$65bn per month (US$35bn Treasuries and US$30bn MBS). Less clear is what the Fed intends to do with its forward guidance, particularly the 6.5% unemployment threshold. As the unemployment rate has been falling for largely the "wrong" reasons, we anticipate the FOMC will drop this threshold altogether, in favor of vaguer but more robust qualitative guidance on the broad labor market conditions that would warrant a rate hike. This change likely will be made at one of the next few meetings - possibly this week. More troublesome for the Fed is the persistently low inflation rate; we expect some strengthening of guidance to suggest that the FOMC will not hike rates until inflation is much closer to the Fed's longer-run 2% target. However, that language change may be more likely later this year.Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, the FOMC Meeting Announcement will be released. No change in interest rates is expected (for a long time). However the FOMC is expected to reduce QE3 asset purchases by $10 billion per month at this meeting.