by Calculated Risk on 1/13/2014 04:07:00 PM

Monday, January 13, 2014

Weekly Update: Housing Tracker Existing Home Inventory up 2.0% year-over-year on Jan 13th

Here is another weekly update on housing inventory ... for the thirteenth consecutive week, housing inventory is up year-over-year. This suggests inventory bottomed early in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for November). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 2.0% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low - and barely up year-over-year - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (this would still be a little below normal).

Treasury: $53 Billion Budget Surplus in December

by Calculated Risk on 1/13/2014 03:36:00 PM

From the WSJ: U.S. Posts December Budget Surplus of $53.22 Billion

Revenues outpaced spending by $53.22 billion in December, the first surplus for the month since the 2007 fiscal year and the biggest on record. Economists surveyed by Dow Jones had forecast a $44.5 billion surplus.Here is the Monthly Treasury Statement for December.

...

The U.S. government's deficit for October through December totaled $173.60 billion, down 41% from the $293.30 billion shortfall during the same period a year earlier, the Treasury Department said Monday in its monthly report. The 2014 fiscal year started on Oct. 1.

In December 2012 the deficit was $1.2 billion. Taxes were raised in January 2013, so the comparison next month will show how much of the improvement is related to taxes - and how much due to an improving economy. The deficit has declined very quickly over the last few years - and is no longer a short term issue.

Update: The California Budget Surplus

by Calculated Risk on 1/13/2014 10:33:00 AM

In November 2012, I was interviewed by Joe Weisenthal at Business Insider. One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”At the time that was way out of the consensus view. And a couple of months later California announced a balanced budget, see The California Budget Surplus

The situation has improved since then. Here is the most recent update from California State Controller John Chiang: Controller Releases December Cash Update

State Controller John Chiang today released his monthly report covering California's cash balance, receipts and disbursements in December 2013. Revenues for the month totaled $10.6 billion, surpassing estimates in the state budget by $2.3 billion, or 27.7 percent.This is just one state, but I expect local and state governments (in the aggregate) to add to both GDP and employment in 2014.

Total revenues for the fiscal year-to-date were $2.5 billion ahead (6.4 percent) of budget estimates.

"Revenues for the first half of the fiscal year are well ahead of estimates and reflect a surging economy fueled by a boom in technology, rising exports, improving consumer confidence, and a new housing upswing," said Chiang.

emphasis added

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in December

by Calculated Risk on 1/13/2014 09:21:00 AM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in December.

From CR: This is just a few markets - more to come over the next week - but total "distressed" share is down significantly, mostly because of a decline in short sales.

And foreclosures are down in all of these areas too.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back in markets the share of all cash buyers will probably decline.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Dec-13 | Dec-12 | Dec-13 | Dec-12 | Dec-13 | Dec-12 | Dec-13 | Dec-12 | |

| Las Vegas | 20.7% | 45.8% | 8.5% | 9.5% | 29.2% | 55.3% | 44.4% | 55.2% |

| Reno | 24.0% | 47.0% | 4.0% | 10.0% | 28.0% | 57.0% | ||

| Phoenix | 9.5% | 27.2% | 7.5% | 12.2% | 17.1% | 39.4% | ||

| Mid-Atlantic | 8.0% | 13.0% | 9.3% | 9.7% | 17.3% | 22.7% | 19.3% | 20.3% |

| Toledo | 36.5% | 41.6% | ||||||

| Tucson | 32.3% | 33.1% | ||||||

| Omaha | 23.9% | 20.6% | ||||||

| Memphis* | 21.0% | 25.6% | ||||||

| *share of existing home sales, based on property records | ||||||||

Sunday, January 12, 2014

Sunday Night Futures

by Calculated Risk on 1/12/2014 08:16:00 PM

From the WSJ: Why Business Investment Could Break Out

One gauge of business investment—new orders of nondefense capital goods, excluding aircraft—grew 4.1% in November, the biggest jump in nearly a year, after shrinking for two months. A broader measure of business spending that includes buildings and software grew at an annualized pace of 4.8% in the third quarter of 2013 and 4.7% in the second, after declining 4.6% in the first quarter.When demand picks up, companies invest ...

Economists now expect business spending to keep accelerating. ... Several things are pushing economists' forecasts for business spending higher. For one, businesses often follow consumers when it comes to spending, not the other way around. When the economy began growing again after the 2007-2009 recession, spending on equipment shot up—but then flagged when it became clear, by 2011, that the recovery had stalled. If the economic recovery now shifts into higher gear, businesses will expand capacity to meet demand.

Monday:

• At 2:00 PM ET, the Monthly Treasury Budget Statement for December. The CBO estimates that the Treasury ran a surplus of $44 billion in December.

Weekend:

• Schedule for Week of January 12th

• Update: When will payroll employment exceed the pre-recession peak?

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW futures are unchanged (fair value).

Oil prices are mostly unchanged with WTI futures at $92.80 per barrel and Brent at $107.49 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.30 per gallon (about the same as a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 1/12/2014 11:51:00 AM

Friday on the employment report:

• December Employment Report: 74,000 Jobs, 6.7% Unemployment Rate

• Comments on the Disappointing Employment Report

A few more employment graphs by request ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is at 2.5% of the labor force - the lowest since April 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

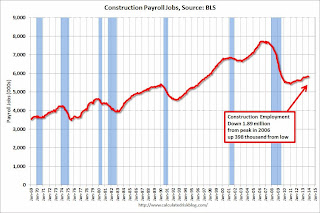

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 398 thousand.

According to the BLS, construction employment declined in December (probably due to weather). Historically there is a lag between an increase in activity and more hiring - and it appears hiring should pickup significant in 2014.

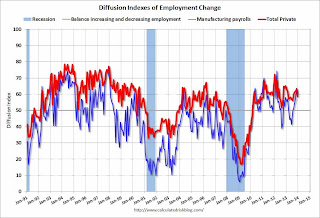

The BLS diffusion index for total private employment was at 58.8 in December, down from 63.2 in November.

The BLS diffusion index for total private employment was at 58.8 in December, down from 63.2 in November.For manufacturing, the diffusion index increased to 60.5, down from 63.6 in November.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was still fairly widespread in December (a good sign even with fewer jobs added).

Saturday, January 11, 2014

Update: When will payroll employment exceed the pre-recession peak?

by Calculated Risk on 1/11/2014 05:13:00 PM

Just over two years ago I posted a graph with projections of when payroll employment would return to pre-recession levels (see: Sluggish Growth and Payroll Employment from November 2011).

In 2011, I argued we'd continue to see sluggish growth (back in 2011 many analysts were forecasting another US recession - those forecasts were wrong).

On the graph I posted two lines - one with payroll growth of 125,000 payroll jobs added per month (the pace in 2011), and another line with 200,000 payroll jobs per month. The following graph is an update with reported payroll growth through December 2013.

The dashed red line is 125,000 payroll jobs added per month. The dashed blue line is 200,000 payroll jobs per month. Both projections are from November 2011.

Click on graph for larger image.

Click on graph for larger image.

So far the economy has tracked just below the blue line (200,000 payroll jobs per month).

Right now it appears payrolls will exceed the pre-recession peak in mid-2014.

Currently there are about 1.18 million fewer payroll jobs than before the recession started, and at the expected pace of job growth in 2014 it will take about 6 months to reach the previous peak.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow). Also the annual benchmark revision will be released in February (with the January employment report), and the preliminary estimate is an upward revision of 345,000 jobs - HOWEVER the increase is due to a classification change, and the actual impact will probably be negative.

Note: There are 640 thousand fewer private sector payroll jobs than before the recession started. At the expected pace of private sector job growth, the private sector could be back at the pre-recession peak in March 2014.

Schedule for Week of January 12th

by Calculated Risk on 1/11/2014 11:18:00 AM

The key reports this week are retail sales and housing starts for December.

For manufacturing, Industrial Production for December, and the NY Fed (Empire State), and Philly Fed January surveys will be released this week.

For prices, CPI will be released on Thursday.

2:00 PM ET: the Monthly Treasury Budget Statement for December. The CBO estimates that the Treasury ran a surplus of $44 billion in December.

7:30 AM ET: NFIB Small Business Optimism Index for December.

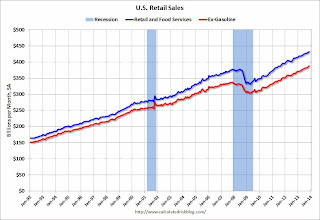

8:30 AM ET: Retail sales for December will be released.

8:30 AM ET: Retail sales for December will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales increased 0.7% from October to November (seasonally adjusted), and sales were up 4.7% from November 2012.

The consensus is for retail sales to be unchanged in December, and to increase 0.4% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.3% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index for the previous two weeks.

8:30 AM: Producer Price Index for December. The consensus is for a 0.4% increase in producer prices (and 0.1% increase in core PPI).

8:30 AM: NY Fed Empire Manufacturing Survey for January. The consensus is for a reading of 3.3, up from 1.0 in December (above zero is expansion).

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decline to 327 thousand from 330 thousand.

8:30 AM: Consumer Price Index for December. The consensus is for a 0.3% increase in CPI in December and for core CPI to increase 0.1%.

10:00 AM: the Philly Fed manufacturing survey for January. The consensus is for a reading of 8.7, up from 7.0 last month (above zero indicates expansion).

10:00 AM ET: The January NAHB homebuilder survey. The consensus is for a reading of 57.5, down from 58.0 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. Total housing starts were at 1.09 million (SAAR) in November. Single family starts were at 727 thousand SAAR in November.

The consensus is for total housing starts to decrease to 985 thousand (SAAR) in December.

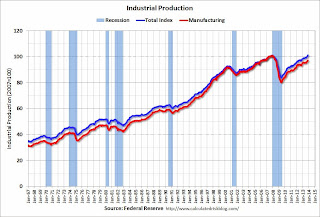

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.1%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 83.5, up from 82.5 in December.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in October to 3.925 million from 3.883 million in September. The number of job openings (yellow) is up 7.7% year-over-year compared to October 2012 and openings are at the highest level since early 2008.

Quits increase in October and are up about 14.7% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits"). This is the highest level for quits since 2008.

Friday, January 10, 2014

Unofficial Problem Bank list declines to 613 Institutions

by Calculated Risk on 1/10/2014 09:17:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for January 10, 2013.

Changes and comments from surferdude808:

A few removals this week and the strengthening of an enforcement action are the changes to the Unofficial Problem Bank List this week. In all, there were five removals that leave the list with 613 institutions with $203.0 billion of assets. A year ago, the list held 832 institutions with assets of $310.7 billion.

The OCC stepped up its enforcement action against Los Alamos National Bank, Los Alamos, NM ($1.5 billion) from a Formal Agreement to a Consent Order in December 2013. The bank has been operating under various corrective actions since 2010.

Actions were terminated against North Community Bank, Chicago, IL ($2.5 billion); Westbury Bank, West Bend, WI ($525 million); and Bank of Commerce, Chelsea, OK ($145 million). There are some official confirmations that Talmer Bancorp, Inc. has successfully acquired some banks controlled by Capitol Bancorp, Ltd. Based on these confirmations, we have removed Bank of Las Vegas, Henderson, NV ($224 million) and Sunrise Bank of Albuquerque, Albuquerque, NM ($42 million). Two banks controlled by Capitol Bancorp remain on the list as we wait for confirmation from the FDIC if there has been a change in ownership.

Next Friday, we anticipate the OCC will release its enforcement action activity through the middle of December 2013.

Lawler on Builder "supply-chain" Issues in 2013

by Calculated Risk on 1/10/2014 06:15:00 PM

From a piece on Meritage Homes by housing economist Tom Lawler:

Meritage over the last year has aggressively added to its land/lot positions over the last two years, and as of the end of September of 2013 Meritage owned or controlled 25,046 lots, up 40.4% from a year earlier and up about 56.5% from two years earlier. As was the case for many home builders last year, “supply-chain” issues increased lot-development timelines at Meritage in many areas of the country, resulting in slower-than-desired community openings and homes built (Supply issues, and not demand, was a major reason why SF housing starts last year fell short of consensus last year). Meritage (and many other builders) dealt with the increased demand and low supply by raising home prices in many areas sharply, resulting in the company’s highest margins since 2006.

Not surprisingly, the combination of increasing mortgage rates and sharply higher home prices led to a substantial slowdown in the pace of new home sales in second half of 2013, and as a result it appears as if builders have responded by “stabilizing” home prices.

As a group, large home builders are planning for a significant increase in housing production/home sales in 2014, and have increased significantly their land/lot positions in anticipation of higher sales/production. For example, lots owned or optioned by 13 large publicly-traded home builders near the end of last year (some as of 9/30, some as of 10/31, and some as of 11/30) were up 19.5% from a year earlier and up almost 30% from two years earlier. With margins as a whole very high and demand at current interest rate and price levels down, builders are unlikely to be able to raise prices much in 2014 after the “incredible” price hikes seen last year.

emphasis added

CR Note: At the beginning of last year, I wrote: "I've heard some builders might be land constrained in 2013 (not enough finished lots in the pipeline)." At Lawler notes, the builders have aggressively acquired land in 2013, and this "supply-chain" issue might be resolved. Less supply allowed the builders to raise prices aggressively in 2013, but that probably will not happen in 2014.