by Calculated Risk on 12/10/2013 10:00:00 AM

Tuesday, December 10, 2013

BLS: Job Openings "little changed" in October

From the BLS: Job Openings and Labor Turnover Summary

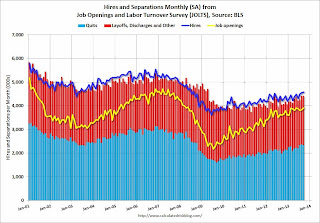

There were 3.9 million job openings on the last business day of October, little changed from September, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.3 percent) and separations rate (3.1 percent) were also little changed in October. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in October for total nonfarm and total private and was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in October to 3.925 million from 3.883 million in September. The number of job openings (yellow) is up 7.7% year-over-year compared to October 2012 and openings are at the highest level since early 2008.

Quits increase in October and are up about 14.7% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits"). This is the highest level for quits since 2008.

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings and quits (voluntary separations) are both at the highest level since 2008.

NFIB: Small Business Optimism Index increases in November

by Calculated Risk on 12/10/2013 08:50:00 AM

From the National Federation of Independent Business (NFIB): Small Businesses Optimism Up Slightly

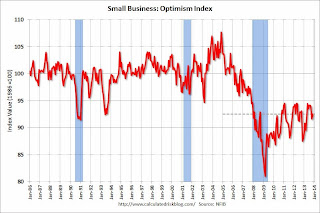

Owner sentiment increased by 0.9 points to 92.5 ... Over half of the improvement was accounted for by the labor market components which is certainly good news, lifting them closer to normal levels.

Fifty-one percent of the owners hired or tried to hire in the last three months and 44 percent reported few or no qualified applicants for open positions. This is the highest level of hiring activity since October 2007.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 92.5 in November from 91.6 in October.

Another positive: During the recession, the single most important problem was "poor sales". The percentage of owners naming "poor sales" has fallen significantly, and small business owners are once again complaining about taxes and government - this is what they complain about in good times!

Monday, December 09, 2013

Tuesday: Small Business Survey, Job Openings

by Calculated Risk on 12/09/2013 08:56:00 PM

The FHFA will charge higher fees in certain states (slow judicial foreclosure states). From Nick Timiraos at the WSJ: Fannie, Freddie to Raise Loan Fees

Mortgage-finance giants Fannie Mae and Freddie Mac will boost certain fees that they charge lenders ... The firms’ federal regulator, the Federal Housing Finance Agency, said Monday it would direct the companies to increase by 0.1 percentage points the so-called “guarantee” fees that the companies charge to lenders. Those fees have nearly doubled since 2009.It is clearly appropriate to charge higher fees in states with higher costs. Maybe there will be a move towards a national foreclosure law ...

But the latest increase will be muted in most states because the FHFA also said that it would direct the companies to eliminate separate fees that had been implemented in the aftermath of the financial crisis. ...

The upshot is that borrowing costs could rise slightly in the four states—New York, Florida, New Jersey and Connecticut—where the latest fee increases won’t be offset by the removal of the crisis-era fees.

Tuesday:

• 7:30 AM ET, NFIB Small Business Optimism Index for November.

• 10:00 AM, Job Openings and Labor Turnover Survey for October from the BLS. Jobs openings increased in September to 3.913 million from 3.844 million in August. This is a survey closely followed by the Fed.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.4% increase in inventories.

Weekly Update: Housing Tracker Existing Home Inventory up 1.8% year-over-year on Dec 9th

by Calculated Risk on 12/09/2013 04:32:00 PM

Here is another weekly update on housing inventory ... for the eight consecutive week, housing inventory is up year-over-year. This suggests inventory bottomed early in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for October). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is now 1.8% above the same week in 2012 (red is 2013, blue is 2012).

We can be pretty confident that inventory bottomed early this year. Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? I'll post some thoughts on inventory at the end of the year.

Fed's Q3 Flow of Funds: Household Mortgage Debt increased slightly, First Mortgage Debt increase since Q1 2008

by Calculated Risk on 12/09/2013 12:00:00 PM

The Federal Reserve released the Q3 2013 Flow of Funds report today: Flow of Funds.

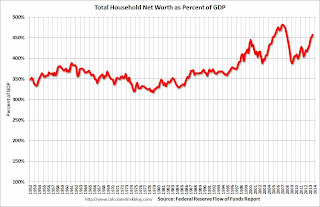

According to the Fed, household net worth increased in Q3 compared to Q2, and is at a new record. Net worth peaked at $69.1 trillion in Q3 2007, and then net worth fell to $55.7 trillion in Q1 2009 (a loss of $13.4 trillion). Household net worth was at $77.3 trillion in Q3 2013 (up $21.6 trillion from the trough in Q1 2009).

The Fed estimated that the value of household real estate increased to $19.0 trillion in Q3 2013. The value of household real estate is still $3.6 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.

This is the Households and Nonprofit net worth as a percent of GDP. Although household net worth is at a record high, as a percent of GDP it is still below the peaks in 2000 (stock bubble) and 2006 (housing bubble).

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles. The ratio has been trending up and increased again in Q3 with both stock and real estate prices increasing.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2013, household percent equity (of household real estate) was at 50.7% - up from Q2, and the highest since Q2 2007. This was because of both an increase in house prices in Q3 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 50.7% equity - and millions have negative equity.

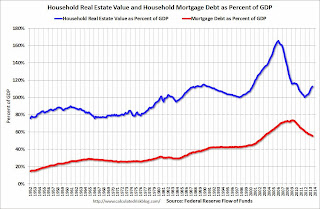

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt increased by $10.0 billion in Q3. (Still declined as percent of GDP). This is the first increase in mortgage debt since Q1 2008.

Mortgage debt has now declined by $1.32 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q3 (as house prices increased), but still close to the average of the last 30 years (excluding bubble). However household mortgage debt, as a percent of GDP, is still historically high, suggesting a little more deleveraging ahead for certain households.

Update on "Small Ball" Budget Agreement

by Calculated Risk on 12/09/2013 09:27:00 AM

An agreement should be reached this week ...

From Ezra Klein and Evan Soltas at the WaPo: Wonkbook: The ‘Grand Bargain’ is over

The budget deal Patty Murray and Paul Ryan are crafting isn't a "grand bargain." ... But the deal does lift about a third of sequestration's cuts while giving agencies more flexibility to deal with the rest. It does mean the 2014 budget is the work of human hands rather than automatic cuts. It might be a vehicle for Capitol Hill to extend expiring unemployment benefits. And it would be a small but real boost to the economy.Reducing the sequester budget cuts is good policy. And it would be good economics (and good overall policy) to extend the emergency unemployment benefits too - but it isn't clear if that will happen.

Joel Prakken of Macroeconomic Advisors says the deal "would be a modest boost to GDP growth (relative to sequester). Maybe 1/4 percentage point." Moody's Mark Zandi adds in the possibility of extending unemployment insurance and estimates that "the lift to GDP next year compared to current law is .4. Small, but it matters."

Sunday, December 08, 2013

Sunday Night Futures: Taper Talk and "Small Ball" Budget Agreement

by Calculated Risk on 12/08/2013 08:44:00 PM

This will be a light week for economic data, but there will be plenty of discussion about when the Fed will start to taper QE3 asset purchases. From Binyamin Appelbaum at the NY Times: Fed’s Plan to Taper Stimulus Effort Not Expected Until Next Year

Federal Reserve officials are in no hurry to retreat from their bond-buying campaign to stimulate the economy and are likely to postpone any cuts to the program until next year, according to public statements by Fed officials and interviews with some of them.I still think there is a chance that the taper will start in December, but the consensus seems to be early in 2014 (either at the January or March meeting).

...

[I]nfluential Fed officials see little harm in postponing the decision, particularly compared with the risks of pulling back too soon. Significant details of the eventual retreat also remain the subjects of unresolved debates, according to the public statements and interviews. And some officials argue that the slow pace of inflation is itself a reason for the Fed to maintain its stimulus campaign.

Another key event this week will be the expected "small ball" budget agreement on Friday. From Lori Montgomery at the WaPo: Budget deal expected this week amounts to a cease-fire as sides move to avert a standoff

House and Senate negotiators were putting the finishing touches Sunday on what would be the first successful budget accord since 2011 ...Cutting back the sequester is good economic policy, and we don't need more austerity right now ... so this agreement will be a positive for the economy.

Senior aides familiar with the talks say the emerging agreement aims to partially repeal the sequester and raise agency spending to roughly $1.015 trillion in fiscal 2014 and 2015. That would bring agency budgets up to the target already in place for fiscal 2016. To cover the cost, Ryan and Murray are haggling over roughly $65 billion in alternative policies, including cuts to federal worker pensions and higher security fees for the nation’s airline passengers.

Weekend:

• Schedule for Week of December 8th

• Update: Four Charts to Track Timing for QE3 Tapering

The Nikkei is up about 1.8%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 2 and DOW futures are up 20 (fair value).

Oil prices are up with WTI futures at $97.76 per barrel and Brent at $111.58 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.24 per gallon. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 12/08/2013 03:31:00 PM

Friday on the employment report:

• November Employment Report: 203,000 Jobs, 7.0% Unemployment Rate

• Employment Report: Decent Report, Solid Seasonal Retail Hiring

A few more employment graphs by request ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is at 2.6% of the labor force - the lowest since May 2009 - however the number (and percent) of long term unemployed remains a serious problem.

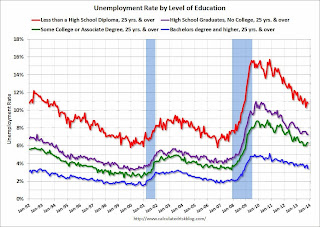

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment!

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 416 thousand. According to the BLS, essentially no construction jobs have been over the last five months. Historically there is a lag between an increase in activity and more hiring - and it appears hiring should pickup significant in 2014.

The BLS diffusion index for total private employment was at 63.5 in November, up from 61.1 in October.

The BLS diffusion index for total private employment was at 63.5 in November, up from 61.1 in October.For manufacturing, the diffusion index increased to 63.0, up from 56.8 in October.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was widespread in November (a good sign).

Update: Four Charts to Track Timing for QE3 Tapering

by Calculated Risk on 12/08/2013 09:55:00 AM

Here is an update of the four charts I'm using to track when the Fed will start tapering QE3 purchases.

In general the year-end data might be "broadly consistent" with the June (and September) FOMC projections.

However I suspect the FOMC is very concerned about the low level of inflation, and also the decline in the employment participation rate.

The December FOMC meeting is on the 17th and 18th. Note: Another key is that a budget agreement is reached by December 13th.

Click on graph for larger image.

Click on graph for larger image.

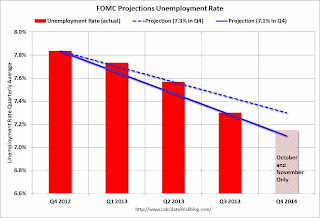

The first graph is for the unemployment rate.

The current forecast is for the unemployment rate to decline to 7.1% to 7.3% in Q4 2013.

We only have data through November, but it is pretty clear that the unemployment rate is tracking the FOMC forecast (lower is better).

However, in July, Bernanke said that the unemployment rate "probably understates the weakness of the labor market." He suggested he is watching other employment indicators too, and I suspect the FOMC will also discuss the decline in the participation rate.

The second graph is for GDP.

The second graph is for GDP.

The current forecast is for GDP to increase between 2.0% and 2.3% (the FOMC revised down their forecast from 2.3% and 2.6% in June). This is the increase in GDP from Q4 2012 to Q4 2013.

Currently GDP is tracking the FOMC forecasts, and real GDP only has to increase 0.8% annualized in Q4 to reach the lower forecast. Even with a negative contribution from inventories in Q4, it appears GDP will meet the lower forecast.

The third graph is for PCE prices.

The current forecast is for prices to increase 1.1% to 1.2% from Q4 2012 to Q4 2013. This was revised up from 0.8% to 1.2% in June.

The current forecast is for prices to increase 1.1% to 1.2% from Q4 2012 to Q4 2013. This was revised up from 0.8% to 1.2% in June.

We only have data through October, but so far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

The fourth graph is for core PCE prices

The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

Through October core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%.

Saturday, December 07, 2013

Schedule for Week of December 8th

by Calculated Risk on 12/07/2013 01:11:00 PM

This will be a light week for economic data.

The key report this week will be retail sales for November.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

7:30 AM ET: NFIB Small Business Optimism Index for November.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in September to 3.913 million from 3.844 million in August. The number of job openings (yellow) is up 8.6% year-over-year compared to September 2012 and openings are at the highest level since early 2008.

Quits were mostly unchanged in September and are up about 18% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.4% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 325 thousand from 298 thousand last week.

8:30 AM ET: Retail sales for November will be released.

8:30 AM ET: Retail sales for November will be released.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 29.1% from the bottom, and now 13.2% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to be 0.6% in November, and to increase 0.3% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for October. The consensus is for a 0.3% increase in inventories.

8:30 AM: Producer Price Index for November. The consensus is for a 0.1% decrease in producer prices (and 0.1% increase in core PPI).