by Calculated Risk on 11/29/2013 03:24:00 PM

Friday, November 29, 2013

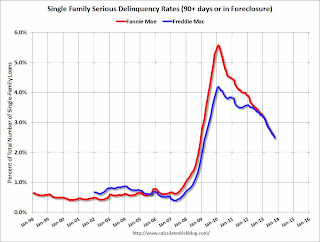

Fannie Mae: Mortgage Serious Delinquency rate declined in October, Lowest since December 2008

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in October to 2.48% from 2.55% in September. The serious delinquency rate is down from 3.35% in October 2012, and this is the lowest level since December 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier this week, Freddie Mac reported that the Single-Family serious delinquency rate declined in October to 2.48% from 2.58% in September. Freddie's rate is down from 3.31% in October 2012, and this is the lowest level since March 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.87 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in less than 2 years. Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

Europe: Euro Zone Unemployment Rate dips slightly

by Calculated Risk on 11/29/2013 01:37:00 PM

From the NY Times: Euro Zone Inflation Rises to 0.9% as Jobless Rate Dips to 12.1%

Unemployment in the 17 countries of the euro zone dropped to 12.1 percent in October from 12.2 percent the previous month, according to official figures. While that was certainly decent news for the 61,000 fewer people who are jobless, unemployment remains near a record high.Here is the unemployment data from Eurostat:

At the same time, inflation in the euro zone rose to 0.9 percent in November from a year earlier, up from 0.7 percent in October, according to Eurostat, the European Union’s statistics office. The inflation rate is still well below the European Central Bank’s target rate of below but close to 2 percent, and short of the level required to convince many economists that the euro zone is safe from deflation, a persistent and broad decline of prices that is a typical feature of economic depression.

Eurostat estimates that 26.654 million men and women in the EU-28, of whom 19.298 million were in the euro area (EA-17), were unemployed in October 2013. Compared with September 2013, the number of persons unemployed decreased by 75 000 in the EU-28 and by 61 000 in the euro area. Compared with October 2012, unemployment rose by 512 000 in the EU-28 and by 615 000 in the euro area.This was the first decline in the unemployment rate since 2011, but the situation is still very grim, especially in Greece (27.3%) and Spain (26.7%).

The euro area seasonally-adjusted unemployment rate was 12.1% in October 2013, down from 12.2% in September; it was 11.7% in October 2012. The EU-28 unemployment rate was 10.9 % in October 2013, stable compared with September; it was 10.7 % in October 2012.

Budget Negotiations Update: Playing "Small Ball"

by Calculated Risk on 11/29/2013 10:41:00 AM

From the WSJ: Narrow Budget Agreement Comes Into View

Negotiators in Congress are moving toward a narrow agreement on this year's federal budget that ... modestly reduce the roughly $100 billion in across-the-board spending cuts, known as sequestration, that will hit in January.The budget conference committee is scheduled to present any agreement on December 13th, and then vote on the spending bill by January 15th. It appears a "small ball" agreement is likely.

...

To replace the sequester cuts, officials close to the talks said, lawmakers are looking at increasing airport-security fees, cutting costs in federal-employee retirement programs and drawing on revenue from the auction of broadband spectrum. Democrats also want to count savings from program changes in a farm bill, which is being negotiated in a separate process, to offset sequester cuts, but Republicans say those savings should go to general deficit reduction.

Thursday, November 28, 2013

Philly Fed: State Coincident Indexes increased in 44 states in October

by Calculated Risk on 11/28/2013 08:14:00 PM

This was released this week by the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for October 2013. In the past month, the indexes increased in 44 states, decreased in four states, and remained stable in two, for a one-month diffusion index of 80. Over the past three months, the indexes increased in 45 states and decreased in five, for a three-month diffusion index of 80.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In October, 45 states had increasing activity(including minor increases). This measure has been and up down over the last few years ...

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.There are a few states with three month declining activity, but most of the map is green.

Irwin: "Five economic trends to be thankful for"

by Calculated Risk on 11/28/2013 10:47:00 AM

From Neil Irwin at the WaPo looked for a few positives again this year: Five economic trends to be thankful for. Some excerpts a few comments:

1) Falling gasoline prices. ... The average national price of a gallon of gas has fallen from $3.67 in July to $3.29 as of Tuesday, a 10 percent drop in Americans' fuel costs.CR Note: This is a trend we've been falling. See this graph from gasbuddy.com.

2) Fewer layoffs. The job market isn't great overall, with unemployment still high. But one key measure of the labor market has shown major progress in 2013. The number of people filing new claims for unemployment insurance benefits was a mere 316,000 last week, and over the last four weeks has averaged 332,000. That's below the 340,000 of December 2007, the month the recession began, and far, far below the high of 670,000 the last week of March 2009.CR Note: Here is a graph of initial weekly unemployment claims.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 331,750.

Some of the recent volatility in weekly claims was due to processing problems in California (now resolved).

The level of weekly claims suggests an improving labor market.

3) Home prices are rising. ... In the year that ended in September, prices rose 13.3 percent in 20 major metro areas, according to the S&P/Case-Shiller home price index. This translates into higher wealth levels among Americans, leaving them the confidence to spend more money. And it that fewer people are underwater on their mortgages, or owing more than their homes are worth.CR Note: This has been a real positive for homeowners - but a negative for potential home buyers.

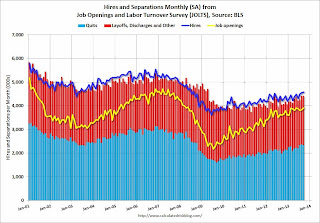

4) More job openings. Hiring has been slow to rebound, but employers are increasingly reporting that they have jobs open. There were 3.91 million job openings in September, the Labor Department said in its Job Openings and Labor Turnover Survey. That was the highest since May 2008 and returns the number of jobs available to early 2005 levels (though the population was smaller then). The story through this slow, halting jobs recovery has been about employers failing to hire; this data suggest things are starting to thaw.

CR Note: Here is a graph of the data Irwin is mentioning on job openings.

CR Note: Here is a graph of the data Irwin is mentioning on job openings. Jobs openings increased in September to 3.913 million from 3.844 million in August. The number of job openings (yellow) is up 8.6% year-over-year compared to September 2012 and openings are at the highest level since early 2008.

Also Quits were mostly unchanged in September and are up about 18% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

5) Debt burdens keep on falling. The ratio of Americans' income going to meet debt obligations has plummeted in recent years, as consumers have both reduced debt burdens (by paying them down and in some cases defaulting) and benefited from lower interest rates. The debt service ratio was only 9.89 percent in the second quarter, hovering near an all-time low of 9.84 percent from late 2012 (the data go back to 1980). That ratio was 13.5 percent in the third quarter of 2007, before the crisis.

CR Note: This graph based on data from the Fed shows the debt service ratio (DSR) for both renters and homeowners (red), and the homeowner financial obligations ratio for mortgages (blue) and consumer debt (yellow).

CR Note: This graph based on data from the Fed shows the debt service ratio (DSR) for both renters and homeowners (red), and the homeowner financial obligations ratio for mortgages (blue) and consumer debt (yellow).The overall Debt Service Ratio is just above the record low set in Q4 2012 thanks to very low interest rates. The homeowner's financial obligation ratio for consumer debt is back to levels last seen in early 1995.

Also the homeowner's financial obligation ratio for mortgages (blue) is at a new record low. This ratio increased rapidly during the housing bubble, and continued to increase until 2008. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined to an all time low.

Happy Thanksgiving!

Wednesday, November 27, 2013

Zillow: Case-Shiller House Price Index expected to show 13.9% year-over-year increase in October

by Calculated Risk on 11/27/2013 06:08:00 PM

The Case-Shiller house price indexes for September were released Tuesday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. It looks like another very strong month ...

From Zillow: Zillow Predicts October Case-Shiller Will Show Still More Inflated Appreciation

The Case-Shiller data for September came out [Tuesday], and based on this information and the October 2013 Zillow Home Value Index (ZHVI, released Nov. 26), we predict that next month’s Case-Shiller data (October 2013) will show that both the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased 13.9 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from August to September will be 1 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for October will not be released until Tuesday, Dec. 31.The following table shows the Zillow forecast for the October Case-Shiller index.

...

The Zillow Home Value index continues to show moderation in home value appreciation, with several of the largest metros showing month-over-month declines in October, as well as a fair amount of volatility in home value growth as the housing recovery continues. Case-Shiller indices have also shown slowdowns in monthly appreciation, but have not yet recorded monthly declines (at least not in their seasonally-adjusted monthly numbers). Even when the Case-Shiller indices do begin to show monthly depreciation in some areas, they will continue to show an inflated picture of home prices, especially when considering year-over-year growth. The Case-Shiller indices are biased toward the large, coastal metros currently seeing enormous home value gains, and they include foreclosure resales. The inclusion of foreclosure resales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed.

| Zillow October Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Oct 2012 | 158.66 | 156.72 | 146.03 | 144.26 |

| Case-Shiller (last month) | Sept 2013 | 180.03 | 176.19 | 165.66 | 162.19 |

| Zillow Forecast | YoY | 13.9% | 13.9% | 13.9% | 13.9% |

| MoM | 0.4% | 1.0% | 0.4% | 1.0% | |

| Zillow Forecasts1 | 180.7 | 178.2 | 166.3 | 164.1 | |

| Current Post Bubble Low | 146.45 | 149.62 | 134.07 | 136.87 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 23.4% | 19.1% | 24.1% | 19.9% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Freddie Mac: Mortgage Serious Delinquency rate declined in October, Lowest since March 2009

by Calculated Risk on 11/27/2013 03:01:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in October to 2.48% from 2.58% in September. Freddie's rate is down from 3.31% in October 2012, and this is the lowest level since March 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for October next week.

Click on graph for larger image

Click on graph for larger image

Although this indicates progress, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen from 3.31% in October 2013 - and at that rate of improvement, the serious delinquency rate will not be below 1% until mid-to-late 2015.

Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications. Therefore I expect an above normal level of distressed sales for 2+ years (mostly in judicial states).

Merrill Lynch: Economy "Out of Rehab"

by Calculated Risk on 11/27/2013 01:01:00 PM

Note: Ethan Harris and the Merrill Lynch team has done an excellent job of forecasting the U.S. economy. Here is their outlook for 2014, from Ethan Harris at Merrill Lynch: Out of rehab. A few excerpts:

As we have been arguing for more than a year, we think 2014 is the year when the economy finally exits rehab and starts growing at a healthy 3% (4Q/4Q). In our view, the economy would have already exited rehab this year if the politicians had not hit the economy with a double dose of austerity and confidence shocks. Two keys to better growth—the housing market and the banking sector—had already shown serious signs of improvement in 2012, with solid gains in home prices and construction and a modest improvement in bank lending. ... Absent the shocks out of Washington, we believe growth this year would have been 3 to 3.5%.Harris makes several key points that I agree with (see my post from a month ago: Comment: Looking for Stronger Economic Growth in 2014). As Harris notes, the auto recovery is "well-advanced", but many other sectors of the economy (like housing) have "a long way to go". With improved balance sheets, improving housing market, the end of state and local government austerity, less Federal government austerity, 2014 should be a better year for growth.

...

Not only are structural headwinds fading, we expect Washington to be less shocking. While the sequester shock is not over—there is about a 0.2pp hit to GDP in 2014—the vast majority of the 2%-plus in fiscal austerity has already been absorbed into the economy. At the same time, with the election looming, we expect moderate politicians in each party to assert themselves and avoid another shutdown.

...

While some of the cyclical bounce has already happened, it is important to recognize that the US is still in the early stage of the business cycle. Business cycles don’t die of old age, they die from overexpansion and inflation. ... In our view, the auto recovery is fairly well-advanced, but there is a long way to go in other consumer durables, housing, and business investment. Even more important ... inflation seems a distant concern.

emphasis added

Final November Consumer Sentiment increases to 75.1, Chicago PMI at 63.0

by Calculated Risk on 11/27/2013 09:59:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for November was at 75.1, up from the October reading of 73.2, and up from the preliminary November reading of 72.0.

This was above the consensus forecast of 73.3. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011.

Unfortunately Congress shut down the government in October, and once again threatened to "not pay the bills", and this impacted sentiment last month. The spike down wasn't as large this time, probably because many people realized the House was bluffing with a losing hand. And now sentiment is starting to recover.

Chicago PMI: From the Chicago ISM:

November 2013:

The November Chicago Business Barometer softened to 63.0 after October’s sharp rise to a 31-month high of 65.9. November’s slight correction came amid mild declines in New Orders, Production and Order Backlogs after double digit gains in the prior month.This was a solid report and above the consensus estimate of 60.5.

Despite November’s weakening, the Barometer remained well above 60 for the second month, pushing the three month moving average to the highest level since November 2011 [note: above 50 is expansion]

Employment was up for the second consecutive month, reaching the highest level since October 2011, and the first time above 60 since February 2012.

Commenting on the MNI Chicago Report, Philip Uglow, Chief Economist at MNI Indicators said, “The Barometer might be down in November, but this was another impressive month with companies reporting firm growth”.

“Having kept inventories lean for so long, a pick-up in demand has led to a sharp rise in stock building among the companies in our panel. And to handle the latest production and new orders boost, companies are hiring at the fastest pace for two years,” he added.

Weekly Initial Unemployment Claims decline to 316,000

by Calculated Risk on 11/27/2013 08:34:00 AM

The DOL reports:

In the week ending November 23, the advance figure for seasonally adjusted initial claims was 316,000, a decrease of 10,000 from the previous week's revised figure of 326,000. The 4-week moving average was 331,750, a decrease of 7,500 from the previous week's revised average of 339,250.The previous week was up from 323,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 331,750.

Some of the recent volatility in weekly claims was due to processing problems in California (now resolved).

The level of weekly claims suggests an improving labor market.