by Calculated Risk on 11/28/2013 10:47:00 AM

Thursday, November 28, 2013

Irwin: "Five economic trends to be thankful for"

From Neil Irwin at the WaPo looked for a few positives again this year: Five economic trends to be thankful for. Some excerpts a few comments:

1) Falling gasoline prices. ... The average national price of a gallon of gas has fallen from $3.67 in July to $3.29 as of Tuesday, a 10 percent drop in Americans' fuel costs.CR Note: This is a trend we've been falling. See this graph from gasbuddy.com.

2) Fewer layoffs. The job market isn't great overall, with unemployment still high. But one key measure of the labor market has shown major progress in 2013. The number of people filing new claims for unemployment insurance benefits was a mere 316,000 last week, and over the last four weeks has averaged 332,000. That's below the 340,000 of December 2007, the month the recession began, and far, far below the high of 670,000 the last week of March 2009.CR Note: Here is a graph of initial weekly unemployment claims.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 331,750.

Some of the recent volatility in weekly claims was due to processing problems in California (now resolved).

The level of weekly claims suggests an improving labor market.

3) Home prices are rising. ... In the year that ended in September, prices rose 13.3 percent in 20 major metro areas, according to the S&P/Case-Shiller home price index. This translates into higher wealth levels among Americans, leaving them the confidence to spend more money. And it that fewer people are underwater on their mortgages, or owing more than their homes are worth.CR Note: This has been a real positive for homeowners - but a negative for potential home buyers.

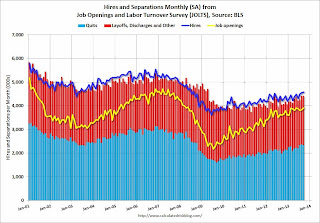

4) More job openings. Hiring has been slow to rebound, but employers are increasingly reporting that they have jobs open. There were 3.91 million job openings in September, the Labor Department said in its Job Openings and Labor Turnover Survey. That was the highest since May 2008 and returns the number of jobs available to early 2005 levels (though the population was smaller then). The story through this slow, halting jobs recovery has been about employers failing to hire; this data suggest things are starting to thaw.

CR Note: Here is a graph of the data Irwin is mentioning on job openings.

CR Note: Here is a graph of the data Irwin is mentioning on job openings. Jobs openings increased in September to 3.913 million from 3.844 million in August. The number of job openings (yellow) is up 8.6% year-over-year compared to September 2012 and openings are at the highest level since early 2008.

Also Quits were mostly unchanged in September and are up about 18% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

5) Debt burdens keep on falling. The ratio of Americans' income going to meet debt obligations has plummeted in recent years, as consumers have both reduced debt burdens (by paying them down and in some cases defaulting) and benefited from lower interest rates. The debt service ratio was only 9.89 percent in the second quarter, hovering near an all-time low of 9.84 percent from late 2012 (the data go back to 1980). That ratio was 13.5 percent in the third quarter of 2007, before the crisis.

CR Note: This graph based on data from the Fed shows the debt service ratio (DSR) for both renters and homeowners (red), and the homeowner financial obligations ratio for mortgages (blue) and consumer debt (yellow).

CR Note: This graph based on data from the Fed shows the debt service ratio (DSR) for both renters and homeowners (red), and the homeowner financial obligations ratio for mortgages (blue) and consumer debt (yellow).The overall Debt Service Ratio is just above the record low set in Q4 2012 thanks to very low interest rates. The homeowner's financial obligation ratio for consumer debt is back to levels last seen in early 1995.

Also the homeowner's financial obligation ratio for mortgages (blue) is at a new record low. This ratio increased rapidly during the housing bubble, and continued to increase until 2008. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined to an all time low.

Happy Thanksgiving!