by Calculated Risk on 11/24/2013 01:29:00 PM

Sunday, November 24, 2013

Housing Starts and Permits

The Census Bureau has announced that the housing starts releases for September and October will be delayed until December 18th, but that housing permits for September and October will be released this coming Tuesday.

The good news is housing starts and permits mostly move together. "Housing starts" are an estimate for the entire country, and "permits" are only for areas requiring building permits. From the Census Bureau:

Housing starts and completions estimates cover the entire United States, not just areas requiring building permits. The number of housing units built in non-permit areas is about 2.5 percent of the total. Nearly all are single-family houses. (Note that the number of jurisdictions (or "places") requiring building permits increases over time as non-permit places become permit-issuing. The Census Bureau's universe of permit offices was increased in 2005 from 19,000 to 20,000 places.)

Click on graph for larger image.

Click on graph for larger image.The first graph shows total housing starts and permits since January 2008.

Over time, more areas have required permits, and now permits and starts mostly move together.

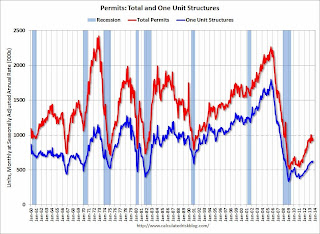

The second graph shows total and single unit permits since 1960. This is the graph I'll post on Tuesday when permits are released.

This shows the huge collapse following the housing bubble, and that housing permits have been generally increasing after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing permits have been generally increasing after moving sideways for about two years and a half years. Since housing starts will be delayed, there will be an extra focus on permits on Tuesday - especially since some of the homebuilders have posted weak results recently.

Housing Starts for September and October Delayed Again until December 18th

by Calculated Risk on 11/24/2013 10:06:00 AM

The Census Bureau has delayed the release of housing starts again. They will release permit data for September and October this week (on Tuesday), but housing start data for September and October will be released on December 18th.

From the Census Bureau: Census Bureau to Postpone Release of Some New Residential Construction Information

Due to the recent lapse in federal funding, the U.S. Census Bureau today announced revisions to the release date for the September and October New Residential Construction indicator's housing starts and housing completions statistics. Originally scheduled for release on October 17 and November 19 respectively, these dates had been previously revised to November 26, 2013.

The Census Bureau's monthly New Residential Construction indicator includes statistics on building permits, housing starts and housing completions. On November 26 at 8:30 a.m., the Census Bureau will release estimates of housing units authorized by building permits in September and October. However, the release of new housing unit starts and housing unit completions will now be released on December 18, 2013.

The lapse in federal funding affected the data collection schedule for the Survey of Construction, which is the source of data on new housing unit starts and housing unit completions. Accurate data collection for September and October could not be completed in time for the November 26 release. As a result, the December 18 release will include data on housing units started and completed in September, October and November 2013.

Saturday, November 23, 2013

Schedule for Week of November 24th

by Calculated Risk on 11/23/2013 01:03:00 PM

This will be a short, but busy week. The key reports this week are housing permits for both September and October, and Case-Shiller house prices.

For manufacturing, the Dallas and Richmond Fed November surveys will be released this week.

10:00 AM ET: Pending Home Sales Index for October. The consensus is for a 1.1% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for November. The consensus is a reading of 5.0, up from 3.6 in October (above zero is expansion).

8:30 AM: Housing Permits for September and October. Housing starts have been delayed until December 18th.

9:00 AM: FHFA House Price Index for September 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September.This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through July 2012 (the Composite 20 was started in January 2000).

The consensus is for a 13.1% year-over-year increase in the Composite 20 index (NSA) for August. The Zillow forecast is for the Composite 20 to increase 13.2% year-over-year, and for prices to increase 0.8% month-to-month seasonally adjusted.

10:00 AM: Conference Board's consumer confidence index for November. The consensus is for the index to increase to 72.9 from 71.2.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November. The consensus is a reading of 4, up from 1 in October (above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 323 thousand last week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 2.0% decrease in durable goods orders.

8:30 AM ET: Chicago Fed National Activity Index for October.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a decrease to 60.5, down from 65.9 in October.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 73.3, up from the preliminary reading of 72.0, and up from the October reading of 73.2.

10:00 AM: Conference Board Leading Indicators for October. The consensus is for a 0.1% increase in this index.

All US markets will be closed in observance of the Thanksgiving Day Holiday.

US markets will close at 2:00 PM ET following the Thanksgiving Day Holiday. The NYSE will close at 1:00 PM ET.

Unofficial Problem Bank list declines to 654 Institutions

by Calculated Risk on 11/23/2013 10:00:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for November 22, 2013.

Changes and comments from surferdude808:

Another quiet week for the Unofficial Problem Bank List as there was only removal. The OCC terminated the action against Lafayette Savings Bank, FSB, Lafayette, IN ($355 million Ticker: LSBI). After removal, the list holds 654 institutions with assets of $222.8 billion. A year ago, the list held 857 institutions with assets of $329.2 billion. We thought the FDIC would release industry results and the Official Problem Bank List totals for the third quarter, but perhaps that will happen next week along with the FDIC's enforcement action activity through October.

According to SNL Securities, Capitol Bancorp was able to sell its controlling interest in Bank of Maumee, Maumee, OH ($28 million) to Princeton Capital LLC (Princeton Capital completes buy of majority stake in Bank of Maumee). The FDIC issued a cross-guaranty waiver/tolling agreement in 2011 to facilitate the transaction that was set to expire this past Tuesday, November 19, 2013. There are reports of potential buyers other than previously identified Talmer Bancorp, Inc. surfacing that are interested in acquiring some of the remaining banks controlled by Capitol Bancorp.

Friday, November 22, 2013

WSJ: Survey Indicates Weak New Home Sales in October

by Calculated Risk on 11/22/2013 07:28:00 PM

From the WSJ: Weak October Sales Have Home Builders Fretting About Spring

A monthly survey of builders across the U.S. by John Burns Real Estate Consulting, a housing research and advisory firm, has found that respondents’ sales of new homes declined by 8% in October from the September level and by 6% from a year earlier. Last month’s result marked the second consecutive month in which the survey yielded a year-over-year decline in sales volumes, the first dips since early 2011.New home sales have been weak for a few months. Part of the reason is that builders have been raising prices significantly, and in October the government shut down probably hurt sales too. Still 2013 has seen a solid increase in new home sales over 2012, and I'm pretty confident new home sales will continue to increase in 2014.

...

“October was basically a crummy month for a lot of builders,” said Jody Kahn, a senior vice president at Irvine, Calif.-based Burns. “Their frustration is about the government shutdown and how it probably trumped any seasonal (sales) lift that builders were hoping to see. Most did not have very good sales.”

...

“I think this (slowdown) is a good wakeup call for the industry,” Mr. [Scott Laurie, chief executive of The Olson Co] said. “You can’t just raise prices 2% a month. That doesn’t work. What works is affordability.”

DOT: Vehicle Miles Driven increased 1.5% in September

by Calculated Risk on 11/22/2013 04:00:00 PM

The Department of Transportation (DOT) reported:

◦ Travel on all roads and streets changed by 1.5% (3.7 billion vehicle miles) for September 2013 as compared with September 2012.The following graph shows the rolling 12 month total vehicle miles driven.

◦ Travel for the month is estimated to be 241.7 billion vehicle miles.

◦ Cumulative Travel for 2013 changed by 0.4% (9.8 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways but has started to increase a little recently.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 70 months - almost 6 years - and still counting. Currently miles driven (rolling 12 months) are about 2.5% below the previous peak.

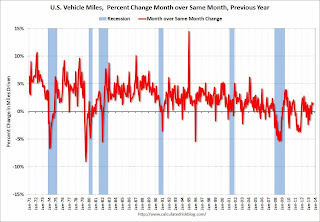

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were down in September compared to September 2012. In September 2013, gasoline averaged of $3.60 per gallon according to the EIA. In 2012, prices in September averaged $3.91 per gallon. (In 2012 there were refinery issues in September).

Gasoline prices were down in September compared to September 2012. In September 2013, gasoline averaged of $3.60 per gallon according to the EIA. In 2012, prices in September averaged $3.91 per gallon. (In 2012 there were refinery issues in September).Gasoline prices were down sharply year-over-year in October, so I expect miles driven to be up in October too.

As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 6 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take a few more years before we see a new peak in miles driven.

BLS: State unemployment rates were "little changed" in October

by Calculated Risk on 11/22/2013 12:23:00 PM

From the BLS: Regional and state unemployment rates were little changed in October

Regional and state unemployment rates were little changed in October. Twenty-eight states had unemployment rate decreases from September, 11 states and the District of Columbia had increases, and 11 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada had the highest unemployment rate among the states in October, 9.3 percent. The next highest rates were in Rhode Island, 9.2 percent, and Michigan, 9.0 percent. North Dakota continued to have the lowest jobless rate, 2.7 percent.

Click on graph for larger image in graph gallery.

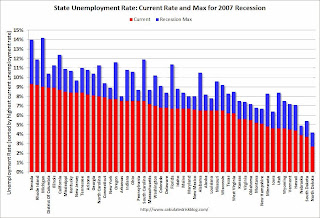

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan, Nevada and Florida have seen the largest declines and many other states have seen significant declines.

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at or above 9% in three states: Nevada, Rhode Island and Michigan.

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).Currently three states have an unemployment rate at or above 9% (purple), thirteen states at or above 8% (light blue), and 23 states at or above 7% (blue).

Kansas City Fed: Manufacturing Survey shows Activity Growing at "Moderate Rate"

by Calculated Risk on 11/22/2013 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Survey Continued to Grow

The Federal Reserve Bank of Kansas City released the November Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity continued to grow, and producers’ expectations for future activity improved moderately.In aggregate the regional surveys have suggested slower growth in November. The last of the regional Fed manufacturing surveys for November will be released early next week (Richmond and Dallas Fed).

“Factory activity in our region continues to hum along at a moderate rate of growth” said Wilkerson. “The marked improvement in hiring plans was a nice development"

...

The month-over-month composite index was 7 in November, up from 6 in October and 2 in September ... The new orders index jumped from 3 to 15 ...

emphasis added

BLS: Job Openings "little changed" in September

by Calculated Risk on 11/22/2013 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

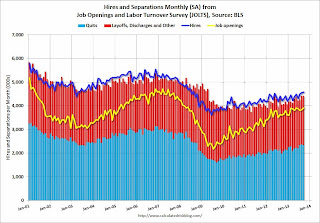

There were 3.9 million job openings on the last business day of September, little changed from August, the U.S. Bureau of Labor Statistics reported today. The hires rate (3.4 percent) and separations rate (3.2 percent) were little changed in September. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in September for total nonfarm and total private, and was little changed for government. The number of quits rose in several industries. Over the year, quits increased in the Midwest, South, and West regions.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September, the most recent employment report was for October.

Click on graph for larger image.

Click on graph for larger image.Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in September to 3.913 million from 3.844 million in August. The number of job openings (yellow) is up 8.6% year-over-year compared to September 2012 and openings are at the highest level since early 2008.

Quits were mostly unchanged in September and are up about 18% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market.

LPS: Mortgage Delinquency Rate declined in October, In-Foreclosure Rate lowest since 2008

by Calculated Risk on 11/22/2013 08:44:00 AM

According to the First Look report for October to be released today by Lender Processing Services (LPS), the percent of loans delinquent decreased in October compared to September, and declined about 11% year-over-year. Also the percent of loans in the foreclosure process declined further in October and were down 30% over the last year.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 6.28% from 6.46% in September. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 2.54% in October from 2.63% in September. The is the lowest level since late 2008.

The number of delinquent properties, but not in foreclosure, is down 348,000 properties year-over-year, and the number of properties in the foreclosure process is down 524,000 properties year-over-year.

LPS will release the complete mortgage monitor for October in early December.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| October 2013 | September 2013 | October 2012 | |

| Delinquent | 6.28% | 6.46% | 7.03% |

| In Foreclosure | 2.54% | 2.63% | 3.61% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,869,000 | 1,935,000 | 1,957,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,283,000 | 1,331,000 | 1,543,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,276,000 | 1,328,000 | 1,800,000 |

| Total Properties | 4,427,000 | 4,593,000 | 5,300,000 |