by Calculated Risk on 11/12/2013 09:22:00 AM

Tuesday, November 12, 2013

Chicago Fed: "Economic activity slightly improved in September"

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic activity slightly improved in September

The Chicago Fed National Activity Index (CFNAI) increased to +0.14 in September from +0.13 in August.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased to –0.03 in September from –0.15 in August, marking its seventh consecutive reading below zero. September’s CFNAI-MA3 suggests that growth in national economic activity was slightly below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly below the historical trend in September (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

NFIB: Small Business Optimism Index Declines in October

by Calculated Risk on 11/12/2013 07:31:00 AM

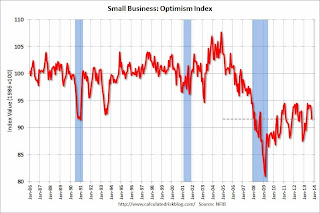

From the National Federation of Independent Business (NFIB): October Small Business Optimism Takes a Tumble

Fall arrived literally this month, as small-business optimism dropped from 93.9 to 91.6, largely due to a precipitous decline in hiring plans and expectations for future small-business conditions. ... The stalemate in early October over funding the government ... left 68 percent of owners feeling that the current period is a bad time to expand; 37 percent of those owners identified the political climate in Washington as the culprit—a record high level.

Job Creation. Job creation was up in October. NFIB owners increased employment by an average of 0.11 workers per firm in October after September’s decline

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index decreased to 91.6 in October from 93.9 in September.

This decline was expected due to the shutdown of the government, and optimism will probably increase again in November or December.

Monday, November 11, 2013

Tuesday: Small Business Optimism Index (or more likely Pessimism)

by Calculated Risk on 11/11/2013 08:18:00 PM

Trom the NY Times: Skeptics See Euro as Working Against European Unity

[T]he big worry lately is the specter of deflation, a doom loop of falling prices, wages and profits that, once under way, is a tailspin hard to pull out of. The fear of years of stagnation was the main impetus for the European Central Bank’s decision to reduce interest rates, over the objections of Germany, which worries that looser money will only encourage profligacy by its weaker euro neighbors.Not only has austerity in Europe been a dismal failure, but policymakers still haven't addressed the fundamental issues in the Eurozone.

It is not evident, though, that anything has been gained by the austerity policies that Germany long preached, which have been a drag on economic growth; government debt in the euro zone has risen sharply over the last half decade.

Perhaps worst of all, the various economic afflictions have reinforced the kind of nationalism and xenophobia that the broader European Union project was supposed to chase away.

Tuesday:

• At 7:30 AM ET, the NFIB Small Business Optimism Index for October. Expect a decline in optimism.

• At 8:30 AM, the Chicago Fed National Activity Index for September. This is a composite index of other data.

Weekly Update: Housing Tracker Existing Home Inventory up 2.2% year-over-year on Nov 11th

by Calculated Risk on 11/11/2013 03:44:00 PM

Here is another weekly update on housing inventory ... for the fourth consecutive week, housing inventory is up year-over-year. This suggests inventory bottomed early this year.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for September). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is now above the same week in 2012 (red is 2013, blue is 2012).

We can be pretty confident that inventory bottomed early this year, and I expect the seasonal decline to be less than usual at the end of the year - so the year-over-year change will continue to increase.

Inventory is still very low, but this increase in inventory should slow house price increases.

Update: Looking for Stronger Economic Growth in 2014

by Calculated Risk on 11/11/2013 01:40:00 PM

Two weeks ago I wrote: Comment: Looking for Stronger Economic Growth in 2014

Fiscal austerity probably subtracted 1.5% to 2.0% from GDP growth in 2013, and the foolish government shutdown probably subtracted a little more.Here is some more analysis on 2014:

But even with contractionary fiscal policy, it looks like the US economy will grow in the 2% range this year. Ex-austerity (and ex-shutdown), we'd probably be looking at a decent year - maybe this would have been the best year since Clinton was President!

Right now it looks like 2014 will be a better than 2013 for a number of reasons:

1) The housing recovery should continue.

2) Household balance sheets are in much better shape. See: NY Fed: Household Debt declined in Q2 as Deleveraging Continues and Fed: Household Debt Service Ratio near lowest level in 30+ years

3) State and local government austerity is over (in the aggregate) [updated link].

4) There will be less Federal austerity in 2014 (hopefully the sequester cuts will be minimized). And a government shutdown is unlikely. ...

5) And demographics are favorable going forward.

From Goldman Sachs economists Sven Jari Stehn and Kris Dawsey:

Looking beyond Q4, we continue to expect a meaningful acceleration of GDP growth―to 3% in 2014Q1 and 3.5% for the remainder of the year―as the economy moves over the "hump" of fiscal contraction.From Merrill Lynch economists:

Getting the exact timing of the acceleration in growth is tough, but the case for better growth next year is strong. The economy has healed significantly since the 2008-9 crisis. In particular, the government, households, businesses and banks have gone a long way toward fixing their balance sheets, allowing them to slowly shift their focus from balance sheet repair to expansion.Right now it looks like 2014 will be a solid year.

...

We expect GDP growth to exceed 3% in the back half of next year as the federal fiscal drag drops from ~1.5pp in 2013 to ~0.5pp in 2014.

Update: When will payroll employment exceed the pre-recession peak?

by Calculated Risk on 11/11/2013 09:53:00 AM

Two years ago I posted a graph with projections of when payroll employment would return to pre-recession levels (see: Sluggish Growth and Payroll Employment from November 2011).

In 2011, I argued we'd continue to see sluggish growth (back in 2011 many analysts were forecasting another US recession - those forecasts were wrong).

On the graph I posted two lines - one with payroll growth of 125,000 payroll jobs added per month (the pace in 2011), and another line with 200,000 payroll jobs per month. The following graph is an update with reported payroll growth through October 2013.

The dashed red line is 125,000 payroll jobs added per month. The dashed blue line is 200,000 payroll jobs per month. Both projections are from November 2011.

Click on graph for larger image.

Click on graph for larger image.

So far the economy has tracked just below the blue line (200,000 payroll jobs per month).

Right now it appears payrolls will exceed the pre-recession peak in mid-2014.

Currently there are about 1.5 million fewer payroll jobs than before the recession started, and at the recent pace of job growth it will take about 8 months to reach the previous peak.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow).

Note: There are 976 thousand fewer private sector payroll jobs than before the recession started. At the recent pace of private sector job growth, the private sector could be back at the pre-recession peak in the first few months of 2014.

Sunday, November 10, 2013

Sunday Night Futures: Gasoline Prices declines to $3.20 per Gallon

by Calculated Risk on 11/10/2013 09:33:00 PM

Monday:

• Government offices, banks and the bond market will be closed in observance of the Veteran's Day holiday. Stock markets will be open.

Weekend:

• Schedule for Week of November 10th

• Update: Four Charts to Track Timing for QE3 Tapering

• State and local government austerity is over

The Nikkei is up about 1.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are flat and DOW futures are down slightly (fair value).

Oil prices are mostly unchanged with WTI futures at $94.63 per barrel and Brent at $105.12 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices have fallen to $3.20 per gallon. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Q3 2013 GDP Details: Residential Investment increases, Commercial Investment very Low

by Calculated Risk on 11/10/2013 12:19:00 PM

The BEA released the underlying details for the Q3 advance GDP report Friday.

The first graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

A few key points:

1) Usually the most important components are investment in single family structures followed by home improvement. However home improvement has been the top category for twenty consecutive quarters, but that is about to change. Investment in single family structures should be the top category again soon.

2) Even though investment in single family structures has increased significantly from the bottom, single family investment is still very low - and still below the bottom for previous recessions. I expect further increases over the next few years.

3) Look at the contribution from Brokers’ commissions and other ownership transfer costs. This is the category mostly related to existing home sales (this is the contribution to GDP from existing home sales). If existing home sales are flat, or even decline due to fewer foreclosures, this will have little impact on total residential investment.

Click on graph for larger image.

Click on graph for larger image.

Investment in home improvement was at a $178 billion Seasonally Adjusted Annual Rate (SAAR) in Q3 (about 1.0% of GDP), still above the level of investment in single family structures of $172 billion (SAAR) (also 1.0% of GDP). Single family structure investment will probably overtake home improvement as the largest category of residential investment very soon.

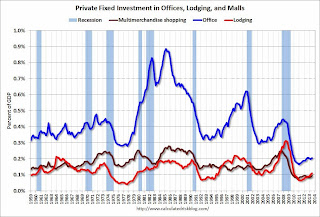

The second graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased recently, but from a very low level.

Investment in offices is down about 54% from the recent peak (as a percent of GDP). There has been some increase in the Architecture Billings Index lately, so office investment might start to increase. However the office vacancy rate is still very high, so any increase in investment will probably be small.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 62% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 62% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 65%. With the hotel occupancy rate close to normal, it is possible that hotel investment will probably continue to increase.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is increasing, but from a very low level.

State and local government austerity is over

by Calculated Risk on 11/10/2013 10:46:00 AM

On Friday, California State Controller John Chiang said

"[B]ecause higher-than-expected payroll withholdings and estimated payments are driving the good news [more state revenue], it signals that Californians are beginning to earn more, work more, and the Great Recession is becoming a faint image in the rear view mirror"This "good news" is happening in many state and local areas (not all). This is a significant change from state and local governments being a headwind for the economy to becoming a slight tailwind.

Here are two graphs that show the aggregate austerity is over.

The first graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has been adding added to GDP growth.

The red bars are the contribution from state and local governments. Although not as big a drag as the housing bust, there was an unprecedented period of state and local austerity (not seen since the Depression).

Now state and local governments have added to GDP for two consecutive quarters, and I expect state and local governments to continue to make small positive contributions to GDP going forward.

The second graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

The second graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In 2013, state and local government employment is up 74 thousand through October.

Here is a table of the annual change in payrolls for state and local governments.

| Year | Annual Change State and Local Government Payrolls (000s) |

|---|---|

| 2002 | 204.0 |

| 2003 | -2.0 |

| 2004 | 159.0 |

| 2005 | 181.0 |

| 2006 | 212.0 |

| 2007 | 262.0 |

| 2008 | 158.0 |

| 2009 | -129.0 |

| 2010 | -262.0 |

| 2011 | -239.0 |

| 2012 | -34.0 |

| 20131 | 74.0 |

| 12013 through October | |

I think most of the recession related state and local government layoffs are over, and it appears state and local government employment has bottomed. Of course Federal government layoffs are ongoing, but it appears state and local government austerity is over (in the aggregate).

Saturday, November 09, 2013

Update: Four Charts to Track Timing for QE3 Tapering

by Calculated Risk on 11/09/2013 04:43:00 PM

Here is an update of the four charts I'm using to track when the Fed will start tapering the QE3 purchases.

In general the year-end data might be "broadly consistent" with the June (and September) FOMC projections.

However I suspect the FOMC is very concerned about the low level of inflation, and also the decline in the employment participation rate.

The December FOMC meeting is on the 17th and 18th.

Click on graph for larger image.

Click on graph for larger image.

The first graph is for the unemployment rate.

The current forecast is for the unemployment rate to decline to 7.1% to 7.3% in Q4 2013.

We only have data through October - and that data was muddled by the government shutdown - however so far the unemployment rate is tracking the FOMC forecast (lower is better).

However, in July, Bernanke said that the unemployment rate "probably understates the weakness of the labor market." (He repeated this yesterday). He suggested he is watching other employment indicators too, and I suspect the FOMC will be looking closely at the participation rate in the November employment report.

The second graph is for GDP.

The second graph is for GDP.

The current forecast is for GDP to increase between 2.0% and 2.3% (the FOMC revised down their forecast from 2.3% and 2.6% in June). This is the increase in GDP from Q4 2012 to Q4 2013.

Currently GDP is tracking the FOMC forecasts, and real GDP only has to increase 1.5% annualized in Q4 to reach the lower forecast (Edit: Corrected required Q4 growth rate, ht Michael)

The third graph is for PCE prices.

The current forecast is for prices to increase 1.1% to 1.2% from Q4 2012 to Q4 2013. This was revised up from 0.8% to 1.2% in June.

The current forecast is for prices to increase 1.1% to 1.2% from Q4 2012 to Q4 2013. This was revised up from 0.8% to 1.2% in June.

So far PCE prices are close just below this projection - however this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

The fourth graph is for core PCE prices

The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

So far core PCE prices are just below this projection - and, once again, this projection is significantly below the FOMC target of 2%.