by Calculated Risk on 10/30/2013 08:15:00 AM

Wednesday, October 30, 2013

ADP: Private Employment increased 130,000 in October

Private sector employment increased by 130,000 jobs from September to October, according to the October ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis. September’s job gain was revised down from 166,000 to 145,000.This was a little below the consensus forecast for 138,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The government shutdown and debt limit brinksmanship hurt the already softening job market in October. Average monthly growth has fallen below 150,000. Any further weakening would signal rising unemployment. The weaker job growth is evident across most industries and company sizes.”

Note: ADP hasn't been very useful in predicting the BLS report on a monthly basis. The BLS report for October will be delayed until next Friday, November 8th, due to the government shutdown.

MBA: Mortgage Applications increase 6% in Latest Weekly Survey

by Calculated Risk on 10/30/2013 07:02:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 6.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 25, 2013. ...

The Refinance Index increased 9 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.33 percent, the lowest rate since June 2013, from 4.39 percent, with points decreasing to 0.26 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

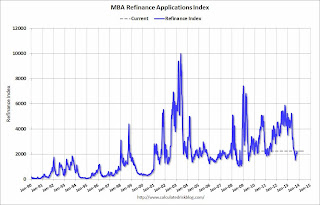

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is up over the last seven weeks as rates have declined from the August levels.

However the index is still down 57% from the levels in early May.

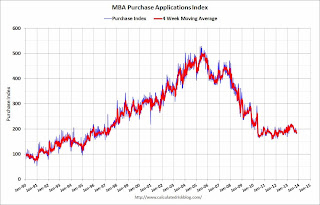

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has fallen since early May, and the 4-week average of the purchase index is now down about 4% from a year ago.

Tuesday, October 29, 2013

Wednesday: FOMC Statement, ADP Employment, CPI

by Calculated Risk on 10/29/2013 08:11:00 PM

A little good news via MarketWatch: Retail gas prices hit lowest level of 2013: AAA

The average U.S. price for a gallon of regular unleaded gasoline stood at $3.28 on Monday, the lowest price of 2013, according to AAA. The motorist and leisure travel group also said it expects gas prices to fall even further, approaching the end of the year "as sufficient, flat demand, the shift to cheaper winter-blend gasoline and falling crude-oil prices likely mean cheaper prices at the pump."Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the weekly mortgage purchase applications index.

• At 8:30 AM, the ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 138,000 payroll jobs added in October, down from 166,000 in September.

• At 8:30 AM, the Consumer Price Index for September. The consensus is for a 0.2% increase in CPI in September and for core CPI to increase 0.2%.

• At 2:00 PM, the FOMC Meeting Announcement. No change to interest rates or QE purchases is expected at this meeting.

Fed: Household Debt Service Ratio near lowest level in 30+ years

by Calculated Risk on 10/29/2013 05:43:00 PM

The Federal Reserve released the Q2 2013 Household Debt Service and Financial Obligations Ratios today. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The household debt service ratio (DSR) is an estimate of the ratio of debt payments to disposable personal income. Debt payments consist of the estimated required payments on outstanding mortgage and consumer debt.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The financial obligations ratio (FOR) adds automobile lease payments, rental payments on tenant-occupied property, homeowners' insurance, and property tax payments to the debt service ratio.

...

The homeowner mortgage FOR includes payments on mortgage debt, homeowners' insurance, and property taxes, while the homeowner consumer FOR includes payments on consumer debt and automobile leases

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only a rough approximation of the current debt service ratio faced by households. Nonetheless, this rough approximation may be useful if, by using the same method and data series over time, it generates a time series that captures the important changes in household debt service payments.

Click on graph for larger image.

Click on graph for larger image.The graph shows the DSR for both renters and homeowners (red), and the homeowner financial obligations ratio for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio decreased in Q2, and is just above the record low set in Q4 2012 thanks to very low interest rates. The homeowner's financial obligation ratio for consumer debt increased slightly in Q2, and is back to levels last seen in early 1995.

Also the homeowner's financial obligation ratio for mortgages (blue) is at a new record low. This ratio increased rapidly during the housing bubble, and continued to increase until 2008. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined to an all time low.

FOMC Preview: Flying Blind

by Calculated Risk on 10/29/2013 03:28:00 PM

The Federal Open Market Committee (FOMC) is meeting today and Wednesday, with the FOMC statement expected to be released at 2:00 PM ET on Wednesday.

Expectations are the FOMC will take no action at this meeting (the FOMC will probably not adjust the size of their purchases of agency mortgage-backed securities and Treasury securities).

A key question for the meeting this week is how the FOMC will address the lack of data (aka "flying blind"). The delayed data probably means the FOMC will be on hold until at least the December meeting. However the shutdown will still be impacting data releases through the end of the year, so the FOMC might wait until 2014 to start the "taper".

As a reminder, here are the quarterly projections from the September meeting. Unfortunately the advance report for Q3 GDP has been delayed (now scheduled for November 7th), so the FOMC is flying blind on GDP.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | 2.0 to 2.3 | 2.9 to 3.1 | 3.0 to 3.5 | 2.5 to 3.3 |

The unemployment rate was at 7.2% in September, however the unemployment rate is expected to increase in October due to the shutdown (and then decline in November as people return to work).

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | 7.1 to 7.3 | 6.4 to 6.8 | 5.9 to 6.2 | 5.4 to 5.9 |

For inflation, PCE inflation was up 1.2% year-over-year in August (close to projected rate, but far below target), however the September report was delayed until next week (November 8th).

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | 1.1. to 1.2 | 1.3 to 1.8 | 1.6 to 2.0 | 1.7 to 2.0 |

For core inflation, core PCE inflation was up 1.2% year-over-year in August.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2013 | 2014 | 2015 | 2016 |

| Sept 2013 Meeting Projections | 1.2 to 1.3 | 1.5 to 1.7 | 1.7 to 2.0 | 1.9 to 2.0 |

So a key for the FOMC statement is how the FOMC addresses the lack of data (and if they mention the shutdown and related economic slowdown).

Comment on House Prices: Real Prices, Price-to-Rent Ratio, Cities

by Calculated Risk on 10/29/2013 11:56:00 AM

It appears house price increases have slowed recently based on agent reports and asking prices (a combination of a little more inventory and higher mortgage rates), but this slowdown in price increases is not showing up yet in the Case-Shiller index because of the reporting lag and because of the three month average (the August report was an average of June, July and August prices). I expect to see smaller year-over-year price increases going forward and some significant deceleration towards the end of the year or in early 2014.

I also think it is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation. That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Zillow's chief economist Stan Humphries said today: "Home value appreciation is better when it’s boring", and I agree. I'd sure like to see nominal price increases closer to the level of inflation. But that is just wishcasting (as opposed to forecasting).

Earlier: Case-Shiller: Case-Shiller: Comp 20 House Prices increased 12.8% year-over-year in August

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through August) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through August) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q4 2003 levels (and also back up to Q4 2008), and the Case-Shiller Composite 20 Index (SA) is back to April 2004 levels, and the CoreLogic index (NSA) is back to October 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 2000 levels, the Composite 20 index is back to December 2001, and the CoreLogic index back to June 2002.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

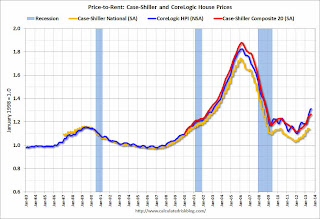

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 2000 levels, the Composite 20 index is back to May 2002 levels, and the CoreLogic index is back to February 2003.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 39% above January 2000.

These are nominal prices, and as I noted above real prices (adjusted for inflation) are up about 38% since January 2000 - so the increase in Phoenix from January 2000 until now is about the change in inflation.

Two cities - Denver (up 43% since Jan 2000) and Dallas (up 28% since Jan 2000) - are at new highs (no other Case-Shiller Comp 20 city is very close). Denver is up slightly more than inflation over that period, and Dallas slightly less. Detroit prices are still below the January 2000 level.

Case-Shiller: Comp 20 House Prices increased 12.8% year-over-year in August

by Calculated Risk on 10/29/2013 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3 month average of June, July and August prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Rise Further in August 2013 According to the S&P/Case-Shiller Home Price Indices

Data through August 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed that the 10-City and 20-City Composites increased 12.8% year-over-year. Compared to July 2013, the annual growth rates accelerated for both Composites and 14 cities.

On a monthly basis, the 10-City and 20-City Composites gained 1.3% in August. Las Vegas led the cities with an increase of 2.9%, its highest since August 2004. Detroit and Los Angeles followed with gains of 2.0%. ... In August 2013, the 10- and 20-City Composites posted annual increases of 12.8%.

“The 10-City and 20-City Composites posted a 12.8% annual growth rate,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Both Composites showed their highest annual increases since February 2006. All 20 cities reported positive year-over-year returns. Thirteen cities posted double-digit annual gains. Las Vegas and California continue to impress with year-over-year increases of over 20%. Denver and Phoenix posted 20 consecutive annual increases; Miami and Minneapolis 19. Despite showing 26 consecutive annual gains, Detroit remains the only city below its January 2000 index level.

...

“Denver and Dallas again set new highs. All the other cities remain below their peaks. Boston and Charlotte are the two MSAs closest to their peaks with only 8-9% left to go. Las Vegas is still down 47.1% from its peak level.”

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 23.1% from the peak, and up 0.9% in August (SA). The Composite 10 is up 16.7% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 22.3% from the peak, and up 0.9% (SA) in August. The Composite 20 is up 17.3% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 12.2% compared to August 2012.

The Composite 20 SA is up 12.8% compared to August 2012. This was the fifteenth consecutive month with a year-over-year gain.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in August seasonally adjusted. Prices in Las Vegas are off 47.7% from the peak, and prices in Denver and Dallas are at new highs.

This was above the consensus forecast for a 12.4% YoY increase. I'll have more on prices later.

Retail Sales declined 0.1% in September

by Calculated Risk on 10/29/2013 08:30:00 AM

On a monthly basis, retail sales declined 0.1% from August to September (seasonally adjusted), and sales were up 3.2% from September 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $425.9 billion, a decrease of 0.1 percent from the previous month, but 3.2 percent above September 2012. ... The July to August 2013 percent change was unrevised from +0.2 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 28.5% from the bottom, and now 12.6% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos increased 0.4%.

Excluding gasoline, retail sales are up 25.6% from the bottom, and now 13.1% above the pre-recession peak (not inflation adjusted).

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 4.1% on a YoY basis (3.2% for all retail sales).

This was slightly below the consensus forecast of no change for retail sales, however sales ex-autos were at forecast.

Monday, October 28, 2013

Tuesday: Retail Sales, Case-Shiller House Prices, PPI

by Calculated Risk on 10/28/2013 09:14:00 PM

From economist Shuyan Wu at Goldman Sachs: "How Much Noise in the October Employment Report?" A couple of excerpts:

Around 800,000 federal employees were furloughed on October 1. The Department of Defense (DoD) brought back roughly 350,000 by October 8, leaving about 450,000 federal employees still out of work during the reference week (Oct 6-12). The recalled DoD workers would be classified as employed; the non-DoD workers would be classified as unemployed on layoff since they did not work during the reference week but were expecting a recall. Assuming the October household sample was representative as usual, an additional 450,000 unemployed persons could add as much as 0.3 percentage points to the unemployment rate.Any impact on the unemployment rate and hiring would be reversed in the November report. We will have to wait until the December report (early January) for a report without shutdown distortions.

...

It is difficult to estimate the aggregate impact on private payrolls ...

Tuesday:

• At 8:30 AM ET, Retail sales for September. The consensus is for retail sales to be unchanged in September, and to increase 0.4% ex-autos.

• Also at 8:30 AM, the Producer Price Index for September. The consensus is for a 0.2% increase in producer prices (0.1% increase in core).

• At 9:00 AM, the S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August. The consensus is for a 12.4% year-over-year increase in the Composite 20 index (NSA) for August.

• At 10:00 AM, Conference Board's consumer confidence index for October. The consensus is for the index to decrease to 75.0 from 79.7.

• Also at 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for a 0.3% increase in inventories.

Weekly Update: Housing Tracker Existing Home Inventory up 0.3% year-over-year on Oct 28th

by Calculated Risk on 10/28/2013 06:19:00 PM

Here is another weekly update on housing inventory ... for the second consecutive week, housing inventory is up slightly year-over-year.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for September). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is increasing, and is now slightly above the same week in 2012 (red is 2013, blue is 2012).

We can be pretty confident that inventory bottomed early this year, and I expect the seasonal decline to be less than usual at the end of the year - so the year-over-year change will continue to increase.

Inventory is still very low, but this increase in inventory should slow house price increases.