by Calculated Risk on 10/04/2013 08:28:00 AM

Friday, October 04, 2013

Fed's Lockhart: No Jobs Report, Fed "more cautious"

It is pretty clear - no jobs report, no taper. The September report is delayed, but - important - if the shutdown impacts data collection for October (the week including the 12th of the month), there might not be an October report.

From the WSJ: No Jobs Report Complicates Fed's Thinking

"If this lasts for several more days" or weeks, Federal Reserve Bank of Atlanta President Dennis Lockhart said Thursday, "by the end of October we will still be looking at a very ambiguous situation."And on the October employment report:

"Less data is not helpful in gauging where the economy is and where it's going," said Mr. Lockhart, whose views often represent the emerging consensus at the central bank. "So that would tend to make me somewhat more cautious." ...

Beyond the loss of economic data, the shutdown could also act as a drag on economic growth, Mr. Lockhart said.

"It's a little early to draw any conclusions," Mr. Lockhart said. "If it's protracted then I would expect that there would be some measurable impact at least on fourth-quarter growth."

A shutdown lasting more than a few weeks could also cause headaches for the October jobs report, due out Nov. 1, said Keith Hall, a former commissioner of the Bureau of Labor Statistics, which produces the jobs report. Government analysts are due to start the next survey of households in mid-October, muddying the data due to a delay in data collection.

Thursday, October 03, 2013

Friday: Jobs, Jobs ... uh, No Jobs Report

by Calculated Risk on 10/03/2013 09:00:00 PM

Here was my employment overview post from earlier today.

Some exerpts from an interview with Mark A. Patterson, chief of staff at the Treasury Department 2009 until May 2013:

We have this unbelievably unique and privileged position to have always had the world’s trust that our treasury securities are the safest and most secure investment in the world. We have always paid all our bills on time and in full. For 200 years we’ve built that reputation. It’s worth an awful lot. I think that if we squandered it suddenly the potential is there for the whole world to reevaluate if that trust was misplaced. And once you lose somebody’s trust it’s pretty hard to get it back. ...• DELAYED: At 8:30 AM ET, the Employment Report for September was scheduled. The consensus was for an increase of 178,000 non-farm payroll jobs in September; the economy added 169,000 non-farm payroll jobs in August. The consensus is for the unemployment rate to be unchanged at 7.3% in September.

Someone wrote up an analogy saying imagine the situation was reversed and a Democratic House said to a Republican president that we want to double the minimum wage or enact a sweeping gun control law or we throw the country into default. The underlying tactics being used here is totally irresponsible and can’t be accepted by any president.

Employment Situation

by Calculated Risk on 10/03/2013 05:00:00 PM

Important Note: The employment report will be delayed. If the government shutdown lasts into the week of the 12th (when employment data is collected), it is unclear if there will be an October employment report.

Tomorrow (Friday), at 8:30 AM ET, the BLS will NOT release the employment report for September. The consensus was for an increase of 178,000 non-farm payroll jobs in September, and for the unemployment rate to be unchanged at 7.3%.

Although the employment report will be delayed, here is a summary of recent data:

• The ADP employment report showed an increase of 166,000 private sector payroll jobs in September. This was below expectations of 175,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any particular month. But in general, this suggests employment growth slightly below expectations.

• The ISM manufacturing employment index increased in September to 55.4% from 53.3% in August. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs increased about 10,000 in September.

The ISM non-manufacturing employment index decreased in September to 52.7% from 57.0% in August. A historical correlation between the ISM non-manufacturing index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing increased by about 145,000 in September.

Taken together, these surveys suggest around 155,000 jobs added in September, somewhat below the consensus forecast.

• Initial weekly unemployment claims averaged 308,000 in September. This was down from an average of 323,000 in August, and is at the lowest level since early-2007 (before the recession).

For the BLS reference week (includes the 12th of the month), initial claims were at 311,000; the lowest level in years (although there were reporting issues that have since been resolved).

• The final September Reuters / University of Michigan consumer sentiment index decreased to 77.5 from the August reading of 82.1. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors (like threats from the House).

• The small business index from Intuit showed a slight increase in small business employment in September.

• Conclusion: The data was mixed. The ADP report was a little lower the consensus, and the ISM surveys suggest slightly less hiring in September than in August. Also consumer sentiment decreased. However weekly claims for the reference week have declined to pre-recession levels.

The employment report will be delayed, but my guess is the report would have been somewhat below expectations.

Trulia: Asking House Prices suggest "Slowdown" in Sales Price Increases

by Calculated Risk on 10/03/2013 03:33:00 PM

This was released earlier today: Trulia Reports Asking Home Prices Slow Down in Hottest Housing Markets

Nationally, asking home prices rose 3.0 percent quarter-over-quarter (Q-o-Q) in September – the smallest Q-o-Q change since February. However, the downward trend is harder to spot in the more volatile monthly changes and smoothed out yearly changes. Asking prices rose 2.0 percent month-over-month (M-o-M) and 11.5 percent year-over-year (Y-o-Y), but year-over-year changes should start to shrink in the coming months. At the metro level, 89 of the 100 largest metros had Q-o-Q price increases in September, down from 97 in June.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis (but the year-over-year increases will probably slow).

...

Nationally, rents rose 3.0 percent Y-o-Y in September, down from 3.9 percent Y-o-Y in June. Locally, rent rose more slowly in September than in June in 18 of the 25 largest rental markets, including Seattle, Denver, and Houston. However, rents rose faster in September than in June in Portland, San Diego, Phoenix, and several other metros.

“Asking home prices give us the first look at where home sale prices are headed, and they point to a slowdown,” said Jed Kolko, Trulia’s Chief Economist. “After rising rapidly in the first half of 2013, asking prices in two thirds of the largest metros are cooling. In fact, asking prices are falling – not just rising more slowly – in 11 of the 100 largest metros, the most markets to see prices slip in six months.”

emphasis added

More from Kolko: Asking Prices Slowing in Two Thirds of the Largest Metros

Reis: Regional Mall Vacancy Rates decline slightly in Q3

by Calculated Risk on 10/03/2013 01:17:00 PM

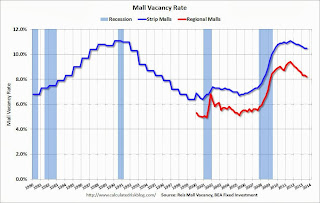

Reis reported that the vacancy rate for regional malls declined slightly in Q3 to 8.2%, down from 8.3% in Q2. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was unchanged in Q3 at 10.5%, the same as in Q2. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Head of Economics Victor Calanog:

[Strip Malls] National vacancies remained unchanged in the third quarter for neighborhood and community centers. ... Vacancies for neighborhood and community centers now stand at 10.5%, down 30 basis points year over year, and just a paltry 60 basis points below the peak vacancy rate of 11.1% which was recorded two years ago, during the third quarter of 2011. By any measure this is a weak recovery; only 2.351 million SF of space was absorbed this period, the slowest rate of increase in occupied stock this year. And all this despite the fact that 1.472 million SF of new space came online, the largest number for quarterly additions from new construction in 2013.

...

[Regional] Malls have generally experienced a stronger recovery relative to their smaller brethren shopping centers; national vacancies peaked at 9.4% in the third quarter of 2011, and have descended at a faster pace than neighborhood and community center vacancies. Third quarter mall vacancies stand at 8.2%, down 10 basis points from the second quarter and down 50 basis points year over year. Asking rents grew by 0.4% in the third quarter and 1.4% from twelve months prior. This is the tenth consecutive quarter of rent increases at the national level for regional malls.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.

ISM Non-Manufacturing Index at 54.4 indicates slower expansion in September

by Calculated Risk on 10/03/2013 10:00:00 AM

The August ISM Non-manufacturing index was at 54.4%, down from 58.6% in August. The employment index declined in September to 52.7%, down from 57.0% in August. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: September 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in September for the 45th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 54.4 percent in September, 4.2 percentage points lower than August's reading of 58.6 percent. This indicates continued growth at a slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased to 55.1 percent, which is 7.1 percentage points lower than the 62.2 percent reported in August, reflecting growth for the 50th consecutive month but at a significantly slower rate. The New Orders Index decreased by 0.9 percentage point to 59.6 percent, and the Employment Index decreased 4.3 percentage points to 52.7 percent, indicating growth in employment for the 14th consecutive month. The Prices Index increased 3.8 percentage points to 57.2 percent, indicating prices increased at a faster rate in September when compared to August. According to the NMI™, 11 non-manufacturing industries reported growth in September. The majority of the respondents' comments continue to be positive; however, there is an increase in the degree of uncertainty regarding the future business climate and the direction of the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 57.0% and indicates slower expansion in September than in August.

Weekly Initial Unemployment Claims increase slightly, Four Week Average lowest since May 2007

by Calculated Risk on 10/03/2013 08:37:00 AM

The DOL reports:

In the week ending September 28, the advance figure for seasonally adjusted initial claims was 308,000, an increase of 1,000 from the previous week's revised figure of 307,000. The 4-week moving average was 305,000, a decrease of 3,750 from the previous week's revised average of 308,750.The previous week was revised up from 305,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 305,000.

The 4-week average is at the lowest level since May 2007 (before the recession started). Claims were below the 313,000 consensus forecast.

Here is a long term graph of the 4-week average of weekly unemployment claims back to 1971.

Here is a long term graph of the 4-week average of weekly unemployment claims back to 1971.The current level of weekly claims is consistent with a solidly growing economy.

Note: This information is collected by the states and will continue to be released.

Wednesday, October 02, 2013

Thursday: Unemployment Claims, ISM Service Index

by Calculated Risk on 10/02/2013 07:34:00 PM

From Gavyn Davies at the Financial Times blog: Why have markets ignored Washington risk?

Turning to the latest political shenanigans in Washington, risk committees all over the financial world are undoubtedly thinking hard about how to hedge these risks. No-one believes that a temporary shut-down in some government activities is critical, but the debt ceiling is seen as a different matter entirely. A default by the US government on its debt payments could be very disruptive, and set in train a series of events which would be hard for the authorities subsequently to control.Thursday:

However, the risk committees will have started with a strong pre-disposition to believe that the US democratic process will not entirely take leave of its senses, though much brinkmanship could be involved in the meantime. They will also know that the US political process has it within its power to end the uncertainty at very short notice when political calculations change. This is not a case of “can’t pay”, it is a case of “won’t pay”.

To a sensible outside observer, it seems improbable that enough members of Congress would act against the interests of the US to trigger a “won’t pay” catastrophe.

...

Hopefully, though, another feedback loop – between the politicians and their voters – will kick in before the markets need to react.

• Early, Reis Q3 2013 Mall Survey of rents and vacancy rates.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 313 thousand from 305 thousand last week.

• At 10:00 AM, the ISM non-Manufacturing Index for September. The consensus is for a reading of 57.0, down from 58.6 in August. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is for a 0.2% increase in orders.

• Also at 10:00 AM, the Trulia Price Rent Monitors for September. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

Update: Seasonal Pattern for House Prices

by Calculated Risk on 10/02/2013 04:06:00 PM

There has always been a clear seasonal pattern for house prices, but the seasonal differences have been more pronounced in recent years.

Even in normal times house prices tend to be stronger in the spring and early summer than in the fall and winter. Recently there has been a larger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have had a larger negative impact on prices in the fall and winter.

It is possible that we will see the Not Seasonally Adjusted (NSA) numbers show a decline in a few months.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index since 2001 (Case-Shiller through July and CoreLogic through August). The seasonal pattern was smaller back in the early '00s, and increased since the bubble burst.

Case-Shiller NSA and CoreLogic both turned slightly negative month-to-month last Fall, but only for a short period.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

The second graph shows the seasonal factors for the Case-Shiller composite 20 index. The factors started to change near the peak of the bubble, and really increased during the bust.

Note: I was one of several people to question this change in the seasonal factor - and this led to S&P Case-Shiller reporting the NSA numbers.

It appears the seasonal factor has stopped increasing, and I expect that over the next several years - as the percent of distressed sales decline - the seasonal factors will slowly move back towards the previous levels.

Flying Blind: Data Held Hostage

by Calculated Risk on 10/02/2013 12:41:00 PM

The Depression led to an effort to enhance and expand data collection on employment, and I was hoping the housing bubble and bust would lead to a similar effort to collect better housing related data. From the BLS history:

[T]he growing crisis [the Depression], spurred action on improving employment statistics. In July [1930], Congress enacted a bill sponsored by Senator Wagner directing the Bureau to "collect, collate, report, and publish at least once each month full and complete statistics of the volume of and changes in employment." Additional appropriations were provided.In the early stages of the Depression, policymakers were flying blind. But at least they recognized the need for better data, and took action. All business people know that when there is a problem, a key first step is to measure the problem. That is why I've been a strong supporter of trying to improve data collection on the number of households, vacant housing units, foreclosures and more. Unfortunately that hasn't happened, and in fact there has been an effort to reduce the amount of data collected.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Back in May, the House voted to kill the American Community Survey, a survey that is widely used by businesses and economists. Fortunately that vote was criticized across the political spectrum.

A couple of examples, first an editorial from the WSJ: Republicans try to kill data collection that helps economic growth

The House voted 232 to 190 to abolish the Census's American Community Survey, or ACS, which is the new version of the long-form questionnaire and is conducted annually. Republicans claim the long form—asking about everything from demographics to income to commuting times—is prying into private life and is unconstitutional.And AEI's Norman Ornstein at Roll Call: Research Cuts Are Akin to Eating Seed Corn

In fact, the ACS provides some of the most accurate, objective and granular data about the economy and the American people, in something approaching real time. Ideally, Congress would use the information to make good decisions. Or economists and social scientists draw on the resource to offer better suggestions. Businesses also depend on the ACS's county-by-county statistics to inform investment and hiring decisions. As the great Peter Drucker had it, you can't manage or change what you don't measure.

...

Since the political class is attempting to define the GOP as insane and redefine "moderation" as anything President Obama favors, Republicans do themselves no favors by targeting a useful government purpose.

[S]ignificant was the House vote to eliminate the annual American Community Survey and the Economic Census to provide basic information on the state of businesses and industries in the country and data used for generating quarterly gross domestic product estimates.Once again the House is depriving us of data, and right now we are flying blind. In the short term this is a minor inconvenience compared to the widespread suffering related to the shutdown, but once again this shutdown is "evidence of ideology run rampant".

If ever we need evidence of ideology run rampant, these actions become exhibit A. Learning about the population and about the economy are fundamental for a society to understand where it has been and where it is going ...