by Calculated Risk on 10/03/2013 01:17:00 PM

Thursday, October 03, 2013

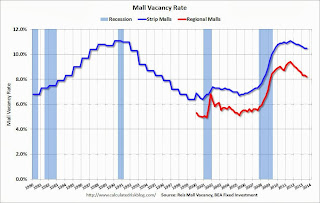

Reis: Regional Mall Vacancy Rates decline slightly in Q3

Reis reported that the vacancy rate for regional malls declined slightly in Q3 to 8.2%, down from 8.3% in Q2. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was unchanged in Q3 at 10.5%, the same as in Q2. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Head of Economics Victor Calanog:

[Strip Malls] National vacancies remained unchanged in the third quarter for neighborhood and community centers. ... Vacancies for neighborhood and community centers now stand at 10.5%, down 30 basis points year over year, and just a paltry 60 basis points below the peak vacancy rate of 11.1% which was recorded two years ago, during the third quarter of 2011. By any measure this is a weak recovery; only 2.351 million SF of space was absorbed this period, the slowest rate of increase in occupied stock this year. And all this despite the fact that 1.472 million SF of new space came online, the largest number for quarterly additions from new construction in 2013.

...

[Regional] Malls have generally experienced a stronger recovery relative to their smaller brethren shopping centers; national vacancies peaked at 9.4% in the third quarter of 2011, and have descended at a faster pace than neighborhood and community center vacancies. Third quarter mall vacancies stand at 8.2%, down 10 basis points from the second quarter and down 50 basis points year over year. Asking rents grew by 0.4% in the third quarter and 1.4% from twelve months prior. This is the tenth consecutive quarter of rent increases at the national level for regional malls.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Mall vacancy data courtesy of Reis.