by Calculated Risk on 9/25/2013 12:20:00 PM

Wednesday, September 25, 2013

Fed's Q2 Flow of Funds: Household Mortgage Debt down $1.3 Trillion from Peak, Record Household Net Worth

The Federal Reserve released the Q2 2013 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q2 compared to Q1, and is at a new record. Net worth peaked at $69.0 trillion in Q3 2007, and then net worth fell to $55.6 trillion in Q1 2009 (a loss of $13.4 trillion). Household net worth was at $74.8 trillion in Q2 2013 (up $19.2 trillion from the trough in Q1 2009).

The Fed estimated that the value of household real estate increased to $18.6 trillion in Q2 2013. The value of household real estate is still $4.0 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.

This is the Households and Nonprofit net worth as a percent of GDP. Although household net worth is at a record high, as a percent of GDP it is still below the peaks in 2000 (stock bubble) and 2006 (housing bubble).

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles. The ratio has been trending up and increased again in Q2 with both stock and real estate prices increasing.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2013, household percent equity (of household real estate) was at 49.8% - up from Q1, and the highest since Q3 2007. This was because of both an increase in house prices in Q2 (the Fed uses CoreLogic) and a reduction in mortgage debt.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 52+ million households with mortgages have far less than 49.8% equity - and millions have negative equity.

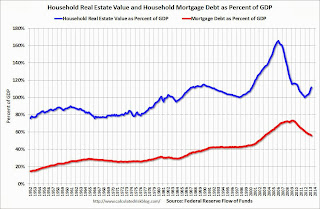

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $41.8 billion in Q2. Mortgage debt has now declined by $1.32 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q2 (as house prices increased), but still close to the average of the last 30 years (excluding bubble). However household mortgage debt, as a percent of GDP, is still historically high, suggesting still more deleveraging ahead for certain households.

New Home Sales increased to 421,000 Annual Rate in August

by Calculated Risk on 9/25/2013 10:00:00 AM

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 421 thousand. This was up from 390 thousand SAAR in July (July sales were revised down from 394 thousand).

May sales were revised down from 439 thousand to 429 thousand, and June sales were revised down from 455 thousand to 454 thousand.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in August 2013 were at a seasonally adjusted annual rate of 421,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.9 percent above the revised July rate of 390,000 and is 12.6 percent above the August 2012 estimate of 374,000."

Click on graph for larger image in graph gallery.

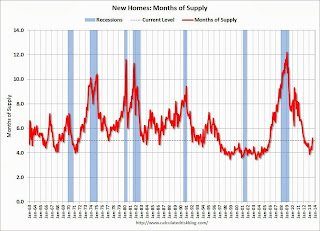

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply decreased in August to 5.0 months from 5.2 months in July.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of August was 175,000. This represents a supply of 5.0 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is near the record low. The combined total of completed and under construction is increasing, but still very low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In August 2013 (red column), 35 thousand new homes were sold (NSA). Last year 31 thousand homes were sold in August. The high for August was 110 thousand in 2005, and the low for August was 23 thousand in 2010.

This was slightly below expectations of 425,000 sales in August, and a weak report including the minor downward revisions to prior months. I'll have more later today.

MBA: Mortgage Applications Increase in Latest Weekly Survey, HARP Refinance Share Increases

by Calculated Risk on 9/25/2013 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 20, 2013....

The Refinance Index increased 5 percent from the previous week. The seasonally adjusted Purchase Index increased 7 percent from one week earlier. ... The Purchase Index was at its highest level since July 2013.

...

The HARP share of refinance applications increased to 41 percent from 40 percent the week before, and is the highest since MBA started tracking this measure in early 2012.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.62 percent from 4.75 percent, with points increasing to 0.41 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index increased partially because of more HARP refinance activity. I expect to see even more HARP activity soon. From Mortgage News Daily: HARP is a "No Brainer" -FHFA

Feeling that they may have reached only about half of the families who could benefit from the program, the Federal Housing Finance Agency (FHFA) launched a campaign today to inform homeowners about the Home Affordable Refinance Program (HARP). ...

Acting FHFA Director Edward J. DeMarco said that 2.8 million homeowners have refinanced through HARP but with mortgage rates still historically low and HARP eligibility requirements expanded, other qualified homeowners could reduce their monthly mortgage payments or build their equity faster with a shorter term mortgage through the program.

DeMarco told Bloomberg News in an interview this weekend that FHFA used focus groups to find out why borrowers with high rates hadn't yet tried to refinance through HARP. They found many didn't realize they were eligible. They thought they had to be delinquent on their mortgages before the government would help them. DeMarco said he hoped the educational outreach would bring in an additional 2 million HARP borrowers.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index was generally been trending up over the last year (but down over the last few months), and the 4-week average of the purchase index is at the highest level since July and up over 3% from a year ago.

Tuesday, September 24, 2013

Zillow: Case-Shiller House Price Index expected to show 12.4% year-over-year increase in August

by Calculated Risk on 9/24/2013 08:56:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Durable Goods Orders report for August will be released by the Census Bureau. The consensus is for a 0.5% decline in durable goods orders.

• At 10:00 AM, New Home Sales for August from the Census Bureau. The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 394 thousand in July. Based on the various reports, sales were probably weak again in August.

• At 12:00 PM, the Federal Reserve will release the Q2 Flow of Funds Accounts of the United States.

The Case-Shiller house price indexes for July were released yesterday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: August Case Shiller Indices Expected to Show Further Monthly Slowdowns

The Case-Shiller data for July came out this morning and, based on this information and the August 2013 Zillow Home Value Index (released yesterday), we predict that next month’s Case-Shiller data (August 2013) will show that both the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased 12.4 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from July to August will be 0.6 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for August will not be released until Tuesday, October 29.The following table shows the Zillow forecast for the August Case-Shiller index.

...

Both the Case-Shiller indices and the Zillow Home Value index are showing the first signs of moderation in home value appreciation. We are seeing slowing in month-over-month appreciation, although the Case-Shiller indices will continue to show an inflated picture of home prices. The Case-Shiller indices are biased toward the large, coastal metros currently seeing enormous home value gains, and they include foreclosure resales. The inclusion of foreclosure resales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed.

...

To forecast the Case-Shiller indices, we use the July Case-Shiller index level, as well as the August Zillow Home Value Index (ZHVI), which is available more than a month in advance of the Case-Shiller index, paired with July foreclosure resale numbers, which Zillow also publishes more than a month prior to the release of the Case-Shiller index. Together, these data points enable us to reliably forecast the Case-Shiller 10-City and 20-City Composite indices.

| Zillow August Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | August 2012 | 158.51 | 154.97 | 145.81 | 142.44 |

| Case-Shiller (last month) | July 2013 | 176.52 | 173.19 | 162.49 | 159.18 |

| Zillow Forecast | YoY | 12.4% | 12.4% | 12.4% | 12.4% |

| MoM | 0.9% | 0.6% | 0.8% | 0.6% | |

| Zillow Forecasts1 | 178.1 | 174.2 | 163.8 | 160.1 | |

| Current Post Bubble Low | 146.46 | 149.63 | 134.07 | 136.87 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 21.6% | 16.4% | 22.2% | 17.0% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Lawler on Home Builder Results: Rising Rates, Aggressive Price Increases Dampened Sales

by Calculated Risk on 9/24/2013 02:56:00 PM

From housing economist Tom Lawler:

Lennar Corporation reported that net home orders in the quarter ended August 31, 2013 totaled 4,785, up 14.0% from the comparable quarter of 2012, at an average net order price of about $316,750, up 16% from a year ago. Home deliveries totaled 4,990 last quarter, up 36.5% from the comparable quarter of 2012, at an average sales price of $291,000, up 12.8% from a year ago. Sales discounts as a % of purchase price averaged 6.0% last quarter, down from 9.2% in the comparable quarter of 2012. The company’s sales cancellation rate, expressed as a % of gross orders, was 18% last quarter, up from 18% from a year ago. The company’s order backlog at the end of August totaled 5,958, up 32.0% from last August.

KB Homes reported that net home orders totaled 1,736 in the quarter ended August 31, 2013, down 8.6% from the comparable quarter of 2012, at an average net order price of about $304,650, up 16% from a year ago. Home deliveries totaled 1,825 last quarter, up 6.1% from the comparable quarter of 2012, at an average sales price of $299,100, up 22.0% from a year ago. The company’s sales cancellation rate, expressed as a % of gross orders, was 33% last quarter, up 29% from a year ago. The company’s order backlog at the end of August totaled 3,039, down 3.3% from last August.

Here are some quarterly net orders numbers for three large builders (note: Hovnanian’s fiscal quarters end in April and July, but it shows monthly net orders numbers through August in its last presentation).

| Net Home Orders, 3 Months Ending: | ||||||

|---|---|---|---|---|---|---|

| 8/31/2013 | 8/31/2012 | % Change | 5/31/2013 | 5/31/2012 | % Change | |

| Lennar Corp. | 4,785 | 4,198 | 14.0% | 5,705 | 4,481 | 27.3% |

| KB Home | 1,736 | 1,900 | -8.6% | 2,162 | 2,049 | 5.5% |

| Hovnanian Ent. | 1,487 | 1,519 | -2.1% | 1,862 | 1,753 | 6.2% |

| Total | 8,008 | 7,617 | 5.1% | 9,729 | 8,283 | 17.5% |

Philly Fed: State Coincident Indexes increased in 40 states in August

by Calculated Risk on 9/24/2013 01:19:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for August 2013. In the past month, the indexes increased in 40 states, decreased in five states, and remained stable in five, for a one-month diffusion index of 70. Over the past three months, the indexes increased in 42 states, decreased in six, and remained stable in two, for a three-month diffusion index of 72.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In August, 45 states had increasing activity, the same as in June (including minor increases). This measure has been and up down over the last few years ...

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.There are several states with declining activity again.

Comment on House Prices: Real Prices, Price-to-Rent Ratio, Cities

by Calculated Risk on 9/24/2013 10:07:00 AM

The Case-Shiller index released this morning was for July, and it is actually a 3 month of average prices in May, June and July (when the market was really hot).

I think price increases have slowed recently based on agent reports (a combination of a little more inventory and higher mortgage rates), but this slowdown in price increases will not show up for several months in the Case-Shiller index because of the reporting lag and because of the three month average. I expect to see smaller year-over-year price increases going forward and some significant deceleration towards the end of the year.

I also think it is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation.

Earlier: Case-Shiller: Case-Shiller: Comp 20 House Prices increased 12.4% year-over-year in July

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through July) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through July) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q4 2003 levels (and also back up to Q4 2008), and the Case-Shiller Composite 20 Index (SA) is back to April 2004 levels, and the CoreLogic index (NSA) is back to September 2004.

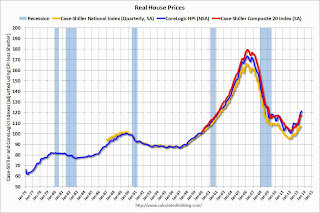

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 2000 levels, the Composite 20 index is back to November 2001, and the CoreLogic index back to May 2002.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 2000 levels, the Composite 20 index is back to May 2002 levels, and the CoreLogic index is back to February 2003.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 37% above January 2000.

These are nominal prices, and as I noted above real prices (adjusted for inflation) are up about 37% since January 2000 - so the increase in Phoenix from January 2000 until now is about the change in inflation.

Two cities - Denver (up 42% since Jan 2000) and Dallas (up 27% since Jan 2000) - are at new highs (no other Case-Shiller Comp 20 city is close). Denver is up slightly more than inflation over that period, and Dallas slightly less. Detroit prices are still below the January 2000 level.

Case-Shiller: Comp 20 House Prices increased 12.4% year-over-year in July

by Calculated Risk on 9/24/2013 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3 month average of May, June and July prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Steadily Rise in July 2013 According to the S&P/Case-Shiller Home Price Indices

Data through July 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed increases of 1.9% and 1.8% from June for the 10- and 20-City Composites. For at least four months in a row, all 20 cities showed monthly gains. Phoenix posted 22 consecutive months of positive returns. Although home prices in all the cities increased, 15 cities and both Composites saw these monthly rates decelerate in July versus June.

Over the last 12 months, prices rose 12.3% and 12.4% as measured by the 10- and 20-City Composites. ...

“Home prices gains are holding their 12% annual rate of gain established by the two Composite indices in April,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “The Southwest continues to lead the housing recovery. Las Vegas home prices are up 27.5% year-over-year; in California, San Francisco, Los Angeles and San Diego are up 24.8%, 20.8% and 20.4% respectively. However, all remain far below their peak levels.

“Since April 2013, all 20 cities are up month to month; however, the monthly rates of price gains have declined. More cities are experiencing slow gains each month than the previous month, suggesting that the rate of increase may have peaked."

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 23.7% from the peak, and up 0.7% in July (SA). The Composite 10 is up 15.7% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 23.0% from the peak, and up 0.6% (SA) in July. The Composite 20 is up 16.3% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 12.2% compared to July 2012.

The Composite 20 SA is up 12.4% compared to July 2012. This was the fourteenth consecutive month with a year-over-year gain and it appears the YoY change might be starting to slow.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in July seasonally adjusted. (20 of 20 increased NSA) Prices in Las Vegas are off 50.1% from the peak, and prices in Denver and Dallas are at new highs.

This was at the consensus forecast for a 12.4% YoY increase. I'll have more on prices later.

Monday, September 23, 2013

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg Survey

by Calculated Risk on 9/23/2013 09:31:00 PM

Annie Lowery writes at the NY Times: Shutdown vs. Default: The Relative Impact

At the moment, Congress is figuring out how to avoid two forms of chaos of its own making: a government shutdown and a public default.Lowery discussed the costs of both. Basically a shutdown will be inconvenient (for econbloggers because of the lack of data) and will probably cost a few billion dollars (dumb, but manageable). But failing to pay the bills could be very expensive:

The former might happen when the continuing resolution financing the federal government expires on Sept. 30. The latter might happen when the Treasury runs out of room under its statutory debt ceiling. That day — often called the X-date — is likely to come around Oct. 15.

There is no real comparison between the cost of a shutdown and the cost of a breach in the debt ceiling.Tuesday:

The two shutdowns of the Clinton years — a six-day shutdown in 1995 and a 21-day shutdown between 1995 and 1996 — cost about $1.4 billion. A more complete accounting suggests that is on the low side.

...

In contrast, a breach of the debt ceiling ... might cost hundreds of billions, perhaps more.

• 9:00 AM ET, the S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average for closings in May, June and July. The consensus is for a 12.4% year-over-year increase in the Composite 20 index (NSA).

• Also at 9:00 AM, the FHFA House Price Index for July 2013. The consensus is for a 0.7% increase.

• 10:00 AM, the Conference Board's consumer confidence index for September. The consensus is for the index to decrease to 80.0 from 81.5.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for September. The consensus is for a reading of 10.5 for this survey, down from 14 in August (Above zero is expansion).

Weekly Update: Existing Home Inventory is up 21.8% year-to-date on Sept 23rd

by Calculated Risk on 9/23/2013 05:25:00 PM

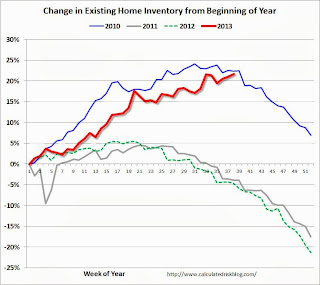

Here is another weekly update on housing inventory: One of key questions for 2013 is Will Housing inventory bottom this year? Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for August). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 21.8%. There might be some further increases over the next few weeks, but then inventory should start declining seasonally.

It is important to remember that inventory is still very low, and is down 2.7% from the same week last year according to Housing Tracker.

The second graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2012 and 2013.

Inventory in 2013 is still 2.7% below the same week in 2012, but the inventory level is getting close to last year.

Inventory in 2013 is still 2.7% below the same week in 2012, but the inventory level is getting close to last year.

This strongly suggests inventory bottomed early this year, and I expect inventory to be up year-over-year very soon, and I also expect the seasonal decline to be less than usual at the end of the year. This increase in inventory should slow house price increases.