by Calculated Risk on 9/24/2013 08:56:00 PM

Tuesday, September 24, 2013

Zillow: Case-Shiller House Price Index expected to show 12.4% year-over-year increase in August

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Durable Goods Orders report for August will be released by the Census Bureau. The consensus is for a 0.5% decline in durable goods orders.

• At 10:00 AM, New Home Sales for August from the Census Bureau. The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 394 thousand in July. Based on the various reports, sales were probably weak again in August.

• At 12:00 PM, the Federal Reserve will release the Q2 Flow of Funds Accounts of the United States.

The Case-Shiller house price indexes for July were released yesterday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: August Case Shiller Indices Expected to Show Further Monthly Slowdowns

The Case-Shiller data for July came out this morning and, based on this information and the August 2013 Zillow Home Value Index (released yesterday), we predict that next month’s Case-Shiller data (August 2013) will show that both the non-seasonally adjusted (NSA) 20-City Composite Home Price Index and the NSA 10-City Composite Home Price Index increased 12.4 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from July to August will be 0.6 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for August will not be released until Tuesday, October 29.The following table shows the Zillow forecast for the August Case-Shiller index.

...

Both the Case-Shiller indices and the Zillow Home Value index are showing the first signs of moderation in home value appreciation. We are seeing slowing in month-over-month appreciation, although the Case-Shiller indices will continue to show an inflated picture of home prices. The Case-Shiller indices are biased toward the large, coastal metros currently seeing enormous home value gains, and they include foreclosure resales. The inclusion of foreclosure resales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed.

...

To forecast the Case-Shiller indices, we use the July Case-Shiller index level, as well as the August Zillow Home Value Index (ZHVI), which is available more than a month in advance of the Case-Shiller index, paired with July foreclosure resale numbers, which Zillow also publishes more than a month prior to the release of the Case-Shiller index. Together, these data points enable us to reliably forecast the Case-Shiller 10-City and 20-City Composite indices.

| Zillow August Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | August 2012 | 158.51 | 154.97 | 145.81 | 142.44 |

| Case-Shiller (last month) | July 2013 | 176.52 | 173.19 | 162.49 | 159.18 |

| Zillow Forecast | YoY | 12.4% | 12.4% | 12.4% | 12.4% |

| MoM | 0.9% | 0.6% | 0.8% | 0.6% | |

| Zillow Forecasts1 | 178.1 | 174.2 | 163.8 | 160.1 | |

| Current Post Bubble Low | 146.46 | 149.63 | 134.07 | 136.87 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 21.6% | 16.4% | 22.2% | 17.0% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Lawler on Home Builder Results: Rising Rates, Aggressive Price Increases Dampened Sales

by Calculated Risk on 9/24/2013 02:56:00 PM

From housing economist Tom Lawler:

Lennar Corporation reported that net home orders in the quarter ended August 31, 2013 totaled 4,785, up 14.0% from the comparable quarter of 2012, at an average net order price of about $316,750, up 16% from a year ago. Home deliveries totaled 4,990 last quarter, up 36.5% from the comparable quarter of 2012, at an average sales price of $291,000, up 12.8% from a year ago. Sales discounts as a % of purchase price averaged 6.0% last quarter, down from 9.2% in the comparable quarter of 2012. The company’s sales cancellation rate, expressed as a % of gross orders, was 18% last quarter, up from 18% from a year ago. The company’s order backlog at the end of August totaled 5,958, up 32.0% from last August.

KB Homes reported that net home orders totaled 1,736 in the quarter ended August 31, 2013, down 8.6% from the comparable quarter of 2012, at an average net order price of about $304,650, up 16% from a year ago. Home deliveries totaled 1,825 last quarter, up 6.1% from the comparable quarter of 2012, at an average sales price of $299,100, up 22.0% from a year ago. The company’s sales cancellation rate, expressed as a % of gross orders, was 33% last quarter, up 29% from a year ago. The company’s order backlog at the end of August totaled 3,039, down 3.3% from last August.

Here are some quarterly net orders numbers for three large builders (note: Hovnanian’s fiscal quarters end in April and July, but it shows monthly net orders numbers through August in its last presentation).

| Net Home Orders, 3 Months Ending: | ||||||

|---|---|---|---|---|---|---|

| 8/31/2013 | 8/31/2012 | % Change | 5/31/2013 | 5/31/2012 | % Change | |

| Lennar Corp. | 4,785 | 4,198 | 14.0% | 5,705 | 4,481 | 27.3% |

| KB Home | 1,736 | 1,900 | -8.6% | 2,162 | 2,049 | 5.5% |

| Hovnanian Ent. | 1,487 | 1,519 | -2.1% | 1,862 | 1,753 | 6.2% |

| Total | 8,008 | 7,617 | 5.1% | 9,729 | 8,283 | 17.5% |

Philly Fed: State Coincident Indexes increased in 40 states in August

by Calculated Risk on 9/24/2013 01:19:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for August 2013. In the past month, the indexes increased in 40 states, decreased in five states, and remained stable in five, for a one-month diffusion index of 70. Over the past three months, the indexes increased in 42 states, decreased in six, and remained stable in two, for a three-month diffusion index of 72.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In August, 45 states had increasing activity, the same as in June (including minor increases). This measure has been and up down over the last few years ...

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green at times during the recovery.There are several states with declining activity again.

Comment on House Prices: Real Prices, Price-to-Rent Ratio, Cities

by Calculated Risk on 9/24/2013 10:07:00 AM

The Case-Shiller index released this morning was for July, and it is actually a 3 month of average prices in May, June and July (when the market was really hot).

I think price increases have slowed recently based on agent reports (a combination of a little more inventory and higher mortgage rates), but this slowdown in price increases will not show up for several months in the Case-Shiller index because of the reporting lag and because of the three month average. I expect to see smaller year-over-year price increases going forward and some significant deceleration towards the end of the year.

I also think it is important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation.

Earlier: Case-Shiller: Case-Shiller: Comp 20 House Prices increased 12.4% year-over-year in July

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through July) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through July) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q4 2003 levels (and also back up to Q4 2008), and the Case-Shiller Composite 20 Index (SA) is back to April 2004 levels, and the CoreLogic index (NSA) is back to September 2004.

Real House Prices

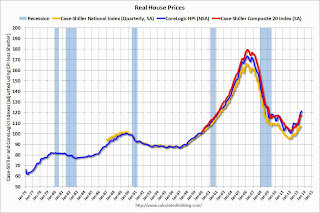

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 2000 levels, the Composite 20 index is back to November 2001, and the CoreLogic index back to May 2002.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 2000 levels, the Composite 20 index is back to May 2002 levels, and the CoreLogic index is back to February 2003.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 37% above January 2000.

These are nominal prices, and as I noted above real prices (adjusted for inflation) are up about 37% since January 2000 - so the increase in Phoenix from January 2000 until now is about the change in inflation.

Two cities - Denver (up 42% since Jan 2000) and Dallas (up 27% since Jan 2000) - are at new highs (no other Case-Shiller Comp 20 city is close). Denver is up slightly more than inflation over that period, and Dallas slightly less. Detroit prices are still below the January 2000 level.

Case-Shiller: Comp 20 House Prices increased 12.4% year-over-year in July

by Calculated Risk on 9/24/2013 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3 month average of May, June and July prices).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Steadily Rise in July 2013 According to the S&P/Case-Shiller Home Price Indices

Data through July 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed increases of 1.9% and 1.8% from June for the 10- and 20-City Composites. For at least four months in a row, all 20 cities showed monthly gains. Phoenix posted 22 consecutive months of positive returns. Although home prices in all the cities increased, 15 cities and both Composites saw these monthly rates decelerate in July versus June.

Over the last 12 months, prices rose 12.3% and 12.4% as measured by the 10- and 20-City Composites. ...

“Home prices gains are holding their 12% annual rate of gain established by the two Composite indices in April,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “The Southwest continues to lead the housing recovery. Las Vegas home prices are up 27.5% year-over-year; in California, San Francisco, Los Angeles and San Diego are up 24.8%, 20.8% and 20.4% respectively. However, all remain far below their peak levels.

“Since April 2013, all 20 cities are up month to month; however, the monthly rates of price gains have declined. More cities are experiencing slow gains each month than the previous month, suggesting that the rate of increase may have peaked."

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 23.7% from the peak, and up 0.7% in July (SA). The Composite 10 is up 15.7% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 23.0% from the peak, and up 0.6% (SA) in July. The Composite 20 is up 16.3% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 12.2% compared to July 2012.

The Composite 20 SA is up 12.4% compared to July 2012. This was the fourteenth consecutive month with a year-over-year gain and it appears the YoY change might be starting to slow.

Prices increased (SA) in 18 of the 20 Case-Shiller cities in July seasonally adjusted. (20 of 20 increased NSA) Prices in Las Vegas are off 50.1% from the peak, and prices in Denver and Dallas are at new highs.

This was at the consensus forecast for a 12.4% YoY increase. I'll have more on prices later.

Monday, September 23, 2013

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg Survey

by Calculated Risk on 9/23/2013 09:31:00 PM

Annie Lowery writes at the NY Times: Shutdown vs. Default: The Relative Impact

At the moment, Congress is figuring out how to avoid two forms of chaos of its own making: a government shutdown and a public default.Lowery discussed the costs of both. Basically a shutdown will be inconvenient (for econbloggers because of the lack of data) and will probably cost a few billion dollars (dumb, but manageable). But failing to pay the bills could be very expensive:

The former might happen when the continuing resolution financing the federal government expires on Sept. 30. The latter might happen when the Treasury runs out of room under its statutory debt ceiling. That day — often called the X-date — is likely to come around Oct. 15.

There is no real comparison between the cost of a shutdown and the cost of a breach in the debt ceiling.Tuesday:

The two shutdowns of the Clinton years — a six-day shutdown in 1995 and a 21-day shutdown between 1995 and 1996 — cost about $1.4 billion. A more complete accounting suggests that is on the low side.

...

In contrast, a breach of the debt ceiling ... might cost hundreds of billions, perhaps more.

• 9:00 AM ET, the S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average for closings in May, June and July. The consensus is for a 12.4% year-over-year increase in the Composite 20 index (NSA).

• Also at 9:00 AM, the FHFA House Price Index for July 2013. The consensus is for a 0.7% increase.

• 10:00 AM, the Conference Board's consumer confidence index for September. The consensus is for the index to decrease to 80.0 from 81.5.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for September. The consensus is for a reading of 10.5 for this survey, down from 14 in August (Above zero is expansion).

Weekly Update: Existing Home Inventory is up 21.8% year-to-date on Sept 23rd

by Calculated Risk on 9/23/2013 05:25:00 PM

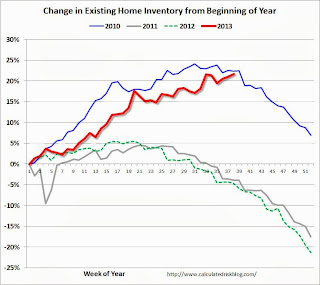

Here is another weekly update on housing inventory: One of key questions for 2013 is Will Housing inventory bottom this year? Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for August). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 21.8%. There might be some further increases over the next few weeks, but then inventory should start declining seasonally.

It is important to remember that inventory is still very low, and is down 2.7% from the same week last year according to Housing Tracker.

The second graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2012 and 2013.

Inventory in 2013 is still 2.7% below the same week in 2012, but the inventory level is getting close to last year.

Inventory in 2013 is still 2.7% below the same week in 2012, but the inventory level is getting close to last year.

This strongly suggests inventory bottomed early this year, and I expect inventory to be up year-over-year very soon, and I also expect the seasonal decline to be less than usual at the end of the year. This increase in inventory should slow house price increases.

Lawler: Video of How CoreLogic and Zillow House Price Indexes are Constructed

by Calculated Risk on 9/23/2013 03:33:00 PM

From economist Tom Lawler:

Zillow reported that its “National” Home Value Index for August was up 0.4% from July, and was up 6.6% from last August. Zillow’s HVI is a “hedonic” index, regional and national HVIs are median home value measures (or unit-weighted by the housing stock for which Zillow has “Zestimate”), “monthly” HVIs are three-month moving averages, and the HVIs are seasonally adjusted. Zillow also does not use foreclosure resales in constructing its HVIs.

CR Note: Here is the Zillow release: U.S. Home Values Continue to Surge in August; Pace Expected to Slow as Summer Season Ends

Home values continued their rapid rise in August, climbing 6.6 percent year-over-year to a Zillow Home Value Index of $162,100, the largest annual gain since July 2006. However, signs are emerging that the pace of home value appreciation is beginning to slow in the face of rising mortgage interest rates and increased supply.Of the 382 metro areas for which Zillow releases a HVI to the public, 324 showed a YOY increase in August.

National home values have risen or remained flat month-over-month for almost two years, but August marked the third consecutive month in which monthly home values rose more slowly than the month prior. After the pace of monthly home value appreciation peaked for the year at 0.9 percent in May, monthly home value growth slowed to 0.7 percent in June, 0.6 percent in July and 0.4 percent in August.

Recently Mark Fleming of CoreLogic and Stan Humphries of Zillow gave presentations on each firm’s home price indexes at a “Lunchtime Data Talk” (“Home Price Indexes: Appreciating the Differences”) at the Urban Institute. The presentation covered index construction, as well as the main differences between a hedonic imputation index, like the Zillow Home Value Index, and a repeat sales index, like the CoreLogic Home Price Index, and slides are available here. A video of the presentation is available here.

Video streaming by Ustream

DOT: Vehicle Miles Driven increased 1.6% in July

by Calculated Risk on 9/23/2013 01:37:00 PM

The Department of Transportation (DOT) reported:

◦ Travel on all roads and streets changed by 1.6% (4.2 billion vehicle miles) for July 2013 as compared with July 2012The following graph shows the rolling 12 month total vehicle miles driven.

◦ Travel for the month is estimated to be 263.6 billion vehicle miles.

◦ Cumulative Travel for 2013 changed by 0.2% (2.7 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 68 months - over 5 1/2 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in July compared to July 2012. In July 2013, gasoline averaged of $3.66 per gallon according to the EIA. In 2012, prices in July averaged $3.50 per gallon. Even with higher gasoline prices, vehicle miles were up in July.

Gasoline prices were up in July compared to July 2012. In July 2013, gasoline averaged of $3.66 per gallon according to the EIA. In 2012, prices in July averaged $3.50 per gallon. Even with higher gasoline prices, vehicle miles were up in July.Gasoline prices were down year-over-year in August, so I expect miles driven to be up in August too.

As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5+ years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven.

NY Fed's Dudley: Two Tests Before Taper

by Calculated Risk on 9/23/2013 10:55:00 AM

From NY Fed President William Dudley: Reflections on the Economic Outlook and the Implications for Monetary Policy

To begin to taper, I have two tests that must be passed: (1) evidence that the labor market has shown improvement, and (2) information about the economy’s forward momentum that makes me confident that labor market improvement will continue in the future. So far, I think we have made progress with respect to these metrics, but have not yet achieved success.On the first metric, clearly Dudley puts significant emphasis on the JOLTS report in addition to the employment report. On the second metric, Congress has to do their job (pay the bills, fund the government) before Dudley would be willing to start to taper.

With respect to the first metric, we have seen labor market improvement since the program began last September. Over this time period, the unemployment rate has declined to 7.3 percent from 8.1 percent. However, at the same time, this decline in the unemployment rate overstates the degree of improvement. Other metrics of labor market conditions, such as the hiring, job-openings, job-finding rate, quits rate and the vacancy-to-unemployment ratio, collectively indicate a much more modest improvement in labor market conditions compared to that suggested by the decline in the unemployment rate. In particular, it is still hard for those who are unemployed to find jobs. Currently, there are three unemployed workers per job opening, as opposed to an average of two during the period from 2003 to 2007.

With respect to the second metric—confidence that the economic recovery is strong enough to generate sustained labor market improvement—I don’t think we have yet passed that test. The economy has not picked up forward momentum and a 2 percent growth rate—even if sustained—might not be sufficient to generate further improvement in labor market conditions. Moreover, fiscal uncertainties loom very large right now as Congress considers the issues of funding the government and raising the debt limit ceiling. Assuming no change in my assessment of the efficacy and costs associated with the purchase program, I’d like to see economic news that makes me more confident that we will see continued improvement in the labor market. Then I would feel comfortable that the time had come to cut the pace of asset purchases.

emphasis added