by Calculated Risk on 9/23/2013 03:33:00 PM

Monday, September 23, 2013

Lawler: Video of How CoreLogic and Zillow House Price Indexes are Constructed

From economist Tom Lawler:

Zillow reported that its “National” Home Value Index for August was up 0.4% from July, and was up 6.6% from last August. Zillow’s HVI is a “hedonic” index, regional and national HVIs are median home value measures (or unit-weighted by the housing stock for which Zillow has “Zestimate”), “monthly” HVIs are three-month moving averages, and the HVIs are seasonally adjusted. Zillow also does not use foreclosure resales in constructing its HVIs.

CR Note: Here is the Zillow release: U.S. Home Values Continue to Surge in August; Pace Expected to Slow as Summer Season Ends

Home values continued their rapid rise in August, climbing 6.6 percent year-over-year to a Zillow Home Value Index of $162,100, the largest annual gain since July 2006. However, signs are emerging that the pace of home value appreciation is beginning to slow in the face of rising mortgage interest rates and increased supply.Of the 382 metro areas for which Zillow releases a HVI to the public, 324 showed a YOY increase in August.

National home values have risen or remained flat month-over-month for almost two years, but August marked the third consecutive month in which monthly home values rose more slowly than the month prior. After the pace of monthly home value appreciation peaked for the year at 0.9 percent in May, monthly home value growth slowed to 0.7 percent in June, 0.6 percent in July and 0.4 percent in August.

Recently Mark Fleming of CoreLogic and Stan Humphries of Zillow gave presentations on each firm’s home price indexes at a “Lunchtime Data Talk” (“Home Price Indexes: Appreciating the Differences”) at the Urban Institute. The presentation covered index construction, as well as the main differences between a hedonic imputation index, like the Zillow Home Value Index, and a repeat sales index, like the CoreLogic Home Price Index, and slides are available here. A video of the presentation is available here.

Video streaming by Ustream

DOT: Vehicle Miles Driven increased 1.6% in July

by Calculated Risk on 9/23/2013 01:37:00 PM

The Department of Transportation (DOT) reported:

◦ Travel on all roads and streets changed by 1.6% (4.2 billion vehicle miles) for July 2013 as compared with July 2012The following graph shows the rolling 12 month total vehicle miles driven.

◦ Travel for the month is estimated to be 263.6 billion vehicle miles.

◦ Cumulative Travel for 2013 changed by 0.2% (2.7 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 68 months - over 5 1/2 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in July compared to July 2012. In July 2013, gasoline averaged of $3.66 per gallon according to the EIA. In 2012, prices in July averaged $3.50 per gallon. Even with higher gasoline prices, vehicle miles were up in July.

Gasoline prices were up in July compared to July 2012. In July 2013, gasoline averaged of $3.66 per gallon according to the EIA. In 2012, prices in July averaged $3.50 per gallon. Even with higher gasoline prices, vehicle miles were up in July.Gasoline prices were down year-over-year in August, so I expect miles driven to be up in August too.

As we've discussed, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5+ years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven.

NY Fed's Dudley: Two Tests Before Taper

by Calculated Risk on 9/23/2013 10:55:00 AM

From NY Fed President William Dudley: Reflections on the Economic Outlook and the Implications for Monetary Policy

To begin to taper, I have two tests that must be passed: (1) evidence that the labor market has shown improvement, and (2) information about the economy’s forward momentum that makes me confident that labor market improvement will continue in the future. So far, I think we have made progress with respect to these metrics, but have not yet achieved success.On the first metric, clearly Dudley puts significant emphasis on the JOLTS report in addition to the employment report. On the second metric, Congress has to do their job (pay the bills, fund the government) before Dudley would be willing to start to taper.

With respect to the first metric, we have seen labor market improvement since the program began last September. Over this time period, the unemployment rate has declined to 7.3 percent from 8.1 percent. However, at the same time, this decline in the unemployment rate overstates the degree of improvement. Other metrics of labor market conditions, such as the hiring, job-openings, job-finding rate, quits rate and the vacancy-to-unemployment ratio, collectively indicate a much more modest improvement in labor market conditions compared to that suggested by the decline in the unemployment rate. In particular, it is still hard for those who are unemployed to find jobs. Currently, there are three unemployed workers per job opening, as opposed to an average of two during the period from 2003 to 2007.

With respect to the second metric—confidence that the economic recovery is strong enough to generate sustained labor market improvement—I don’t think we have yet passed that test. The economy has not picked up forward momentum and a 2 percent growth rate—even if sustained—might not be sufficient to generate further improvement in labor market conditions. Moreover, fiscal uncertainties loom very large right now as Congress considers the issues of funding the government and raising the debt limit ceiling. Assuming no change in my assessment of the efficacy and costs associated with the purchase program, I’d like to see economic news that makes me more confident that we will see continued improvement in the labor market. Then I would feel comfortable that the time had come to cut the pace of asset purchases.

emphasis added

LPS: House Price Index increased 0.6% in July, Up 8.7% year-over-year

by Calculated Risk on 9/23/2013 10:16:00 AM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FHFA, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses June closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: LPS Home Price Index Report: July Transactions, U.S. Home Prices Up 0.6 Percent for the Month; Up 8.7 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on July 2013 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 14.7% from the peak in June 2006. Note: The press release has data for the 20 largest states, and 40 MSAs. LPS shows prices off 46.1% from the peak in Las Vegas, off 38.8% in Orlando, and 36.7% off from the peak in Riverside-San Bernardino, CA (Inland Empire). Prices were at new peaks in Austin, Dallas, Denver, Houston and San Antonio.

Note: Case-Shiller for July will be released tomorrow.

Chicago Fed: "Economic Growth Picked Up in August"

by Calculated Risk on 9/23/2013 08:30:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Growth Picked Up in August

The Chicago Fed National Activity Index (CFNAI) increased to +0.14 in August from –0.43 in July.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased to –0.18 in August from –0.24 in July, marking its sixth consecutive reading below zero. August’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in August (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, September 22, 2013

Sunday Night Futures

by Calculated Risk on 9/22/2013 09:59:00 PM

From Jon Hilsenrath at the WSJ: Yellen Would Bring Tougher Tone to Fed

Janet Yellen, the lead candidate to succeed Federal Reserve Chairman Ben Bernanke, brings a demanding and harder-driving leadership style to the central bank, in contrast to Mr. Bernanke's low-key and often understated approach.I believe Yellen will be an excellent Fed Chair.

Ms. Yellen, the Fed vice chairwoman, is highly regarded by many central bank staff members, who call her an effective leader with a sharp mind. But she has clashed with others and left some hard feelings in the wake of those confrontations, according to interviews with more than a dozen current and former staff members and officials who worked with her directly in recent years.

Most agree that Ms. Yellen—who has climbed the ranks from Fed researcher to Fed governor and regional Fed bank president, in between stints outside the central bank—is exacting and exceptionally detail-oriented.

Monday:

• 8:30 AM ET, the Chicago Fed National Activity Index for August. This is a composite index of other data.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash for September. The consensus is for an increase to 54.0 from 53.9 in August.

Weekend:

• Schedule for Week of September 22nd

• Preliminary annual Employment benchmark revision to be released Thursday

The Nikkei is down about 0.2%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are flat and DOW futures are up slightly (fair value).

Oil prices are mostly unchanged with WTI futures at $104.59 per barrel and Brent at $109.02 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are below $3.50 per gallon again. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Preliminary annual Employment benchmark revision to be released Thursday

by Calculated Risk on 9/22/2013 02:20:00 PM

On Thursday the BLS will release the preliminary annual Benchmark Revision for the Current Employment Statistics. The final revision will be published next February when the January 2012 employment report is released. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

Each year, the Current Employment Statistics (CES) survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. On September 26, 2013 at 10:00 a.m. the Bureau of Labor Statistics (BLS) will release the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series.With the release of the final benchmark estimate in February, total payroll employment in March 2013 will changed by the amount of the revision. The number is then "wedged back" to the previous revision (March 2012).

For details on the benchmark revision process, see from the BLS Benchmark Article.

The following table shows the benchmark revisions since 1979. The BLS employment estimate tends to miss turning points - as an example the benchmark revisions were down in 2007 through 2010, and have been up for the last two years. We see a similar pattern for previous recessions (like in the early '80s and early '90s). My guess is the revision will be small this year.

A few months ago Josh Lehner looked at state level data and he thinks the revision will be positive again this year. Although he thinks the revision for government employees may be larger than normal due to the sequester. According to MarketWatch, economists at BNP Paribas expect a negative revision.

| Year | Percent benchmark revision | Benchmark revision (in thousands) |

|---|---|---|

| 1979 | 0.5 | 447 |

| 1980 | -0.1 | -63 |

| 1981 | -0.4 | -349 |

| 1982 | -0.1 | -113 |

| 1983 | * | 36 |

| 1984 | 0.4 | 353 |

| 1985 | * | -3 |

| 1986 | -0.5 | -467 |

| 1987 | * | -35 |

| 1988 | -0.3 | -326 |

| 1989 | * | 47 |

| 1990 | -0.2 | -229 |

| 1991 | -0.6 | -640 |

| 1992 | -0.1 | -59 |

| 1993 | 0.2 | 263 |

| 1994 | 0.7 | 747 |

| 1995 | 0.5 | 542 |

| 1996 | * | 57 |

| 1997 | 0.4 | 431 |

| 1998 | * | 44 |

| 1999 | 0.2 | 258 |

| 2000 | 0.4 | 468 |

| 2001 | -0.1 | -123 |

| 2002 | -0.2 | -313 |

| 2003 | -0.2 | -122 |

| 2004 | 0.2 | 203 |

| 2005 | -0.1 | -158 |

| 2006 | 0.6 | 752 |

| 2007 | -0.2 | -293 |

| 2008 | -0.1 | -89 |

| 2009 | -0.7 | -902 |

| 2010 | -0.3 | -378 |

| 2011 | 0.1 | 162 |

| 2012 | 0.3 | 424 |

| 2013 | NA | NA |

| * less than 0.05% | ||

Mortgages, Eminent domain and Richmond

by Calculated Risk on 9/22/2013 10:21:00 AM

I was hoping to avoid writing about this dumb idea, but readers keep asking ...

Mike Konczal writes in the WaPo: Is Richmond’s mortgage seizure scheme even legal?

The short answer is No (Although Konczal apparently disagrees).

There are some confusing passages in Konczal's piece. The key issue is if there is a public interest for the city of Richmond to use eminent domain. Konczal writes:

It is very likely Richmond will argue that preventing blight is a major, legitimate public purpose, and the courts agree. Abandoned homes result in increased crime and significant public costs, in addition to destabilizing neighborhoods. ... The banks argue that the loans are performing (more on their argument about this in a minute), and as such don’t serve a public purpose. But there’s also a public purpose in solving problems in the coordination of mortgage servicers to writedown and deal with failing mortgages. There’s also the public purpose of allowing people to move as well as refinance allowing for the movement of individuals as well as the ability to refinance. These are all legitimate purposes of eminent domain ...First, blight is a legitimate issue for eminent domain, but blight doesn't apply in the Richmond case. Most of these homes are owner occupied and the owners are current on their mortgages. The "abandoned homes" is mostly irrelevant in this case (there might be a few abandoned). Drive down any street in Richmond with one of the houses in question, and there is no evidence of "blight". Note: For any house that is not maintained, the city has alternatives to eminent domain - so we can rule this one out.

Konczal also writes "there’s also a public purpose in solving problems in the coordination of mortgage servicers to writedown and deal with failing mortgages". But once again, most of these loans are current and the mortgages are not "failing". (I don't buy the public interest argument for a city with coordination).

Konczal also writes: "There’s also the public purpose of allowing people to move as well as refinance allowing for the movement of individuals as well as the ability to refinance." A public purpose in "allowing people to move"? Clearly Konczal is suggesting that someone underwater on their mortgage will have difficulty moving for employment. That may be true - they may have to lose their home in foreclosure or do a short sale to move from say Richmond to Texas - but helping someone move might be in the national public interest, but not in the interest of the city of Richmond. And a public purpose to "refinance"? That is a stretch.

Also even if there is a little public interest, most of the benefits accrue to individual homeowners - and that violates the spirit of eminent domain.

I think there is no clearly stated public purpose for using eminent domain. And this is how I expect the courts to rule.

Konczal writes about valuation.

One way to evaluate these mortgages would be to compare them to bonds of mortgages containing similar instruments and see what discount is used. Given the still high levels of foreclosures, this would generate a significant discount. This is a common technique to evaluate risk and valuations when markets aren’t available, say for understanding the credit risk of a brand new company, as they aren’t in high foreclosure areas.I won't discuss the difference between the mortgage and the promissory note, but the first key here is that the valuation is for the note, not the underlying property.

The banks also argue that the fact that a majority of homeowners are current on their loans means that they aren’t relevant to either public purpose or subject to a steep discount.

Pop quiz: Say someone with excellent credit buys a new car for $30,000 with 100% financing. They drive the car home, and the car is now "used" and only worth $25,000 (I'm making up numbers for this example). What is the value of the note (the loan)? Of course the value is $30,000 even though the car is now only worth $25,000.

The same idea applies to loans on houses. If the outstanding principal balance is $400,000, but the house is only worth $250,000, the starting point for the value of the note is $400,000. As Konczal writes the value could be discounted because of the possibility of foreclosure, but these loans are current and well seasoned (the borrowers have been paying for eight years or so). The value might be less than $400,000, but the value is clearly more than $250,000 - so the scheme doesn't work since the intention is to "seize the mortgage" and refinance at less than the current property value - but that will be far below fair value for the note.

The bottom line is I expect the courts to rule against this scheme (little or no public interest) - and it wouldn't work anyway (can't pay fair value).

Saturday, September 21, 2013

Schedule for Week of September 22nd

by Calculated Risk on 9/21/2013 11:47:00 AM

The key reports this week are August New Home sales on Wednesday, Case-Shiller house prices for July on Tuesday, the third estimate of Q2 GDP on Thursday, and the August Personal Income and Outlays report on Friday.

Also the Fed will release the Q2 Flow of Funds report this week, and the Pending Home Sales index for August might show a sharp decline.

For manufacturing, the Richmond and Kansas City regional manufacturing surveys for September will be released this week.

Note: My guess is Janet Yellen will be nominated as Fed Chair this week, perhaps on Monday.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

9:00 AM: The Markit US PMI Manufacturing Index Flash for September. The consensus is for an increase to 54.0 from 53.9 in August.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average for closings in May, June and July.

9:00 AM: S&P/Case-Shiller House Price Index for July. Although this is the July report, it is really a 3 month average for closings in May, June and July. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through June 2012 (the Composite 20 was started in January 2000).

The consensus is for a 12.4% year-over-year increase in the Composite 20 index (NSA). The Zillow forecast is for the Composite 20 to increase 12.5% year-over-year, and for prices to increase 1.2% month-to-month seasonally adjusted.

9:00 AM: FHFA House Price Index for July 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase.

10:00 AM: Conference Board's consumer confidence index for September. The consensus is for the index to decrease to 80.0 from 81.5.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for September. The consensus is for a reading of 10.5 for this survey, down from 14 in August (Above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 0.5% decline in durable goods orders.

10:00 AM: New Home Sales for August from the Census Bureau.

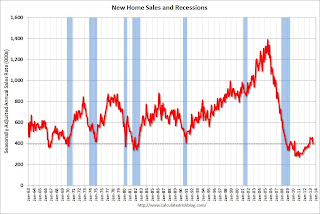

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 394 thousand in July. Based on the various reports, sales were probably weak again in August.

12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 330 thousand from 309 thousand last week.

8:30 AM: Q2 GDP (third estimate). This is the second estimate of Q2 GDP from the BEA. The consensus is that real GDP increased 2.6% annualized in Q2, revised up from the second estimate of 2.5% in Q2.

10:00 AM ET: Pending Home Sales Index for August. The consensus is for a 1.0% decrease in the index. Economist Tom Lawler is estimating the NAR will report a decline of "about 5%" in this index.

10:00 AM: 2013 Current Employment Statistics (CES) Preliminary Benchmark Revision. From the BLS: "[T]he Current Employment Statistics (CES) survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. ... The final benchmark revision will be issued with the publication of the January 2014 Employment Situation news release in February."

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for August. The consensus is for a reading of 9 for this survey, up from 8 in August (Above zero is expansion).

8:30 AM ET: Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 78.0, up from the preliminary reading of 76.8, but down from the August reading of 82.1.

Unofficial Problem Bank list declines to 692 Institutions

by Calculated Risk on 9/21/2013 09:33:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for September 20, 2013.

Changes and comments from surferdude808:

As anticipated, the OCC released its actions through mid-August this week, which led to many changes to the Unofficial Problem Bank List. In all, there were nine removals and one addition that leave the list with 692 institutions and assets of $242.9 billion. It is the first time the list has under 700 institutions since April 2010. A year ago, the list held 878 institutions with assets of $327.4 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. Less than two years later the list peaked at 1,002 institutions. Now, more than two years after the peak, the list is down to 692 (the list increased faster than it is decreasing - but it is steadily decreasing as regulators terminate actions and close a few banks).

Bank of St. Augustine, Saint Augustine, FL ($164 million), found its way off the list by finding a merger partner. Actions were terminated against Far East National Bank, Los Angeles, CA ($1.2 billion); First Community Bank, Santa Rosa, CA ($678 million); CBC National Bank, Fernandina Beach, FL ($399 million); MidSouth Bank, N. A., Dothan, AL ($372 million); First National Bank South, Alma, GA ($309 million); The Camden National Bank, Camden, AL ($110 million); Peoples Community National Bank, Bremen , GA ($73 million); and The National Bank of Harvey, Harvey, ND ($46 million). The banking regulators have picked-up the pace on action terminations this quarter, which are now above any prior quarter in total or removal rate since publication of the first list in 2009. More info will be included in an updated transition matrix next week.

The First National Bank of Russell Springs, Russell Springs, KY ($192 million) was added to the list this week.

Next week, we anticipate the FDIC will release its enforcement action activity through August 2013. There is nothing new to report on the status of banks controlled by Capitol Bancorp, Ltd.