by Calculated Risk on 9/05/2013 06:55:00 PM

Thursday, September 05, 2013

The Deregulators, Smarts and Judgment

Quiz: who said what (two different people):

1) “Let me be clear, it is the private sector, not the public sector, that is in the best position to provide effective supervision. Counterparties and creditors have more knowledge of their counterparts, more skill in evaluating risk and greater incentives than any public regulator will ever have.”

2) "As we move into a new century, the market-stabilizing private regulatory forces should gradually displace many cumbersome, increasingly ineffective government structures."

Hint: One person partially apologized in 2008: “Those of us who have looked to the self-interest of lending institutions to protect shareholders’ equity, myself included, are in a state of shocked disbelief."

Of course the 2nd quote from April 1997 - and the admission of error in 2008 - is former Fed Chairman Alan Greenspan.

The first quote is from then Treasury Secretary Larry Summers in March 2000.

I'm posting this as a response to all the recent articles about Larry Summers. Every articles says he is "smart". But intelligence is only part of the puzzle. Since we never have complete information, or foreknowledge of what will happen, we frequently have to make decisions on partial information (use our best judgment).

Summers is obviously smart, but I wonder about his judgment. I could post many examples of judgment errors - from putting too much confidence in "Counterparties and creditors", to ignoring Brooksley Born, to calling Raghuram Rajan a "luddite" in 2005 for correctly pointing out potential "severe adverse consequences" of the financial system, to the housing tax credit (that I vigorously opposed), to the ludicrous "Summer of recovery" campaign in 2010 (when many of us were arguing the recovery would be sluggish), to the pivot to austerity ... and on and on.

I think articles should discuss both "smarts" and judgment.

And Zachary Goldfarb at the WaPo points out another issue; the lack of discipline when speaking:

If he’s appointed Fed chairman, Summers will probably have to bite his tongue a lot more than usual, both internally and externally. The words of a Fed chairman can create or cost millions of jobs and send markets up and down. A quieter Summers would ... be crucial if Summers doesn’t want the controversies that have followed him over the past decade to undermine his leadership at the Fed.Like Goldfarb, I'm concerned about Summers' speaking discipline. It is important for a Fed Chairman to stick to their talking points, and limit their comments to the responsibilities of the Federal Reserve (Greenspan was terrible about this, overall Bernanke was very disciplined).

Employment Situation Preview

by Calculated Risk on 9/05/2013 02:49:00 PM

Tomorrow (Friday), at 8:30 AM ET, the BLS will release the employment report for August. The consensus is for an increase of 175,000 non-farm payroll jobs in August, and for the unemployment rate to be unchanged at 7.4%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 176,000 private sector payroll jobs in August. This was close to expectations of 177,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. But in general, this suggests employment growth in line with expectations.

• The ISM manufacturing employment index decreased in August to 53.3% from 54.4% in July. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs were mostly unchanged in August. The ADP report indicated a 5,000 increase for manufacturing jobs in August.

The ISM non-manufacturing employment index increased in August to 57.0% from 53.2% in July. A historical correlation between the ISM non-manufacturing index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing increased by about 260,000 in August.

Taken together, these surveys suggest around 260,000 jobs added in August - well above the consensus forecast.

• Initial weekly unemployment claims averaged close to 330,000 in August. This was down from an average of 342,000 in July, and at the lowest level since the recession started in December 2007.

For the BLS reference week (includes the 12th of the month), initial claims were at 337,000; about the same as in July.

• The final August Reuters / University of Michigan consumer sentiment index decreased to 82.1 from the July reading of 85.1. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors.

• The small business index from Intuit showed a slight decrease in small business employment in August.

• And on the unemployment rate from Gallup: Gallup's seasonally adjusted U.S. unemployment rate for August was 8.6%, up from 7.4% in July

Gallup's unadjusted unemployment rate for the U.S. workforce was 8.7% in August, up from 7.8% in July and from 8.1% in August 2012. Similar to P2P, unemployment fluctuates seasonally, and the year-over-year change is the most informative comparison. The uptick in unemployment this August compared with August of last year is the first year-over-year increase since Gallup was able to begin tracking yearly changes in 2011.Oh my, 8.6%? I have very little confidence in the Gallup survey as far as predicting the BLS reported unemployment rate, and I will probably stop looking at their results going forward (unless the unemployment rate increases significantly in August!).

Gallup's seasonally adjusted U.S. unemployment rate for August was 8.6%, up from 7.4% in July. Gallup calculates this rate by applying the adjustment factor the government used for the same month in the previous year. Last year, the government adjusted August's rate down by 0.1 points, but adjusted July's down by 0.4 points, which partly accounts for the increase in seasonally adjusted unemployment.

• Conclusion: The data was mixed. The ADP report was a little lower in August than in July, however the ISM surveys suggest a significant increase in hiring. Weekly claims for the reference week were about the same in August as in July, and consumer sentiment decreased slightly.

There is always some randomness to the employment report - and there are reasons for optimism (ISM surveys, decline in unemployment claims) so maybe we will see an upside surprise - but my guess is the BLS will report close to the consensus of 175,000 jobs added in August. It will be important to look at payroll revisions and the unemployment rate (the Gallup number seems way off). This is an especially important report because this is the last major data point before the September FOMC meeting.

Trulia: "Asking home prices rose 11.0 percent year-over-year (Y-o-Y) and 1.2 percent month-over-month (M-o-M) in August"

by Calculated Risk on 9/05/2013 11:59:00 AM

This was released earlier today: Asking home prices rose 11.0 percent year-over-year (Y-o-Y) and 1.2 percent month-over-month (M-o-M) in August

Asking home prices rose 11.0 percent year-over-year (Y-o-Y) and 1.2 percent month-over-month (M-o-M) in August. However, a closer look at the quarterly changes in asking home prices reveals a downward trend that’s much less volatile than the monthly changes suggest. Quarter-over-quarter (Q-o-Q), asking home prices rose 3.1 percent in August, down from 3.2 percent in July and 4.0 percent in April. And this downward slope will likely continue as mortgage rates rise, inventory expands, and investor interest declines.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis (but the year-over-year increases will probably slow).

...

Rents rose 3.5 percent Y-o-Y nationally, jumping 3.9 percent on apartment units and only 1.6 percent on single-family homes. Among the 25 largest U.S. rental markets, rents increased the most in Seattle, Portland, and Miami, while declining slightly in Philadelphia, Washington, and Sacramento. Looking at single-family homes only, rents fell Y-o-Y in 6 of the 25 largest rental markets, including investor favorites such as Las Vegas, Phoenix, and Atlanta. ...

“The rate spike since early May has raised the cost of a mortgage by more than 10 percent, but rising rates aren’t the whole story behind the price slowdown,” said Jed Kolko, Trulia’s Chief Economist. “Expanding inventory and declining investor interest have helped cool prices, too. At the same time, mortgage credit has finally started to expand, and the economy continues to strengthen – both of which boost housing demand and offset some of the dampening effect of rising rates.”

emphasis added

More from Kolko: Most Price-Boomtown Markets are Still Far From Fully Recovered

ISM Non-Manufacturing Index at 58.6 indicates faster expansion in August

by Calculated Risk on 9/05/2013 10:00:00 AM

The August ISM Non-manufacturing index was at 58.6%, up from 56.0% in July. The employment index increased in August to 57.0%, up from 53.2% in July. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: August 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 44th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 58.6 percent in August, 2.6 percentage points higher than the 56 percent registered in July. This indicates continued growth at a faster rate in the non-manufacturing sector. This month's NMI™ is the highest reading for the index since its inception in January 2008. The Non-Manufacturing Business Activity Index increased to 62.2 percent, which is 1.8 percentage points higher than the 60.4 percent reported in July, reflecting growth for the 49th consecutive month. The New Orders Index increased by 2.8 percentage points to 60.5 percent, and the Employment Index increased 3.8 percentage points to 57 percent, indicating growth in employment for the 13th consecutive month. The Prices Index decreased 6.7 percentage points to 53.4 percent, indicating prices increased at a significantly slower rate in August when compared to July. According to the NMI™, 16 non-manufacturing industries reported growth in August. The majority of respondents' comments continue to be mostly positive about business conditions and the direction of the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 55.0% and indicates faster expansion in August than in July. A very strong survey.

Weekly Initial Unemployment Claims decline to 323,000

by Calculated Risk on 9/05/2013 08:30:00 AM

The DOL reports:

In the week ending August 31, the advance figure for seasonally adjusted initial claims was 323,000, a decrease of 9,000 from the previous week's revised figure of 332,000. The 4-week moving average was 328,500, a decrease of 3,000 from the previous week's revised average of 331,500.

The previous week was revised up from 331,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 330,500.

The 4-week average is at the lowest level since October 2007 (before the recession started). Claims were below the 330,000 consensus forecast.

Here is a long term graph of the 4-week average of weekly unemployment claims back to 1971.

Here is a long term graph of the 4-week average of weekly unemployment claims back to 1971.

ADP: Private Employment increased 176,000 in August

by Calculated Risk on 9/05/2013 08:18:00 AM

Private sector employment increased by 176,000 jobs from July to August, according to the August ADP National Employment Report®. ... July’s job gain was revised down slightly from 200,000 to 198,000.This was at the consensus forecast for 177,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 175,000 payroll jobs in August, on a seasonally adjusted (SA) basis.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "It is steady as she goes in the job market. Job gains in August were consistent with increases experienced over the past two-plus years."

Note: ADP hasn't been very useful in predicting the BLS report.

Wednesday, September 04, 2013

Thursday: ADP Employment, Unemployment Claims, ISM Service Index

by Calculated Risk on 9/04/2013 07:36:00 PM

Small business employment gains have been weak for the last few years, and it appears small business employment was slightly negative in August ... but the outlook is improving.

From NFIB: Summer Winds Down; Job Growth Does Not Wind Up

Overall, owners reported a decline in employment averaging 0.3 workers per firm. ... Rosier skies appear ahead, it seems, as plan for future job creation rose a very large 7 points, netting sixteen percent of owners with plans to increase total employment. This is the best report since January 2007 and historically a very strong reading. ... If we assume this increase is not a fluke, it signals a substantial resumption of hiring in the coming months.From Intuit: Small Business Employment Remained Flat in August

“The slight drop of one-hundredth of 1 percent in August employment equates to about 1,300 jobs lost, which means employment was essentially flat for the month. This is the second month that small business recovery has been flat or falling,” said Susan Woodward, the economist who worked with Intuit to create the indexes.Thursday:

• 8:15 AM ET, the ADP Employment Report for August. This report is for private payrolls only (no government). The consensus is for 177,000 payroll jobs added in August, down from 200,000 in July.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 331 thousand last week.

• At 10:00 AM, the ISM non-Manufacturing Index for August. The consensus is for a reading of 55.0, down from 56.0 in July. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for July. The consensus is for a 3.4% decrease in orders.

• Also at 10:00 AM, the Trulia Price Rent Monitors for August. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

U.S. Light Vehicle Sales increase to 16.0 million annual rate in August

by Calculated Risk on 9/04/2013 03:01:00 PM

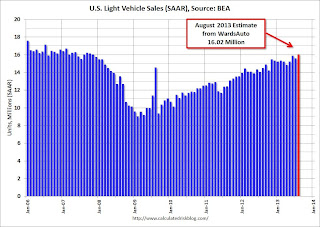

Based on an estimate from WardsAuto, light vehicle sales were at a 16.02 million SAAR in August. That is up 11% from August 2012, and up 2.6% from the sales rate last month.

This was above the consensus forecast of 15.8 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for August (red, light vehicle sales of 16.02 million SAAR from WardsAuto).

Click on graph for larger image.

Click on graph for larger image.

This was the first time the sales rate has been over 16 million since November 2007.

The growth rate will probably slow in 2013 - compared to the previous three years - but this will still be another solid year for the auto industry.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and are still a key driver of the recovery. Looking forward, growth will slow for auto sales. If sales average the recent pace for the entire year, total sales will be up about 9% from 2012, not quite double digit but still strong.

Fed's Beige Book: Economic activity increased "at a modest to moderate pace"

by Calculated Risk on 9/04/2013 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of San Francisco and based on information collected on or before August 26, 2013."

Reports from the twelve Federal Reserve Districts suggest that national economic activity continued to expand at a modest to moderate pace during the reporting period of early July through late August. Eight Districts characterized growth as moderate; of the remaining four, Boston, Atlanta, and San Francisco reported modest growth, and Chicago indicated activity had improved. Consumer spending rose in most Districts, reflecting, in part, strong demand for automobiles and housing-related goods. Activity in the travel and tourism sector expanded in most areas. Demand for nonfinancial services, including professional and transportation services, increased slightly on net. Manufacturing activity expanded modestly. Residential real estate activity increased moderately in most Districts, and demand for nonresidential real estate gained overall. Lending activity was mixed. Lending standards were largely unchanged, while credit quality improved.And on real estate:

Activity in residential real estate markets increased moderately. The pace of sales of existing single-family homes continued to increase moderately in most Districts. ... Reports from several Districts suggested that rising home prices and mortgage interest rates may have spurred a pickup in recent market activity, as many "fence sitters" were prompted to commit to purchases. Sales of new single-family homes stabilized during the past few months in the Cleveland District after accelerating earlier in the year. New home sales declined slightly in parts of the Philadelphia and Richmond Districts in July. Philadelphia conveyed that some borrowers apparently preferred to lock in a mortgage rate for an existing home rather than wait for a new home to be completed and chance higher mortgage rates. Home prices climbed in most Districts. Richmond and Boston reported that houses in some areas were staying on the market fewer days and increasingly receiving multiple offers. New York noted that bidding wars were common in the Buffalo area. Many Districts reported that limited inventories of desirable properties contributed to upward price pressures. Single-family home construction was strong in the Minneapolis and Dallas Districts, and Chicago reported that a number of builders are planning new developments to begin later this year. However, several Districts noted constraints on the construction of single-family homes. San Francisco pointed to shortages of construction workers. In the Kansas City District, some building materials, such as drywall and roofing shingles, were in short supply.Overall this was similar to the previous beige book with economic activity increasing at a "modest to moderate" pace.

Demand for nonresidential real estate increased. Office vacancy rates and other indicators in markets for office space improved modestly in the major metropolitan markets in the New York, Richmond, and St. Louis and Districts. Rents for Class B office space in Manhattan have risen more than 10 percent over the past twelve months. Demand for commercial real estate showed strong growth in the Dallas District and moderate growth in the Minneapolis District. Both Districts reported new plans for construction of industrial space. Philadelphia, Cleveland, Richmond, Atlanta, Chicago, Kansas City, and San Francisco reported modest growth in demand for commercial real estate. Philadelphia highlighted a shift in recent leasing activity toward larger commercial spaces. The Boston, Philadelphia, Cleveland, Atlanta, Dallas, and San Francisco Districts all reported increases in construction of multifamily residential properties.

emphasis added

Survey: "Shortage of Lots Slows Housing Recovery"

by Calculated Risk on 9/04/2013 11:50:00 AM

I talked with several builders at the end of last year, and in early January I reported: "I've heard some builders might be land constrained in 2013 (not enough finished lots in the pipeline)."

Here are the results of a NAHB survey released today: Shortage of Lots Slows Housing Recovery

A shortage of buildable lots, especially in the most desirable locations, has emerged as one of the key factors holding back a more robust housing recovery, according to the latest survey on the topic conducted by the National Association of Home Builders (NAHB).Land developers are working to meet the demand from home builders, but it takes time to obtain all the entitlements - so this could still be an issue in 2014.

“In our August 2013 survey, 59 percent of builders reported that the supply of lots in their markets was low or very low—up from 43 percent September of last year, and the largest low supply percentage we’ve seen since we began conducting these surveys in 1997,” said NAHB Chief Economist David Crowe. “One reason is that many residential developers left the industry, abandoned certain markets or simply stopped buying land and developing lots during the downturn.”

...

The survey found that lot shortages tended to be especially acute in the most desirable, or “A,” locations. Thirty-four percent of builders said that the supply of A lots was very low, compared to 18 percent for lots in B and 12 percent for lots in C locations. The shortages have also translated into higher prices for builders who are able to obtain developed lots to build on. ...

... “Lot shortages are one of several barriers that have arisen, restraining builders from responding completely to increased demand. Other barriers include a shortage of labor in carpentry and other key building trades, limited availability of loans even for credit worthy home builders and home buyers; and, more recently, an uptick in interest rates.” [said Crowe].

emphasis added