by Calculated Risk on 8/13/2013 10:11:00 AM

Tuesday, August 13, 2013

NFIB: Small Business Optimism Index increased in July

Earlier this morning from the National Federation of Independent Business (NFIB): Small Business Optimism Up Marginally

Small business optimism [increased] in July, with NFIB’s monthly Index increasing just over half a point (0.6) for a total reading of 94.1. ... On the positive front, while the two labor market indicators remained weak, both improved and are beginning to push into "normal" territory. ...Small business hiring plans increased in the July survey to a reading of 9 from 7 in June (zero is neutral). This was the 2nd highest reading since 2008.

Credit continues to be a non-issue for small employers, five percent of whom say that all their credit needs were not met in July, unchanged from June and May, and the lowest reading since February 2008.

In another small sign of good news, only 16% of owners reported weak sales as the top problem (lack of demand). This was down from 18% last month, down from 20% a year ago, and half the peak of 33% during the recession. During good times, small business owners usually complain about taxes and regulations - and those are now the top problems again.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 94.1 in July from 93.5 in June. This is still low, but just below the post-recession high.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Retail Sales increased 0.2% in July

by Calculated Risk on 8/13/2013 08:46:00 AM

On a monthly basis, retail sales increased 0.2% from June to July (seasonally adjusted), and sales were up 5.4% from July 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for July, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $424.5 billion, an increase of 0.2 percent from the previous month, and 5.4 percent above July 2012. ... The May to June 2013 percent change was revised from +0.4 percent to +0.6 percent.

Click on graph for larger image.

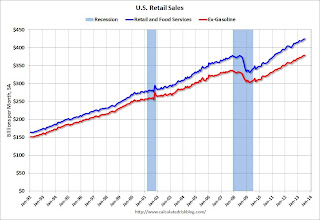

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 28.1% from the bottom, and now 12.2% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos increased 0.5%.

Excluding gasoline, retail sales are up 25.1% from the bottom, and now 12.6% above the pre-recession peak (not inflation adjusted).

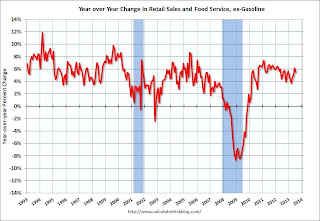

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 5.5% on a YoY basis (5.4% for all retail sales).

This was below the consensus forecast of 0.3% increase in retail sales, however this was above the forecast ex-autos - and the June retail sales were revised up from a 0.4% gain to a 0.6% gain.

Monday, August 12, 2013

Tuesday: Retail Sales

by Calculated Risk on 8/12/2013 08:44:00 PM

On Sunday I posted the following animation of the U.S population distribution, by age, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

There are many interesting points - the Depression baby bust, the baby boom and more. What jumps out at me are the improvements in health care. And also that the largest cohorts will all soon be under 40 (I suspect more and more emphasis will shift away from the Boomers to younger generations). Heck, in the last frame (2060), any remaining Boomers will be in those small (but growing) 95 to 99, and 100+ cohorts.

Some people are concerned about supporting those older Americans. But the ratio of total Americans in the prime working age (20 to 55) will be about the same in 2060 as in 1900. The mix of dependents will change (fewer young, more old), but having fewer infant and child deaths, and a longer healthier life, seem like huge positives to me! Also I expect the definition of the prime working age will expand to include more older workers - so the ratio of dependents to workers might actually decline.

The future is bright!

• At 7:30 AM ET, the NFIB Small Business Optimism Index for July.

• At 8:30 AM, Retail sales for July will be released. The consensus is for retail sales to increase 0.3% in July, and to increase 0.4% ex-autos.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.3% increase in inventories.

Weekly Update: Existing Home Inventory is up 18.1% year-to-date on Aug 12th

by Calculated Risk on 8/12/2013 05:13:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for June). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 18.1%, and I expect some further increases over the next month or two.

It now seems likely that inventory bottomed early this year.

It is important to remember that inventory is still very low, and is down 8.9% from the same week last year according to Housing Tracker.

Sacramento: Conventional Sales up Sharply Year-over-year in July, Active Inventory increases 54% year-over-year!

by Calculated Risk on 8/12/2013 01:03:00 PM

Several years ago I started following the Sacramento market to look for changes in the mix of houses sold (conventional, REOs, and short sales). Note: I used Sacramento because the data was available!

For a long time, not much changed. But over the last 2 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market, although some of this is due to investor buying. Other distressed markets are showing similar improvement.

Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In July 2013, 23.1% of all resales (single family homes) were distressed sales. This was down from 26.5% last month, and down from 54.4% in July 2012. This is the lowest percentage of distressed sales - and therefore the highest percentage of conventional sales - since the association started tracking the data.

The percentage of REOs was at 5.1% (the lowest since the data was tracked), and the percentage of short sales decreased to 17.9%. (the lowest percentage for short sales since July 2009).

Here are the statistics.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional sales recently (blue).

Active Listing Inventory for single family homes increased 54.3% year-over-year in July. This is the third consecutive month with a year-over-year increase in inventory - the first three months in two years - and strongly suggests inventory has bottomed in Sacramento.

Cash buyers accounted for 25.5% of all sales, down from 29.9% last month (frequently investors). It appears investors are becoming less of a factor in Sacramento.

Total sales were down 9% from July 2012, but conventional sales were up 53% compared to the same month last year. This is exactly what we expect to see in an improving distressed market - flat or even declining overall sales as distressed sales decline, and conventional sales increasing.

We are seeing a similar pattern in other distressed areas, with a move to more conventional sales, and a shift from REO to short sales.

Possibly the most important number in the release this month was the strong year-over-year increase in active inventory. This suggests price increases will slow in Sacramento, and I expect to see a similar pattern in other areas.

If this data is a hint at what will happen in other areas, we can expect: 1) Flat or declining overall existing home sales, 2) but increasing conventional sales. 3) Less investor buying, 4) more inventory, and 5) slower price increases.

Comment: The Key Downside Economic Risk

by Calculated Risk on 8/12/2013 12:07:00 PM

S&P's David Blitzer was on CNBC this morning and said:

"The big issue is the debt ceiling, the budget deficit, the U.S. Congress," Blitzer said in a "Squawk Box" interview. "It's the whole fiscal policy side that's the huge problem. ... I don't think we're going to default but I think we're going to have one of these crazy 11th-hour skirmishes."At the beginning of the year, I wrote Question #1 for 2013: US Fiscal Policy "[U.S. fiscal policy] is probably the biggest downside risk for the US economy in 2013." If anything I was too optimistic. I thought there would be some sort of compromise on the sequester budget cuts - I was wrong, although I was correct on the debt ceiling. Now here we go again ...

"Everybody will decide the U.S. Congress is even worse than their worst nightmare and the markets will get hit as a result," Blitzer added. "It'll be worse than the J.C. Penney board situation because there will be 535 of them."

If we all lived in a sane world, the "debt ceiling" would be eliminated (see discussion here), we'd all recognize that the deficit is declining quickly (probably too quickly), and that the sequestration cuts are crazy (OK, on the last one, just about everyone admits the cuts are dumb).

The negotiations this year should be easy - eliminate the sequestration cuts and don't do anything else in the short term (there are long term issues, but I doubt we will see progress there).

Unfortunately we live in the real world, and politics trump reality. Note: For a discussion of many of the budget issues this year, see Stan Collender's Budget Bedlam This Fall

Still - even in the insane world of politics - the debt ceiling is a fake issue (the House will cave again - they have no choice). And hopefully we will not see a government shutdown, but I expect the negotiations will go down to the wire. My guess is we will see another "continuing resolution", but you never know with politics.

The good news is these showdowns mostly happen in odd years with the hope that the voters will forget the congressional shenanigans by the next election. So IF we can get through the fall, fiscal policy will probably not be a big downside risk in 2014. Unfortunately that is a big "if".

Greece: A Primary Budget Surplus, Depression Continues

by Calculated Risk on 8/12/2013 09:53:00 AM

From the WSJ: Spending Cuts in Line With Commitments to Creditors But Economy Continues to Contract. First the good news:

Budget data from Greece's central government showed Monday a primary surplus for the first seven months of the year, turning around a steep deficit seen the previous year, according to the country's Finance Ministry.And then the bad:

The data showed that the primary surplus reached €2.6 billion ($3.47 billion) against a deficit of €3.1 billion a year earlier.

The data, which don't include payments on debt interest, local government and social security fund budgets, show that Greece is likely to secure a primary budget surplus for the year, for the first time in more than a decade.

Greece's improving fiscal performance, however, has taken a toll on its economy, which is contracting for a sixth straight year under the weight of austerity.Maybe there will be a change in plans after the German election in September, but right now they are creating an economic wasteland and calling it progress.

...

Greece expects the economy to shrink by 4.2% this year, though government officials have indicated that a stronger-than-expected tourism season this summer could provide some relief to the economy and result in a milder contraction of some 4% for the year. Many private-sector economists believe that this is too optimistic and that the economy could shrink for another year after the country's jobless rate hit 27.6% in May.

Sunday, August 11, 2013

Sunday Night Futures

by Calculated Risk on 8/11/2013 09:52:00 PM

Monday:

• 2:00 PM ET, the Monthly Treasury Statement for July. The CBO has projected a deficit of $96 billion in July 2013, down $10 billion from July 2012 after accounting for "quirks of the calendar".

Weekend:

• Schedule for Week of August 11th (busy week!)

• U.S. Population Distribution by Age, 1900 through 2060 (hopefully cool graphic!)

The Nikkei is down about 0.9%, and the Shanghai up 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 4 and DOW futures are down 30 (fair value).

U.S. Population Distribution by Age, 1900 through 2060

by Calculated Risk on 8/11/2013 06:34:00 PM

As I follow up to my earlier post on the number of births in 2012, here is an animation of the U.S population distribution, by age, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

In 1900, the graph was fairly steep, but with improving health care, the graph has flattened out over the last 100 years.

Note: Prior to 1940, the oldest group was 75+. From 1940 through 1985, the oldest group was 85+. Starting in 1990, the oldest group is 100+.

Watch for:

1) the original baby bust preceding the baby boom (the decline in births prior to and during the Depression). Those are the people currently in retirement.

2) the Baby Boom is obvious.

3) By 2020 or 2025, the largest cohorts will all be under 40.

Animation updates every second.

U.S. Births "essentially unchanged" in 2012 after Declining for Four Consecutive Years

by Calculated Risk on 8/11/2013 11:28:00 AM

This provisional data for 2012 was released in June and shows a possible impact of the great recession ...

From the National Center for Health Statistics: Recent Trends in Births and Fertility Rates Through December 2012. The NCHS reports:

The provisional count of births in the United States for the 12-month period ending December 2012 was 3,958,000, essentially unchanged from the 3,953,593 births (preliminary total) for 2011. The trend in the number of births was down, having declined steadily from the historic high of 4,316,233 in 2007 through 2011 but slowing from 2010 to 2011, and is essentially flat from 2011 to 2012.Here is a long term graph of annual U.S. births through 2012 ...

The provisional fertility rate in the United States for 2012 was 63.2 births per 1,000 women aged 15–44, unchanged from the rate in 2011. Like the number of births, the trend in the fertility rate was down, having declined steadily from the recent high of 69.3 in 2007 through 2010 but slowing from 2010 to 2011, and is unchanged from 2011 to 2012.

Click on graph for larger image.

Click on graph for larger image.Births had declined for four consecutive years, and are about 8.3% below the peak in 2007 (births in 2007 were at the all time high - even higher than during the "baby boom"). I suspect certain segments of the population were under stress before the recession started - like construction workers - and even more families were in distress in 2008 through 2012. And this led to fewer babies.

Notice that the number of births started declining a number of years before the Great Depression started. Many families in the 1920s were under severe stress long before the economy collapsed. By 1933 births were down by almost 23% from the early '20s levels.

Of course economic distress isn't the only reason births decline - look at the huge decline following the baby boom that was driven by demographics. But it is not surprising that the number of births slow or decline during tough economic times - but that appears to be ending now.

My guess is births will increase further in 2013 as confidence slowly improves.