by Calculated Risk on 8/09/2013 12:59:00 PM

Friday, August 09, 2013

Update: When will payroll employment exceed the pre-recession peak?

About two years ago I posted a graph with projections of when payroll employment would return to pre-recession levels (see: Sluggish Growth and Payroll Employment from November 2011).

In 2011, I argued we'd continue to see sluggish growth (back in 2011 many analysts were forecasting another US recession - those forecasts were wrong).

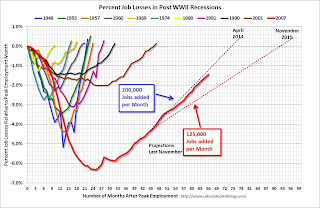

On the graph I posted two lines - one with payroll growth of 125,000 payroll jobs added per month (the pace in 2011), and another line with 200,000 payroll jobs per month. The following graph is an update with reported payroll growth through July 2013.

The dashed red line is 125,000 payroll jobs added per month. The dashed blue line is 200,000 payroll jobs per month. Both projections are from November 2011.

Click on graph for larger image.

Click on graph for larger image.

So far the economy has tracked fairly closely to the blue line (200,000 payroll jobs per month).

Right now it appears payrolls will exceed the pre-recession peak in early to mid-2014.

Currently there are about 2 million fewer payroll jobs than before the recession started, and at the recent pace of job growth it will take another 11 months to reach the previous peak. Note: I expect another upward adjustment when the annual benchmark revision is released in January, so we will probably reach the previous peak in fewer than 11 months.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow).

Note: There are 1.482 million fewer private sector payroll jobs than before the recession started. At the recent pace of private sector job growth - plus a positive benchmark revision in January - we could be back at the pre-recession peak early in 2014.

LA Times: The Return of Condo Conversions

by Calculated Risk on 8/09/2013 09:59:00 AM

An interesting story from Cale Ottens at the LA Times: Condo conversions inch up in Los Angeles

Apartment building owners in Los Angeles and throughout California are once again converting to condos, but not at the torrid pace of 2007, when condo conversion peaked before the Great Recession.Right now it seems like most of the conversions from apartments to condos are buildings originally intended to be condos, but were converted to rental units during the housing bust. So far I haven't seen older apartments being converted to condos as was happening during the bubble.

...

Before the last recession, it was common for apartments to convert to condos when the market was hot. But the trend came to a screeching halt when the housing bubble burst.

At the peak in 2007, the city issued 208 permits allowing apartment complexes to be converted. But that number has declined every year since. The city issued a mere 38 permits last year.

...

The number of condo conversions, however, probably won't get anywhere near the levels they were before the economic downturn, said Chris Foley, a principal at real estate marketing firm Polaris Pacific in San Francisco.

The only conversions Foley said he expects to see throughout the state are the properties originally intended to be condos but turned into apartments when the housing market tanked and condos weren't selling.

Thursday, August 08, 2013

MBA National Delinquency Survey: Judicial vs. Non-Judicial Foreclosure States

by Calculated Risk on 8/08/2013 09:41:00 PM

Earlier I posted the MBA National Delinquency Survey press release and a graph that showed mortgage delinquencies and foreclosures by period past due. There is a clear downward trend for mortgage delinquencies, however some states are further along than others. From the press release:

States with a judicial foreclosure system continue to bear a disproportionate share of the foreclosure backlog. .... The rate of new foreclosures in New York hit an all-time high during the second quarter and is now essentially equal with Florida. The percentage of loans in foreclosure in New Jersey remains about the same as the rates in California, Arizona and Nevada combined. The foreclosure percentages in Connecticut are back to near all-time highs for that state.

Click on graph for larger image.

Click on graph for larger image.This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

The top states are Florida (10.58% in foreclosure down from 11.43% in Q1), New Jersey (8.01% down from 9.00%), New York (6.09% down from 6.18%), and Maine (5.62% down from 5.80%). Nevada is the only non-judicial state in the top 10, and this is partially due to state laws that slow foreclosures.

California (1.64% down from 1.76%) and Arizona (1.51% down from 1.77%) are now well below the national average by every measure.

For judicial foreclosure states, it appears foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for four consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.

For judicial foreclosure states, it appears foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for four consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.It looks like the judicial states will have a significant number of distressed sales for several more years.

Las Vegas Real Estate in July: Year-over-year Non-contingent Inventory up 9%

by Calculated Risk on 8/08/2013 05:43:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR report shows 18-month run of rising home prices

GLVAR said the total number of existing local homes, condominiums and townhomes sold in July was 3,633. That’s down slightly from 3,642 in June, but up from 3,572 total sales in July 2012. ...There are several key trends that we've been following:

...

In July, [GLVAR President Dave Tina said] “traditional” sales accounted for a recent high of 64 percent of all local home sales. ... In July, 28.0 percent of all existing home sales were short sales, down from 31.0 percent in June. Another 8.0 percent of all July sales were bank-owned properties, down from 9.0 percent of all sales in June. The remaining 64 percent of all sales were the traditional type, up from 60 percent in June.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service increased in July, with 14,133 single-family homes listed for sale at the end of the month. That’s up 2.8 percent from 13,750 single-family homes listed for sale at the end of June, but down 16.6 percent from last year. ...

By the end of July, GLVAR reported 4,681 single-family homes listed without any sort of offer. That’s up 22.3 percent from 3,828 such homes listed in June and up 9.0 percent from one year ago.

emphasis added

1) Overall sales were down slightly from June, but up slightly year-over-year.

2) Conventional sales are up sharply. In July 2012, only 39.3% of all sales were conventional. This year, in July 2013, 64% were conventional. That is an increase in conventional sales of about 65% (of course there is heavily investor buying, but that is still quite an increase in non-distressed sales).

3) Most distressed sales are short sales instead of foreclosures (over 3 to 1).

4) and probably most interesting right now is that non-contingent inventory (year-over-year) is now increasing. Non-contingent inventory is up 9.0% year-over-year.

This suggests inventory has bottomed in Las Vegas (A major theme for housing in 2013). And this suggests price increases will slow.

Fannie, Freddie, FHA REO inventory declines in Q2 2013

by Calculated Risk on 8/08/2013 02:24:00 PM

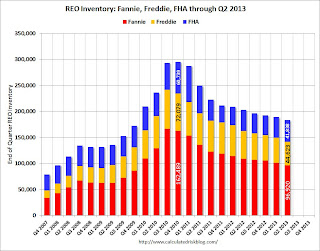

Fannie released their second quarter results this morning. In their SEC filing, Fannie reported their Real Estate Owned (REO) declined to 96,920 single family properties, down from 101,449 at the end of Q1.

The combined Real Estate Owned (REO) for Fannie, Freddie and the FHA declined to 183,381 at the end of Q2 2013, down 3% from Q1, and down almost 10% from 202,765 in Q2 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.

This following graph shows the REO inventory for Fannie, Freddie and the FHA.

Click on graph for larger image.

Click on graph for larger image.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too.

Although REO was down for Fannie and Freddie in Q2 from Q1, REO increased for the FHA for the 2nd consecutive quarter - this is something to watch.

NAHB: Builder Confidence improves in the 55+ Housing Market in Q2

by Calculated Risk on 8/08/2013 12:02:00 PM

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so the readings have been very low. This is the first ever reading above 50.

From the NAHB: Builder Confidence in the 55+ Housing Market Shows Significant Improvement in Second Quarter

Builder confidence in the 55+ housing market for single-family homes showed strong continued improvement in the second quarter of 2013 compared to the same period a year ago, according to the National Association of Home Builders’ (NAHB) latest 55+ Housing Market Index (HMI) released today. The index increased 24 points to a level of 53, which is the highest second-quarter number since the inception of the index in 2008 and the seventh consecutive quarter of year over year improvements. [CR Note: NAHB is reporting the year-over-year increase]

...

All of the components of the 55+ single-family HMI showed major growth from a year ago: present sales climbed 24 points to 54, expected sales for the next six months increased 25 points to 60 and traffic of prospective buyers rose 26 points to 48

The 55+ multifamily condo HMI posted a substantial gain of 24 points to 43, which is the highest second-quarter reading since the inception of the index. All 55+ multifamily condo HMI components increased compared to a year ago as present sales rose 26 points to 44, expected sales for the next six months climbed 26 points to 46 and traffic of prospective buyers rose 19 points to 38.

The 55+ multifamily rental indices also showed strong gains in the second quarter as present production increased 19 points to 50, expected future production rose 20 points to 52, current demand for existing units climbed 20 points to 62 and future demand increased 21 points to 63.

“The 55+ HMI for single-family homes almost doubled from a year ago,” said NAHB Chief Economist David Crowe. “Sentiment in other segments of the 55+ market housing was strong as well. This is consistent with the increase in builder confidence we’ve seen in other NAHB surveys recently. At this point, the main challenge for builders in many parts of the country is finding enough buildable lots in desirable locations and workers with the necessary skill set to respond to the increased demand.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q2 2013. This is the first reading above 50, and this indicates that more builders view conditions as good than poor.

This is going to be a key demographic for household formation over the next couple of decades, but only if the baby boomers can sell their current homes.

There are two key drivers: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

MBA: Mortgage Delinquency Rates declined in Q2

by Calculated Risk on 8/08/2013 10:00:00 AM

From the MBA: Mortgage Delinquencies, Foreclosures Continue to Drop

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 6.96 percent of all loans outstanding at the end of the second quarter of 2013, the lowest level since mid-2008. The delinquency rate dropped 29 basis points from the previous quarter, and 62 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans on which foreclosure actions were started during the second quarter decreased to 0.64 percent from 0.70 percent, a decrease of six basis points and reached the lowest level since the first quarter of 2007 and less than half of the all-time high of 1.42 percent reached in September 2009. The percentage of loans in the foreclosure process at the end of the second quarter was 3.33 percent down 22 basis points from the first quarter and 94 basis points lower than one year ago.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 5.88 percent, a decrease of 51 basis points from last quarter, and a decrease of 143 basis points from the second quarter of last year. However, as with last quarter’s results, the improvement in the seriously delinquent percentages may be slightly less than stated because at least one large specialty servicer that has received a number of loan transfers does not participate in the MBA survey.

“For most of the country, delinquencies and foreclosures have returned to more normal historical levels. Most states are at or only slightly above longer-term averages, and some of the worst-hit states are showing improvement. For example while 10 percent of the mortgages in Florida are somewhere in the process of foreclosure, this is down considerably from the high of 14.5 percent two years ago. While Florida leads the country in the rate of foreclosures started, that rate of 1.1 percent is the lowest since mid-2007 and half of what it was three years ago,” said Jay Brinkmann, MBA’s Chief Economist and SVP of Research and Economics.

Some of the highest numbers are in New York, New Jersey and Connecticut. The rate of new foreclosures in New York hit an all-time high during the second quarter and is now essentially equal with Florida. The percentage of loans in foreclosure in New Jersey remains about the same as the rates in California, Arizona and Nevada combined. The foreclosure percentages in Connecticut are back to near all-time highs for that state.

“In contrast, foreclosure starts fell or were unchanged in 43 states and the foreclosure inventory rate either improved or was unchanged in 45 states.

“States with a judicial foreclosure system continue to bear a disproportionate share of the foreclosure backlog. While the percentage of loans in foreclosure dropped in both states with judicial systems and states with nonjudicial systems, the average rate for judicial states was 5.59 percent, triple the average rate of 1.86 percent for nonjudicial states. Both declined to recent lows, with judicial states seeing the lowest foreclosure inventory since 2009 and nonjudicial states seeing the lowest foreclosure inventory since 2007.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 3.19% from 3.21% in Q1. This is just above the long term average.

Delinquent loans in the 60 day bucket decrease to 1.12% in Q2, from 1.17% in Q1.

The 90 day bucket decreased to 2.65% from 2.88%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 3.33% from 3.55% and is now at the lowest level since 2008.

Weekly Initial Unemployment Claims at 333,000, Four Week Average Lowest since 2007

by Calculated Risk on 8/08/2013 08:30:00 AM

The DOL reports:

In the week ending August 3, the advance figure for seasonally adjusted initial claims was 333,000, an increase of 5,000 from the previous week's revised figure of 328,000. The 4-week moving average was 335,500, a decrease of 6,250 from the previous week's revised average of 341,750.

The previous week was revised up from 326,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 335,500.

The 4-week average is at the lowest level since November 2007 (before the recession started). Claims were below the 336,000 consensus forecast.

Wednesday, August 07, 2013

Thursday: Unemployment Claims, Q2 National Mortgage Delinquency Survey

by Calculated Risk on 8/07/2013 09:48:00 PM

First, Josh Lehner of the Oregon Office of Economic Analysis points out the sequester is having an impact on employment: The Sequester Impact

A common discussion in recent months and quarters has been the impact, or lack thereof, of the federal sequester. ...Thursday:

First there is the federal workforce. Two direct impacts are seen in the data here: actual employment reductions and more part-time workers due to furloughs. Both of these items have direct labor market and economic impacts as they result in less wages and less jobs immediately. Employment cuts at the Department of Defense averaged 1,200 per month in 2012 yet that has accelerated to 2,500 in the 3 months since the sequester officially has been in place. Across other federal agencies (excluding hospitals and the postal service) the cuts have accelerated even further, from 1,600 in 2012 to 5,100 in recent months. ... [also there has been a] dramatic increase in part-time federal workers for economic reasons (i.e. furloughs).

In terms of the private sector, the impacts are a bit more hidden given that the government buys goods and services from all types of firms so isolating the impact can be difficult. ... The slowdown in employment in the military dependent industries begins in November 2012 and employment has stagnated since, even down a couple thousand yet no substantial job losses, at least not yet. However there has been a clear change in employment patterns in the industry since the threat of sequester became 100% real at the end of 2012.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 336 thousand from 326 thousand last week.

• At 10:00 AM: the Mortgage Bankers Association (MBA) 2nd Quarter 2013 National Delinquency Survey (NDS).

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due for Q1 2013.

Loans 30 days delinquent increased to 3.21% from 3.04% in Q4. Delinquent loans in the 60 day bucket increased slightly to 1.17% in Q1, from 1.16% in Q4. The 90 day bucket decreased slightly to 2.88% from 2.89%. This is still way above normal (around 0.8% would be normal according to the MBA). The percent of loans in the foreclosure process decreased to 3.55% from 4.74% and was now at the lowest level since 2008.

Q2 2013 GDP Details: Single Family investment increases, Commercial Investment very Low

by Calculated Risk on 8/07/2013 05:01:00 PM

The BEA released the underlying details for the Q2 advance GDP report this afternoon.

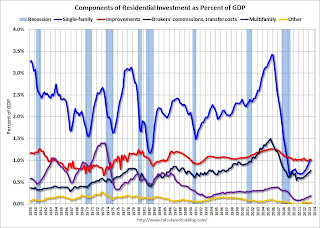

The first graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

Note: A change in the comprehensive revision was:

The presentation of the components of residential fixed investment was updated to reflect the expansion of the ownership transfer costs of residential fixed assets that are recognized as fixed investment. “Brokers’ commissions and other ownership transfer costs” is presented in place of “brokers’ commissions on sale of structures.”A few key points:

1) Usually the most important components are investment in single family structures followed by home improvement. However home improvement has been the top category for nineteen consecutive quarters, but that is about to change. Investment in single family structures should be the top category again soon.

2) Even though investment in single family structures has increased significantly from the bottom, single family investment is still very low - and still below the bottom for previous recessions. I expect further increases over the next few years.

3) Look at the contribution from Brokers’ commissions and other ownership transfer costs. This is the category mostly related to existing home sales (this is the contribution to GDP from existing home sales). If existing home sales are flat, or even decline due to fewer foreclosures, this will have little impact on total residential investment.

Click on graph for larger image.

Click on graph for larger image.Investment in home improvement was at a $171 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.0% of GDP), still above the level of investment in single family structures of $167 billion (SAAR) (also 1.0% of GDP). Single family structure investment will probably overtake home improvement as the largest category of residential investment in the next quarter or so.

The second graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased recently, but from a very low level.

Investment in offices is down about 56% from the recent peak (as a percent of GDP). There has been some increase in the Architecture Billings Index lately, so office investment might start to increase. However the office vacancy rate is still very high, so any increase in investment will probably be small.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 68%. With the hotel occupancy rate close to normal, it is possible that hotel investment will probably continue to increase.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is starting to pickup, but from a very low level.