by Calculated Risk on 8/08/2013 05:43:00 PM

Thursday, August 08, 2013

Las Vegas Real Estate in July: Year-over-year Non-contingent Inventory up 9%

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR report shows 18-month run of rising home prices

GLVAR said the total number of existing local homes, condominiums and townhomes sold in July was 3,633. That’s down slightly from 3,642 in June, but up from 3,572 total sales in July 2012. ...There are several key trends that we've been following:

...

In July, [GLVAR President Dave Tina said] “traditional” sales accounted for a recent high of 64 percent of all local home sales. ... In July, 28.0 percent of all existing home sales were short sales, down from 31.0 percent in June. Another 8.0 percent of all July sales were bank-owned properties, down from 9.0 percent of all sales in June. The remaining 64 percent of all sales were the traditional type, up from 60 percent in June.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service increased in July, with 14,133 single-family homes listed for sale at the end of the month. That’s up 2.8 percent from 13,750 single-family homes listed for sale at the end of June, but down 16.6 percent from last year. ...

By the end of July, GLVAR reported 4,681 single-family homes listed without any sort of offer. That’s up 22.3 percent from 3,828 such homes listed in June and up 9.0 percent from one year ago.

emphasis added

1) Overall sales were down slightly from June, but up slightly year-over-year.

2) Conventional sales are up sharply. In July 2012, only 39.3% of all sales were conventional. This year, in July 2013, 64% were conventional. That is an increase in conventional sales of about 65% (of course there is heavily investor buying, but that is still quite an increase in non-distressed sales).

3) Most distressed sales are short sales instead of foreclosures (over 3 to 1).

4) and probably most interesting right now is that non-contingent inventory (year-over-year) is now increasing. Non-contingent inventory is up 9.0% year-over-year.

This suggests inventory has bottomed in Las Vegas (A major theme for housing in 2013). And this suggests price increases will slow.

Fannie, Freddie, FHA REO inventory declines in Q2 2013

by Calculated Risk on 8/08/2013 02:24:00 PM

Fannie released their second quarter results this morning. In their SEC filing, Fannie reported their Real Estate Owned (REO) declined to 96,920 single family properties, down from 101,449 at the end of Q1.

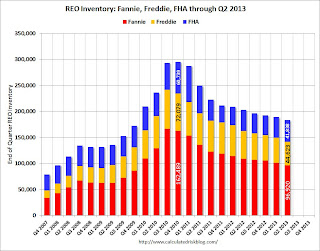

The combined Real Estate Owned (REO) for Fannie, Freddie and the FHA declined to 183,381 at the end of Q2 2013, down 3% from Q1, and down almost 10% from 202,765 in Q2 2012. The peak for the combined REO of the F's was 295,307 in Q4 2010.

This following graph shows the REO inventory for Fannie, Freddie and the FHA.

Click on graph for larger image.

Click on graph for larger image.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too.

Although REO was down for Fannie and Freddie in Q2 from Q1, REO increased for the FHA for the 2nd consecutive quarter - this is something to watch.

NAHB: Builder Confidence improves in the 55+ Housing Market in Q2

by Calculated Risk on 8/08/2013 12:02:00 PM

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so the readings have been very low. This is the first ever reading above 50.

From the NAHB: Builder Confidence in the 55+ Housing Market Shows Significant Improvement in Second Quarter

Builder confidence in the 55+ housing market for single-family homes showed strong continued improvement in the second quarter of 2013 compared to the same period a year ago, according to the National Association of Home Builders’ (NAHB) latest 55+ Housing Market Index (HMI) released today. The index increased 24 points to a level of 53, which is the highest second-quarter number since the inception of the index in 2008 and the seventh consecutive quarter of year over year improvements. [CR Note: NAHB is reporting the year-over-year increase]

...

All of the components of the 55+ single-family HMI showed major growth from a year ago: present sales climbed 24 points to 54, expected sales for the next six months increased 25 points to 60 and traffic of prospective buyers rose 26 points to 48

The 55+ multifamily condo HMI posted a substantial gain of 24 points to 43, which is the highest second-quarter reading since the inception of the index. All 55+ multifamily condo HMI components increased compared to a year ago as present sales rose 26 points to 44, expected sales for the next six months climbed 26 points to 46 and traffic of prospective buyers rose 19 points to 38.

The 55+ multifamily rental indices also showed strong gains in the second quarter as present production increased 19 points to 50, expected future production rose 20 points to 52, current demand for existing units climbed 20 points to 62 and future demand increased 21 points to 63.

“The 55+ HMI for single-family homes almost doubled from a year ago,” said NAHB Chief Economist David Crowe. “Sentiment in other segments of the 55+ market housing was strong as well. This is consistent with the increase in builder confidence we’ve seen in other NAHB surveys recently. At this point, the main challenge for builders in many parts of the country is finding enough buildable lots in desirable locations and workers with the necessary skill set to respond to the increased demand.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q2 2013. This is the first reading above 50, and this indicates that more builders view conditions as good than poor.

This is going to be a key demographic for household formation over the next couple of decades, but only if the baby boomers can sell their current homes.

There are two key drivers: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

MBA: Mortgage Delinquency Rates declined in Q2

by Calculated Risk on 8/08/2013 10:00:00 AM

From the MBA: Mortgage Delinquencies, Foreclosures Continue to Drop

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 6.96 percent of all loans outstanding at the end of the second quarter of 2013, the lowest level since mid-2008. The delinquency rate dropped 29 basis points from the previous quarter, and 62 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans on which foreclosure actions were started during the second quarter decreased to 0.64 percent from 0.70 percent, a decrease of six basis points and reached the lowest level since the first quarter of 2007 and less than half of the all-time high of 1.42 percent reached in September 2009. The percentage of loans in the foreclosure process at the end of the second quarter was 3.33 percent down 22 basis points from the first quarter and 94 basis points lower than one year ago.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 5.88 percent, a decrease of 51 basis points from last quarter, and a decrease of 143 basis points from the second quarter of last year. However, as with last quarter’s results, the improvement in the seriously delinquent percentages may be slightly less than stated because at least one large specialty servicer that has received a number of loan transfers does not participate in the MBA survey.

“For most of the country, delinquencies and foreclosures have returned to more normal historical levels. Most states are at or only slightly above longer-term averages, and some of the worst-hit states are showing improvement. For example while 10 percent of the mortgages in Florida are somewhere in the process of foreclosure, this is down considerably from the high of 14.5 percent two years ago. While Florida leads the country in the rate of foreclosures started, that rate of 1.1 percent is the lowest since mid-2007 and half of what it was three years ago,” said Jay Brinkmann, MBA’s Chief Economist and SVP of Research and Economics.

Some of the highest numbers are in New York, New Jersey and Connecticut. The rate of new foreclosures in New York hit an all-time high during the second quarter and is now essentially equal with Florida. The percentage of loans in foreclosure in New Jersey remains about the same as the rates in California, Arizona and Nevada combined. The foreclosure percentages in Connecticut are back to near all-time highs for that state.

“In contrast, foreclosure starts fell or were unchanged in 43 states and the foreclosure inventory rate either improved or was unchanged in 45 states.

“States with a judicial foreclosure system continue to bear a disproportionate share of the foreclosure backlog. While the percentage of loans in foreclosure dropped in both states with judicial systems and states with nonjudicial systems, the average rate for judicial states was 5.59 percent, triple the average rate of 1.86 percent for nonjudicial states. Both declined to recent lows, with judicial states seeing the lowest foreclosure inventory since 2009 and nonjudicial states seeing the lowest foreclosure inventory since 2007.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent decreased to 3.19% from 3.21% in Q1. This is just above the long term average.

Delinquent loans in the 60 day bucket decrease to 1.12% in Q2, from 1.17% in Q1.

The 90 day bucket decreased to 2.65% from 2.88%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 3.33% from 3.55% and is now at the lowest level since 2008.

Weekly Initial Unemployment Claims at 333,000, Four Week Average Lowest since 2007

by Calculated Risk on 8/08/2013 08:30:00 AM

The DOL reports:

In the week ending August 3, the advance figure for seasonally adjusted initial claims was 333,000, an increase of 5,000 from the previous week's revised figure of 328,000. The 4-week moving average was 335,500, a decrease of 6,250 from the previous week's revised average of 341,750.

The previous week was revised up from 326,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 335,500.

The 4-week average is at the lowest level since November 2007 (before the recession started). Claims were below the 336,000 consensus forecast.

Wednesday, August 07, 2013

Thursday: Unemployment Claims, Q2 National Mortgage Delinquency Survey

by Calculated Risk on 8/07/2013 09:48:00 PM

First, Josh Lehner of the Oregon Office of Economic Analysis points out the sequester is having an impact on employment: The Sequester Impact

A common discussion in recent months and quarters has been the impact, or lack thereof, of the federal sequester. ...Thursday:

First there is the federal workforce. Two direct impacts are seen in the data here: actual employment reductions and more part-time workers due to furloughs. Both of these items have direct labor market and economic impacts as they result in less wages and less jobs immediately. Employment cuts at the Department of Defense averaged 1,200 per month in 2012 yet that has accelerated to 2,500 in the 3 months since the sequester officially has been in place. Across other federal agencies (excluding hospitals and the postal service) the cuts have accelerated even further, from 1,600 in 2012 to 5,100 in recent months. ... [also there has been a] dramatic increase in part-time federal workers for economic reasons (i.e. furloughs).

In terms of the private sector, the impacts are a bit more hidden given that the government buys goods and services from all types of firms so isolating the impact can be difficult. ... The slowdown in employment in the military dependent industries begins in November 2012 and employment has stagnated since, even down a couple thousand yet no substantial job losses, at least not yet. However there has been a clear change in employment patterns in the industry since the threat of sequester became 100% real at the end of 2012.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 336 thousand from 326 thousand last week.

• At 10:00 AM: the Mortgage Bankers Association (MBA) 2nd Quarter 2013 National Delinquency Survey (NDS).

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due for Q1 2013.

Loans 30 days delinquent increased to 3.21% from 3.04% in Q4. Delinquent loans in the 60 day bucket increased slightly to 1.17% in Q1, from 1.16% in Q4. The 90 day bucket decreased slightly to 2.88% from 2.89%. This is still way above normal (around 0.8% would be normal according to the MBA). The percent of loans in the foreclosure process decreased to 3.55% from 4.74% and was now at the lowest level since 2008.

Q2 2013 GDP Details: Single Family investment increases, Commercial Investment very Low

by Calculated Risk on 8/07/2013 05:01:00 PM

The BEA released the underlying details for the Q2 advance GDP report this afternoon.

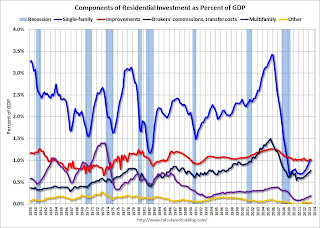

The first graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

Note: A change in the comprehensive revision was:

The presentation of the components of residential fixed investment was updated to reflect the expansion of the ownership transfer costs of residential fixed assets that are recognized as fixed investment. “Brokers’ commissions and other ownership transfer costs” is presented in place of “brokers’ commissions on sale of structures.”A few key points:

1) Usually the most important components are investment in single family structures followed by home improvement. However home improvement has been the top category for nineteen consecutive quarters, but that is about to change. Investment in single family structures should be the top category again soon.

2) Even though investment in single family structures has increased significantly from the bottom, single family investment is still very low - and still below the bottom for previous recessions. I expect further increases over the next few years.

3) Look at the contribution from Brokers’ commissions and other ownership transfer costs. This is the category mostly related to existing home sales (this is the contribution to GDP from existing home sales). If existing home sales are flat, or even decline due to fewer foreclosures, this will have little impact on total residential investment.

Click on graph for larger image.

Click on graph for larger image.Investment in home improvement was at a $171 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.0% of GDP), still above the level of investment in single family structures of $167 billion (SAAR) (also 1.0% of GDP). Single family structure investment will probably overtake home improvement as the largest category of residential investment in the next quarter or so.

The second graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased recently, but from a very low level.

Investment in offices is down about 56% from the recent peak (as a percent of GDP). There has been some increase in the Architecture Billings Index lately, so office investment might start to increase. However the office vacancy rate is still very high, so any increase in investment will probably be small.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 68%. With the hotel occupancy rate close to normal, it is possible that hotel investment will probably continue to increase.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is starting to pickup, but from a very low level.

Another Dumb Idea: "Eminent domain" for Underwater Mortgages

by Calculated Risk on 8/07/2013 03:13:00 PM

I haven't written about the use of "eminent domain" to buy mortgages because it seemed like such a dumb idea I didn't expect it to go anywhere (the city is proposing to use eminent domain to help individual homeowners who are underwater - who may or may not be able to afford their mortgage - obviously not an intended use of eminent domain).

An appropriate public policy to help underwater homeowners would be cramdowns in bankruptcy (see Tanta's Just Say Yes To Cram Downs), but having cities use "eminent domain" is obviously not. I'll write more if this spreads ...

From Alejandro Lazo at the LA Times: Eminent domain proposal for mortgages gains traction in California

Cities in the Golden State are once again testing a controversial mortgage relief plan that could use local eminent domain powers to help residents stung by the last housing crisis. ...From Nick Timiraos at the WSJ: Freddie Mac Considers Legal Action to Block Eminent Domain Plan

... the idea is gaining traction again, with the city of Richmond, Calif., last week becoming the first to press forward. The hardscrabble Bay Area city announced that it had asked the holders of more than 620 underwater mortgages — on which the borrower owes more than the home is worth — to sell the loans to the city at a discount. The city would then write down the debt and refinance the loans for amounts in line with current home values.

If lenders refuse, the city could use eminent domain powers to force the transaction, a move widely expected to bring lawsuits from the financial industry.

“Our sense is that so-called voluntary loan sales would not be very voluntary. They are loan sales under pressure,” said William McDavid, general counsel of Freddie Mac, on a conference call with reporters Wednesday. “We would consider taking legal action” if it had the backing of its federal regulator, he said. ...

Eminent domain allows a government to forcibly acquire property that is then reused in a way considered good for the public—new housing, roads or shopping centers. Owners of the properties are entitled to compensation, often determined by a court.

Instead of acquiring houses, Richmond and other cities would buy the mortgages from investors at a price below the property’s current market value. They could cut the loan principal to around 97.75% of the property’s market value and then refinance the loan into a government-backed mortgage.

Event at 1 PM ET: President Obama answers questions on housing

by Calculated Risk on 8/07/2013 12:28:00 PM

President Barack Obama will answer questions about housing in an event hosted by Zillow CEO Spencer Rascoff.

The virtual event will be streamed on zillow.com/whitehouse and Whitehouse.gov.

Freddie Mac on Q2: $5.0 Billion Net Income, No Treasury Draw, REO Declines

by Calculated Risk on 8/07/2013 09:36:00 AM

From Freddie Mac: Freddie Mac Reports Net Income of $5.0 billion for Second Quarter 2013

Second quarter 2013 net income was $5.0 billion, compared to $4.6 billion in the first quarter of 2013 – the seventh consecutive quarter of profitability and second largest in company history...

...

No additional Treasury draw required for the second quarter of 2013

Based on net worth of $7.4 billion, the company’s dividend obligation to Treasury will be $4.4 billion in September 2013. Including the September obligation, the company’s aggregate cash dividends paid to Treasury will total approximately $41 billion

Senior preferred stock outstanding and held by Treasury remained $72.3 billion, as dividend payments do not reduce prior Treasury draws

Click on graph for larger image.

Click on graph for larger image.On Real Estate Owned (REO), Freddie acquired 16,418 properties in Q2 2013, and disposed of 19,763 and the total REO fell to 44,623 at the end of Q2. This graph shows REO inventory for Freddie.

From Freddie's SEC 10-Q:

Since the beginning of 2008, on an aggregate basis, we have recorded provision for credit losses associated with single-family loans of approximately $74.2 billion, and have recorded an additional $3.8 billion in losses on loans purchased from PC trusts, net of recoveries. The majority of these losses are associated with loans originated in 2005 through 2008. While loans originated in 2005 through 2008 will give rise to additional credit losses that have not yet been incurred and, thus, have not yet been provisioned for, we believe that, as of June 30, 2013, we have reserved for or charged-off the majority of the total expected credit losses for these loans. Nevertheless, various factors, such as increases in unemployment rates or future declines in home prices, could require us to provide for losses on these loans beyond our current expectations.

Our loan loss reserves for single-family loans declined in each of the last six quarters, which in part reflects improvement in both borrower payment performance and lower severity ratios for both REO dispositions and short sale transactions due to the improvements in home prices in most areas during these periods. Our REO inventory also declined in each of the last six quarters primarily due to lower foreclosure activity as well as a significant number of borrowers completing short sales rather than foreclosures.

Our average REO disposition severity ratio improved to 31.2% for the second quarter of 2013 compared to 34.4% and 37.9% for the first quarter of 2013 and second quarter of 2012, respectively. We observed improvements in most areas during the first half of 2013, primarily due to increasing home prices. This ratio improved in each of the last six quarters, but remains high as compared to our experience in periods before 2008. Additionally, our REO disposition severity ratios have also been positively affected by changes made during 2012 to our process for determining the list price for our REO properties when we offer them for sale.

emphasis added