by Calculated Risk on 7/20/2013 11:30:00 AM

Saturday, July 20, 2013

Schedule for Week of July 21st

The key reports this week are the June existing home sales on Monday, and the June new home sales report on Wednesday.

For manufacturing, the Richmond and Kansas City regional manufacturing surveys for July will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 5.27 million on seasonally adjusted annual rate (SAAR) basis. Sales in May were at a 5.18 million SAAR. Economist Tom Lawler is estimating the NAR will report a June sales rate of 4.99 million.

A key will be inventory and months-of-supply.

9:00 AM: FHFA House Price Index for May 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.8% increase

10:00 AM: Richmond Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 8 for this survey, unchanged from June (Above zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: The Markit US PMI Manufacturing Index Flash for July. The consensus is for an increase to 52.8 from 52.2 in June.

10:00 AM: New Home Sales for June from the Census Bureau.

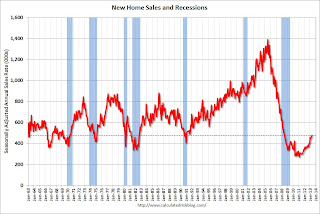

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the May sales rate.

The consensus is for an increase in sales to 481 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 476 thousand in May.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 341 thousand from 334 thousand last week.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for July. The consensus is for a reading of 0 for this survey, up from minus 5 in June (Above zero is expansion).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 84.0.

Krugman: How Much Should We Worry About A China Shock?

by Calculated Risk on 7/20/2013 09:33:00 AM

Quite a few people have asked me about China. My view is the impact of a Chinese slowdown - or even recession - will be minimal on the US.

Note: As always, I recommend reading Michael Pettis' China Financial Markets website. He has been way ahead of the curve on China. (Pettis' site feed sometimes gets hacked - that is the joke at the bottom of Krugman's post today).

Paul Krugman discusses three possible impacts: How Much Should We Worry About A China Shock?

Suppose that those of us now worried that China’s Ponzi bicycle is hitting a brick wall (or, as some readers have suggested, a BRIC wall) are right. How much should the rest of the world worry, and why?There is more in Krugman's post. The mechanical trade impact is the one everyone worries about, and it really isn't a huge concern. On the second point, the US does sell some commodities to China (Lumber prices started falling when Chinese buying slowed). However, overall for the US, lower commodity prices is mostly a positive.

I’d group this under three headings:

1. “Mechanical” linkages via exports, which are surprisingly small.

2. Commodity prices, which could be a bigger deal.

3. Politics and international stability, which involves some serious risks.

So, on the first: this is what many people immediately think of. China’s economy stumbles; China therefore buys less from the rest of the world; and the result is a global slump. Or, maybe not so much.

Some quick, rough, but I think useful math: In 2011, the combined GDP of all the world’s economies not including China was slightly over $60 trillion. Meanwhile, Chinese imports of goods and services were about $2 trillion, or around 3 percent of the rest of the world’s GDP.

Now suppose that China has a slowdown of 5 percent relative to trend. Imports would fall more than this; typical estimates of the “income elasticity” of imports (the percentage change from a 1 percent change in GDP, other things equal) are around 2. So we could be looking at a 10 percent fall in Chinese imports — an adverse shock to the rest of the world of one-tenth of 3 percent,or 0.3 percent of GDP. Not nothing, but not [catastrophic].

The last one - political unrest - is the scary one and is complete unknown.

Friday, July 19, 2013

Two more Q2 GDP Downgrades

by Calculated Risk on 7/19/2013 07:42:00 PM

From Reuters: Morgan Stanley cuts second quarter U.S. GDP forecast to 0.3 percent

Morgan Stanley economist Ted Wieseman, but the softness in June nonetheless prompted him to cut Morgan Stanley’s Q2 GDP estimate to 0.3 percent from 0.4 percent.From Merrill Lynch:

This week we are marking to market both our growth and inflation forecasts. On the growth side, the story is simple. With most of the data in, our tracking model pegs 2Q GDP growth at just 0.9%. ... Clearly, the fiscal shock and weak global growth are undercutting the recovery. The main reasons for the downward revision in 2Q are weaker inventory accumulation and a wider trade deficit.And Mark Zandi of Moody's Analytics last week:

This weakness is not a fluke: it reflects weakness in many key growth indicators. ...

That said, the good news is that we don’t think the weakness will be persistent. The consumer looks healthier heading into 2H, and manufacturing is starting to improve thanks to autos. Low inventories in 2Q give capacity to rebuild in 3Q. Thus, we are revising up 3Q GDP growth to 2.0% from 1.5%, and continue to expect 2.5% in 4Q. We are not out of the woods yet, but conditions are improving.

The thing that changed is the GDP number.... That is really coming in much weaker than anyone had expected. Certainly than I had expected earlier in the year. It's tracking slightly positive and it's possible that it could be a negative print in Q2.This slowdown is probably related to the significant drag from fiscal policy. I expect the fiscal policy drag to diminish and growth to improve going forward.

DOT: Vehicle Miles Driven increased 0.9% in May

by Calculated Risk on 7/19/2013 03:44:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by +0.9% (2.3 billion vehicle miles) for May 2013 as compared with May 2012. Travel for the month is estimated to be 262.1 billion vehicle miles.

The following graph shows the rolling 12 month total vehicle miles driven.

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 66 months - over 5 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were down in May compared to May 2012. In May 2013, gasoline averaged of $3.67 per gallon according to the EIA. In 2012, prices in May averaged $3.79 per gallon. However gasoline prices were up year-over-year in June and especially in July of this year, so I expect miles driven to be down year-over-year in July.

Gasoline prices were down in May compared to May 2012. In May 2013, gasoline averaged of $3.67 per gallon according to the EIA. In 2012, prices in May averaged $3.79 per gallon. However gasoline prices were up year-over-year in June and especially in July of this year, so I expect miles driven to be down year-over-year in July.Gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven.

Brent and WTI Oil Futures: "The Spread is Dead"

by Calculated Risk on 7/19/2013 01:25:00 PM

From MarketWatch: WTI crude prices trade at premium to Brent

Prices for West Texas Intermediate crude oil on the New York Mercantile Exchange traded at a premium versus Brent crude prices on ICE futures Friday.

That was the first time WTI cost more than Brent crude since October 2010 ...

“Assuming our petroleum product consumption and exports remain at recent levels or more, then the spread is dead.” [said Richard Hastings, a macro strategist at Global Hunter Securities]

Click on graph for larger image.

Click on graph for larger image.For the last few years there have been some capacity issues at Cushing (see Jim Hamilton's post Prices of gasoline and crude oil for a discussion of the issues).

As Hamilton noted:

[A]n increase in production in Canada and the central U.S. combined with a decrease in U.S. consumption has led to a surplus of oil in the central U.S. This overwhelmed existing infrastructure for cheap transportation of crude from Cushing to the coast, causing a big spread to develop between the prices of WTI and Brent.The spread has been closing as more infrastructure has been put in place, US demand has increased, and global demand (Brent) has slowed. At one point Brent was selling for about 25% more than WTI (even though they are comparable quality). Right now the "spread is dead".

BLS: State unemployment rates were "little changed" in June

by Calculated Risk on 7/19/2013 10:00:00 AM

Note: This data was released yesterday. From the BLS: Regional and state unemployment rates were little changed in June

Twenty-eight states had unemployment rate increases, 11 states had decreases, and 11 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada had the highest unemployment rate among the states in June, 9.6 percent. The next highest rates were in Illinois and Mississippi, 9.2 percent and 9.0 percent, respectively. North Dakota again had the lowest jobless rate, 3.1 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Nevada have seen the largest declines and many other states have seen significant declines (California, Florida and more).

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at or above 9% in only three states: Nevada, Illinois, and Mississippi. This is the fewest states with 9% unemployment since 2008.

For some of the sand states (largest real estate bubble states), the improvement has been significant. The unemployment rate in California has declined from 10.6% in June 2012 to 8.5% in June 2013. The unemployment rate in Florida has declined from 8.8% in June 2012 to 7.1% in June 2013.

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).Currently only three states have an unemployment rate above 9% (purple), sixteen states above 8% (light blue), and 27 states above 7% (blue).

Janet Yellen for Fed Chair

by Calculated Risk on 7/19/2013 09:11:00 AM

I've been an admirer of Dr. Janet Yellen for a number of years (In 2009 I suggested her as an alternative to reappointing Ben Bernanke). I've linked to a couple of articles below and they suggest the choice is between Janet Yellen and Larry Summers - and the key difference is "leadership style". However another key difference is that Yellen has a much better track record of correctly analyzing the economic situation, while Summers has frequently been wrong (but never in doubt). As an example, in 2005 Yellen was expressing concerns about housing:

" ...there are downside risks to economic growth relating to the housing market. This sector has been a key source of strength in the current expansion, and the concern is that, if house prices fell, the negative impact on household wealth could lead to a pullback in consumer spending. Certainly, analyses do indicate that house prices are abnormally high—that there is a "bubble" element, even accounting for factors that would support high house prices, such as low mortgage interest rates. So a reversal is certainly a possibility. Moreover, even the portion of house prices that is explained by low mortgage rates is at risk."And in 2006 she was talking about "ghost towns" in the West:

According to some of our contacts elsewhere in this Federal Reserve District, data like these are actually "behind the curve," and they're willing to bet that things will get worse before they get better. For example, a major home builder has told me that the share of unsold homes has topped 80 percent in some of the new subdivisions around Phoenix and Las Vegas, which he labeled the new "ghost towns" of the West.What was Larry Summers saying about housing in 2005 and 2006? From the WaPo:

In August 2005, Raghuram Rajan, an economist at the University of Chicago’s Booth School of Business, predicted the financial crisis. And he did it at possibly the least friendly of venues: a conference of high-powered economists who had convened in part to honor Federal Reserve Chairman Alan Greenspan.Note: I started this blog in January 2005, and I was writing frequently about the housing bubble - the coming housing bust - and the impact on the U.S. economy. I quoted Yellen on housing, but never Summers (I'm pretty sure Summers didn't see the housing bubble).

Rajan presented a paper titled “Has Financial Innovation Made the World Riskier?” His answer, put simply, was “Yes.” He was dismissed by the assembled masters of the universe. “Misguided,” said Larry Summers. But Rajan was right.

I'd like to see reporters dig into the track record of both individuals instead of just reporting on "personality" differences. As an example, most people (not all) now understand that a little inflation is better than no inflation. Janet Yellen was able to convince Alan Greenspan of this view in the '90s. From Binyamin Appelbaum at the NY Times: Possible Fed Successor Has Admirers and Foes

In July 1996, the Federal Reserve broke the metronomic routine of its closed-door policy-making meetings to hold an unusual debate. The Fed’s powerful chairman, Alan Greenspan, saw a chance for the first time in decades to drive annual inflation all the way down to zero, achieving the price stability he had long regarded as the central bank’s primary mission.Unfortunately most of the focus now seems to be on leadership style (I prefer Yellen's style), from a Bloomberg article: Yellen or Summers: Who'd Be Better at Running the Fed?

But Janet L. Yellen, then a relatively new and little-known Fed governor, talked Mr. Greenspan to a standstill that day, arguing that a little inflation was a good thing. She marshaled academic research that showed it would reduce the depth and frequency of recessions, articulating a view that has prevailed at the Fed. And as the Fed’s vice chairwoman since 2010, Ms. Yellen has played a leading role in cementing the central bank’s commitment to keep prices rising about 2 percent each year.

Where Yellen and Summers may differ most is in their leadership style. That may be the critical issue for a Fed that's trying to be more open about its thinking despite disagreements among its top policy makers. The Fed's minutes show Yellen as influential but not particularly loud and outspoken. It's safe to say Summers would be loud and outspoken -- and authoritarian rather than merely influential.And from the LA Times: Obama may choose between two economists to replace Bernanke at Fed

President Obama's choice for replacing Federal Reserve Chairman Ben S. Bernanke probably comes down to a quiet consensus builder, who would be a historic pick, or one considered brilliant but difficult to work with.I don't believe in the indispensable man (or woman), but I think Janet Yellen is the right person for the job.

Thursday, July 18, 2013

Research: Labor force participation rate expected to stay flat through 2015

by Calculated Risk on 7/18/2013 07:58:00 PM

I've written frequently about the participation rate (the percent of the civilian noninstitutional population in the labor force). A few posts: Understanding the Decline in the Participation Rate, Update: Further Discussion on Labor Force Participation Rate, Merrill Lynch on Labor Force Participation Rate, Labor Force Participation Rate Research

The participation rate was expected to decline for structural reasons even before the great recession started (baby boomers retiring, younger Americans staying in school longer, etc.). A key question is how much of the recent decline in the participation rate was due to long term trends, and how much was cyclical (economic weakness)?

Here is some research from Macroeconomic Advisers: Where’s Labor Force Participation Heading?

• Fifty-five percent of the recent decline in the participation rate is due to structural factors that, on balance, will continue to exert downward pressure on participation through 2015.CR Note: A significant portion of the decline in the unemployment rate from 10.0% in October 2009 to 7.6% in June 2013 was related to a decline in the participation rate from 65.0% in Oct 2009 to 63.5% in June 2013. If the participation rate had held steady, the unemployment rate would be 9.7% (assuming an increase in the participation rate with the same employment level).

• The other forty-five percent is cyclical and will gradually abate. However, the cyclical decline in participation has been larger and more persistent than in past cycles due to the unusually large increase in the average duration of unemployment during this cyclical episode.

• Going forward, the cyclical rebound in participation will roughly offset the continuing downward push of structural forces. Consequently, we project that in 2015, when the FOMC will be contemplating the first increase in the federal funds rate, the participation rate will be 63.4%, the same as in the second quarter of this year.

That projection for the participation rate implies that monthly changes in household employment averaging about 114,000 will be sufficient to stabilize the unemployment rate through 2015. Anything faster will push the unemployment rate down. To reach the FOMC’s threshold unemployment rate of 6.5% in the second quarter of 2015, as shown in our forecast, requires monthly changes in household employment averaging roughly 170,000 over the next 24 months, consistent with our forecast that monthly changes in establishment employment will average roughly 190,000 over that same period.

Now the participation rate is forecast to mostly move sideways - or maybe even increase a little in the short term - so we probably shouldn't expect a decline in the participation rate to help push down the unemployment rate over the next year or two. Instead, and decline in the unemployment rate will probably because of an increase in employment.

Longer term the participation rate will probably continue to decline until 2030 or 2040. I expect the rate to fall from the current 63.4% to around 60% in 2030 based on recent trends and demographics.

Detroit Files for Bankruptcy

by Calculated Risk on 7/18/2013 05:02:00 PM

From the WSJ: Detroit Files for Chapter 9 Bankruptcy

The city of Detroit filed for federal bankruptcy protection on Thursday afternoon ... the country's largest-ever municipal bankruptcy case.The prediction of “hundreds of billions” of dollars in municipal bond defaults in 2011 never happened, however this one has been in the works for some time. A shrinking population makes the situation very difficult.

...

The financial outlook has never been bleaker for the Motor City, which has shrunk from its peak of nearly two million people in 1950 to 700,000 today.

...

Most at risk under the bankruptcy case is the city's $11 billion in unsecured debt. That includes almost $6 billion in health and other benefits for retirees; more than $3 billion for retiree pensions; and about $530 million in general-obligation bonds.

More from Brad Plummer at the WaPo: Detroit just filed for bankruptcy. Here’s how it got there.

To get a better sense of just how Detroit got into such dire straits, it’s worth browsing through the city’s official “Proposals for Creditors” from June and a separate May report on the city’s finances. Emergency manager Kevyn Orr laid out all the problems and economic headwinds facing Detroit ...

Freddie Mac: 30 Year Mortgage Rates Decline to 4.37% in Latest Weekly Survey

by Calculated Risk on 7/18/2013 12:49:00 PM

From Freddie Mac today: Mortgage Rates Cool Off

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates easing along with market concerns over the Federal Reserve's bond purchase program ...

30-year fixed-rate mortgage (FRM) averaged 4.37 percent with an average 0.7 point for the week ending July 18, 2013, down from last week when it averaged 4.51 percent. Last year at this time, the 30-year FRM averaged 3.53 percent.

15-year FRM this week averaged 3.41 percent with an average 0.7 point, down from last week when it averaged 3.53 percent. A year ago at this time, the 15-year FRM averaged 2.83 percent.

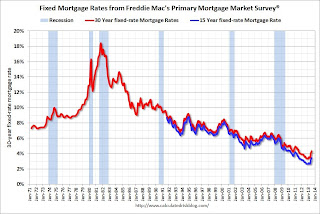

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up from 3.35% in early May, and 15 year mortgage rates are up from 2.56% over the last 2 months.

The Freddie Mac survey started in 1971.

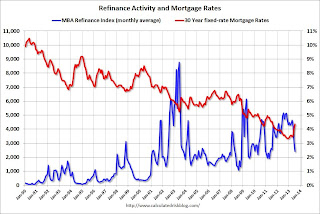

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The second graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index. The refinance index has dropped sharply recently (down 55% over the last 10 weeks) and will continue to decline if rates stay at this level.