by Calculated Risk on 7/11/2013 01:51:00 PM

Thursday, July 11, 2013

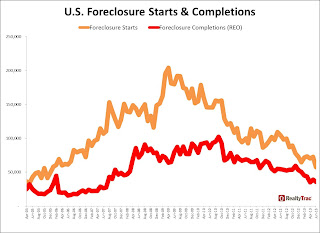

RealtyTrac: Foreclosure Activity Drops to Lowest Level since 2006

This was released this morning from RealtyTrac: U.S. Foreclosure Activity Decreases 14 Percent in June to Lowest Level Since December 2006 Despite 34 Percent Jump in Judicial Scheduled Foreclosure Auctions

RealtyTrac® ... today released its Midyear 2013 U.S. Foreclosure Market Report™, which shows a total of 801,359 U.S. properties with foreclosure filings — default notices, scheduled auctions and bank repossessions — in the first half of 2013, a 19 percent decrease from the previous six months and down 23 percent from the first half of 2012.

...

A total of 127,790 U.S. properties had foreclosure filings in June, down 14 percent from the previous month and down 35 percent from a year ago to the lowest monthly level since December 2006 — a six and a half year low.

U.S. foreclosure starts in June dropped 21 percent from the previous month and were down 45 percent from a year ago to the lowest monthly level since December 2005 — a seven and a half year low. Year to date through June, 409,491 foreclosure starts have been filed nationwide, on pace to reach more than 800,000 for the year, which would be down from 1.1 million foreclosure starts in 2012.

...

Judicial foreclosure auctions (NFS) were scheduled for 28,296 U.S. properties in June, up less than 1 percent from May but up 34 percent from June 2012. States with substantial annual increases in scheduled judicial foreclosure auctions included New Jersey (up 103 percent), Florida (up 100 percent), Maryland (up 94 percent), New York (up 66 percent), and Illinois (up 65 percent to a 35-month high).

...

“Halfway through 2013 it is becoming increasingly evident that while foreclosures are no longer a problem nationally they continue to be a thorn in the side of several state and local markets, particularly where a backlog of delayed distress has built up thanks to a lengthy foreclosure process,” said Daren Blomquist, vice president at RealtyTrac. “The increases in judicial foreclosure auctions demonstrate that these delayed foreclosure cases are now being moved more quickly through to foreclosure completion.

Click on graph for larger image.

Click on graph for larger image.This graph from RealtyTrac shows foreclosure starts and completions since 2005.

Some of the decline in foreclosure activity is related to the increased emphasis on short sales and modifications.

The difference in various states is another reminder that a national foreclosure law, with strong borrower protections, should be part of the housing finance reform legislation.

Will the Fed "Taper" in September if the August unemployment rate is 7.6%?

by Calculated Risk on 7/11/2013 10:47:00 AM

Short answer: No.

The BLS will release two more employment reports before the September 17-18 FOMC meeting (employment reports for July and August). The current unemployment rate is 7.6% (as of June), and the Fed's forecast is for the unemployment rate to decline to an average of 7.2% to 7.3% in Q4 of this year.

A significant portion of the decline in the unemployment rate from 10.0% in October 2009 to 7.6% in June 2013 was related to a decline in the participation rate from 65.0% in Oct 2009 to 63.5% in June 2013. If the participation rate had held steady, the unemployment rate would be 9.7% (assuming an increase in the participation rate with the same employment level).

Of course a large portion of the decline in the participation rate was expected and was due to demographics (both the aging of the population, and more young Americans staying in school). There has been an ongoing debate about how much of the decline in the participation rate has been due to demographics and how much due to economic weakness (I think more demographics, other have attributed more of the decline to economic weakness).

However just about every analyst expects 1) a continued long term decline in the participation rate, 2) some short term bounce back in the participation rate as the economy recovers. The bounce back could be just a flattening of the participation rate (the short term bounce back just offsetting the long term decline) or the participation rate could increase 0.5% or so in the next year or two. (I think somewhat flat is likely)

The participation rate could be very important regarding the timing of when the Fed starts tapering QE3 asset purchases. We can use the Atlanta Fed's Jobs Calculator tool to estimate how many jobs per month will be needed to reach a certain unemployment level based on the participation rate.

As an example, if the participation rate holds steady over the next two months, it would take 114 thousand jobs added per month to keep the unemployment rate at 7.6%. The economy has added 202 per month so far in 2013, and at that pace - with the participation rate steady at 63.5% - the unemployment rate would decline to 7.4% to 7.5% in August.

However, if the participation rate increases slightly to 63.6% (more people returning to the labor force), then the economy would need to add 220 thousand jobs per month to just keep the unemployment rate steady at 7.6%.

The participation rate was probably one of the factors Fed Chairman Ben Bernanke was referring to yesterday when he said the June unemployment rate of 7.6% "probably understates the weakness of the labor market." I've seen a number of analysts point to recent job gains as the key to the Fed tightening in September; I think the unemployment rate and participation rate are more important indicators for the Fed.

Note: You can put in your own assumptions to the calculator. Another frequent question is when will the unemployment rate fall to 6.5% (the Fed's threshold, but not trigger, for raising the Fed's funds rate). If the participation rate stays steady, the unemployment rate will fall to 6.5% in December 2014 if the economy adds around 200,000 jobs per month. This is consistent with the Fed not raising rates until 2015 or later.

Weekly Initial Unemployment Claims increase to 360,000

by Calculated Risk on 7/11/2013 08:35:00 AM

The DOL reports:

In the week ending July 6, the advance figure for seasonally adjusted initial claims was 360,000, an increase of 16,000 from the previous week's revised figure of 344,000. The 4-week moving average was 351,750, an increase of 6,000 from the previous week's revised average of 345,750.The previous week was revised up from 343,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 351,750.

The 4-week average has mostly moved sideways over the last few months. Claims were above the 337,000 consensus forecast, but I wouldn't read too much into this one report since this was a holiday week and data in July can be impacted by the timing of auto plant shutdowns.

Wednesday, July 10, 2013

Thursday: Weekly Unemployment Claims

by Calculated Risk on 7/10/2013 08:28:00 PM

From the WSJ: Fed Affirms Easy-Money Tilt

"You can only conclude that highly accommodative monetary policy for the foreseeable future is what's needed in the U.S. economy," he said Wednesday at a conference held by the National Bureau of Economic Research, citing the high unemployment rate, low inflation and "quite restrictive" fiscal policy. He said he expects the Fed won't raise short-term rates for some time after the unemployment rate hits 6.5%, which would be more than a full percentage point lower than its current level.I just don't see tapering in September unless the economy clearly picks up in July and August. However many analysts think tapering is a "done deal".

...

Mr. Bernanke, speaking at Wednesday's conference, said he was "somewhat optimistic" about the economy. However, he noted the June unemployment rate of 7.6% "probably understates the weakness of the labor market," inflation is running below the Fed's 2% objective and fiscal policy is quite restrictive.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 337 thousand from 343 thousand last week.

Bernanke: "A Century of U.S. Central Banking: Goals, Frameworks, Accountability"

by Calculated Risk on 7/10/2013 04:10:00 PM

Note: This is an interesting speech, but the key will be the Q&A.

Speech from Fed Chairman Ben Bernanke: A Century of U.S. Central Banking: Goals, Frameworks, Accountability

Today, I'll discuss the evolution over the past 100 years of three key aspects of Federal Reserve policymaking: the goals of policy, the policy framework, and accountability and communication. The changes over time in these three areas provide a useful perspective, I believe, on how the role and functioning of the Federal Reserve have changed since its founding in 1913, as well as some lessons for the present and for the future. I will pay particular attention to several key episodes of the Fed's history, all of which have been referred to in various contexts with the adjective "Great" attached to them: the Great Experiment of the Federal Reserve's founding, the Great Depression, the Great Inflation and subsequent disinflation, the Great Moderation, and the recent Great Recession.

FOMC Minutes: "Many members indicated that further improvement in the outlook for the labor market would be required before it would be appropriate to slow the pace of asset purchases"

by Calculated Risk on 7/10/2013 02:00:00 PM

Note: We will probably know more on the Fed's plans after Bernanke's speech and Q&A later today.

From the Fed: Minutes of the Federal Open Market Committee, June 18-19, 2013. A few excerpts on asset purchases:

While recognizing the improvement in a number of indicators of economic activity and labor market conditions since the fall, many members indicated that further improvement in the outlook for the labor market would be required before it would be appropriate to slow the pace of asset purchases. ...

Participants discussed how best to communicate the Committee's approach to decisions about its asset purchase program and how to reduce uncertainty about how the Committee might adjust its purchases in response to economic developments. Importantly, participants wanted to emphasize that the pace, composition, and extent of asset purchases would continue to be dependent on the Committee's assessment of the implications of incoming information for the economic outlook, as well as the cumulative progress toward the Committee's economic objectives since the institution of the program last September. The discussion centered on the possibility of providing a rough description of the path for asset purchases that the Committee would anticipate implementing if economic conditions evolved in a manner broadly consistent with the outcomes the Committee saw as most likely. Several participants pointed to the challenge of making it clear that policymakers necessarily weigh a broad range of economic variables and longer-run economic trends in assessing the outlook. As an alternative, some suggested providing forward guidance about asset purchases based on numerical values for one or more economic variables, broadly akin to the Committee's guidance regarding its target for the federal funds rate, arguing that such guidance would be more effective in reducing uncertainty and communicating the conditionality of policy. However, participants also noted possible disadvantages of such an approach, including that such forward guidance might inappropriately constrain the Committee's decisionmaking, or that it might prove difficult to communicate to investors and the general public.

Since the September meeting, some participants had become more confident of sustained improvement in the outlook for the labor market and so thought that a downward adjustment in asset purchases had or would likely soon become appropriate; they saw a need to clearly communicate an intention to lower the pace of purchases before long. However, to some other participants, this approach appeared likely to limit the Committee's flexibility in adjusting asset purchases in response to changes in economic conditions, which they viewed as a key element in the design of the purchase program. Others were concerned that stating an intention to slow the pace of asset purchases, even if the intention were conditional on the economy developing about in line with the Committee's expectations, might be misinterpreted as signaling an end to the addition of policy accommodation or even be seen as the initial step toward exit from the Committee's highly accommodative policy stance. It was suggested that any statement about asset purchases make clear that decisions concerning the pace of purchases are distinct from decisions concerning the federal funds rate.

Participants generally agreed that the Committee should provide additional clarity about its asset purchase program relatively soon. A number thought that the postmeeting statement might be the appropriate vehicle for providing additional information on the Committee's thinking. However, some saw potential difficulties in being able to convey succinctly the desired information in the postmeeting statement. Others noted the need to ensure that any new statement language intended to provide more information about the asset purchase program be clearly integrated with communication about the Committee's other policy tools. At the conclusion of the discussion, most participants thought that the Chairman, during his postmeeting press conference, should describe a likely path for asset purchases in coming quarters that was conditional on economic outcomes broadly in line with the Committee's expectations. In addition, he would make clear that decisions about asset purchases and other policy tools would continue to be dependent on the Committee's ongoing assessment of the economic outlook. He would also draw the distinction between the asset purchase program and the forward guidance regarding the target for the federal funds rate, noting that the Committee anticipates that there will be a considerable time between the end of asset purchases and the time when it becomes appropriate to increase the target for the federal funds rate.

emphasis added

Timiraos: Foreclosure Squeeze Crimps Las Vegas Real-Estate Market

by Calculated Risk on 7/10/2013 11:03:00 AM

From Nick Timiraos at the WSJ: Foreclosure Squeeze Crimps Las Vegas Real-Estate Market

The number of available homes has plunged here after a sweeping state law subjected lenders to stiff new foreclosure rules and penalties. With banks exercising caution, many homeowners—including those seriously delinquent on their loans—have been allowed to remain in place. As a result, there is little on the market at a time when first-time buyers and real-estate speculators are anxious to tap both cheap prices and low-interest mortgages.The Nevada law was passed with good intentions - and the banks were definitely bad actors - but the result is Las Vegas will have a high level of foreclosures for years (and poorly maintained homes).

...

The perverse outcome: Inventory shortages have spurred new developments despite a glut of properties stuck in foreclosure limbo.

...

The inventory shortages, meanwhile, have been a boon for some—especially builders. "A.B. 284 has been great for us. It darn near eliminated the constant inflow of foreclosures on the resale market," says Robert Beville, president of Harmony Homes, a local home builder.

...

Studies by researchers at the Federal Reserve Bank of Boston show that "delaying the foreclosure process does not in the end lead to fewer foreclosures," said Paul Willen, a senior economist at the Boston Fed. "If they're delaying a foreclosure that is going to happen eventually, what we're really concerned about is that they're reducing the quality of life for the neighborhood."

emphasis added

MBA: Mortgage Refinance Applications Decline as Mortgage Rates Increase in Latest Weekly Survey

by Calculated Risk on 7/10/2013 08:14:00 AM

From the MBA: Mortgage Applications Decrease as Rates Reach Two-year High in Latest MBA Weekly Survey

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier.Note: This was for a holiday week with a large seasonal adjustment. I expect a large decline in refinance activity in the survey next week.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.68 percent, the highest rate since July 2011, from 4.58 percent, with points increasing to 0.46 from0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates above 4.5%, refinance activity has fallen sharply, decreasing in 8 of the last 9 weeks.

This index is down 50% over the last nine weeks.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and even with the recent decline, the 4-week average of the purchase index is up almost 10% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and even with the recent decline, the 4-week average of the purchase index is up almost 10% from a year ago.

Tuesday, July 09, 2013

Wednesday: FOMC Minutes, Bernanke

by Calculated Risk on 7/09/2013 08:31:00 PM

Not a usual topic, but an interesting article from Nick Bilton at the NY Times: The Money Side of Driverless Cars

Washington, an average of six parking tickets are issued every minute of a normal workday. That is about 5,300 tickets on each of those days. Those slips of paper have added up to $80 million in parking fines a year, according to a report by AAA Mid-Atlantic.Smart cars will have a huge impact on some areas ... I hope this happens quickly!

As I noted in my Disruptions column this week, ”How Driverless Cars Could Reshape Cities,” the parking ticket could vanish from the future city as cars park themselves ...

According to the National Highway Traffic Safety Administration, 93 percent of all traffic accidents result from human error. If cars are smart enough to avoid accidents — and many researchers working on these cars believe they will be — the multibillion-dollar car insurance industry could completely change and be reimagined.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. Expect higher mortgage rates and a decline in refinance activity.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for May. The consensus is for a 0.3% increase in inventories.

• At 2:00 PM, FOMC Minutes for Meeting of June 18-19, 2013 will be released. These will be scrutinized for timing of the tapering of QE3 asset purchases.

• At 4:10 PM, Fed Chairman Ben Bernanke will speak, A Century of U.S. Central Banking: Goals, Frameworks, Accountability, At the National Bureau of Economic Research Conference: The First 100 Years of the Federal Reserve: The Policy Record, Lessons Learned, and Prospects for the Future, Cambridge, Mass.

Fed's Williams: "A Defense of Moderation in Monetary Policy"

by Calculated Risk on 7/09/2013 06:24:00 PM

From San Francisco Fed President John Williams: A Defense of Moderation in Monetary Policy. From the abstract:

This paper examines the implications of uncertainty about the effects of monetary policy for optimal monetary policy with an application to the current situation. Using a stylized macroeconomic model, I derive optimal policies under uncertainty for both conventional and unconventional monetary policies. According to an estimated version of this model, the U.S. economy is currently suffering from a large and persistent adverse demand shock. Optimal monetary policy absent uncertainty would quickly restore real GDP close to its potential level and allow the inflation rate to rise temporarily above the longer-run target. By contrast, the optimal policy under uncertainty is more muted in its response. As a result, output and inflation return to target levels only gradually. This analysis highlights three important insights for monetary policy under uncertainty. First, even in the presence of considerable uncertainty about the effects of monetary policy, the optimal policy nevertheless responds strongly to shocks: uncertainty does not imply inaction. Second, one cannot simply look at point forecasts and judge whether policy is optimal. Indeed, once one recognizes uncertainty, some moderation in monetary policy may well be optimal. Third, in the context of multiple policy instruments, the optimal strategy is to rely on the instrument associated with the least uncertainty and use alternative, more uncertain instruments only when the least uncertain instrument is employed to its fullest extent possible.Currently inflation is below the Fed's target (and is forecast to remain below the target), and unemployment is significantly above target (and forecast to remain above target). In general the current situation and forecasts would suggest more accommodation.

emphasis added

Williams argues because of uncertainty that current policy might be optimal. Note: Williams is an influential Fed president and has been supportive of QE. Maybe ... but high unemployment is a serious problem now (and also keeps down wages for almost everyone), and I'd think monetary and fiscal policymakers would be discussing this daily. With the current Congress, fiscal policy aimed at reducing unemployment is off the table, so all we have is monetary policy. And now Williams is defending "moderation" ...