by Calculated Risk on 6/18/2013 08:30:00 AM

Tuesday, June 18, 2013

Housing Starts increase in May to 914,000 SAAR

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 914,000. This is 6.8 percent above the revised April estimate of 856,000 and is 28.6 percent above the May 2012 rate of 711,000.

Single-family housing starts in May were at a rate of 599,000; this is 0.3 percent above the revised April figure of 597,000. The May rate for units in buildings with five units or more was 306,000.

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 974,000. This is 3.1 percent below the revised April rate of 1,005,000, but is 20.8 percent above the May 2012 estimate of 806,000.

Single-family authorizations in May were at a rate of 622,000; this is 1.3 percent above the revised April figure of 614,000. Authorizations of units in buildings with five units or more were at a rate of 374,000 in April.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in May following the sharp decrease in April (Multi-family is volatile month-to-month).

Single-family starts (blue) increased slightly to 599,000 SAAR in May (Note: April was revised down from 610 thousand to 597 thousand).

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been generally increasing after moving sideways for about two years and a half years. This was below expectations of 950 thousand starts in May. Total starts in May were up 28.6% from May 2012; however single family starts were only up 16.3% year-over-year. I'll have more later ...

Monday, June 17, 2013

Tuesday: Housing Starts, CPI

by Calculated Risk on 6/17/2013 09:22:00 PM

Earlier today, Robin Harding at the Financial Times released a market moving story of the Fed: Fed likely to signal tapering move is close

Ben Bernanke is likely to signal that the US Federal Reserve is close to tapering down its $85bn-a-month in asset purchases when he holds a press conference on Wednesday, but balance that by saying subsequent moves depend on what happens to the economy.This depends on the definition of "close". I think it is very unlikely the Fed will start to taper before September, and based on my expectations of only a slow improvement in the unemployment rate and continued low inflation, I think they will wait even longer.

excerpt with permission

Tuesday economic releases:

• At 8:30 AM, Housing Starts for May. The consensus is for total housing starts to increase to 950 thousand (SAAR) in May.

• Also at 8:30 AM, the Consumer Price Index for May will be released. The consensus is for a 0.2% decrease in CPI in May and for core CPI to increase 0.2%.

FNC: House prices increased 4.6% year-over-year in April

by Calculated Risk on 6/17/2013 05:56:00 PM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

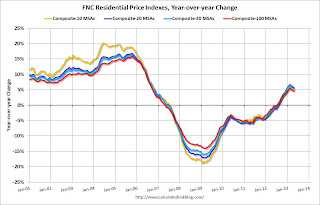

From FNC: FNC Index: Rise in Home Prices Picks up in April

The latest FNC Residential Price Index™ (RPI) shows that U.S. home prices continue to rise in April, up 0.7% from the previous month. April’s gain marks the largest price acceleration since June 2012, caused in part by rising seasonal demand entering spring and summer.Note: This increase is partially seasonal. This year prices were up 0.7% in April (from March). Last year, in April 2012, prices were up 1.0% in April - so this is slower seasonal price appreciation.

... Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that April home prices rose much faster than in the previous months. The two narrower indices (30-MSA and 10-MSA composites) similarly recoded a nearly 1.0% increase. On a year-over-year basis, home prices were up 4.6% from a year ago. The indices have been revised downward for the prior months, resulting in more moderate annual price accelerations.

The year-over-year change slowed in April, with the 100-MSA composite up 4.6% compared to April 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Even with the recent increase, the FNC composite 100 index is still off 28.6% from the peak.

Existing Home Inventory is up 14.9% year-to-date on June 17th

by Calculated Risk on 6/17/2013 02:10:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 14.9%, however inventory is down over the last few weeks. I expect further increases over the next few months.

Inventory is well above the peak percentage increases for 2011 and 2012 and this suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year (it could still happen early next year).

It is important to remember that inventory is still very low, and is down 15.8% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.

Redfin: "Here Comes the Inventory"

by Calculated Risk on 6/17/2013 12:47:00 PM

The bottom for inventory is a key topic for 2013 ...

From Tim Ellis at Redfin: Here Comes the Inventory

Increasing home prices are giving more sellers sufficient equity to sell, and sellers who already had equity are being lured into the market after seeing their neighbor’s homes sell in record time and in fierce bidding wars.

More inventory begets more inventory, too. “I have several clients who are ready to take the plunge and list their homes—they’ve even decluttered and we have the listing ready to hit the MLS,” explained Redfin listing specialist Paul Stone. “The sellers are just waiting to get under contract on a home to buy, at which point we’ll pull the trigger and list their current home.”

Here’s what the inventory recovery looks like so far, along with a forecast for the rest of the year, should the trend hold:

Total active listings are still down 22% from a year ago as of May, but even that is an improvement compared to the 32% year-over-year drop we experienced in January.

New listings have turned around completely in just four months, from a 10% year-over-year decline in January to a 15% year-over-year increase in May.CR Notes: I've been tracking inventory very closely this year. Ellis thinks (first graph) that inventory in the areas Redfin tracks will continue to build until September or October, and only decline slightly at the end of the year. He thinks inventory will be up year-over-year towards the end of this year. (that is pretty close to my current outlook for inventory).

...

As supply and demand are brought back into balance bidding wars will ease and price gains will moderate.

As more inventory comes on the market, buyer urgency will wane and price increases will slow and even decline seasonally in many areas this winter. IMO this will be another step towards a more normal housing market.

NAHB: Builder Confidence increases in June, Over 50 for first time since April 2006

by Calculated Risk on 6/17/2013 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) increased 8 points in June to 52. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Hits Major Milestone in June

Builder confidence in the market for newly-built single-family homes hit a significant milestone in June, surging eight points to a reading of 52 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. Any reading over 50 indicates that more builders view sales conditions as good than poor.

“This is the first time the HMI has been above 50 since April 2006, and surpassing this important benchmark reflects the fact that builders are seeing better market conditions as demand for new homes increases,” said NAHB Chairman Rick Judson, a home builder and developer from Charlotte, N.C. “With the low inventory of existing homes, an increasing number of buyers are gravitating toward new homes.”

...

All three HMI components posted gains in June. The index gauging current sales conditions increased eight points to 56, while the index measuring expectations for future sales rose nine points to 61 – its highest level since March 2006. The index gauging traffic of prospective buyers rose seven points to 40.

The HMI three-month moving average was up in three of the four regions, with the Northeast and Midwest posting a one-point and three-point gain to 37 and 47, respectively. The South registered a four point gain to 46 while the West fell one point to 48.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the June release for the HMI and the April data for starts (May housing starts will be released tomorrow). This was well above the consensus estimate of a reading of 45.

NY Fed: Empire State Manufacturing index increases in June

by Calculated Risk on 6/17/2013 08:38:00 AM

From the NY Fed: Empire State Manufacturing Survey

The June 2013 Empire State Manufacturing Survey indicates that conditions for New York manufacturers improved modestly. The general business conditions index—the most comprehensive of the survey’s measures—rose nine points to 7.8. Nevertheless, most other indicators in the survey fell. The new orders index slipped six points to -6.7, the shipments index fell twelve points to -11.8, and the unfilled orders index fell eight points to -14.5.This was above the consensus forecast of a reading of 0.0.

...

Labor market conditions worsened, with the index for number of employees dropping to zero and the average workweek index retreating ten points to -11.3.

emphasis added

Sunday, June 16, 2013

Monday: Empire State Manufacturing, NAHB Homebuilder Confidence

by Calculated Risk on 6/16/2013 09:00:00 PM

Another FOMC meeting preview from Jon Hilsenrath and Phil Izzo at the WSJ: Forget Fed-Speak, Look for the Latest Growth View

Weekend:

• Schedule for Week of June 16th

• FOMC Projections Preview: Disinflation Watch

• Mid-year Review: Ten Economic Questions for 2013

Monday economic releases:

• At 8:30 AM, the NY Fed Empire Manufacturing Survey for June will be released. The consensus is for a reading of 0.0, up from -1.4 in May (above zero is expansion).

• At 10:00 AM, the June NAHB homebuilder survey will be released. The consensus is for a reading of 45, up from 44 in May. This index increased sharply last year, but has moved sideways recently with some builders

Oil prices have moved up recently with WTI futures at $97.85 per barrel and Brent at $105.93 per barrel.

Mid-year Review: Ten Economic Questions for 2013

by Calculated Risk on 6/16/2013 05:22:00 PM

At the end of last year, I posted Ten Economic Questions for 2013. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2013 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand why I was wrong).

By request, here is a mid-year review (a little before mid-year). I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2013: Europe and the Euro

Even though I've been pessimistic on Europe (In 2011, I argued that the eurozone was heading into recession), I was less pessimistic than many others. Each of the last two years, I argued the eurozone would stay together ... My guess is the eurozone makes it through another year without losing any countries or a serious collapse. Obviously several countries are near the edge, and the key will be to return to expansion soon.Half way through the year, it looks like the Eurozone will stay together through 2013. Of course the news in Europe remains grim. However it is now obvious to everyone that "austerity" alone has failed, and I expect less fiscal tightening after German Chancellor Angela Merkel is reelected in a few months.

Note: unless the eurozone "implodes", I don't think Europe poses a large downside risk to the US. If there is a breakup of the euro (something I do not expect in 2013), then the impact on the US could be significant due to financial tightening.

9) Question #9 for 2013: How much will Residential Investment increase?

New home sales will still be competing with distressed sales (short sales and foreclosures) in many areas in 2013 - and probably even more foreclosures in some judicial states. Also I've heard some builders might be land constrained in 2013 (not enough finished lots in the pipeline). Both of these factors could slow the growth of residential investment, but I expect another solid year of growth.We only have four months of data (starts for May will be released this week), but starts in the January through April 2013 period were up about 29% compared to the same period in 2012. New home sales are up 26% during the first four months of 2013 compared to the same period in 2012. So far so good ...

... I expect growth for new home sales and housing starts in the 20% to 25% range in 2013 compared to 2012.

8) Question #8 for 2013: Will Housing inventory bottom in 2013?

If prices increase enough then some of the potential sellers will come off the fence, and some of these underwater homeowners will be able to sell. It might be enough for inventory to bottom in 2013.I track inventory weekly, and there is no question that the year-over-year rate of decline has slowed sharply. My mid-year guess is that inventory did bottom in January 2013 (this should be a huge focus right now, since rising inventory will slow price increases).

Right now my guess is active inventory will bottom in 2013, probably in January. At the least, the rate of year-over-year inventory decline will slow sharply.

7) Question #7 for 2013: What will happen with house prices in 2013?

Calling the bottom for house prices in 2012 now appears correct.The Case-Shiller Comp 20 and National indexes both increased about 7% in 2012. We only have Q1 price data, but house prices increased about 3.5% in Q1. I expect price increases to slow, but my initial prediction for house prices this year might have been low.

[E]ven though I expect inventories to be low this year, I think we will see more inventory come on the market in 2013 than 2012, as sellers who were waiting for a better market list their homes, and as some "underwater" homeowner (those who owe more than their homes are worth) finally can sell without taking a loss.

Also I expect more foreclosure in some judicial states, and I think the price momentum in Phoenix and other "bounce back" areas will slow.

All of these factors suggest further prices increases in 2013, but at a slower rate than in 2012.

6) Question #6 for 2013: What will happen with Monetary Policy and QE3?

I expect the FOMC will review their purchases at each meeting just like they used to review the Fed Funds rate. We might see some adjustments during the year, but currently I expect the Fed to purchase securities at about the same level all year.There has been some discussion of "tapering" asset purchases later this year, but I still think the Fed will wait longer than many people expect to start tapering.

5) Question #5 for 2013: Will the inflation rate rise or fall in 2013?

I still expect inflation to be near the Fed's target. With high unemployment and low resource utilization, I don't see inflation as a threat in 2013.Inflation has been falling and is now below the Fed's target. This is a significant issue for the Fed, and it appears my inflation forecast was a little high (at least mid-year).

4) Question #4 for 2013: What will the unemployment rate be in December 2013?

My guess is the participation rate will remain around 63.6% in 2013, and with sluggish employment growth, the unemployment rate will be in the mid-to-high 7% range in December 2013 (little changed from the current rate).In May, the participation rate was at 63.4% (I still expect it to mostly move sideways this year), and the unemployment rate was at 7.6%. This forecast still seems about right.

3) Question #3 for 2013: How many payroll jobs will be added in 2013?

Both state and local government and construction hiring should improve in 2013. Unfortunately there are other employment categories that will be hit by the austerity (especially the increase in payroll taxes). I expect that will offset any gain from construction and local governments. So my forecast is close to the previous two years, a gain of about 150,000 to 200,000 payroll jobs per month in 2013.Through the first five months of 2013, the economy has added an average of 189 thousand jobs per month - about as expected.

2) Question #2 for 2013: Will the U.S. economy grow in 2013?

[R]ight now it appears the drag from austerity will probably offset the pickup in the private sector - and we can expect another year of sluggish growth in 2013 probably in the 2% range again.The economy grew at a 2.4% annualized real rate in Q1, and forecasts are for around 1.8% in Q2. About as expected so far, however there was more austerity than I expected - and I also expect some pickup later this year.

1) Question #1 for 2013: US Fiscal Policy

[T]the House will fold their losing hand [on the debt ceiling] soon. ...I wrote the post linked above just after the fiscal cliff agreement was reached. I was correct about the debt ceiling (the House folded - the debt ceiling is absurd). But unfortunately I was wrong about the sequester (bad policy).

Although the negotiations on the "sequester" will be tough, I suspect something will be worked out (remember the goal is to limit the amount of austerity in 2013). The issue that might blow up is the “continuing resolution", and that might mean a partial shut down of the government. This wouldn't be catastrophic (like the "debt ceiling"), but it would still cause problems for the economy and is a key downside risk.

And a final prediction: If we just stay on the current path - and the "debt ceiling" is raised, and a reasonable agreement is reached on the "sequester", and the “continuing resolution" is passed - I think the deficit will decline faster than most people expect over the next few years. Eventually the deficit will start to increase again due to rising health care costs (this needs further attention), but that isn't a short term emergency.

Another point I was correct about was that the deficit is decreasing faster than most people expected - probably too fast. Fiscal policy (specifically the U.S. House) remains the key downside risk for the U.S. economy this year.

Overall 2013 is unfolding about as expected - at least so far. Longer term, the future's so bright ...

WaPo on Deficiency Judgments

by Calculated Risk on 6/16/2013 10:56:00 AM

Historically lenders haven't pursued many previous homeowners for deficiencies after foreclosure because it wasn't worth their time. As the following article notes:

It’s unclear how many people walk away from homes when they can still afford to pay the mortgage. Likewise, there is little publicly available data on how many people pay off their deficiency judgments. A recent government audit found the recovery rate at one-fifth of 1 percent.In judicial foreclosure states, the lender will frequently file for a deficiency judgment as part of the foreclosure case (they are in court anyway). Then the lender might sell the deficiency judgment to a debt collector for a pittance. Sometimes the debt collector will settle for pennies on the dollar (a nice return because they paid almost nothing) or the debt collector will force the former borrower into bankruptcy.

emphasis added

In non-judicial foreclosure states, the lenders rarely bothered to file for a deficiency judgment. (Tanta and I wrote extensively about mortgage deficiency judgments several years ago).

Of course everything changes if the lender thinks the borrower has assets and "strategically defaulted". In these cases the lender can recover some of their losses.

From Kimbriell Kelly at the WaPo: Lenders seek court actions against homeowners years after foreclosure

[Freddie Mac spokesman Brad German] said Freddie Mac is targeting “strategic defaulters,” which the agency defines as “someone who had the means but chose to go into default, that there were no extenuating circumstances that affected their ability to pay. If you’re choosing not to pay off your mortgage, but you’re paying other bills, we would consider that strategic default.”There is much more in the article including a discussion of how long lenders can collect deficiency judgments (several decades in some states).

In 2011, Fannie and Freddie flagged 12 percent of 298,327 properties they had foreclosed on — more than 35,000 — for deficiency judgments in an attempt to collect $2.1 billion in unpaid mortgage debt, according to an inspector general’s report released in October from the Federal Housing Finance Agency.

“Pursuing these collections against borrowers we believe have the ability to pay but who have decided not to helps us minimize our losses, which in turn helps minimize taxpayer losses,” said Malloy Evans, an attorney and Fannie Mae’s vice president for default management. “And we think it’s our responsibility to try to minimize those taxpayers’ losses as much as we can.”

I think now would be a good time for a major overhaul of the foreclosure system. I think we could start with 1) a national system with a non-judicial option like California, 2) ban deficiency judgments on loans up to the amount of the original purchase loan (so the borrower can refinance without worrying about a deficiency judgment if they lose their home, but they will liable if they extract equity), 3) allow cram-downs in bankruptcy (this allows bankruptcy judges to reduce the amount of debt on a home in bankruptcy).