by Calculated Risk on 6/16/2013 10:56:00 AM

Sunday, June 16, 2013

WaPo on Deficiency Judgments

Historically lenders haven't pursued many previous homeowners for deficiencies after foreclosure because it wasn't worth their time. As the following article notes:

It’s unclear how many people walk away from homes when they can still afford to pay the mortgage. Likewise, there is little publicly available data on how many people pay off their deficiency judgments. A recent government audit found the recovery rate at one-fifth of 1 percent.In judicial foreclosure states, the lender will frequently file for a deficiency judgment as part of the foreclosure case (they are in court anyway). Then the lender might sell the deficiency judgment to a debt collector for a pittance. Sometimes the debt collector will settle for pennies on the dollar (a nice return because they paid almost nothing) or the debt collector will force the former borrower into bankruptcy.

emphasis added

In non-judicial foreclosure states, the lenders rarely bothered to file for a deficiency judgment. (Tanta and I wrote extensively about mortgage deficiency judgments several years ago).

Of course everything changes if the lender thinks the borrower has assets and "strategically defaulted". In these cases the lender can recover some of their losses.

From Kimbriell Kelly at the WaPo: Lenders seek court actions against homeowners years after foreclosure

[Freddie Mac spokesman Brad German] said Freddie Mac is targeting “strategic defaulters,” which the agency defines as “someone who had the means but chose to go into default, that there were no extenuating circumstances that affected their ability to pay. If you’re choosing not to pay off your mortgage, but you’re paying other bills, we would consider that strategic default.”There is much more in the article including a discussion of how long lenders can collect deficiency judgments (several decades in some states).

In 2011, Fannie and Freddie flagged 12 percent of 298,327 properties they had foreclosed on — more than 35,000 — for deficiency judgments in an attempt to collect $2.1 billion in unpaid mortgage debt, according to an inspector general’s report released in October from the Federal Housing Finance Agency.

“Pursuing these collections against borrowers we believe have the ability to pay but who have decided not to helps us minimize our losses, which in turn helps minimize taxpayer losses,” said Malloy Evans, an attorney and Fannie Mae’s vice president for default management. “And we think it’s our responsibility to try to minimize those taxpayers’ losses as much as we can.”

I think now would be a good time for a major overhaul of the foreclosure system. I think we could start with 1) a national system with a non-judicial option like California, 2) ban deficiency judgments on loans up to the amount of the original purchase loan (so the borrower can refinance without worrying about a deficiency judgment if they lose their home, but they will liable if they extract equity), 3) allow cram-downs in bankruptcy (this allows bankruptcy judges to reduce the amount of debt on a home in bankruptcy).

Saturday, June 15, 2013

FOMC Projections Preview: Disinflation Watch

by Calculated Risk on 6/15/2013 08:48:00 PM

The FOMC meets on Tuesday and Wednesday of the coming week. I expect no policy change following the FOMC meeting with the Fed continuing to purchase $85 billion in longer-term Treasury and agency mortgage-backed securities per month. I also expect the forward guidance thresholds will remain unchanged.

In the press conference on Wednesday, I expect Fed Chairman Ben Bernanke to argue we still need to see "substantial improvement" in the labor market, and to note the downside risks to the economy, especially from current fiscal policy. He will probably make it clear that the Fed will not raise rates for a "considerable" time after the end of QE, and it seems likely he will express some concern about the low level of inflation.

Looking at the May 1st FOMC statement, the sentence on inflation will probably be changed:

"Inflation has been running somewhat below the Committee's longer-run objective, apart from temporary variations that largely reflect fluctuations in energy prices. Longer-term inflation expectations have remained stable."This will probably be changed to something like "Measures of underlying inflation have trended lower, and the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term".

The first part of the sentence is from the November 2010 FOMC meeting; the last part of that sentence is from the FOMC's March 2009 statement. Those were key meetings for the FOMC: In 2009, the FOMC expanded QE1, and in November 2010, the FOMC announced QE2.

On the projections, it looks like GDP will be downgraded again, and inflation projections will be reduced. The projections for the unemployment rate will probably be unchanged. Note: December 2012 projections included to show the trend, TBA - To be announced.

The central range for 2012 GDP will probably be closer to the lower end of the March projections.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2013 | 2014 | 2015 |

| June 2013 Meeting Projections | TBA | TBA | TBA |

| Mar 2013 Meeting Projections | 2.3 to 2.8 | 2.9 to 3.4 | 2.9 to 3.7 |

| Dec 2012 Meeting Projections | 2.3 to 3.0 | 3.0 to 3.5 | 3.0 to 3.7 |

The unemployment rate was at 7.6% in May and the June projections will probably be unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2013 | 2014 | 2015 |

| June 2013 Meeting Projections | TBA | TBA | TBA |

| Mar 2013 Meeting Projections | 7.3 to 7.5 | 6.7 to 7.0 | 6.0 to 6.5 |

| Dec 2012 Meeting Projections | 7.4 to 7.7 | 6.8 to 7.3 | 6.0 to 6.6 |

Projections for inflation will probably be reduced. Goldman Sachs believes the FOMC will lower the central projection for PCE inflation to 1.25% in 2013, and core PCE to 1.3%. The current concern is that inflation is below the Fed's target.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2013 | 2014 | 2015 |

| June 2013 Meeting Projections | TBA | TBA | TBA |

| Mar 2013 Meeting Projections | 1.3 to 1.7 | 1.5 to 2.0 | 1.7 to 2.0 |

| Dec 2012 Meeting Projections | 1.3 to 2.0 | 1.5 to 2.0 | 1.7 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2013 | 2014 | 2015 |

| June 2013 Meeting Projections | TBA | TBA | TBA |

| Mar 2013 Meeting Projections | 1.5 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 |

| Dec 2012 Meeting Projections | 1.6 to 1.9 | 1.6 to 2.0 | 1.8 to 2.1 |

Conclusion: I expect no change to policy at this meeting, but a slight downgrade to the economic projections - and some concern about inflation (but probably not enough to increase the size of QE3 purchases).

Schedule for Week of June 16th

by Calculated Risk on 6/15/2013 12:30:00 PM

The key event this week will be the FOMC statement and press conference on Wednesday. No changes in policy are expected, but Fed Chairman Ben Bernanke is expected to reiterate that rates will stay low for a long long time.

There are three key housing reports that will be released this week, housing starts on Tuesday, homebuilder confidence survey on Monday, and existing home sales on Thursday.

For manufacturing, the NY Fed (Empire State) and Philly Fed June surveys will be released this week. For prices, CPI will be released on Tuesday.

8:30 AM: NY Fed Empire Manufacturing Survey for June. The consensus is for a reading of 0.0, up from -1.4 in May (above zero is expansion).

10:00 AM ET: The June NAHB homebuilder survey. The consensus is for a reading of 45, up from 44 in May. This index increased sharply last year, but has moved sideways recently with some builders complaining about higher costs and lack of buildable land. Any number below 50 still indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for May.

8:30 AM: Housing Starts for May. Total housing starts were at 853 thousand (SAAR) in April, 16.5 percent below the revised March estimate of 1.021 million. Single family starts declined slightly to 610 thousand SAAR in April.

The consensus is for total housing starts to increase to 950 thousand (SAAR) in May.

8:30 AM: Consumer Price Index for May. The consensus is for a 0.2% decrease in CPI in May and for core CPI to increase 0.2%.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. No change to interest rates or QE purchases is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 340 thousand from 334 thousand last week.

9:00 AM: The Markit US PMI Manufacturing Index Flash for June. The index was at 52.3 in May.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for sales of 5.00 million on seasonally adjusted annual rate (SAAR) basis. Sales in April were at a 4.97 million SAAR. Economist Tom Lawler is estimating the NAR will report a May sales rate of 5.2 million.

A key will be inventory and months-of-supply.

10:00 AM: the Philly Fed manufacturing survey for June. The consensus is for a reading of -0.5, up from -5.2 last month (above zero indicates expansion).

10:00 AM: Regional and State Employment and Unemployment (Monthly) for May 2013

Unofficial Problem Bank list declines to 757 Institutions

by Calculated Risk on 6/15/2013 08:35:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list (update: Link fixed - was linking to old list) for June 14, 2013.

Changes and comments from surferdude808:

As anticipated, it was quiet week for changes to the Unofficial Problem Bank List as the OCC will wait until next Friday to provide its enforcement actions through mid-May 2013. There were three removals, which leave the list holding 757 institutions with assets of $274.8 billion. Last year, the list held 919 institutions with assets of $354.0 billion.

The OCC terminated actions against Communityone Bank, National Association, Asheboro, NC ($1.4 billion Ticker: FNBN) and Metrobank, National Association, Houston, TX ($1.1 billion Ticker: MCBI). The other removal was an unassisted merger of The First National Bank of Grant Park, Grant Park, IL ($110 million) with Midland States Bank, Clayton, IL.

We continue to monitor the operating status of the banking subsidiaries of Capitol Bancorp, LTD, but there is nothing new to report since the closing of the North Las Vegas unit last week.

Friday, June 14, 2013

Goldman FOMC Preview: "Calming the Market"

by Calculated Risk on 6/14/2013 10:21:00 PM

A short excerpt from a research note by Jan Hatzius and Sven Jari Stehn at Goldman Sachs: FOMC Preview: Calming the Market

The economic data have improved a bit since the last FOMC meeting ... But the improvement has been far from “substantial.” Growth remains in the sluggish 1-3% range ... and jobs gains remain moderate.The FOMC meeting is on Tuesday and Wednesday, with the FOMC statement and projections scheduled for release at 2 PM ET on Wednesday. Fed Chairman Ben Bernanke will hold a press conference at 2:30 PM. I'll post a preview on Sunday, but I don't expect any changes to policy.

Inflation, meanwhile, has continued to fall further below the FOMC’s 2% PCE target. ...

Financial conditions have tightened since the last FOMC meeting, as bond yields have risen, mortgage and credit spreads have widened ... The tightening in financial conditions appears in large part driven by worries that Fed officials will soon tighten policy.

... While we do not expect the committee to deviate much from the existing message, we anticipate that Fed officials will, on the margin, try to calm markets at the June 18-19 FOMC meeting.

We therefore expect the FOMC statement to show only modest changes, mostly focused on acknowledging the lower inflation numbers. Moreover, the committee is likely to downgrade its 2013 growth and inflation numbers moderately. While Chairman Bernanke is likely to reiterate in the post-statement press conference that the QE tapering decision is data dependent, we expect him to dissuade markets from frontloading too much of the entire monetary tightening process—not just the end of QE but also the normalization of the funds rate—as soon as the committee takes the first step in that direction.

Lawler: Early Look at Existing Home Sales in May

by Calculated Risk on 6/14/2013 03:51:00 PM

From housing economist Tom Lawler:

Based on local realtor/MLS reports I’ve seen so far across the country, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.2 million in May, up 4.6% from April’s pace and up 13.3% from last May’s pace.

On the inventory front, data from inventory trackers might suggest that the inventory of existing homes in May increased by 3 1/2 to 4%. As I’ve noted before, however, the NAR’s inventory estimates don’t always track “listings” month-to-month, with the NAR’s inventory estimate for April always showing an “out-sized” gain, and May showing a smaller increase/larger decline, relative to “listings trackers.” Based on limited historical data, I’d estimate that the NAR’s inventory estimate for May will be up 1.9% from April, which would result in a year-over-year decline of 10.9%.

CR Note: The NAR is scheduled to report May existing home sales next Thursday, June 20th, and the consensus is for sales of 5.0 million.

Based on Tom's estimates, this would put inventory at around 2.2 million for May, and months-of-supply around 5.1. This would still be a very low level of inventory - probably the lowest for May since 2001 or so - but this would be the smallest year-over-year decline in inventory since 2011 (when inventory started to decline sharply).

Housing bubble: The "Wealth" is Gone, but the Debt Remains

by Calculated Risk on 6/14/2013 02:00:00 PM

From Floyd Norris at the NY Times: Despite Recovery, Younger Households Are Slower to Make Gains

THE total wealth of American households has recovered from the financial crisis and Great Recession, according to the Federal Reserve Board. But ... many Americans, particularly younger adults who took on heavy debt to acquire homes before the housing bubble collapsed, are lagging.

...

During the housing boom, said William R. Emmons, the chief economist of the Center for Household Financial Stability at the Federal Reserve Bank of St. Louis, “exactly the people you would think need to act conservatively were doing the opposite.” Homeownership rates, and mortgage debt levels, rose for younger households, as well as for less educated and minority ones. Those groups suffered more during the crisis, he said, and have been slower to recover.

Mr. Emmons compiled average wealth figures for different groups from the triennial surveys ... older households are down just 3 percent on average, while those headed by middle-age people are down about 10 percent. But the decline is nearly 40 percent for the younger group.

During the housing boom, households ended up with more of their wealth in real estate than before, and mortgage debt rose to record levels relative to the size of the economy. The proportion of wealth in homes is now back to close to the level of the 1990s, but the debt levels remain high by historical standards.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph based on the Fed's Flow of Funds report shows household real estate assets and mortgage debt as a percent of GDP.

As Norris noted, the bubble wealth is gone, but the debt remains (still high on a historical basis). This was especially hard on younger households since they bought during the housing bubble.

Preliminary June Consumer Sentiment decreases to 82.7

by Calculated Risk on 6/14/2013 09:55:00 AM

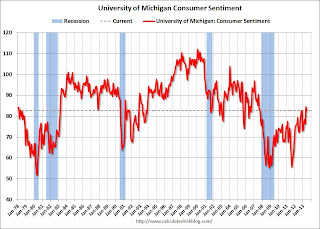

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for June decreased to 82.7 from the May reading of 84.5.

This was below the consensus forecast of 84.5 and reverses some of the large increase last month. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011.

Fed: Industrial Production unchanged in May

by Calculated Risk on 6/14/2013 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production was unchanged in May after having decreased 0.4 percent in April. In May, manufacturing production rose 0.1 percent after falling in each of the previous two months, and the output at mines increased 0.7 percent. The gains in manufacturing and mining were offset by a decrease of 1.8 percent in the output of utilities. At 98.7 percent of its 2007 average, total industrial production in May was 1.6 percent above its year-earlier level. The rate of capacity utilization for total industry edged down 0.1 percentage point to 77.6 percent, a rate 0.2 percentage point below its level of a year earlier and 2.6 percentage points below its long-run (1972–2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.6% is still 2.6 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was essentially unchanged in May at 98.7 . This is 17.8% above the recession low, but still 2.1% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were below expectations. The consensus was for a 0.2% increase in Industrial Production in April, and for Capacity Utilization to increases to 77.9%. Most of the weakness in industrial production was due to a sharp decline in the output of utilities.

Thursday, June 13, 2013

Friday: Industrial Production, PPI, Consumer Sentiment

by Calculated Risk on 6/13/2013 07:36:00 PM

From Victoria McGrane at the WSJ: Fed's Bond-Buying Wild Card: Inflation Expectations

"It is no longer clear that inflation expectations are so stable," Jan Hatzius, chief economist at Goldman Sachs Group Inc., said in an interview. Market-based measures of inflation expectations are now on "the low side of comfortable." In a note to clients June 10, he predicted that expectations of lower inflation are likely to make Fed officials less willing to pull back on the bond-buying programs out of fear it could destabilize those expectations about future inflation.If there is a concern about inflation, it is that inflation is below the Fed's target (those predicting hyperinflation have consistently been wrong). With the unemployment rate at 7.6% and inflation falling, it is very unlikely the Fed will reduce their monthly asset purchases any time soon.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for four key measures of inflation for April: median CPI, trimmed-mean CPI, core CPI and core PCE. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.6%, and the CPI less food and energy rose 1.7%. On the graph, Core PCE is for March - core PCE for April was at 1.1% year-over-year.

On a monthly basis, median CPI was at 1.8% annualized, trimmed-mean CPI was at 1.0% annualized, and core CPI increased 0.6% annualized. Core PCE for April increased 0.1% annualized.

Friday economic releases:

• At 8:30 AM, the Producer Price Index for May will be released. The consensus is for a 0.2% increase in producer prices (0.1% increase in core).

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 77.9%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for a reading of 84.5, unchanged from May.