by Calculated Risk on 5/09/2013 02:01:00 PM

Thursday, May 09, 2013

NAHB: Builder Confidence in the 55+ Housing Market increases sharply in Q1

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so the readings have been very low.

From the NAHB: Builder Confidence in the 55+ Housing Market Shows Strong Growth in First Quarter

In the first quarter of 2013, the National Association of Home Builders’ (NAHB) 55+ single-family Housing Market Index (HMI) increased 19 points on a year over year basis to 46, which is the highest first-quarter number recorded since the inception of the index in 2008 and sixth consecutive quarter of year over year improvements.

...

All of the components of the 55+ single-family HMI showed significant growth from a year ago: present sales climbed 19 points to 46, expected sales for the next six months increased 21 points to 53 and traffic of prospective buyers rose 15 points to 41.

The 55+ multifamily condo HMI posted a substantial gain of 23 points to 38, which is the highest first-quarter reading since the inception of the index. All 55+ multifamily condo HMI components increased compared to a year ago as present sales rose 23 points to 37, expected sales for the next six months climbed 23 points to 43 and traffic of prospective buyers rose 23 points to 38.

...

The strong year over year increase in confidence reported by builders for the 55+ market is consistent with year over year increases in other segments of the home building industry,” said NAHB Chief Economist David Crowe. “While demand for new 55+ housing has improved due to a reduced inventory of homes on the market and low interest rates, builders’ ability to respond to the demand is being limited by a shortage of labor with basic construction skills and rising prices for some building materials.”

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q1 2013. All of the readings have been low for this index, but the trend is up. Still, any reading below 50 "indicates that more builders view conditions as poor than good."

This is going to be a key demographic for household formation over the next couple of decades, but only if the baby boomers can sell their current homes.

There are two key drivers: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group.

The second graph shows the homeownership rate by age for 1990, 2000, and 2010. This shows that the homeownership rate usually increases until 70 years old or so.

The second graph shows the homeownership rate by age for 1990, 2000, and 2010. This shows that the homeownership rate usually increases until 70 years old or so.So demographics should be favorable for the 55+ market.

MBA: Mortgage Delinquency Rates increase in Q1, Foreclosure Inventory Down Sharply

by Calculated Risk on 5/09/2013 11:17:00 AM

From the MBA: Mortgage Delinquency Rates Increase, But Foreclosure Inventory Rate Down Sharply

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 7.25 percent of all loans outstanding at the end of the first quarter of 2013, an increase of 16 basis points from the previous quarter, but down 15 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans on which foreclosure actions were started during the first quarter was unchanged at 0.70 percent, the lowest level since the second quarter of 2007, and was down 26 basis points from one year ago. The percentage of loans in the foreclosure process at the end of the first quarter was 3.55 percent, the lowest level since 2008, down 19 basis points from the fourth quarter and 84 basis points lower than one year ago.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 6.39 percent, a decrease of 39 basis points from last quarter, and a decrease of 105 basis points from the first quarter of last year.

“On a seasonally adjusted basis, the overall delinquency rate increased this quarter, driven by a slight increase in the 30-day delinquency rate. Normal seasonal patterns are beginning to re-emerge, but as has been true post-crisis, it is still difficult to parse typical seasonal swings from true changes in performance. It is also important to note the decline relative to last year at this time. Regardless, we remain in a period of slow and uneven economic and job growth in the US and there are still many borrowers without stable, full time employment, or that are still unemployed. On a seasonally adjusted basis the largest increases in delinquency were in the subprime fixed and ARM categories, typically sensitive to income and payment shocks, and likely even more so in the current economic environment,” said Michael Fratantoni, MBA’s VP of Research and Economics.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.21% from 3.04% in Q4. This is just above the long term average. This is seasonally adjusted, and as Fratantoni noted the seasonal adjustment is difficult right now. Not Seasonally Adjusted basis (NSA) the 30 day delinquency rate declined in Q1 to 2.86% from 3.21%.

Delinquent loans in the 60 day bucket increased slightly to 1.17% in Q1, from 1.16% in Q4. (NSA was also down significantly for the 60 day bucket).

The 90 day bucket decreased slightly to 2.88% from 2.89%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 3.55% from 4.74% and is now at the lowest level since 2008.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.The top states are Florida (11.43% in foreclosure down from 12.15% in Q4), New Jersey (9.00% up from 8.85%), New York (6.18% down from 6.34%), and Illinois (5.89% down from 6.33%). Nevada is the only non-judicial state in the top 10, and this is partially due to state laws that slow foreclosures.

California (1.76% down from 2.06%) and Arizona (1.77% down from 2.02%) are now well below the national average by every measure.

For judicial foreclosure states, it appears foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for three consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.

For judicial foreclosure states, it appears foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for three consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.As Fratantoni noted, delinquency rates typically decline (NSA) from the end of Q4 to the end of Q1, and that happened this year. The seasonal adjustment might be a little off (so NSA short term delinquency increased slightly), and I expect the delinquency and foreclosure rates to continue to decline.

Fannie Mae Reports Pre-Tax Income of $8.1 Billion for First Quarter 2013

by Calculated Risk on 5/09/2013 10:02:00 AM

From Fannie Mae: Fannie Mae Reports Pre-Tax Income of $8.1 Billion for First Quarter 2013

Fannie Mae reported pre-tax income of $8.1 billion for the first quarter of 2013, compared with pre-tax income of $2.7 billion in the first quarter of 2012 and pre-tax income of $7.6 billion in the fourth quarter of 2012. Fannie Mae’s pre-tax income for the first quarter of 2013 was the largest quarterly pre-tax income in the company’s history. The improvement in the company’s results in the first quarter of 2013 compared with the first quarter of 2012 was due primarily to strong credit results driven by an increase in home prices, including higher average sales prices on Fannie Mae-owned properties, a decline in the number of delinquent loans, and the company’s resolution agreement with Bank of America. Including Fannie Mae’s release of the valuation allowance on its deferred tax assets, the company reported quarterly net income of $58.7 billion for the first quarter of 2013. Fannie Mae reported comprehensive income of $59.3 billion in the first quarter of 2013, compared with comprehensive income of $3.1 billion for the first quarter of 2012.From Nick Timiraos at the WSJ: Fannie Mae to Send $59.4 Billion to U.S. Treasury

Fannie recognized $50.6 billion in tax benefits during the first quarter, in addition to pre-tax income of $8.1 billion during the period. ... The tax boost stemmed from reversing write-downs of its deferred-tax assets, which are unused tax credits and deductions that can offset future tax bills but which are worthless if a company isn't expected to turn a profit and have taxable income.This bailout will probably be positive soon - and the U.S. still owns all the preferred shares!

The mortgage-finance company began writing down the tax benefits in 2008 as rising mortgage defaults threatened to wipe out thin capital reserves. ... Fannie reclaimed the deferred-tax assets during the first quarter because the company concluded it is likely to be profitable for the foreseeable future.

Fannie's expected payment of $59.4 billion to the U.S. Treasury will bring to $95 billion the amount of dividends it has paid to the Treasury. It has received $116.1 billion in aid, leaving the net cost of its bailout at around $21.1 billion.

On REO (Real Estate Owned), Fannie Mae reported that REO declined to 101,449 houses, down from 105,666 at the end of Q4 2012. This is the lowest level of REO since 2009.

From Fannie's SEC filing:

We recognized a benefit for credit losses of $957 million in the first quarter of 2013 compared with a provision for credit losses of $2.0 billion in the first quarter of 2012. This result was driven by an increase in home prices, including the sales prices of our REO properties in the first quarter of 2013, and lower single-family delinquency rates. Home prices increased in the first quarter of 2013, which decreases the likelihood that loans will default and reduces the amount of credit losses on loans that default. Sales prices on dispositions of our REO properties improved in the first quarter of 2013 as a result of strong demand compared with the prior year. We received net proceeds from our REO sales equal to 65% of the loans’ unpaid principal balance in the first quarter of 2013, compared with 56% in the first quarter of 2012. ...So Fannie is taking smaller losses on foreclosed houses (65% of UPB because of rising prices), there are fewer seriously delinquent loans, and there are fewer early stage delinquencies.

The number of seriously delinquent loans declined 19% to approximately 528,000 as of March 31, 2013 from approximately 651,000 as of March 31, 2012 and the number of early stage delinquent loans declined 7% to approximately 392,000 as of March 31, 2013 from approximately 419,000 as of March 31, 2012. The reduction in the number of delinquent loans is due, in part, to our efforts since 2009 to improve our underwriting standards and the credit quality of our single-family guaranty book of business, which has resulted in a decrease in the number of loans becoming delinquent. A decline in the number of loans becoming delinquent or seriously delinquent reduces our total loss reserves and provision for credit losses.

Weekly Initial Unemployment Claims decline to 323,000

by Calculated Risk on 5/09/2013 08:35:00 AM

The DOL reports:

In the week ending May 4, the advance figure for seasonally adjusted initial claims was 323,000, a decrease of 4,000 from the previous week's revised figure of 327,000. The 4-week moving average was 336,750, a decrease of 6,250 from the previous week's revised average of 343,000.The previous week was revised up from 324,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 336,750.

The 4-week average is at the lowest level since the recession started in December 2007. Claims were below the 335,000 consensus forecast.

Wednesday, May 08, 2013

Thursday: Weekly Unemployment Claims

by Calculated Risk on 5/08/2013 09:15:00 PM

Earlier I mentioned the improvement in the California budget (a sign that the drag from state and local governments is ending). Of course the Federal budget deficit is falling quickly. Here is the CBO's monthly budget review:

The federal government ran a budget deficit of $489 billion in the first seven months of fiscal year 2013 (that is, from October 2012 through April 2013), according to CBO’s estimates. That amount is $231 billion less than the shortfall recorded during the same period last year, primarily because revenue collections have been much greater than they were at this point in 2012. In contrast, federal spending so far this year has been slightly lower than what it was last year at this time.I'd argue we should have - and still could spend more to address unemployment.

My view is the deficit is currently falling too quickly and slowing the economy, but that view doesn't seem to be getting any traction among policymakers. At the least there is no reason for further fiscal tightening over the next couple of years - the deficit is already falling fast (there are still longer term issues).

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 335 thousand from 324 thousand last week.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for March. The consensus is for a 0.4% increase in inventories.

Las Vegas Real Estate in April: Year-over-year Inventory decline slows

by Calculated Risk on 5/08/2013 06:29:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local home prices rise again, according to GLVAR report

GLVAR said the total number of existing local homes, condominiums and townhomes sold in April was 3,789. That’s up from 3,642 in March, but down from 3,924 total sales in April 2012. ...There are several key trends that we've been following:

...

Another trend is the decline in foreclosures and short sales – which occur when a lender agrees to sell a home for less than what the borrower owes on the mortgage. In April, 32.5 percent of all existing local home sales were short sales, down from 33.3 percent in March. Another 10.0 percent of all sales were bank-owned properties, down from 11.2 percent of all sales in March. The remaining 57.5 percent of all sales were the traditional type, which was up from 55.5 percent in March.

...

The total number of properties listed for sale on GLVAR’s Multiple Listing Service increased in April, with 13,881 single-family homes listed for sale at the end of the month. That’s up 1.4 percent from 13,693 single-family homes listed for sale at the end of March, but down 22.4 percent from one year ago.

As for available homes listed for sale without any sort of pending or contingent offer by the end of April, GLVAR reported 3,161 single-family homes listed without any sort of offer. That’s up 11.3 percent from 2,839 such homes listed in March, but still down 24.1 percent from one year ago.

...

In April, GLVAR reported that 59.3 percent of all existing local homes sold were purchased with cash. That’s up from 57.5 percent in March and approaching the peak of 59.5 percent in February.

emphasis added

1) Overall sales are down a little year-over-year, but ...

2) Conventional sales are up sharply. In April 2012, only 33.2% of all sales were conventional. This year, in April 2013, 57.5% were conventional. That is an increase in conventional sales of about 67% (of course this is heavily investor buying, but that is still quite an increase in non-distressed sales).

3) There is a shift from foreclosures to short sales.

4) and probably most interesting right now is that the decline in non-contingent inventory (year-over-year) has slowed sharply. This suggests inventory is near a bottom.

Update: California Revenues $4.6 Billion ahead of Projections through April

by Calculated Risk on 5/08/2013 03:21:00 PM

From California State Controller: Controller Releases April Cash Update

Through the first 10 months of the fiscal year, total revenues exceeded the Governor's January projections by $4.6 billion (+6.1 percent). ...This is just one state, but the drag from the cutbacks at the state and local governments levels are mostly over. Over the last four years, state and local governments have reduced budgets and employment substantially. Here are two graphs I've posted recently:

"We've reached an important milestone in California's economic recovery. For the first time in nearly six years, we closed out a month without borrowing from internal state funds to pay our bills," said Chiang. "But, there remains significant debt that must be shed before we can claim victory and these unanticipated revenues provide us with an important opportunity to take further steps toward long-term fiscal stability."

...

The State ended the last fiscal year with a cash deficit of $9.6 billion, and by April 30, 2013, that cash deficit narrowed to $5.8 billion. That deficit is being covered by $10 billion in external borrowing, which the State will begin repaying later this month.

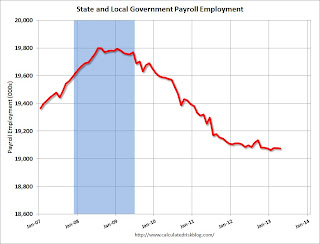

Click on graph for larger image.

Click on graph for larger image.This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

In April 2013, state and local governments lost 3,000 jobs, however state and local employment is unchanged so far in 2013.

The second graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).However the drag from state and local governments has continued. I was expecting the drag from state and local governments to end last year, but this unprecedented and relentless decline in state and local government spending has still been a drag on the economy in early 2013.

The good news is the drag has to end soon - in real terms, state and local government spending is back to early 2001 levels. And just ending the drag from state and local governments will be a positive for the economy.

Freddie Mac on Q1: $4.6 Billion Net Income, No Treasury Draw, REO Declines

by Calculated Risk on 5/08/2013 11:28:00 AM

From Freddie Mac: Freddie Mac Reports Net Income of $4.6 BILLION;

Freddie Mac today reported net income of $4.6 billion for the first quarter of 2013, compared to net income of $4.5 billion for the fourth quarter of 2012. ...

...

On a quarterly basis, the company determines whether a valuation allowance is necessary on its net deferred tax assets. After evaluating all available evidence, Freddie Mac continued to record a valuation allowance on a portion of its net deferred tax assets as of March 31, 2013. The valuation allowance as of March 31, 2013, was $30.1 billion. To the extent Freddie Mac releases the valuation allowance on its deferred tax assets in a future period, the amount released would be included as income in that period and would result in a corresponding increase in the company’s net worth as of the end of that period.

...

(Provision) benefit for credit losses was a benefit of $503 million for the first quarter of 2013, compared to a benefit of $700 million for the fourth quarter of 2012. The benefit for credit losses for the first quarter of 2013 was driven by continued improvement in national home prices combined with a further decrease in the volume of newly delinquent single-family loans.

Click on graph for larger image.

Click on graph for larger image.On Real Estate Owned (REO), Freddie acquired 17,882 properties in Q1 2013, and disposed of 18,895 and the total REO fell to 47,974 at the end of Q1. This graph shows REO inventory for Freddie.

From Freddie:

In 1Q13, REO dispositions continued to exceed the volume of REO acquisitions. The volume of our single-family REO acquisitions in recent periods has been significantly affected by the length of the foreclosure process and a high volume of foreclosure alternatives, which result in fewer loans proceeding to foreclosure, and thus fewer properties transitioning to REO.

The North Central region comprised 42 percent of our REO property inventory at March 31, 2013. This region generally has experienced more challenging economic conditions, and includes a number of states with longer foreclosure timelines due to the local laws and foreclosure process in the region.

MBA: Mortgage Applications Increase, Purchase index at highest level since May 2010

by Calculated Risk on 5/08/2013 08:31:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 8 percent from the previous week to the highest level since December 2012. The gain in the Refinance Index was due to increases in both the conventional and government refinance indices of 8.8 percent and 5.7 percent respectively. The seasonally adjusted Purchase Index increased 2 percent from one week earlier to the highest level since May 2010.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.59 percent, the lowest rate since December 2012, from 3.60 percent, with points increasing to 0.33 from 0.30 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

This was the highest level for the refinance index since last December.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the purchase index - and the 4-week average of the purchase index - are at the highest level since May 2010.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the purchase index - and the 4-week average of the purchase index - are at the highest level since May 2010.

Tuesday, May 07, 2013

Temporary Help Services and Employment

by Calculated Risk on 5/07/2013 06:07:00 PM

Back in 2010, some analysts took the surge in temporary help services as a leading indicator for a pickup in employment. I was skeptical back then, first because of the distortion caused by temporary Census workers, second because housing was still weak, and third because it appeared there had been a change in hiring practices.

Once again there has been a pickup in temporary help services. From the BLS report:

In April, employment rose in temporary help services (+31,000) ...Temporary help services has added an average of 28,000 jobs per month over the last three months.

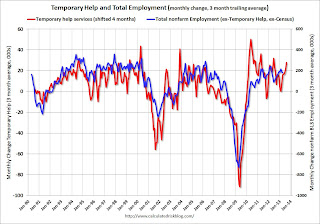

The following graph was a favorite of those expecting a huge rebound in employment in 2010 (see the red spike in 2010). The graph is a little complicated - the red line is the three month average change in temporary help services (left axis). This is shifted four months into the future.

The blue line (right axis) is the three month average change in total employment (excluding temporary help services and Census hiring).

Click on graph for larger image.

Click on graph for larger image. Unfortunately the data on temporary help services only goes back to 1990, but it does appear that temporary help leads employment by about four months (although noisy).

The thinking is that before companies hire permanent employees following a recession, employers will hire temporary employees. But there is also evidence of a recent shift by employers to more temporary workers.

This graph does suggest temporary help services does lead general employment, but the magnitude of the swings is less useful - and I don't think this suggests an imminent pickup in overall hiring.