by Calculated Risk on 5/08/2013 03:21:00 PM

Wednesday, May 08, 2013

Update: California Revenues $4.6 Billion ahead of Projections through April

From California State Controller: Controller Releases April Cash Update

Through the first 10 months of the fiscal year, total revenues exceeded the Governor's January projections by $4.6 billion (+6.1 percent). ...This is just one state, but the drag from the cutbacks at the state and local governments levels are mostly over. Over the last four years, state and local governments have reduced budgets and employment substantially. Here are two graphs I've posted recently:

"We've reached an important milestone in California's economic recovery. For the first time in nearly six years, we closed out a month without borrowing from internal state funds to pay our bills," said Chiang. "But, there remains significant debt that must be shed before we can claim victory and these unanticipated revenues provide us with an important opportunity to take further steps toward long-term fiscal stability."

...

The State ended the last fiscal year with a cash deficit of $9.6 billion, and by April 30, 2013, that cash deficit narrowed to $5.8 billion. That deficit is being covered by $10 billion in external borrowing, which the State will begin repaying later this month.

Click on graph for larger image.

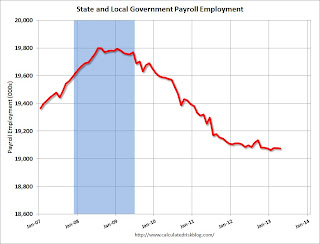

Click on graph for larger image.This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

In April 2013, state and local governments lost 3,000 jobs, however state and local employment is unchanged so far in 2013.

The second graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).However the drag from state and local governments has continued. I was expecting the drag from state and local governments to end last year, but this unprecedented and relentless decline in state and local government spending has still been a drag on the economy in early 2013.

The good news is the drag has to end soon - in real terms, state and local government spending is back to early 2001 levels. And just ending the drag from state and local governments will be a positive for the economy.