by Calculated Risk on 5/01/2013 10:00:00 AM

Wednesday, May 01, 2013

ISM Manufacturing index declines in April to 50.7

The ISM manufacturing index indicated expansion in April. The PMI was at 50.7% in April, down from 51.3% in March. The employment index was at 50.2%, down from 54.2%, and the new orders index was at 52.3%, up from 51.4% in March.

From the Institute for Supply Management: April 2013 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in April for the fifth consecutive month, and the overall economy grew for the 47th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 50.7 percent, a decrease of 0.6 percentage point from March's reading of 51.3 percent, indicating expansion in manufacturing for the fifth consecutive month, but at the lowest rate of the year. The New Orders Index increased in April by 0.9 percentage point to 52.3 percent, and the Production Index increased by 1.3 percentage points to 53.5 percent. The Employment Index registered 50.2 percent, a decrease of 4 percentage points compared to March's reading of 54.2 percent. The Prices Index registered 50 percent, decreasing 4.5 percentage points from March, indicating that overall raw materials prices remained unchanged from last month. Comments from the panel indicate a range of strong/steady growth, to flat/declining volumes, depending upon the particular industry."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 51.0% and suggests manufacturing expanded at a slower pace in April.

ADP: Private Employment increased 119,000 in April

by Calculated Risk on 5/01/2013 08:20:00 AM

Private sector employment increased by 119,000 jobs from March to April, according to the April ADP National Employment Report®, which is produced by ADP® ... in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis. The March report, which reported job gains of 158,000, was revised downward to 131,000 jobs.This was below the consensus forecast for 155,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 153,000 payroll jobs in April, on a seasonally adjusted (SA) basis.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth appears to be slowing in response to very significant fiscal headwinds. Tax increases and government spending cuts are beginning to hit the job market. Job growth has slowed across all industries and most significantly among companies that employ between 20 and 499 workers.”

Note: ADP hasn't been very useful in predicting the BLS report.

MBA: Refinance Mortgage Applications Increase, Purchase Applications Decrease

by Calculated Risk on 5/01/2013 07:00:00 AM

From the MBA: Mortgage Refinance Applications Increase in Latest MBA Weekly Survey

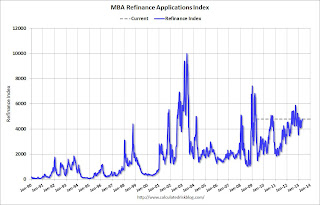

The Refinance Index increased 3 percent from the previous week and is at its highest level since the week ending January 18, 2013. The seasonally adjusted Purchase Index decreased 1.4 percent from one week earlier.

...

The HARP share of refinance applications increased from 32 percent last week to 34 percent this week, the highest level since MBA began tracking HARP applications in February 2012.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.60 percent, the lowest rate since December 2012, from 3.65 percent, with points decreasing to 0.30 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

According to the MBA, the HARP program is contributing significantly to the current level of refis and is at the highest percentage of refinances since the MBA started tracking HARP. Note: HARP is a success story.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and even with the slight decline in the weekly index, the 4-week average of the purchase index is at the highest level since May 2010.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and even with the slight decline in the weekly index, the 4-week average of the purchase index is at the highest level since May 2010.

Tuesday, April 30, 2013

Wednesday: FOMC Meeting, Auto Sales, ISM Mfg Index, Construction Spending, ADP Employment and more

by Calculated Risk on 4/30/2013 07:05:00 PM

A couple of releases earlier today:

From the Chicago ISM: (Ouch!)

The Chicago Purchasing Managers reported April's Chicago Business Barometer fell 3.4 to 49.0, a 3-1/2 year low. Except for a minor gain in New Orders, all Business Activity measures weakened in April with five of seven now in contraction. BUSINESS ACTIVITY: SUPPLIER DELIVERIES, PRICES PAID, and PRODUCTION: all lowest since 2009; ORDER BACKLOGS: ten months of contraction in the past 12 months; EMPLOYMENT: third month over month decline.And from the Conference Board: The Conference Board Consumer Confidence Index® Improves in April

The Conference Board Consumer Confidence Index®, which had declined in March, increased in April. The Index now stands at 68.1 (1985=100), up from 61.9 in March. The Present Situation Index increased to 60.4 from 59.2. The Expectations Index improved to 73.3 from 63.7 last month.Wednesday economic releases:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for April will be released. This report is for private payrolls only (no government). The consensus is for 155,000 payroll jobs added in April.

• At 9:00 AM, the Markit US PMI Manufacturing Index for April. The consensus is for a decrease to 52.0 from 54.6 in March.

• At 10:00 AM, the ISM Manufacturing Index for April. The consensus is for a decrease to 51.0 from 51.3 in March. Based on the regional surveys, a reading below 50 is possible.

• Also at 10:00 AM, Construction Spending for March. The consensus is for a 0.6% increase in construction spending.

• At 2:00 PM, FOMC Meeting Announcement will be released. No change to interest rates or QE purchases is expected at this meeting.

• All day: Light vehicle sales for April. The consensus is for light vehicle sales to be at 15.3 million SAAR in March (Seasonally Adjusted Annual Rate) unchanged from 15.3 SAAR in March.

Restaurant Index increased in March

by Calculated Risk on 4/30/2013 04:40:00 PM

From the National Restaurant Association: Positive same-store sales push RPI above 100 in March

Buoyed by positive sales results and a more optimistic outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) rose above 100 in March. The RPI stood at 100.6 in March, up 0.7 percent from February’s level of 99.9. March represented the second time in the last three months that the RPI stood above 100, which signifies expansion in the index of key industry indicators.

“The Restaurant Performance Index gain was driven by stronger same-store sales results in March, with comparisons aided by the Easter holiday occurring during the month,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, restaurant operators are somewhat more confident in the economy and a majority plan to make a capital expenditure in the next six months.”

...

The Current Situation Index stood at 99.8 in March – up 1.5 percent from February’s level. After reporting a same-store sales decline for the first time in 21 months, restaurant operators bounced back in March with a modest net gain. ... While overall sales were positive in March, restaurant operators reported a net decline in customer traffic for the fourth consecutive month. Despite the mixed sales and traffic results, restaurant operators reported an increase in capital spending activity.

Click on graph for larger image.

Click on graph for larger image.The index increased to 100.6 in March, up from 99.9 in February. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. More evidence of a currently sluggish recovery ...

Earlier on House Prices:

• Case-Shiller: Comp 20 House Prices increased 9.3% year-over-year in February

• Real House Prices, Price-to-Rent Ratio, City Prices relative to 2000

HVS: Q1 2013 Homeownership and Vacancy Rates

by Calculated Risk on 4/30/2013 01:49:00 PM

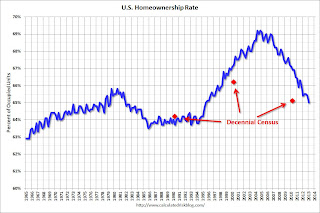

The Census Bureau released the Housing Vacancies and Homeownership report for Q1 2013 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply, or rely on the homeownership rate, except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 65.0%, down from 65.4% in Q4.

I'd put more weight on the decennial Census numbers and that suggests the actual homeownership rate is probably in the 64% to 65% range.

The HVS homeowner vacancy rate was increased to 2.1% in Q1 from 1.9% in Q4.

The HVS homeowner vacancy rate was increased to 2.1% in Q1 from 1.9% in Q4.

The homeowner vacancy rate has peaked and is now generally declining, although it isn't really clear what this means. Are these homes becoming rentals? Anyway - once again - this probably shows that the trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate declined in Q4 to 8.6%, from 8.7% in Q4.

The rental vacancy rate declined in Q4 to 8.6%, from 8.7% in Q4.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the overall trend in the rental vacancy rate - and Reis reported that the rental vacancy rate has fallen to the lowest level since 2001.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that the housing vacancy rates have declined sharply.

Earlier on House Prices:

• Case-Shiller: Comp 20 House Prices increased 9.3% year-over-year in February

• Real House Prices, Price-to-Rent Ratio, City Prices relative to 2000

Real House Prices, Price-to-Rent Ratio, City Prices relative to 2000

by Calculated Risk on 4/30/2013 10:49:00 AM

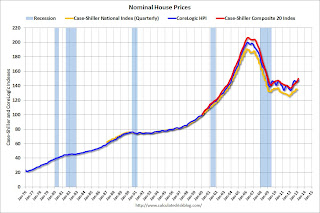

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation. This is why economist also look at real house prices (inflation adjusted).

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through February) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through February) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q2 2003 levels (and also back up to Q3 2010), and the Case-Shiller Composite 20 Index (SA) is back to November 2003 levels, and the CoreLogic index (NSA) is back to January 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to October 1999 levels, the Composite 20 index is back to January 2001, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1999 levels, the Composite 20 index is back to January 2001 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 29% above January 2000 (I'll look at this in real terms later). Some cities - like Denver - are close to the peak level. Other cities, like Atlanta and Detroit, are below the January 2000 level.

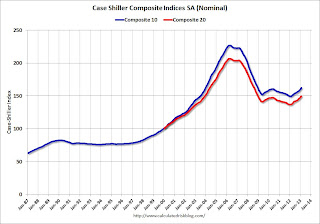

Case-Shiller: Comp 20 House Prices increased 9.3% year-over-year in February

by Calculated Risk on 4/30/2013 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3 month average of December, January and February).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Rise in February 2013 According to the S&P/Case-Shiller Home Price Indices

Data through February 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed average home prices increased 8.6% and 9.3% for the 10- and 20-City Composites in the 12 months ending in February 2013. The 10- and 20-City Composites rose 0.4% and 0.3% from January to February.

“Home prices continue to show solid increases across all 20 cities,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “The 10- and 20-City Composites recorded their highest annual growth rates since May 2006; seasonally adjusted monthly data show all 20 cities saw higher prices for two months in a row – the last time that happened was in early 2005.

“Phoenix, San Francisco, Las Vegas and Atlanta were the four cities with the highest year-over-year price increases. Atlanta recovered from a wave of foreclosures in 2012 while the other three were among the hardest hit in the housing collapse. At the other end of the rankings, three older cities – New York, Boston and Chicago – saw the smallest year-over-year price improvements.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 28.4% from the peak, and up 1.2% in February (SA). The Composite 10 is up 8.6% from the post bubble low set in Feb 2012 (SA).

The Composite 20 index is off 27.5% from the peak, and up 1.2% (SA) in February. The Composite 20 is up 9.4% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 8.6% compared to February 2012.

The Composite 20 SA is up 9.3% compared to February 2012. This was the ninth consecutive month with a year-over-year gain and this was the largest year-over-year gain for the Composite 20 index since 2006.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in February seasonally adjusted (prices increased in 12 of 20 cities NSA). Prices in Las Vegas are off 55.0% from the peak, and prices in Denver only off 1.0% from the peak.

This was just above the consensus forecast for a 9.0% YoY increase. I'll have more on prices later.

Monday, April 29, 2013

Tuesday: Case-Shiller House Prices, Chicago PMI, Consumer Confidence

by Calculated Risk on 4/29/2013 08:35:00 PM

Earlier today from LPS: U.S. Home Prices Up 1.0 Percent for the Month; Up 7.3 Percent Year-Over-Year. LPS reported their House Price Index increased to $210,000 in February, up from $208,000 or 1.0% from January - and up from $196,000 or 7.3% from February 2012. The LPS index is 20.6% below the peak in 2006.

Tuesday economic releases:

• At 9:00 AM ET, the S&P/Case-Shiller House Price Index for February will be released. Although this is the February report, it is really a 3 month average of December, January and February. The consensus is for a 9.0% year-over-year increase in the Composite 20 index (NSA) for February. The Zillow forecast is for the Composite 20 to increase 8.9% year-over-year, and for prices to increase 0.7% month-to-month seasonally adjusted.

• At 9:45 AM, the Chicago Purchasing Managers Index for April. The consensus is for the index to be unchanged at 52.4.

• At 10:00 AM, the Conference Board's consumer confidence index for April. The consensus is for the index to increase to 62.0 from 59.7.

• Also at 10:00 AM, the Census Bureau will release the Q1 Housing Vacancies and Homeownership report. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track other measures (like the decennial Census and the ACS) and this survey probably shouldn't be used to estimate the excess vacant housing supply.

Q1 2013 GDP Details: Single Family investment increases, Commercial Investment very Low

by Calculated Risk on 4/29/2013 04:56:00 PM

The BEA released the underlying details for the Q1 advance GDP report today.

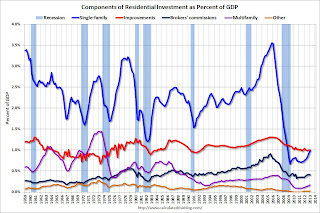

The first graph is for Residential investment (RI) components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

A few key points:

1) Usually the most important components are investment in single family structures followed by home improvement. However home improvement has been the top category for eighteen consecutive quarters, but that is about to change. Investment in single family structures should be the top category again by Q2 or Q3.

2) Even though investment in single family structures has increased significantly from the bottom, single family investment is still very low - and still below the bottom for previous recessions. I expect further increases over the next few years.

3) Look at the contribution from Brokers' commissions. This is the category related to existing home sales (this is the contribution to GDP from existing home sales). If existing home sales are flat, or even decline due to fewer foreclosures, this will have little impact on residential investment.

Click on graph for larger image.

Click on graph for larger image.

Investment in home improvement was at a $161 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.0% of GDP), still above the level of investment in single family structures of (corrected) $157 billion (SAAR) (or 0.98% of GDP). Single family structure investment will probably overtake home improvement as the largest category of residential investment next quarter.

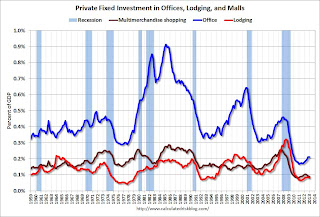

The second graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased slightly, but from a very low level.

Investment in offices is down about 54% from the recent peak (as a percent of GDP). With the high office vacancy rate, investment will probably not increase significantly (as a percent of GDP) for several years - even though there has been some increase in the Architecture Billings Index lately.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 65% from the peak (note that investment includes remodels, so this will not fall to zero). The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.32% of GDP in Q2 2008 and is down about 75%. With the hotel occupancy rate close to normal, it is possible that hotel investment will increase this year.

These graphs show there is currently very little investment in offices, malls and lodging. And residential investment is starting to pickup, but from a very low level.