by Calculated Risk on 4/29/2013 01:05:00 PM

Monday, April 29, 2013

Existing Home Inventory is up 12.1% year-to-date on April 29th

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly this year.

In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory mostly followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

In 2010, inventory was up 15% by the end of March, and close to 20% by the end of April.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is up 12.1%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It is possible that inventory could bottom this year - especially if inventory is up 15% to 18% from the seasonal lows by mid-to-late summer.

It will probably be close. Inventory might have already bottomed in early 2013, or might bottom in early 2014. This will be important for price increases ... once inventory starts to increase (more than seasonal), buyer urgency will wane, and I expect price increases will slow.

Dallas Fed: Regional Manufacturing Activity "stalls" in April

by Calculated Risk on 4/29/2013 10:38:00 AM

This is the last of the regional manufacturing surveys for April. From the Dallas Fed: Growth in Texas Manufacturing Activity Stalls

Texas factory activity was flat in April, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 9.9 to -0.5. The near-zero reading indicates output was little changed from March levels.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Ebbing growth in manufacturing activity was reflected in other survey measures as well. The capacity utilization index came in at 2.7, down from 5.5, and the shipments index fell to zero after rising to 10.6 in March. The new orders index fell nearly 14 points to -4.9, posting its first negative reading this year.

Perceptions of broader business conditions worsened in April. The general business activity index plummeted from 7.4 to -15.6, reaching its lowest level since July 2012.

Labor market indicators remained mixed. The employment index has been in positive territory so far in 2013 and moved up to 6.3 in April. ... The hours worked index pushed further negative, from -2.4 to -6.5.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through April), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

The ISM index for April will be released Wednesday, May 1st, and these surveys suggest a lower reading, possibly even at or below 50 (contraction).

Pending Home Sales index increases in March

by Calculated Risk on 4/29/2013 10:00:00 AM

From the NAR: March Pending Home Sales Improve but Overall Pace Leveling

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 1.5 percent to 105.7 in March from a downwardly revised 104.1 in February, and is 7.0 percent above March 2012 when it was 98.8. Pending sales have been above year-ago levels for the past 23 months; the data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in April and May.

...

The PHSI in the Northeast was unchanged at 82.8 in March and is 6.3 percent higher than March 2012. In the Midwest the index increased 0.3 percent to 103.8 in March and is 13.7 percent above a year ago. Pending home sales in the South rose 2.7 percent to an index of 120.0 in March and are 10.4 percent higher than March 2012. In the West the index increased 1.5 percent in March to 102.9 but is 4.3 percent below a year ago.

As I've noted several times, with limited inventory at the low end and fewer foreclosures, we might see flat or even declining existing home sales. The key is that the number of conventional sales is increasing while foreclosures and short sales decline - and that is a sign of an improving market, even if total sales decline.

Personal Income increased 0.2% in March, Core PCE prices up 1.1% year-over-year

by Calculated Risk on 4/29/2013 08:30:00 AM

The BEA released the Personal Income and Outlays report for March:

Personal income increased $30.9 billion, or 0.2 percent ... in March, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $21.0 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through March (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in March, the same increase as in February. ... PCE price index -- The price index for PCE decreased 0.1 percent in March, in contrast to an increase of 0.4 percent in February. The PCE price index, excluding food and energy, increased less than 0.1 percent, compared with an increase of 0.1 percent.

...

Personal saving -- DPI less personal outlays -- was $329.1 billion in March, compared with $330.9 billion in February. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 2.7 percent in March, the same as in February.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. PCE for both January and February were revised down slightly.

As reported on Friday in the advance GDP report, PCE increased at a 3.2% annual rate in Q1.

A key point is that the PCE price index was only up 1.0% year-over-year (1.1% for core PCE). Core PCE increased at a 0.4% annualized rate in March. This will put pressure on the Fed to do more.

Sunday, April 28, 2013

Monday: Personal Income and Outlays, Pending Home Sales

by Calculated Risk on 4/28/2013 08:54:00 PM

First a couple of articles ...

From Jon Hilsenrath at the WSJ: Tame Inflation to Keep Fed on Course

With inflation now lower than the Fed wants, officials are likely to conclude their policies show no sign of overheating the economy. That allows them to maintain their $85 billion-a-month bond-buying program ...Too little inflation is a growing concern at the Fed.

Several Fed officials have changed the way they are talking about inflation. In a late March speech, New York Fed President William Dudley described inflation as "below" the Fed target. In mid-April, after new inflation data emerged, he described it as "well below" target, the kind of subtle change central-bank officials often deploy after careful deliberation.

"If inflation is lower and continues to go lower than our target, that would be another reason potentially for not pulling back on our program," said Eric Rosengren, president of the Boston Fed, in an interview this month. [James Bullard, president of the Federal Reserve Bank of St. Louis] said he would consider supporting an increase in bond purchases if inflation fell much further.

And from Ben Casselman at the WSJ: Demographics Behind Smaller Workforce. I've discussed the participation rate a number of times - see: Labor Force Participation Rate Update, Understanding the Decline in the Participation Rate and Update: Further Discussion on Labor Force Participation Rate - the key point is that most of the recent decline in the participation rate was expected because of demographics.

Monday economic releases:

• At 8:30 AM ET, The BEA will release the Personal Income and Outlays report for March. The consensus is for a 0.4% increase in personal income in March, and for 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, the NAR will release their Pending Home Sales Index for March. The consensus is for a 0.7% increase in this index.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for April will be released. The consensus is a decrease to 5.0 from 7.4 in March (above zero is expansion).

Weekend:

• Summary for Week ending April 26th

• Schedule for Week of April 28th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 6 and Dow futures are down 19 (fair value).

Oil prices were up over the last week with WTI futures at $92.56 per barrel and Brent at $102.70 per barrel.

According to Gasbuddy.com, gasoline prices are down about 25 cents over the last 2 months to $3.48 per gallon. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.41 per gallon. That is about 7 cents below the current level according to Gasbuddy.com, so I expect gasoline prices to fall some more.

FOMC Preview: Inflation Watch

by Calculated Risk on 4/28/2013 03:09:00 PM

The Federal Open Market Committee (FOMC) is meeting on Tuesday and Wednesday, with the FOMC statement expected to be released at 2:00 PM ET on Wednesday.

Expectations are the FOMC will take no action at this meeting (the FOMC will probably not adjust the size of their purchases of agency mortgage-backed securities and Treasury securities).

Since the most recent meeting in March, the incoming data has been a little weaker, so the FOMC will probably adjust the wording of the statement. For growth, there will probably be some slight changes to the first sentence in the March statement:

Information received since the Federal Open Market Committee met in January suggests a return to moderate economic growth following a pause late last year. Labor market conditions have shown signs of improvement in recent months but the unemployment rate remains elevated.Perhaps something like (from the April 2011 statement):

Information received since the Federal Open Market Committee met in March indicates that the economic recovery is proceeding at a moderate pace and overall conditions in the labor market are improving gradually.A key will be to watch the comments on inflation. From the March meeting:

Inflation has been running somewhat below the Committee's longer-run objective, apart from temporary variations that largely reflect fluctuations in energy prices.Since then, it appears inflation has fallen even more, even excluding energy prices. Core PCE inflation is probably running close to 1.2% year-over-year, and other key measures of inflation are trending down. This decline in inflation is probably becoming a concern for some FOMC participants.

As a reminder, here are the quarterly projections from the March meeting. For GDP, the Q1 advance report released last week probably wouldn't change the outlook.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2013 | 2014 | 2015 |

| Mar 2013 Meeting Projections | 2.3 to 2.8 | 2.9 to 3.4 | 2.9 to 3.7 |

The unemployment rate was at 7.6% in March, and the outlook for Q4 unemployment probably hasn't changed.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2013 | 2014 | 2015 |

| Mar 2013 Meeting Projections | 7.3 to 7.5 | 6.7 to 7.0 | 6.0 to 6.5 |

For inflation, PCE inflation was up 1.2% year-over-year in Q1, and only increased at a 0.9% annualized rate in Q1. This is below the FOMC projected range and is probably a growing concern.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2013 | 2014 | 2015 |

| Mar 2013 Meeting Projections | 1.3 to 1.7 | 1.5 to 2.0 | 1.7 to 2.0 |

The BEA will release core PCE for March tomorrow, and core inflation is also expected to be below the FOMC projections.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2013 | 2014 | 2015 |

| Mar 2013 Meeting Projections | 1.5 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 |

Public and Private Sector Payroll Jobs: Bush and Obama

by Calculated Risk on 4/28/2013 10:33:00 AM

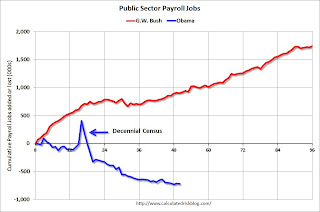

With public sector jobs down over the last several years (Federal, State and local layoffs), several readers have asked if I could update the graphs comparing public and private sector job losses (or added) for President George W. Bush's two terms (following the stock market bust), and for President Obama tenure in office so far (following the housing bust and financial crisis).

Important: There are many differences between the two periods. Both followed the bursting of a bubble (stock and housing), although the housing bust also led to a severe financial crisis.

The first graph shows the change in private sector payroll jobs from when Mr. Bush took office (January 2001) compared to Mr. Obama's tenure (from January 2009).

Mr. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr Obama (blue) took office during the financial crisis and great recession.

Click on graph for larger image.

Click on graph for larger image.

The employment recovery during Mr. Bush's first term was very sluggish, and private employment was down 946,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 665,000 jobs lost during Mr. Bush's two terms.

The recovery has been sluggish under Mr. Obama's presidency too, and there were only 1,933,000 more private sector jobs at the end of Mr. Obama's first term. A couple of months into Mr. Obama's second term, there are now 2,282,000 more private sector jobs than when he took office.

A big difference between Mr. Bush's tenure in office and Mr. Obama's presidency has been public sector employment. The public sector grew during Mr. Bush's term (up 1,748,000 jobs), but the public sector has declined since Obama took office (down 718,000 jobs). These job losses have mostly been at the state and local level, but they are still a significant drag on overall employment.

A big difference between Mr. Bush's tenure in office and Mr. Obama's presidency has been public sector employment. The public sector grew during Mr. Bush's term (up 1,748,000 jobs), but the public sector has declined since Obama took office (down 718,000 jobs). These job losses have mostly been at the state and local level, but they are still a significant drag on overall employment.

Another important difference: I started warning about the housing bubble in 2004, and I started this blog in January 2005 - the beginning of Mr. Bush's 2nd term. My focus in 2005 was on the housing bubble and coming recession. Now - at a similar point in Mr. Obama's tenure - I expect the economy to continue to expand, so I don't expect a sharp decline in employment as happened at the end of Mr. Bush's 2nd term.

Yesterday:

• Summary for Week ending April 26th

• Schedule for Week of April 28th

Saturday, April 27, 2013

Schedule for Week of April 28th

by Calculated Risk on 4/27/2013 04:06:00 PM

This will be a very busy week for economic data. The key report week is the April employment report on Friday.

Other key reports include the Case-Shiller house price index on Tuesday, the ISM manufacturing index on Wednesday, vehicle sales for April also on Wednesday, the March trade report on Thursday, and the ISM service index on Friday.

Also, there is an FOMC meeting on Tuesday and Wednesday.

8:30 AM ET: Personal Income and Outlays for March. The consensus is for a 0.4% increase in personal income in March, and for 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM ET: Pending Home Sales Index for March. The consensus is for a 0.7% increase in this index.

10:30 AM: Dallas Fed Manufacturing Survey for April. The consensus is a decrease to 5.0 from 7.4 in March (above zero is expansion).

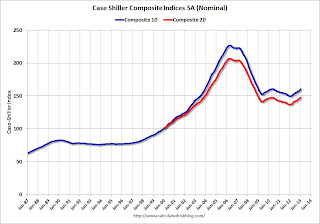

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February.

9:00 AM: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through January 2013 (the Composite 20 was started in January 2000).

The consensus is for a 9.0% year-over-year increase in the Composite 20 index (NSA) for February. The Zillow forecast is for the Composite 20 to increase 8.9% year-over-year, and for prices to increase 0.7% month-to-month seasonally adjusted.

9:45 AM: Chicago Purchasing Managers Index for April. The consensus is for the index to be unchanged at 52.4.

10:00 AM: Conference Board's consumer confidence index for April. The consensus is for the index to increase to 62.0 from 59.7.

10:00 AM: Q1 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track other measures (like the decennial Census and the ACS) and this survey probably shouldn't be used to estimate the excess vacant housing supply.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 155,000 payroll jobs added in April.

9:00 AM: The Markit US PMI Manufacturing Index for April. The consensus is for a decrease to 52.0 from 54.6 in March.

10:00 AM ET: ISM Manufacturing Index for April. The consensus is for a decrease to 51.0 from 51.3 in March. Based on the regional surveys, a reading below 50 is possible.

10:00 AM ET: ISM Manufacturing Index for April. The consensus is for a decrease to 51.0 from 51.3 in March. Based on the regional surveys, a reading below 50 is possible.Here is a long term graph of the ISM manufacturing index. The ISM manufacturing index indicated expansion in March at 51.3% in March. The employment index was at 54.2%, and the new orders index was at 51.4%.

10:00 AM: Construction Spending for March. The consensus is for a 0.6% increase in construction spending.

2:00 PM: FOMC Meeting Announcement. No change to interest rates or QE purchases is expected at this meeting.

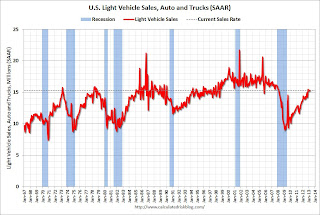

All day: Light vehicle sales for April. The consensus is for light vehicle sales to be at 15.3 million SAAR in March (Seasonally Adjusted Annual Rate) unchanged from 15.3 SAAR in March.

All day: Light vehicle sales for April. The consensus is for light vehicle sales to be at 15.3 million SAAR in March (Seasonally Adjusted Annual Rate) unchanged from 15.3 SAAR in March.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the March sales rate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 345 thousand from 339 thousand last week.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. Exports increased in February, and imports were essentially flat.

The consensus is for the U.S. trade deficit to decrease to $42.4 billion in March from $43.0 billion in February.

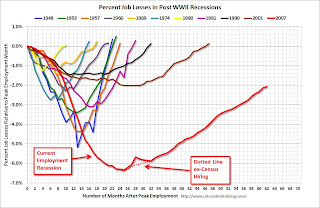

8:30 AM: Employment Report for April. The consensus is for an increase of 153,000 non-farm payroll jobs in April; the economy added 88,000 non-farm payroll jobs in March.

8:30 AM: Employment Report for April. The consensus is for an increase of 153,000 non-farm payroll jobs in April; the economy added 88,000 non-farm payroll jobs in March. The consensus is for the unemployment rate to be unchanged at 7.6% in April.

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions through January.

The economy has added 6.5 million private sector jobs since employment bottomed in February 2010 (5.9 million total jobs added including all the public sector layoffs).

The economy has added 6.5 million private sector jobs since employment bottomed in February 2010 (5.9 million total jobs added including all the public sector layoffs).There are still 2.3 million fewer private sector jobs now than when the recession started in 2007.

10:00 AM: ISM non-Manufacturing Index for April. The consensus is for a reading of 54.0, down from 54.4 in March. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for March. The consensus is for a 2.8% decrease in orders.

Summary for Week ending April 26th

by Calculated Risk on 4/27/2013 11:21:00 AM

There was some disappointing data released last week. First quarter real GDP only increased at a 2.5% annual rate, durable goods orders fell more than expected, and most of the manufacturing data (regional surveys, flash PMI) were weak.

However, some of the underlying GDP details were decent (but not great). Final demand increased in Q1 as personal consumption expenditures (PCE) increased at a 3.2% annual rate (up from 1.8% in Q4 2012), and residential investment (RI) increased at a 12.6% annual rate (down from 17.6% in Q4). This was the strongest private domestic contribution (PCE and RI) since Q4 2010, and the 2nd strongest quarter since the recession began.

Unfortunately I expect PCE to slow over the next couple of quarters due to a combination of the payroll tax increase and the sequester budget cuts.

There was also some good news. The new home sales report for March indicated an ongoing recovery for housing, and the existing home sales report suggested an improving market (more conventional sales, fewer distressed sales). Also on housing, LPS reported that the number of non-current mortgages fell below 5 million for the first time since 2008.

Other good news included a drop in initial weekly unemployment claims, and increasing demand for architectural design services (a leading indicator for commercial real estate).

Overall this suggests sluggish growth.

Here is a summary of last week in graphs:

• Real GDP increased 2.5% Annualized in Q1

Click on graph for larger image.

Click on graph for larger image.

The BEA reported that "real gross domestic product increased at an annual rate of 2.5 percent in the first quarter of 2013". This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column (and dashed line) is the advance estimate for Q1 GDP.

The second graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).

However the drag from state and local governments is ongoing. I was expecting the drag from state and local governments to end, but this unprecedented and relentless decline in state and local government spending is still a drag on the economy. The good news is the drag has to end soon - in real terms, state and local government spending is back to early 2001 levels.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Clearly RI has bottomed, but it still below the levels of previous recessions.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Clearly RI has bottomed, but it still below the levels of previous recessions.

Overall this was a mediocre report and below expectations, mostly due to government spending and trade. The increase in PCE and RI were positives, but the ongoing government budget cuts continue to slow the economy.

• New Home Sales at 417,000 SAAR in March

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 417 thousand. This was up from 411 thousand SAAR in February.

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 417 thousand. This was up from 411 thousand SAAR in February.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is just above the record low. The combined total of completed and under construction is also just above the record low.

This was at expectations of 419,000 sales in March, and a fairly solid report.

• Existing Home Sales in March: 4.92 million SAAR, 4.7 months of supply

The NAR reports: March Existing-Home Sales Slip Due to Limited Inventory, Prices Maintain Uptrend

The NAR reports: March Existing-Home Sales Slip Due to Limited Inventory, Prices Maintain UptrendThis graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2013 (4.92 million SAAR) were 0.6% lower than last month, and were 10.3% above the March 2012 rate.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 16.8% year-over-year in March compared to March 2012. This is the 25th consecutive month with a YoY decrease in inventory, but the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).

Inventory decreased 16.8% year-over-year in March compared to March 2012. This is the 25th consecutive month with a YoY decrease in inventory, but the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).Months of supply increased to 4.7 months in March.

This was below expectations of sales of 5.03 million, but close to Tom Lawler's forecast. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. Overall his was a solid report.

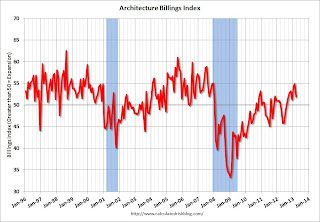

• AIA: Architecture Billings Index indicates increasing demand for design services in March

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment. From AIA: More Positive Momentum for Architecture Billings

This graph shows the Architecture Billings Index since 1996. The index was at 51.9 in February, down from 54.9 in February. Anything above 50 indicates expansion in demand for architects' services, and this was the eight consecutive month with a reading above 50.

Every building sector is now expanding and new project inquiries are strongly positive (down from February, but still at 60.1). Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index suggests some increase in CRE investment in the second half of 2013.

• Weekly Initial Unemployment Claims decline to 339,000

The DOL reports:

The DOL reports:In the week ending April 20, the advance figure for seasonally adjusted initial claims was 339,000, a decrease of 16,000 from the previous week's revised figure of 355,000. The 4-week moving average was 357,500, a decrease of 4,500 from the previous week's revised average of 362,000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 357,500.

Weekly claims were the lowest in six weeks and were below the 350,000 consensus forecast.

• Final April Consumer Sentiment increases to 76.4

The final Reuters / University of Michigan consumer sentiment index for April increased to 76.4 from the preliminary reading of 72.3, but down from the March reading of 78.6.

The final Reuters / University of Michigan consumer sentiment index for April increased to 76.4 from the preliminary reading of 72.3, but down from the March reading of 78.6. This was above the consensus forecast of 73.0, but still fairly low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase and even politics (sequestration, etc).

Sentiment is mostly moving sideways over the last year at a fairly low level (with ups and downs).

Unofficial Problem Bank list declines to 775 Institutions

by Calculated Risk on 4/27/2013 09:31:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Apr 26, 2013.

Changes and comments from surferdude808:

The FDIC, as anticipated, released its enforcement actions through March 2013 and closed a couple banks this week. This led to many changes to the Unofficial Problem Bank List, which had 12 removals and six additions. After changes, the list holds 775 institutions with assets of $285.3 billion. A year ago, the list held 930 institutions with assets of $361.7 billion.

With it being the last Friday of the month, the list had a net decline of 16 institutions and $4.7 billion of assets this April. Notable this month were six removals because of failure as one has to go back to July 2012 to find six or more failures in a month. Also, as noted in the April 5th posting, the cumulative number of removals since the list was first published from action termination now total 356, which is only one shy of the 357 removals because of failure.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining since then.

The removals from failure were Douglas County Bank, Douglasville, GA ($317 million) and Parkway Bank, Lenoir, NC ($109 million). Douglas County Bank is the 86th bank to fail in Georgia since 2008. The 86 failures in Georgia have cost the FDIC an estimated $11.5 billion.

Action terminations include Reliance Bank, Des Peres, MO ($914 million Ticker: RLBS); Mile High Banks, Longmont, CO ($822 million); Jefferson Bank and Trust Company, Eureka, MO ($504 million); International Bank, Raton, NM ($303 million); Huntington State Bank, Huntington, TX ($236 million); Century Bank of Kentucky, Inc., Lawrenceburg, KY ($108 million); First Bank of the Palm Beaches, West Palm Beach, FL ($90 million); First Bank, Wadley, AL ($73 million); and Mitchell Bank, Milwaukee, WI ($57 million). The FDIC also terminated a Prompt Corrective Action order against Mile High Banks.

The FDIC issued actions against State Bank of India (California), Los Angeles, CA ($787 million); Columbia Bank, Lake City, FL ($196 million); Hartford Savings Bank, Hartford, WI ($187 million); Peoples Bank, Clifton, TN ($131 million); and Mid America Bank, Janesville, WI ($114 million). The Federal Reserve issued a Written Agreement against Freedom Bank of Oklahoma, Tulsa, OK ($40 million). It has been some time since October 2012 when the Federal Reserve last issued a new Written Agreement against a state member bank.