by Calculated Risk on 4/16/2013 09:32:00 AM

Tuesday, April 16, 2013

Fed: Industrial Production increased 0.4% in March

From the Fed: Industrial production and Capacity Utilization

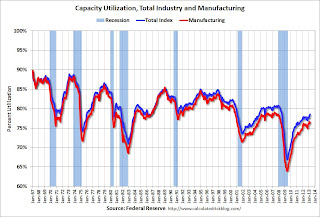

Industrial production rose 0.4 percent in March after having increased 1.1 percent in February. For the first quarter as a whole, output moved up at an annual rate of 5.0 percent, its largest gain since the first quarter of 2012. Manufacturing output edged down 0.1 percent in March after having risen 0.9 percent in February; the index advanced at an annual rate of 5.3 percent in the first quarter. Production at mines decreased 0.2 percent in March and edged down in the first quarter. In March, the output of utilities jumped 5.3 percent, as unusually cold weather drove up heating demand. At 99.5 percent of its 2007 average, total industrial production in March was 3.5 percent above its year-earlier level. The rate of capacity utilization for total industry moved up in March to 78.5 percent, a rate that is 1.2 percentage points above its level of a year earlier but 1.7 percentage points below its long-run (1972--2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.5% is still 1.7 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in March to 99.5. This is 18.8% above the recession low, but still 1.3% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were above expectations.

Housing Starts increase to 1.036 million SAAR in March

by Calculated Risk on 4/16/2013 08:43:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

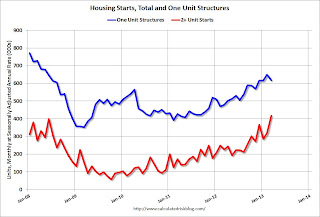

Privately-owned housing starts in March were at a seasonally adjusted annual rate of 1,036,000. This is 7.0 percent above the revised February estimate of 968,000 and is 46.7 percent above the March 2012 rate of 706,000.

Single-family housing starts in March were at a rate of 619,000; this is 4.8 percent below the revised February figure of 650,000. The March rate for units in buildings with five units or more was 392,000.

Building Permits:

Privately-owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 902,000. This is 3.9 percent below the revised February rate of 939,000, but is 17.3 percent above the March 2012 estimate of 769,000.

Single-family authorizations in March were at a rate of 595,000; this is 0.5 percent below the revised February figure of 598,000. Authorizations of units in buildings with five units or more were at a rate of 283,000 in March.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased sharply in March.

Single-family starts (blue) declined to 619,000 in March (Note: February was revised up sharply from 618 thousand to 650 thousand).

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was well above expectations of 930 thousand starts in March, mostly due to the sharp increase in multi-family starts - and the highest level since June 2008. Starts in March were up 46.7% from March 2012; single family starts were up 28.7% year-over-year. Starts in February were revised up sharply. I'll have more later, but this was a strong report.

Monday, April 15, 2013

Tuesday: Housing Starts, CPI, Industrial Production

by Calculated Risk on 4/15/2013 09:01:00 PM

From Annie Lowery at the NY Times: Europe Split Over Austerity as a Path to Growth

Economic fortunes during the recovery from the Great Recession have diverged, with new estimates of growth by the monetary fund expected on Tuesday. But they will not change the basic picture, which Ms. Lagarde has taken to describing as a “three-speed” world. Developing and emerging economies are growing apace. Some advanced economies, including the United States, are gaining strength.At least people are questioning the current policies in Europe.

But a third category of countries remains mired in stagnation or recession. Japan has struggled with a stalled-out economy, but has recently engaged in an athletic campaign of fiscal and monetary stimulus. The true laggard is Europe, suffering from rising unemployment and another bout of economic contraction — seemingly without the political consensus or economic mechanisms to tackle those problems.

...

In light of that reality, the monetary fund and its European partners, the European Commission and the European Central Bank — the so-called troika — have come under continued criticism for the austerity measures imposed on countries including Spain, Portugal and Greece, where unemployment rates extend well into the double digits. The criticism has become louder since the fund said it had determined that austerity had a far worse impact on weak economies than it once thought.

Tuesday economic releases:

• At 8:30 AM ET, Housing Starts for March from the Census Bureau. The consensus is for total housing starts to increase to 930 thousand (SAAR) in March, up from 917 thousand in February.

• Also at 8:30 AM, the BLS will release the Consumer Price Index for March. The consensus is no change in CPI in March (due to lower gasoline prices) and for core CPI to increase 0.2%.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.2% increase in Industrial Production in March, and for Capacity Utilization to decrease to 78.3%.

Gasoline Prices Continue Decline

by Calculated Risk on 4/15/2013 05:29:00 PM

A sad day ... my thoughts are with the victims and the people of Boston.

As part of the commodity sell-off, oil prices were down again today (the price of gold is irrelevant for the economy, but oil matters). According to Bloomberg, WTI was down to $87.62 per barrel, and Brent was down to $100.39 per barrel.

According to Gasbuddy.com (see graph at bottom), gasoline prices are down to a national average of $3.50 per gallon. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.35 per gallon. That is about 15 cents below the current level according to Gasbuddy.com, and I expect prices to fall further. The low for the year is in the $3.20s per gallon, and a year ago gasoline was at $3.90 per gallon.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Existing Home Inventory is up 9.6% year-to-date on April 15th

by Calculated Risk on 4/15/2013 01:32:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly this year.

In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory mostly followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through April 15th - inventory is increasing faster than in 2011 and 2012.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

In 2010, inventory was up 15% by the end of March, and close to 20% by the end of April.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is up 9.6% (above the peak percentage increase for 2011 and 2012). It is possible that inventory could bottom this year - it will probably be close - but right now I expect inventory to bottom in early 2014.

FNC: House prices increased 6.1% year-over-year in February, At 28 Month High

by Calculated Risk on 4/15/2013 11:27:00 AM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: February Home Prices at 28-month High

The latest FNC Residential Price Index® (RPI) indicates that U.S. property values rose again in February, continuing a trend that began in the spring of 2012 which has become widely recognized as the beginning of the housing market’s recovery. In February, the FNC RPI recorded a 28-month high after rising for 12 straight months. For the 12 months through February, the index rose 6.1%−its fastest acceleration since July 2006.The year-over-year change continued to increase in February, with the 100-MSA composite up 6.1% compared to February 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

... Despite rising prices, the supply remains limited as foreclosure activities decline. Meanwhile, the supply from potential trade-up buyers remains constrained by current prices, which are still too low to allow many existing homeowners to capture equity appreciation. Inevitably, the demand by potential trade-up buyers remains constrained. The median sales-to-list price ratio in February was 95.0, up from 93.8 in January and 90.3 a year ago. Foreclosure sales were down to 20.2% from 26.5% a year ago.

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that February home prices rose 0.2% from the previous month and were up 6.1% year-over-year from the same period in 2012. The two narrower composite indices also show a small month-over-month price increase but greater year-over-year change at 7.1% and 7.9% respectively for the nation’s top-30 and top-10 housing markets.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Even with the recent increase, the FNC composite 100 index is still off 29.1% from the peak.

Builder Confidence declines in April due to higher costs

by Calculated Risk on 4/15/2013 10:00:00 AM

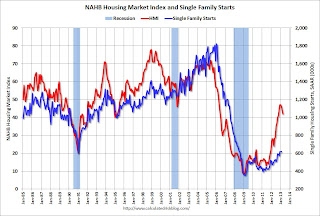

The National Association of Home Builders (NAHB) reported the housing market index (HMI) decreased 2 points in April to 42. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Rising Costs Put Squeeze on Builder Confidence in April

Facing increasing costs for building materials and rising concerns about the supply of developed lots and labor, builders registered less confidence in the market for newly built, single-family homes in April, with a two-point drop to 42 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

...

“Supply chains for building materials, developed lots and skilled workers will take some time to re-establish themselves following the recession, and in the meantime builders are feeling squeezed by higher costs and limited availability issues,” explained NAHB Chief Economist David Crowe. “That said, builders’ outlook for the next six months has improved due to the low inventory of for-sale homes, rock bottom mortgage rates and rising consumer confidence.”

...

While the HMI component gauging current sales conditions declined two points to 45 and the component gauging buyer traffic declined four points to 30 in April, the component gauging sales expectations in the next six months posted a three-point gain to 53 – its highest level since February of 2007.

Looking at three-month moving averages for regional HMI scores, the Northeast was unchanged at 38 in April while the Midwest registered a two-point decline to 45, the South registered a four-point decline to 42 and the West posted a three-point decline to 55.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the April release for the HMI and the February data for starts (March housing starts will be released tomorrow). This was below the consensus estimate of a reading of 45.

As I noted last week, lumber prices are near the housing bubble high, and it appears highers costs are impacting builder confidence.

NY Fed: Empire State Manufacturing index declines, Shows slight expansion in April

by Calculated Risk on 4/15/2013 08:35:00 AM

From the NY Fed: Empire State Manufacturing Survey

The April 2013 Empire State Manufacturing Survey indicates that conditions for New York manufacturers improved slightly. The general business conditions index fell six points but, at 3.1, remained positive for a third consecutive month. Similarly, the new orders index was lower than last month but still positive, dipping six points to 2.2, and the shipments index fell to 0.8.This suggests some expansion, but was below the consensus forecast of a reading of 7.5.

...

Employment indexes pointed to some firming in labor market conditions. The index for number of employees rose four points to 6.8, indicating a modest increase in employment levels, and the average workweek index rose six points to 5.7, indicating a modest increase in hours worked.

Sunday, April 14, 2013

Monday: Empire State Mfg Survey, Homebuilder Confidence

by Calculated Risk on 4/14/2013 10:03:00 PM

A depressing summary of the European situation from Professor Tim Duy: When Can We All Admit the Euro is an Economic Failure?. Duy concludes:

With no depreciation for crisis-stricken economies, no fiscal stimulus, and tight credit conditions through half of Europe as banking consolidates within national boundaries, what exactly is the road forward for Europe? I just don't see it.It doesn't help that European policymakers have been consistently wrong and seem delusional about what they have accomplished ("Ubi solitudinem faciunt, pacem appellant").

Bottom Line: How high does unemployment need to rise, how much output needs to be lost, how much poverty must be endured before European policymakers realize that the framework supporting the Euro politcally is an economic failure?

Monday economic releases:

• At 8:30 AM ET, the NY Fed will release the Empire State Manufacturing Survey for April. The consensus is for a reading of 7.5, down from 9.2 in March (above zero is expansion).

• At 10:00 AM, the NAHB will release the April homebuilder survey. The consensus is for a reading of 45, up from 44 in March. Although this index has increased sharply in 2012, any number below 50 still indicates that more builders view sales conditions as poor than good.

Weekend:

• Summary for Week Ending April 12th

• Schedule for Week of April 14th

The Asian markets are red tonight with the Nikkei down 0.9%, but the Shanghai composite off 0.25%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 3 and Dow futures are down 3 (fair value).

Oil prices are down over the last week with WTI futures at $90.57 per barrel and Brent at $102.80 per barrel. According to Gasbuddy.com, gasoline prices are down about 22 cents over the last 6 weeks to $3.52 per gallon.

Shiller and the Upward Slope of Real House Prices

by Calculated Risk on 4/14/2013 03:06:00 PM

Professor Robert Shiller wrote in the NY Times: Why Home Prices Change (or Don’t)

Home prices look remarkably stable when corrected for inflation. Over the 100 years ending in 1990 — before the recent housing boom — real home prices rose only 0.2 percent a year, on average. The smallness of that increase seems best explained by rising productivity in construction, which offset increasing costs of land and labor.Shiller's comment on the stability of real house prices is based on the long run price index he constructed for the second edition of his book "Irrational Exuberance".

As I've noted before, if Shiller had used some different indexes for earlier periods, his graph would have indicated an upward slope for real house prices. Here was an earlier post on this: The upward slope of Real House Prices. A few excerpts:

It is important to realize that Professor Shiller used the quarterly Case-Shiller National index starting in 1987. From 1975 through 1986 he used what is now called the FHFA index. He used other price indexes in earlier periods.The indexes I used captured a larger percentage of the market than the indexes Shiller used.

...

The FHFA index used by Shiller was based on a small percentage of transactions back in the '70s. If we look at the CoreLogic index instead, there is a clear upward slope to real house prices.

If Professor Shiller had used the Freddie Mac quarterly index back to 1970 (instead of the PHCPI), there would be more of an upward slope to his graph too. So it is important to understand that for earlier periods the data is probably less accurate.

Tom Lawler has also written in depth about this: Lawler: On the upward trend in Real House Prices

During the housing bubble, the difference between a slight increase in real prices (0.2% per year according to Shiller's index) and a slightly larger increase in real prices using other indexes (probably closer to 1.5% per year) didn't make any difference; there was obviously a huge bubble in house prices. But now it makes a difference. A key reason for the upward slope in real house prices is because some areas are land constrained, and with an increasing population, the value of land increases faster than inflation.

Shiller adds this incomplete comment:

[R]eal home prices should decline with time, except to the extent that households shell out some money and plow back some of their incomes into maintenance and improvements, because homes wear out and go out of style.He is referring to the structure only, and he is leaving out the value of the land!

The bottom line is there is an upward slope to real house prices.