by Calculated Risk on 4/15/2013 01:32:00 PM

Monday, April 15, 2013

Existing Home Inventory is up 9.6% year-to-date on April 15th

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly this year.

In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory mostly followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through April 15th - inventory is increasing faster than in 2011 and 2012.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

In 2010, inventory was up 15% by the end of March, and close to 20% by the end of April.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is up 9.6% (above the peak percentage increase for 2011 and 2012). It is possible that inventory could bottom this year - it will probably be close - but right now I expect inventory to bottom in early 2014.

FNC: House prices increased 6.1% year-over-year in February, At 28 Month High

by Calculated Risk on 4/15/2013 11:27:00 AM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: February Home Prices at 28-month High

The latest FNC Residential Price Index® (RPI) indicates that U.S. property values rose again in February, continuing a trend that began in the spring of 2012 which has become widely recognized as the beginning of the housing market’s recovery. In February, the FNC RPI recorded a 28-month high after rising for 12 straight months. For the 12 months through February, the index rose 6.1%−its fastest acceleration since July 2006.The year-over-year change continued to increase in February, with the 100-MSA composite up 6.1% compared to February 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

... Despite rising prices, the supply remains limited as foreclosure activities decline. Meanwhile, the supply from potential trade-up buyers remains constrained by current prices, which are still too low to allow many existing homeowners to capture equity appreciation. Inevitably, the demand by potential trade-up buyers remains constrained. The median sales-to-list price ratio in February was 95.0, up from 93.8 in January and 90.3 a year ago. Foreclosure sales were down to 20.2% from 26.5% a year ago.

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that February home prices rose 0.2% from the previous month and were up 6.1% year-over-year from the same period in 2012. The two narrower composite indices also show a small month-over-month price increase but greater year-over-year change at 7.1% and 7.9% respectively for the nation’s top-30 and top-10 housing markets.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Even with the recent increase, the FNC composite 100 index is still off 29.1% from the peak.

Builder Confidence declines in April due to higher costs

by Calculated Risk on 4/15/2013 10:00:00 AM

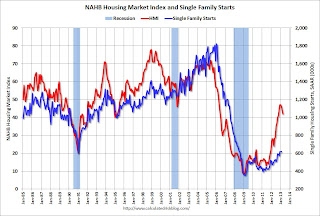

The National Association of Home Builders (NAHB) reported the housing market index (HMI) decreased 2 points in April to 42. Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Rising Costs Put Squeeze on Builder Confidence in April

Facing increasing costs for building materials and rising concerns about the supply of developed lots and labor, builders registered less confidence in the market for newly built, single-family homes in April, with a two-point drop to 42 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

...

“Supply chains for building materials, developed lots and skilled workers will take some time to re-establish themselves following the recession, and in the meantime builders are feeling squeezed by higher costs and limited availability issues,” explained NAHB Chief Economist David Crowe. “That said, builders’ outlook for the next six months has improved due to the low inventory of for-sale homes, rock bottom mortgage rates and rising consumer confidence.”

...

While the HMI component gauging current sales conditions declined two points to 45 and the component gauging buyer traffic declined four points to 30 in April, the component gauging sales expectations in the next six months posted a three-point gain to 53 – its highest level since February of 2007.

Looking at three-month moving averages for regional HMI scores, the Northeast was unchanged at 38 in April while the Midwest registered a two-point decline to 45, the South registered a four-point decline to 42 and the West posted a three-point decline to 55.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the April release for the HMI and the February data for starts (March housing starts will be released tomorrow). This was below the consensus estimate of a reading of 45.

As I noted last week, lumber prices are near the housing bubble high, and it appears highers costs are impacting builder confidence.

NY Fed: Empire State Manufacturing index declines, Shows slight expansion in April

by Calculated Risk on 4/15/2013 08:35:00 AM

From the NY Fed: Empire State Manufacturing Survey

The April 2013 Empire State Manufacturing Survey indicates that conditions for New York manufacturers improved slightly. The general business conditions index fell six points but, at 3.1, remained positive for a third consecutive month. Similarly, the new orders index was lower than last month but still positive, dipping six points to 2.2, and the shipments index fell to 0.8.This suggests some expansion, but was below the consensus forecast of a reading of 7.5.

...

Employment indexes pointed to some firming in labor market conditions. The index for number of employees rose four points to 6.8, indicating a modest increase in employment levels, and the average workweek index rose six points to 5.7, indicating a modest increase in hours worked.

Sunday, April 14, 2013

Monday: Empire State Mfg Survey, Homebuilder Confidence

by Calculated Risk on 4/14/2013 10:03:00 PM

A depressing summary of the European situation from Professor Tim Duy: When Can We All Admit the Euro is an Economic Failure?. Duy concludes:

With no depreciation for crisis-stricken economies, no fiscal stimulus, and tight credit conditions through half of Europe as banking consolidates within national boundaries, what exactly is the road forward for Europe? I just don't see it.It doesn't help that European policymakers have been consistently wrong and seem delusional about what they have accomplished ("Ubi solitudinem faciunt, pacem appellant").

Bottom Line: How high does unemployment need to rise, how much output needs to be lost, how much poverty must be endured before European policymakers realize that the framework supporting the Euro politcally is an economic failure?

Monday economic releases:

• At 8:30 AM ET, the NY Fed will release the Empire State Manufacturing Survey for April. The consensus is for a reading of 7.5, down from 9.2 in March (above zero is expansion).

• At 10:00 AM, the NAHB will release the April homebuilder survey. The consensus is for a reading of 45, up from 44 in March. Although this index has increased sharply in 2012, any number below 50 still indicates that more builders view sales conditions as poor than good.

Weekend:

• Summary for Week Ending April 12th

• Schedule for Week of April 14th

The Asian markets are red tonight with the Nikkei down 0.9%, but the Shanghai composite off 0.25%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 3 and Dow futures are down 3 (fair value).

Oil prices are down over the last week with WTI futures at $90.57 per barrel and Brent at $102.80 per barrel. According to Gasbuddy.com, gasoline prices are down about 22 cents over the last 6 weeks to $3.52 per gallon.

Shiller and the Upward Slope of Real House Prices

by Calculated Risk on 4/14/2013 03:06:00 PM

Professor Robert Shiller wrote in the NY Times: Why Home Prices Change (or Don’t)

Home prices look remarkably stable when corrected for inflation. Over the 100 years ending in 1990 — before the recent housing boom — real home prices rose only 0.2 percent a year, on average. The smallness of that increase seems best explained by rising productivity in construction, which offset increasing costs of land and labor.Shiller's comment on the stability of real house prices is based on the long run price index he constructed for the second edition of his book "Irrational Exuberance".

As I've noted before, if Shiller had used some different indexes for earlier periods, his graph would have indicated an upward slope for real house prices. Here was an earlier post on this: The upward slope of Real House Prices. A few excerpts:

It is important to realize that Professor Shiller used the quarterly Case-Shiller National index starting in 1987. From 1975 through 1986 he used what is now called the FHFA index. He used other price indexes in earlier periods.The indexes I used captured a larger percentage of the market than the indexes Shiller used.

...

The FHFA index used by Shiller was based on a small percentage of transactions back in the '70s. If we look at the CoreLogic index instead, there is a clear upward slope to real house prices.

If Professor Shiller had used the Freddie Mac quarterly index back to 1970 (instead of the PHCPI), there would be more of an upward slope to his graph too. So it is important to understand that for earlier periods the data is probably less accurate.

Tom Lawler has also written in depth about this: Lawler: On the upward trend in Real House Prices

During the housing bubble, the difference between a slight increase in real prices (0.2% per year according to Shiller's index) and a slightly larger increase in real prices using other indexes (probably closer to 1.5% per year) didn't make any difference; there was obviously a huge bubble in house prices. But now it makes a difference. A key reason for the upward slope in real house prices is because some areas are land constrained, and with an increasing population, the value of land increases faster than inflation.

Shiller adds this incomplete comment:

[R]eal home prices should decline with time, except to the extent that households shell out some money and plow back some of their incomes into maintenance and improvements, because homes wear out and go out of style.He is referring to the structure only, and he is leaving out the value of the land!

The bottom line is there is an upward slope to real house prices.

LA Times: The Industrial Boom in the Inland Empire

by Calculated Risk on 4/14/2013 10:43:00 AM

From Roger Vincent at the LA Times: In the Inland Empire, an industrial real estate boom

Nestled on the windy plains at the foot of the San Bernardino Mountains, once austere stretches of agricultural land have morphed into the country's most desirable industrial real estate market, and it is growing faster than any other industrial region in the U.S.Back in 2005 and 2006, I wrote frequently about the coming residential bust in the Inland Empire. But this industrial (distribution) boom makes more sense and is directly related to the increase in trade with Asia.

...

The clamor for these big buildings is so intense in San Bernardino and Riverside counties that developers are erecting more than 16 million square feet of warehouses on speculation, meaning they are gambling that buyers or renters will rush forward to claim the buildings by the time they are complete.

...

Although the Inland Empire was hard hit by the recession and earned a reputation for mortgage foreclosures, evictions and high unemployment rates during the downturn, the industrial property business has remained a bright spot. And it is now picking up speed.

Southern California, with its enormous population and teeming seaports, has long been a vital hub for major retailers and manufacturers ... But with Los Angeles and Orange counties essentially full, the Inland Empire with its wide-open spaces is now where the big new buildings are flying up.

Los Angeles County's industrial vacancy is a mere 2.5%, the lowest in the country, said Kurt Strasmann of brokerage CBRE Group Inc., and some of the priciest industrial property in the U.S. is around Los Angeles International Airport. Orange County is the second-tightest market in the U.S., with 3.5% vacancy.

The two counties and the Inland Empire have a combined total of more than 1.65 billion square feet of industrial property, which is twice as big as the next largest market, Chicago.

Saturday, April 13, 2013

Unofficial Problem Bank list declines to 786 Institutions

by Calculated Risk on 4/13/2013 06:15:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Apr 12, 2013.

Changes and comments from surferdude808:

Mergers were the theme of the week as four problem banks exited the list by merging on an unassisted basis. After removal, the list holds 786 institutions with assets of $289.4 billion. A year ago, the list had 944 institutions with assets of $375.3 billion.Earlier:

Acquired were Herald National Bank, New York, NY ($490 million); Reliance Bank, FSB, Fort Myers, FL ($59 million); The Community Bank of Shell Knob, Shell Knob, MO ($11 million); and Monadnock Community Bank, Peterborough, NH ($207 thousand). A few of these deals happened months ago but the FDIC has just updated their database to reflect the charters being eliminated. Herald National Bank was acquired by BankUnited Inc. (BKU) and is CEO John Kanas return vehicle to the New York City market after he sold North Fork Bancorp in 2006 to Capital One, which delayed his return through a lawsuit claiming breach of a non-compete agreement. Reliance Bank, FSB merged with its sister bank Reliance Bank, Des Peres, MO ($914 million), which is also operating under a formal enforcement action. The other interesting merger is Monadnock, which was acquired by GFA Federal Credit Union in the first ever purchase of a savings bank by a credit union.

Next week, we anticipate the OCC will release its actions through mid-March 2013.

• Summary for Week Ending April 12th

• Schedule for Week of April 14th

Schedule for Week of April 14th

by Calculated Risk on 4/13/2013 01:06:00 PM

Earlier:

• Summary for Week Ending April 12th

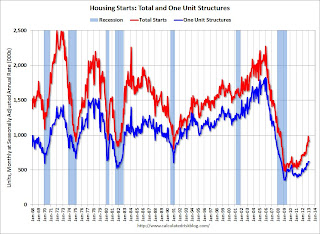

There are two key housing reports that will be released this week: March housing starts on Tuesday, and the April homebuilder confidence survey on Monday.

Also, for manufacturing, the March Industrial Production survey will be released on Tuesday. Also for manufacturing, the NY Fed (Empire State) and Philly Fed April surveys will be released this week.

For prices, CPI for March will be released on Tuesday.

8:30 AM: NY Fed Empire Manufacturing Survey for April. The consensus is for a reading of 7.5, down from 9.2 in March (above zero is expansion).

10:00 AM ET: The April NAHB homebuilder survey. The consensus is for a reading of 45, up from 44 in March. Although this index has increased sharply in 2012, any number below 50 still indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for March.

8:30 AM: Housing Starts for March. Total housing starts were at 917 thousand (SAAR) in February, 0.8% above the revised January estimate of 910 thousand. Single family starts increased to 618 thousand in February and are at the highest level since June 2008.

The consensus is for total housing starts to increase to 930 thousand (SAAR) in March, up from 917 thousand in February.

8:30 AM: Consumer Price Index for March. The consensus is no change in CPI in March (due to lower gasoline prices) and for core CPI to increase 0.2%.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This shows industrial production since 1967 through January.

The consensus is for a 0.2% increase in Industrial Production in March, and for Capacity Utilization to decrease to 78.3%.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. Analysts will look for signs of a slow down.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 347 thousand from 346 thousand last week. The "sequester" budget cuts might be starting to impact weekly claims.

10:00 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of minus 3.3, up from 2.0 last month (above zero indicates expansion).

1:00 PM: Speech by Fed Governor Sarah Bloom Raskin, Reflections on Inequality and the Recent Business Cycle, At the 22nd Annual Hyman P. Minsky Conference on the State of the U.S. and World Economies, New York, New York

10:00 AM: Regional and State Employment and Unemployment (Monthly) for March 2013

Summary for Week ending April 12th

by Calculated Risk on 4/13/2013 08:57:00 AM

It was a very light week for economic data, but the key report - March retail sales - was disappointing. Consumer sentiment was also weak in early April.

However initial weekly unemployment claims declined sharply, and the number of job openings is at the highest level since 2008. So there was a little good economic news.

Not much has changed for the economic outlook - we are still looking at sluggish growth for the next couple of quarters due to the payroll tax increase and sequestration budget cuts, but the economy should continue to grow with housing leading the way.

Here is a summary of last week in graphs:

• Retail Sales declined 0.4% in March

Click on graph for larger image.

Click on graph for larger image.

On a monthly basis, retail sales decreased 0.4% from February to March (seasonally adjusted), and sales were up 2.8% from March 2012. Sales for January and February were revised down.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 26.2% from the bottom, and now 11.2% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos decreased 0.4%. Retail sales ex-gasoline decreased 0.2%.

Excluding gasoline, retail sales are up 23.5% from the bottom, and now 10.4% above the pre-recession peak (not inflation adjusted).

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 3.3% on a YoY basis (2.8% for all retail sales).

This was below the consensus forecast of no change in retail sales. Lower gasoline prices subtracted from retail sales - after boosting sales in February.

• BLS: Job Openings increased in February, Most since May 2008

Jobs openings increased in February to 3.925 million, up from 3.611 million in January. The number of job openings (yellow) has generally been trending up, and openings are up 11% year-over-year compared to February 2012. This is most job openings since May 2008.

Jobs openings increased in February to 3.925 million, up from 3.611 million in January. The number of job openings (yellow) has generally been trending up, and openings are up 11% year-over-year compared to February 2012. This is most job openings since May 2008.

Quits were unchanged in February, and quits are up 7% year-over-year and at the highest level since 2008. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report, but the trend suggests a gradually improving labor market.

• Weekly Initial Unemployment Claims decline to 346,000

The DOL reported: "In the week ending April 6, the advance figure for seasonally adjusted initial claims was 346,000, a decrease of 42,000 from the previous week's revised figure of 388,000. The 4-week moving average was 358,000, an increase of 3,000 from the previous week's revised average of 355,000."

The DOL reported: "In the week ending April 6, the advance figure for seasonally adjusted initial claims was 346,000, a decrease of 42,000 from the previous week's revised figure of 388,000. The 4-week moving average was 358,000, an increase of 3,000 from the previous week's revised average of 355,000."

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 358,000 - the highest level since February.

Weekly claims were below the 365,000 consensus forecast.

• Preliminary April Consumer Sentiment declines to 72.3

The preliminary Reuters / University of Michigan consumer sentiment index for April declined to 72.3 from the March reading of 78.6.

The preliminary Reuters / University of Michigan consumer sentiment index for April declined to 72.3 from the March reading of 78.6.

This was well below the consensus forecast of 79.0. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase and even politics (sequestration, default threats, etc).

Sentiment is mostly moving sideways at a fairly low level (with ups and downs).