by Calculated Risk on 3/14/2013 07:57:00 PM

Thursday, March 14, 2013

Friday: Industrial Production, CPI, Consumer Sentiment

First, here is a price index for commercial real estate that I follow. CoStar reported that their value weighted index is up 4.8% year-over-year, and the equal weighted index is up 5.5% from January 2012. Also the volume of distressed sales is continuing to decline.

From CoStar: Commercial Real Estate Pricing Levels Off In January Following Year-End Surge

The U.S. Value-Weighted Composite Index, which weights each repeat-sale by transaction size or value (and therefore is heavily influenced by larger transactions), ticked up by 0.7% in January, and has now increased 38% from its trough in 2010. The U.S. Equal-Weighted Composite Index, which weights each repeat-sale by transaction equally (and therefore is heavily influenced by numerous smaller transactions), began 2013 with a 2.9% monthly loss, largely due to a seasonal slowdown in trading activities after the year-end sales surge. However, thanks to its steady recovery throughout 2012, the equal-weighted index has increased 5.5% since January 2012.

...

Distressed sales as a percentage of total transactions have been following a declining trend since the start of 2011. Although this percentage ticked up in January 2013 due to the seasonal slowdown in total transactions, the number of repeat sales involving distress assets was the lowest in January 2013 since the summer of 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. As CoStar noted, the Value-Weighted index is up 38.5% from the bottom (showing the demand for higher end properties) and up 4.8% year-over-year. However the Equal-Weighted index is only up 9.0% from the bottom, and up 5.5% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Friday economic releases:

• At 8:30 AM ET, the Consumer Price Index for February will be released. The consensus is for a 0.5% increase in CPI in February (due to higher gasoline prices) and for core CPI to increase 0.2%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for March. The consensus is for a reading of 8.5, down from 10.0 in February (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for February. The consensus is for a 0.3% increase in Industrial Production in February, and for Capacity Utilization to increase to 79.3%.

• At 9:55 AM, the preliminary March Reuter's/University of Michigan's Consumer sentiment index will be released. The consensus is for a reading of 77.5, down from 77.6.

Freddie Mac: Mortgage Rates increase in latest Survey

by Calculated Risk on 3/14/2013 04:15:00 PM

From Freddie Mac today: Mortgage Rates up on Signs of Improving Economy

The 30-year fixed averaged 3.63 percent, its highest reading since the week of August 23, 2012. The 30-year fixed hit its average all-time record low of 3.31 percent the week of November 21, 2012. ...

30-year fixed-rate mortgage (FRM) averaged 3.63 percent with an average 0.8 point for the week ending March 14, 2013, up from last week when it averaged 3.52 percent. Last year at this time, the 30-year FRM averaged 3.92 percent.

15-year FRM this week averaged 2.79 percent with an average 0.8 point, up from last week when it averaged 2.76 percent. A year ago at this time, the 15-year FRM averaged 3.16 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently near the record low for the last 40 years.

This shows the recent small increase in mortgage rates. This probably means refinance activity will slow in 2013. Note: There has been an increase in refinance activity due to HARP.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates. Currently the 10 year Treasury yield is 2.02% and 30 year mortgage rates are at 3.63%. If the ten year yield stay in this range, 30 year mortgage rates might move up a little from here.

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).The recent increase in rates is pretty small on this long term graph.

Note: Mortgage rates were at or below 5% back in the 1950s.

Report: Housing Inventory declines 16% year-over-year in February

by Calculated Risk on 3/14/2013 01:54:00 PM

From Realtor.com: Spring Home Buying Season Starts Early According to realtor.com®'s February Trend Data

In February, the total number of single-family homes, condos, townhomes and co-ops for sale in the U.S. (1,494,218) increased by 1.15 percent month-over-month. On an annual basis, however, inventory was down by 15.97 percent.Note: Realtor.com reports the average number of listings in a month, whereas the NAR uses an end-of-month estimate. Since inventory usually starts to come back on the market early in the year, the NAR will probably report a larger month-to-month increase in inventory for February than Realtor.com.

The median age of inventory of for sale listings fell to 98 days in February, down 9.26 percent from January and 11.71 percent below the median age one year ago (February 2012).

Nearly all of the markets with the largest year-over-year declines in their for sale inventories in February were in California, where declines averaged 48 percent. The list includes Sacramento, Stockton, Oakland, San Jose, Orange County, Los Angeles, Seattle, San Francisco, Riverside and Ventura. These markets also experienced a dramatic decline in the median age of inventory, falling to an average of just 31 days, or 53 percent lower than it was one year ago.

Inventory decreased year-over-year in 141 of the 146 markets realtor.com tracks, and by more than 20% year-over-year in 43 markets.

The NAR is scheduled to report February existing home sales and inventory on Thursday, March 21st.

FNC: Residential Property Values increased 5.7% year-over-year in January

by Calculated Risk on 3/14/2013 10:35:00 AM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: January Home Prices Rise 0.3%

The latest FNC Residential Price Index® (RPI) indicates that U.S. property values continued to recover through January—the 11th consecutive month of rising prices. Despite the uneven pace of price gains across different geographical markets, there are clear signs that the housing recovery is increasingly widespread.The year-over-year change continued to increase in January, with the 100-MSA composite up 5.7% compared to January 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

A limited housing supply and declining foreclosure sales are contributing to the recovery of underlying property values. The average list-to-sale price ratio increased to 93.5 in January, compared to 90.3 during the same period a year ago; in other words, the average asking price discount dropped to 6.5% from 9.7%. Foreclosures, as a percentage of total home sales, were 20.2% in January, down from 26.9% a year ago.

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that January home prices rose 0.3% from the previous month and were up 5.7% on a year-over-year basis from the same period in 2012. The 30-MSA and 10-MSA composite indices show similar trends of rising prices, with the 10-MSA composite accelerating more rapidly at 0.8% month-over-month and 7.2% year-over-year.

...

Although home prices have improved significantly in the last 12 months, a six-year price comparison shows that current prices remain well below their near-peak levels. On average, today’s home prices are about 27.5% below January 2007. In hard-hit markets such as Las Vegas, Orlando, Miami, and Riverside, Calif., home prices are only half of what they were six years ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The key is the indexes are now showing a year-over-year increase indicating prices probably bottomed early in 2012.

Weekly Initial Unemployment Claims decrease to 332,000

by Calculated Risk on 3/14/2013 08:35:00 AM

The DOL reports:

In the week ending March 9, the advance figure for seasonally adjusted initial claims was 332,000, a decrease of 10,000 from the previous week's revised figure of 342,000. The 4-week moving average was 346,750, a decrease of 2,750 from the previous week's revised average of 349,500.The previous week was revised up from 340,000.

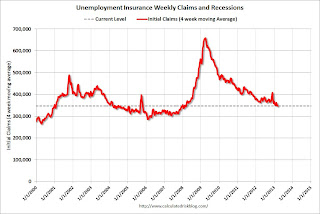

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 346,750 - this is the lowest level since early March 2008.

Weekly claims were below the 350,000 consensus forecast. Claims might increase over the next few months due to the "sequestration" budget cuts, but right now initial unemployment claims suggest an improving labor market.

Wednesday, March 13, 2013

Thursday: Unemployment Claims, PPI

by Calculated Risk on 3/13/2013 08:23:00 PM

On the declining deficit from MarketWatch: February budget deficit $203.5 billion: Treasury

The U.S. government ran a budget deficit of $203.5 billion in February, down 12% from the same month last year, the Treasury Department reported on Wednesday. The narrowing of the gap between spending and revenue in February is further indication that the deficit is on track to improve this fiscal year which ends Sept. 30. If lawmakers hold fiscal policy steady, the deficit for this year will total $845 billion, about $240 billion less than the fiscal 2012 deficit and the first deficit below a trillion since fiscal 2008, according to the Congressional Budget Office projections.The Congressional Budget Office (CBO) is projecting the deficit will decline to $845 billion in fiscal 2013 (the current budget year), and that the deficit will be about 5.3% of GDP.

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

The CBO projects the deficit will decline to 3.7% of GDP in fiscal 2014, and 2.4% of GDP in fiscal 2015. After 2015, the deficit will start to increase again according to the CBO.

Thursday economic releases:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 350 thousand from 340 thousand last week.

• Also at 8:30 AM, the Producer Price Index for February. The consensus is for a 0.6% increase in producer prices (0.1% increase in core).

DataQuick: February Home Sales in SoCal highest in Six Years, Strong Investor Buying

by Calculated Risk on 3/13/2013 05:37:00 PM

One of the housing markets I follow closely is southern California. I highlighted a couple of key points in this article: 1) Activity is picking up, especially in the move-up markets, 2) there is evidence of strong investor buying, and 3) foreclosure resales are at the lowest level since 2007.

From DataQuick: Southland Home Sales at Six-Year High; Median Price Up Again Yr/Yr

Southern California logged the highest February home sales in six years last month amid relatively strong sales of mid- to high-end properties and a record share of homes sold to absentee buyers. ...Cash buying is strong in many areas. Economist Tom Lawler sent me the following comments and table today. From Tom Lawler:

A total of 15,945 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 0.7 percent from 16,058 sales in January, and up 1.0 percent from 15,780 sales in February 2012, according to San Diego-based DataQuick. ... Last month’s sales were the highest for the month of February since 17,680 homes sold in February 2007, but they were 9.9 percent below the February average of 17,696 sales. The low for February sales was 10,777 in 2008, while the high was 26,587 in 2004.

“Our January and February stats certainly indicate housing remains a big target for investors. But typically those two months don't offer much insight into how the market will behave the rest of the year. These are sales that closed in January and February, meaning many of the buyers were out home shopping during the holiday season late last year. That's when many traditional buyers and sellers drop out of the market, leaving a relatively high concentration of very motivated market participants, especially investors,” said John Walsh, DataQuick president.

“March and April will offer a better view of how broader market trends are shaping up this year. One of the real wild cards will be how many more homes go up for sale. More people who've long been thinking of selling will be tempted to list their homes at today's higher prices. Fewer people will be underwater and therefore could at least break even on a sale. Some investors who've held for a while will consider cashing in. A meaningful rise in the supply of homes on the market should at least tame price appreciation.”

Move-up markets continued to show big sales gains from a year earlier. The number of homes sold in February for between $300,000 and $800,000 – a range that would include many first-time move-up buyers – rose 33.4 percent year-over-year. The number that sold for $500,000 or more jumped 54.0 percent from one year earlier, while sales of $800,000-plus homes increased 62.7 percent compared with February 2012.

Last month foreclosure resales – properties foreclosed on in the prior 12 months – accounted for 15.8 percent of the Southland resale market. That was down from a revised 17.2 percent the month before and down from 32.6 percent a year earlier. In recent months foreclosure resales have been at the lowest level since September 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 22.0 percent of Southland resales last month. That was down from an estimated 24.0 percent the month before and 26.9 percent a year earlier.

Investor and cash buying was at or near all-time highs.

Absentee buyers – mostly investors and some second-home purchasers – bought a record 31.4 percent of the Southland homes sold in February. That was up from 30.4 percent the prior month and up from 29.9 percent a year earlier. ... Buyers paying with cash accounted for 35.6 percent of last month's home sales, compared with 33.7 percent both the month before and a year earlier. The peak was 35.8 percent last December.

Emphasis added

"While distressed sales, and especially foreclosure sales, have fallen considerably in most markets over the last year, the all-cash share of transactions in aggregate doesn’t appear to have fallen, and in some markets it has even reason. This suggests that investor buying of non-distressed properties has increased significantly over the last year.

(Note: all save for So. California are MLS based; also, the Las Vegas number for February 2013 is an estimate based on press reports that the all-cash share last month was “nearly” 60%. For some reason the GLVAR has stopped posting its press release on monthly sales)"

| All Cash Home Sales | ||

|---|---|---|

| 13-Feb | 12-Feb | |

| Las Vegas | 59.5% | 53.2% |

| Toledo | 46.7% | 48.7% |

| Phoenix | 46.1% | 49.9% |

| Sacramento | 39.5% | 33.7% |

| So. Cal (DQ) | 35.6% | 33.7% |

| Des Moines | 21.9% | 28.8% |

| Mid-Atlantic | 22.8% | 23.5% |

| Tucson | 39.5% | 39.0% |

| Omaha | 24.1% | 22.7% |

FHFA: Over 1 Million HARP Refinances in 2012

by Calculated Risk on 3/13/2013 03:23:00 PM

Note: HARP is the program that allows borrowers with loans owned or guaranteed by Fannie Mae or Freddie Mac - and with high loan-to-value (LTV) ratios - to refinance at low rates. Fannie or Freddie are already responsible for the loan, and allowing the borrower to refinance lowers the default risk.

From the FHFA:

The Federal Housing Finance Agency (FHFA) today released its December 2012 Refinance Report, which shows that with the number of mortgages refinanced through the Home Affordable Refinance Program (HARP) in the fourth quarter, nearly 1.1 million HARP refinances were completed in 2012 and nearly 2.2 million were completed since HARP was implemented in April 2009. The 2012 HARP performance surpassed previous estimates for the program.Note: the automated system wasn't released until the end of March - and there were some issues with that system - so HARP refinances didn't really pickup until sometime in Q2. This program saw more participation than most analysts expected (I was more optimistic).

...

In December, 25 percent of loans refinanced through HARP had loan-to-value ratios greater than 125 percent.

In December, 18 percent of HARP refinances for underwater borrowers were for shorter-term 15- and 20-year mortgages, which build equity faster than traditional 30-year mortgages.

These "underwater" borrowers are current (most took out loans 5 to 7 years ago), and they will probably stay current with the lower interest rate.

This table shows the number of HARP refinances by LTV in 2012 compared to 2011. Clearly there was a sharp increase in activity. Note: Here is the December report.

| HARP Activity | |||

|---|---|---|---|

| 2012 | 2011 | Since Inception | |

| Total HARP | 1,074,755 | 438,228 | 2,165,021 |

| LTV >80% to 105% | 605,946 | 373,093 | 1,598,978 |

| LTV >105% to 125% | 240,665 | 65,135 | 337,899 |

| LTV >125% | 228,144 | 0 | 228,144 |

Zillow forecasts Case-Shiller House Price index to increase 8.0% Year-over-year for January

by Calculated Risk on 3/13/2013 12:37:00 PM

The Case-Shiller house price indexes for January will be released Tuesday, March 26th. Zillow has started forecasting the Case-Shiller almost a month early - and I like to check the Zillow forecasts since they have been pretty close.

Zillow Forecast: January Case-Shiller Composite-20 Will Be Up 8% Year-Over-Year

[W]e predict that next month’s Case-Shiller data (January 2013) will show that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) increased 8.0 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) increased 7.2 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from December to January will be 0.8 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for January will not be released until Tuesday, March 26th.The following table shows the Zillow forecast for January.

...

To forecast the Case-Shiller indices we use past data from Case-Shiller, as well as the Zillow Home Value Index (ZHVI), which is available more than a month in advance of Case-Shiller numbers, paired with foreclosure resale numbers, which we also have available more than a month prior to Case-Shiller numbers. Together, these data points enable us to reliably forecast the Case-Shiller 10-City and 20-City Composite indices. The ZHVI does not include foreclosure resales and shows home values for January 2013 up 6.2 percent from year-ago levels. We expect home value appreciation to moderate in 2013, rising only 3.3 percent from January 2013 to January 2014. Further details on our forecast can be found here and Zillow’s full January 2013 report can be found here.

| Zillow January Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Jan 2012 | 147.99 | 149.47 | 135.22 | 136.75 |

| Case-Shiller (last month) | Dec 2012 | 158.49 | 158.73 | 145.95 | 146.26 |

| Zillow Forecast | YoY | 7.2% | 7.2% | 8.0% | 8.0% |

| MoM | 0.1% | 0.8% | 0.0% | 0.8% | |

| Zillow Forecasts1 | 158.6 | 160.1 | 146.0 | 147.6 | |

| Current Post Bubble Low | 146.46 | 149.47 | 134.07 | 136.75 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 8.3% | 7.1% | 8.9% | 7.9% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Retail Sales increased 1.1% in February

by Calculated Risk on 3/13/2013 08:45:00 AM

On a monthly basis, retail sales increased 1.1% from January to February (seasonally adjusted), and sales were up 4.6% from February 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $421.4 billion, an increase of 1.1 percent from the previous month and 4.6 percent (±0.7%) above February 2012. ...The December 2012 to January 2013 percent change was revised from +0.1 percent to +0.2 percent.

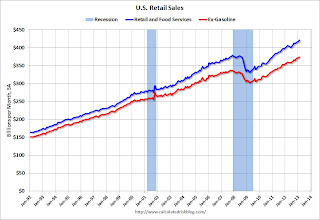

Click on graph for larger image.

Click on graph for larger image.Sales for December were revised up to a 0.2% gain.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 27.2% from the bottom, and now 11.2% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos increased 1.0%. Retail sales ex-gasoline increased 0.6%.

Excluding gasoline, retail sales are up 23.5% from the bottom, and now 11.0% above the pre-recession peak (not inflation adjusted).

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 4.8% on a YoY basis (4.6% for all retail sales).

This was above the consensus forecast of a 0.5% increase. Although higher gasoline prices boosted sales, retail sales ex-gasoline increased 0.6% - suggesting some pickup in the economy in February.